- Home

- »

- Next Generation Technologies

- »

-

U.S. Gallium Nitride Semiconductor Devices Market, Industry Report 2030GVR Report cover

![U.S. Gallium Nitride Semiconductor Devices Market Size, Share & Trends Report]()

U.S. Gallium Nitride Semiconductor Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (GaN RF Devices, Opto-semiconductors), By Component, By Wafer Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-216-7

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

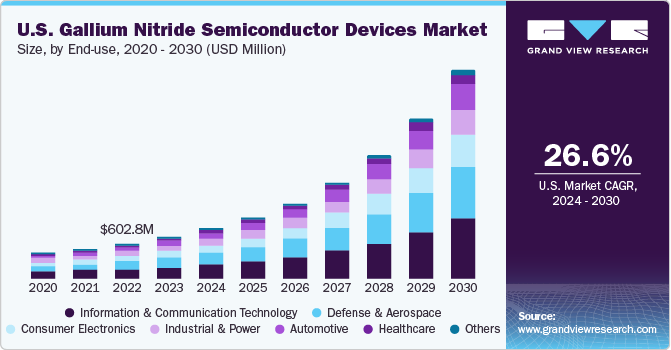

The U.S. gallium nitride semiconductor devices market size was valued at USD 711.3 million in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 26.6% from 2024 to 2030. The increasing utilization of gallium nitride in automotive, military & defense, aerospace, and consumer electronics sectors due to its various benefits over conventional silicon devices is a primary factor driving market expansion in the country. Gallium Nitride (GaN)-based semiconductors possess dynamic electrical properties such as high thermal conduction, large electric field, higher saturation velocity, and high breakdown voltage, which make them an ideal choice for use in various switching devices. Additionally, these semiconductors help minimize switching and conduction losses, thus improving the efficiency of electronic systems.

The U.S. accounted for a 27.80% revenue share in the global gallium nitride semiconductor devices market in 2023. The increasing adoption of electric vehicles in the country has become another major enabler of market expansion in recent years. According to an Urban Science report, EVs accounted for 7.8% of the country’s overall market share in 2023, with areas such as San Francisco seeing an adoption rate as high as 34%. As a result, there is significant demand for EV supply equipment such as charging kiosks and onboard charging stations. The lower switching frequency range of GaN devices makes them suitable for use in GaN-based DC-to-DC converters that are used in onboard charging stations, which bodes well for market growth.

The promising advancement of the 5G industry has further enhanced the growth prospects of this market. In the past few years, significant advances have been made in terms of 5G proliferation across industrial, commercial, and residential segments in the United States, which has resulted in a faster movement of the GaN semiconductor device market. Major telecom companies, such as Nokia and AT&T, are actively participating in R&D initiatives aimed at increasing the use of GaN in 5G infrastructure, including base station, transmitters, and data centers. The higher drain efficiency of GaN devices make them suitable for use in 5G network infrastructure; whereas the drain efficiency of LDMOS is less than 50%, the drain efficiency of GaN devices is around 60%.

In recent years, several notable organizations have entered the market, aided by an increasing awareness regarding its high potential. GaN semiconductors have demonstrated significant improvement in diode performance and their manufacturing costs have sharply gone down. An increasing number of companies, including Toshiba Corporation, GaN Systems, and Efficient Power Conversion Corporation, are focusing on the development of advanced GaN technology. Research organizations are awarding contracts to various companies for encouraging developments in the production process of GaN-based semiconductors, further propelling market expansion in the country.

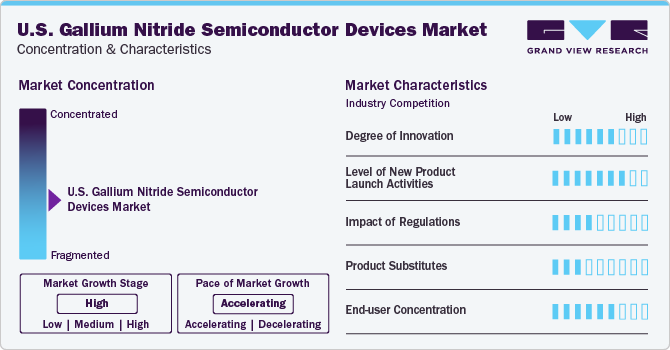

Market Concentration & Characteristics

The market growth stage is high, and pace of market growth is accelerating. The constant growth in the semiconductor industry with a view to provide end-users with more efficient solutions in terms of functionality, size, and sustainability is expected to positively impact innovations in the gallium nitride semiconductor device industry in the United States. Navitas Semiconductor, in February 2024, introduced the ‘GaNSafe’ technology that offers stronger protection against electrostatic discharge and electrical overstress, enabling robust operation in vital applications. Moreover, miniaturization trends and the introduction of Quantum Dot technology in optoelectronic GaN semiconductors is expected to further boost market expansion.

The presence of several established names in the industry has led to a high frequency of product launches in the U.S., particularly as research collaborations have expanded the scope of application of GaN semiconductor devices. For instance, in April 2023, Efficient Power Conversion expanded its radiation-hardened GaN product portfolio for power conversion solutions through the launch of two devices, rated at 200 V and 100 V, to cater to space and high-reliability applications. In another development, in September 2023, GaN Systems introduced its advanced 4th generation GaN (gallium nitride) power platform to better serve power markets such as data centers, consumer electronics, automotive, and solar energy, among others. Such developments are driving intense growth in the U.S.

The impact of regulatory scenarios on the industry is moderate in the country, with most regulations and guidelines currently concerning the trading of semiconductor components with China due to the on-going trade conflict between the two nations. The CHIPS and Science Act that was signed in August 2022 by the current government is expected to positively shape the demand for GaN semiconductors in different application segments.

As gallium nitride is considered to offer better performance and efficiency characteristics than silicon, there has been a rapid shift towards GaN devices from silicon devices by manufacturers, particularly in the EV, renewable energy, and data center sectors. However, there are challenges in the form of wider availability and economical nature of silicon, as well as established manufacturing capabilities. Gallium nitride also faces competition from silicon carbide (SiC), another wide-bandgap material that is better suited for high power and high voltage switching power applications.

The demand for gallium nitride semiconductor devices is growing across major end-use industries, including automotive, defense & aerospace, industrial & power, and healthcare, among others. The growing popularity of the EV industry in the U.S. is expected to act as a major growth driver. Additionally, the country is also investing heavily in improving its defense capabilities, highlighting the need for wider GaN device usage in military applications. The exponential growth in consumer electronics adoption provides further growth opportunities, as GaN chargers are considered to be smaller, more energy-efficient, and faster at charging when compared to conventional chargers.

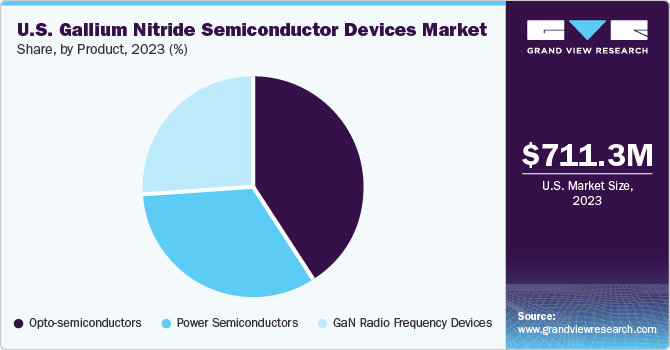

Product Insights

In terms of product, the opto-semiconductors segment accounted for the largest revenue share of 40.87% in 2023. Opto-semiconductors offer extensive capabilities in areas such as communication, sensing, and data transmission, which has compounded their market demand. They also find use in the automotive sector in indoor & outdoor lighting, as well as automotive lights. The rapid development of 5G infrastructure is expected to offer significant growth opportunities, as opto-semiconductors in optical fibers help achieve high-speed data communication. GaN opto-semiconductors are further utilized in devices such as lasers, solar cells, LEDs, lasers, and photodiodes. GaN LEDs are considered a viable alternative to conventional fluorescent and incandescent lighting technologies. Meanwhile, GaN-based lasers find applications in medical, automotive, and industrial sectors, further boosting segment growth.

The GaN radio frequency (RF) device segment is expected to advance at the fastest CAGR through 2030. GaN, being a wide-bandgap material, offers several notable electrical and physical properties such as high power density, high efficiency, high switching frequency, excellent thermal conductivity, and high breakdown voltage. This has led to its extensive use in high-power RF applications. Besides conventional RF applications, for example power amplifiers (PA), such devices are being also deployed in military and space applications. For instance, in military radars, GaN has become a notable solution for developing solid state transmitters during operations on different gigahertz frequency bands, replacing klystron tubes. With the United States making substantial investments in its military and defense sector, the market growth is expected to advance noticeably.

Component Insights

Based on component, the power IC segment accounted for a substantial share in the U.S. gallium nitride semiconductor devices market. A GaN power IC combines various functions in power electronics on a single chip, thus improving reliability, speed, efficiency, and cost-effectiveness. They are available in both ‘half-bridge’ and ‘single’ forms that are used in a variety of applications, such as fast chargers, renewables, data centers, and electric mobility. Companies in the U.S. are improving their power IC solutions for the automotive and telecom sectors, driving segment expansion. For instance, in March 2023, Efficient Power Conversion Corporation unveiled two 100 V power stage ICs, rated at 25 A (EPC23103) and 15 A (EPC23104), designed for motor drives, DC-DC applications, and Class-D audio amplifiers.

The rectifier segment is expected to witness the fastest growth in the market during the forecast period. GaN rectifiers are extensively used for withstanding high-temperature environments. As a result, they are primarily utilized in various consumer electronics and military & aerospace applications. Additionally, owing to their compact size, a majority of the consumer electronics manufacturers prefer GaN rectifiers over conventional silicon (Si) rectifiers.

Wafer Size Insights

The 4-inch segment accounted for the largest revenue share in the market in 2023. There has been an increased rate of implementation of 4-inch wafers in the semiconductor industry in the U.S., as they address various drawbacks presented by 2-inch wafers. Additionally, the production of these wafers on a larger scale also increases their cost-effectiveness. In recent years, with substantial advancements in segments such as optoelectronics devices, high-power amplifiers, and high-temperature devices, there has been a rising demand for GaN devices with 4-inch wafers. These wafers are moreover highly suitable for wideband GaN power amplifiers that are used in software-defined radios. All these factors are defining this segment’s growth.

On the other hand, the 8-inch wafer segment is expected to advance at the fastest CAGR through 2030. This wafer was launched to dynamically provide high-watt GaN for GaN-on-silicon transistors and other electronic peripherals. Semiconductors with 8-inch wafers help reduce parasitic capacitance up to 90%. Thus, they are mainly used in power electronics and compound semiconductor devices for better productivity and high process control, compared to 4- and 6-inch wafers. Devices manufactured using 8-inch wafers are used in automotive applications such as radios, music systems, V2V communication systems, in-vehicle smartphone chargers, and interior lighting systems. The steady expansion of the automotive industry in the U.S., owing to technological advances, is driving market growth.

End-use Insights

The Information & Communication Technology (ICT) segment held the largest revenue share in the market in 2023. The rapid proliferation of 5G infrastructure in the U.S., owing to positive government initiatives and presence of major telecom service providers such as AT&T, Verizon, and T-Mobile, present major growth opportunities to the GaN semiconductor device industry in the country. The high breakdown voltage, high thermal stability, and high electron mobility offered by GaN-powered devices have made them suitable for use in this area. Moreover, these devices also improve 5G base station performance through reduction in equipment weight and size, as well as higher energy efficiency. Notable names such as Qorvo, NXP Semiconductors, and Infineon Technologies have introduced several novel products, aiding market expansion in the ICT segment.

The defense and aerospace segment is expected to advance at the fastest growth rate through 2030, aided by significant investments made by the U.S. government in upgrading the country’s defense infrastructure. The use of GaN technology in this segment is factored by its higher frequency bandwidth, high transmit power, and high efficiency offered in a smaller footprint. This has positively impacted its adoption in next-generation electronic warfare, radar, and communication systems. Government grants to defense organizations have also resulted in the expansion of this sector. For instance, in December 2023, the microelectronics center of BAE Systems, based in New Hampshire, received USD 35 million from the Department of Commerce to enhance its GaN capabilities.

Key U.S. Gallium Nitride Semiconductor Devices Company Insights

NXP Semiconductors; Wolfspeed, Inc.; and Toshiba Corporation are some of the leading companies involved in the U.S. gallium nitride semiconductor devices industry.

-

NXP Semiconductors N.V. is a Dutch-American electronics organization with its headquarters in Austin, Texas. The company’s portfolio mainly includes Radio Frequency, power management, analog, security, interface, and digital processing products. It has a wide range of products related to automotive applications such as safety, power management, radio frequency, secure car access, media & audio processing, and in-vehicle network, with Gallium Nitride (GaN) as a base. The company had opened an RF Gallium Nitride 150 mm wafer size fab in Chandler, Arizona, in September 2020, showcasing its leadership in this industry.

-

Wolfspeed, Inc., headquartered in North Carolina, develops & manufactures wide-bandgap semiconductors, focusing on silicon carbide (SiC) and gallium nitride (GaN) materials and devices. The company mainly offers its products for power and radio frequency applications such as power supplies, power inverters, transportation, and wireless systems. In recent years, the company has launched new products to garner more revenue share, such as a series of GaN High-Electron-Mobility Transistors (HEMT) that it introduced in 2017. The company’s production facilities are located in the U.S. states of Arizona, North Carolina, Arkansas, and California, among others.

Other notable and emerging players that are involved in the U.S. market for GaN semiconductor devices include Efficient Power Conversion Corporation; NexGen Power Systems; and GaN Systems, among others.

- Efficient Power Conversion, headquartered in California, is a semiconductor company that produces gallium nitride (GaN)-based transistors and ICs. It develops eGaN FETs, which enable power device designers to employ various power conversion topologies, buck/boost/PFC/flyback/forward converters, or LLC converters to gain higher performance compared to silicon-powered MOSFETs. The company is involved in product launches and M&A activities to drive its growth; a recent example is the launch of the EPC9157 in February 2021, which integrates Renesas ISL 81806 with EPC2218 eGAN.

Key U.S. Gallium Nitride Semiconductor Devices Companies:

- Wolfspeed Inc. (formerly Cree, Inc.)

- Efficient Power Conversion Corporation

- Fujitsu Ltd.

- GaN Systems

- Infineon Technologies AG

- NexgenPowerSystems

- NXP Semiconductor

- Qorvo, Inc.

- Texas Instruments Incorporated

- Toshiba Corporation

Recent Developments

-

In February 2024, EPC (Efficient Power Conversion) introduced a range of reference designs featuring EPC GaN FETs and Analog Devices, Inc. controllers. Through the use of the latter’s controllers and drivers, EPC gallium nitride FETs have been able to simplify the design, reduce cooling costs, boost efficiency, and improve power density for their use in vital applications such as industrial and computing

-

In August 2023, Wolfspeed, Inc. announced that it had entered an agreement regarding the sale of its radio frequency division, Wolfspeed RF, to MACOM Technology Solutions Holdings, Inc. This business includes extensive technological and innovative capabilities to support a gallium nitride (GaN) on silicon carbide offering portfolio suited for next-generation telecom infrastructure, as well as military and commercial applications

-

In March 2023, at the APEC 2023 event held in San Francisco, GaN Systems unveiled a reference design for a gallium nitride-based 11kW/800V On-Board Charger that offers 36% greater power density and close to 15% lower Bill of Materials cost, in comparison to silicon carbide transistors. Other notable features include lower total semiconductor power loss and better thermal performance via an IMS interface. The product is expected to advance the adoption of GaN in the automotive industry

-

In June 2022, Qorvo announced that it had been selected by the U.S. Department of Defense to initiate the Advanced Integration Interconnection and Fabrication Growth for Domestic State of the Art (SOTA) Radio Frequency Gallium Nitride (GaN) program, otherwise known as STARRY NITE. Through this program, Qorvo would be providing 90 nm GaN foundry process manufacturing at high volume domestically, while developing innovative solutions for advanced commercial and wireless communications systems

U.S. Gallium Nitride Semiconductor Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.51 billion

Growth Rate

CAGR of 26.6% from 2024 to 2030

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, component, wafer size, end-use

Country scope

The U.S.

Key companies profiled

Wolfspeed, Inc.; Efficient Power Conversion Corporation; Fujitsu Ltd.; GaN Systems; Infineon Technologies AG; NexgenPowerSystems; NXP Semiconductor; Qorvo, Inc.; Texas Instruments Incorporated; Toshiba Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gallium Nitride Semiconductor Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. gallium nitride semiconductor devices market report based on product, component, wafer size, and end-use:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

GaN Radio Frequency Devices

-

Opto-semiconductors

-

Power Semiconductors

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Transistor

-

Diode

-

Rectifier

-

Power IC

-

Others

-

-

Wafer Size Outlook (Revenue, USD Million, 2017 - 2030)

-

2-inch

-

4-inch

-

6-inch

-

8-inch

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Consumer Electronics

-

Defense & Aerospace

-

Healthcare

-

Industrial & Power

-

Information & Communication Technology

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. gallium nitride semiconductor device market size was estimated at USD 711.3 million in 2023 and is expected to reach USD 0.85 billion in 2024.

b. The U.S. gallium nitride semiconductor device market is expected to grow at a compound annual growth rate of 26.6% from 2024 to 2030 to reach USD 3.51 billion by 2030.

b. Opto-semiconductors dominated the U.S. gallium nitride semiconductor device market with a share of 40.87% in 2023. Opto-semiconductors offer extensive capabilities in areas such as communication, sensing, and data transmission, which has compounded their market demand.

b. Some key players operating in the U.S. gallium nitride semiconductor device market include Wolfspeed, Inc.; Efficient Power Conversion Corporation; Fujitsu Ltd.; GaN Systems; Infineon Technologies AG; NexgenPowerSystems; NXP Semiconductor; Qorvo, Inc.; Texas Instruments Incorporated; Toshiba Corporation.

b. Key factors that are driving the market growth include advancements in gallium nitride technology and increasing usage of GaN semiconductors in electric vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.