- Home

- »

- Semiconductors

- »

-

Gallium Nitride Semiconductor Devices Market Size Report, 2030GVR Report cover

![Gallium Nitride Semiconductor Devices Market Size, Share & Trends Report]()

Gallium Nitride Semiconductor Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (GaN Radio Frequency Devices, Opto-semiconductors), By Component (Transistor, Diode), By Wafer Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-848-0

- Number of Report Pages: 182

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gallium Nitride Semiconductor Devices Market Summary

The global gallium nitride semiconductor devices market size was estimated at USD 3.06 billion in 2024 and is projected to reach USD 12.47 billion by 2030, growing at a CAGR of 27.4% from 2025 to 2030. Gallium semiconductors provide high-speed performance and contribute to lower carbon emissions, which positions them as effective devices in the field of electronics.

Key Market Trends & Insights

- North America gallium nitride (GaN) semiconductor devices market dominated globally in 2024, with the largest revenue share of 34.3%.

- The gallium nitride (GaN) semiconductor devices market in the U.S. is expected to grow at a significant CAGR of 27.5% from 2025 to 2030.

- By wafer size, the 4-inch segment dominated the market in 2024 with a share of 38.6%.

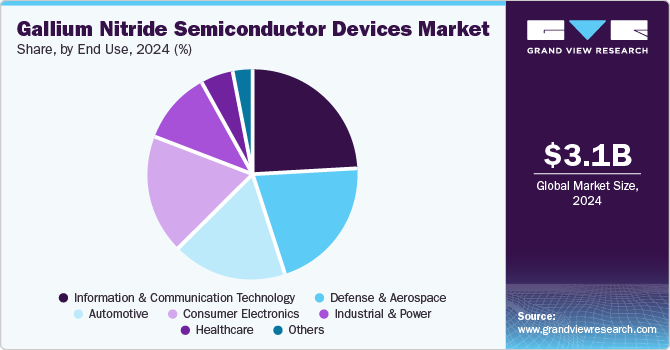

- By end use, the information & communication technology (ICT) segment dominated the market with a revenue share of 23.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.06 Billion

- 2030 Projected Market Size: USD 12.47 Billion

- CAGR (2025-2030): 27.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Gallium Nitride (GaN) possesses a wide band gap that makes the device more compact and capable of handling larger electric fields. As GaN possesses a wider band gap (approximately 3.4 eV) in contrast to silicon (1.2 eV), it facilitates higher carrier density, exceptionally low resistance, and capacitance, contributing to 100 times faster speeds. In addition, the integration of GaN technology across diverse sectors such as optoelectronics, automotive, and data centers has been instrumental in driving the growth of the market.

The automotive sector is currently experiencing a significant transformation toward electrification, with GaN semiconductor devices emerging as crucial components driving this change. Leveraging GaN's exceptional efficiency and robust power handling capabilities, various applications within electric vehicles, including onboard chargers, DC-DC converters, and power inverters, are being optimized for enhanced performance. As the global demand for electric vehicles escalates, the market for GaN semiconductor devices is positioned for substantial expansion, playing a pivotal role in accelerating the widespread adoption of electric transportation solutions. This evolution not only underscores the automotive industry's commitment to sustainability but also signifies a paradigm shift toward cleaner and more efficient mobility solutions on a global scale.

New application areas, such as healthcare, are expected to stimulate the market growth of GaN semiconductor devices. For instance, robots using GaN components are used for the effective execution of delicate surgeries. Leveraging GaN's exceptional speed, efficiency, and reliability, robotic systems equipped with GaN technology offer unprecedented precision and control, crucial for intricate surgeries. These advanced robots, enabled by GaN semiconductor devices, empower healthcare professionals to perform minimally invasive surgeries with unparalleled accuracy, minimizing patient trauma and recovery times. As the healthcare industry continues to embrace technological advancements, the utilization of GaN semiconductor devices in medical robotics represents a compelling frontier, promising transformative benefits for both patients and practitioners.

The demand for wireless communication devices, primarily in defense communication, is expected to drive the demand for GaN semiconductors. GaN technology offers several advantages that are particularly well-suited for defense communication systems. Its high power density, wide bandwidth, and superior thermal conductivity enable the development of robust and reliable wireless devices capable of operating in demanding environments. These attributes make GaN semiconductors ideal for applications such as radar systems, electronic warfare, and satellite communication, where performance, efficiency, and resilience are important.

The industry faces a significant challenge in the form of high initial investments. The fabrication of gallium nitride-based devices demands sophisticated manufacturing processes and specialized equipment, resulting in elevated upfront costs for companies entering the market. These expenses encompass research and development, epitaxial growth, wafer processing, and device packaging, among others. As a result, while the potential benefits of gallium nitride semiconductors, such as higher efficiency and power density, are compelling, the substantial initial investment required poses a considerable challenge for market entrants and smaller players, potentially limiting the market's growth and accessibility.

Product Insights

The opto-semiconductors segment dominated the industry with a revenue share of 36.3% in 2024. This can be largely attributed to the application of opto-semiconductors in devices such as LEDs, solar cells, photodiodes, lasers, and optoelectronics. The automotive sector is increasingly utilizing opto-semiconductors in automotive lights, indoor and outdoor lighting, and pulse-powered lasers. This is subsequently propelling the adoption of opto-semiconductors in the automotive and consumer electronics industries. Furthermore, opto-semiconductors are being widely used in applications such as Light Detection and Ranging (LiDAR) and pulsed lasers, which bodes well for the growth of the segment.

The GaN radio frequency devices segment is anticipated to expand as a result of the increasing use of gallium nitride radio frequency devices for a wide variety of applications across industries such as consumer electronics and defense, which are early adopters in the market. These devices are also used in Improvised Explosive Devices (IEDs) as they offer high performance at moderate costs, which is anticipated to further drive the segment growth. Moreover, high-frequency GaN devices are used in vehicular communication systems and vehicle-to-grid communication systems of electric vehicles.

Component Insights

The transistor segment dominated the market due to its superior performance characteristics in high-frequency and high-power applications. GaN transistors, specifically high electron mobility transistors (HEMTs), demonstrate quantifiably better characteristics than silicon-based alternatives, with documented improvements in switching speeds, breakdown voltage, and conduction losses. These technical attributes position GaN transistors as suitable components for applications including electric vehicle powertrains, fast-charging infrastructure, and 5G network equipment, where specific performance requirements must be met. The ability of GaN transistors to operate at higher temperatures while maintaining performance further enhances their appeal in these applications.

The rectifier segment is expected to grow at the fastest CAGR of 29.8% over the forecast period. This growth can be attributed to the increasing demand for high-efficiency power conversion solutions across various industries, including automotive, consumer electronics, and telecommunications. GaN rectifiers exhibit lower conduction and switching losses, resulting in higher energy efficiency and reduced power dissipation. This efficiency translates into lower operating costs and improved overall system performance, particularly in high-power and high-frequency applications where energy efficiency is paramount. In addition, GaN rectifiers feature faster switching speeds and higher breakdown voltages, enabling them to operate at higher frequencies and handle higher voltages with greater reliability.

Wafer Size Insights

The 4-inch segment dominated the market in 2024 with a share of 38.6%. This is because 4-inch wafers facilitate the large-scale production of semiconductor devices. The implementation of 4-inch wafers is increasing rapidly as these wafers help overcome the limitations of 2-inch wafers and are widely used in semiconductor product-based industries. Furthermore, the increasing demand for gallium nitride devices with 4-inch wafers in high-power amplifiers, optoelectronics devices, telecom frontends, and high-temperature devices is driving the segment growth. Moreover, the suitability of a 4-inch substrate for space communication applications, owing to its radiation-hardened properties, is anticipated to be a key factor influencing segment growth.

The 6-inch segment is anticipated to expand owing to the benefits such as uniform voltage supply and precise current control offered by 6-inch wafers. A 6-inch wafer is engineered to provide better uniformity in voltage and precise control over the current. It has wide applications in defense equipment and consumer electronics owing to benefits such as high breakdown voltage and low current leakage. Furthermore, the increasing adoption of 6-inch wafers in commercial applications such as Monolithic Microwave Integrated-Circuit (MMIC) power amplifiers for wireless cellular base stations and automotive collision-avoidance systems bodes well for the segment growth.

End Use Insights

The information & communication technology (ICT) segment dominated the market with a revenue share of 23.5% in 2024. The growth can be attributed to the increasing adoption of Internet-of-Things (IoT) technology globally. IoT devices demand efficient and cost-effective components that facilitate a constant exchange of information. GaN-based semiconductors are expected to meet low power consumption and high-efficiency requirements for the proper functioning of IoT-enabled products. In addition, these semiconductors are widely used in Distributed Antenna System (DAS), small cells, and remote radio head network densification. They are also used in data centers, servers, base stations, transmission lines, satellite communication, and base transceiver stations, among others.

The growth of the defense and aerospace segment can be attributed to the increasing applications of GaN technology in the defense and aerospace sector to increase the bandwidth and performance reliability in communications, electronic warfare, and radars. The ICs used in radar boards incorporate GaN, which enables efficient navigation, facilitates collision avoidance, and enables real-time air traffic control. The higher operating frequencies provided by GaN semiconductors make them suitable for use in radar communication, terrestrial radios, and military jammers. Moreover, the increasing usage of wideband GaN power transistors in amplifiers for software-defined radios is a major factor responsible for the segment growth.

Regional Insights

North America gallium nitride (GaN) semiconductor devices market dominated globally in 2024, with the largest revenue share of 34.3%. Increasing investments from the defense and aerospace industry in research & development are fueling the market growth in the region. Furthermore, funding provided by government bodies to semiconductor companies is expected to drive market growth in the region. Companies in this region are also focusing on launching the commercialization rights for a range of gallium nitride on silicon (GaN-on-Si) patents. For instance, in March 2024, 5N Plus Inc., a semiconductor technology company, launched the commercialization rights for a collection of gallium nitride on silicon (GaN-on-Si) patents. According to the company, these patents can facilitate the swift development of prototypes and the early market introduction of innovative vertical GaN-on-Si power devices.

U.S. Gallium Nitride Semiconductor Devices Market Trends

The gallium nitride (GaN) semiconductor devices market in the U.S. is expected to grow at a significant CAGR of 27.5% from 2025 to 2030. Advancements in GaN technology and manufacturing processes are bolstering the U.S. market's expansion, positioning the U.S. as a key country in the global GaN semiconductor landscape.

Asia Pacific Gallium Nitride Semiconductor Devices Market Trends

The gallium nitride (GaN) semiconductor devices market in Asia Pacific is anticipated to emerge as the fastest-growing market through the projection period, owing to rapid technological advancements that are leading to increased demand for high-performance and efficient radio frequency components. Countries such as China and Japan in the region are some of the largest manufacturers of consumer electronics, including LED display devices, smartphones, and gaming consoles. This is a key factor boosting the growth of the regional market. The demand for reliable communication devices has expanded due to the expanding defense budgets in countries such as China, South Korea, and India, and this demand is expected to boost the market for gallium nitride-based RF devices. The development of telecommunications infrastructure and the notable rise in the usage of wireless electronic devices in the Asia Pacific region are further propelling the market's expansion.

China gallium nitride (GaN) semiconductor devices market is expected to grow at a significant CAGR from 2025 to 2030. Government initiatives to bolster domestic semiconductor production and advancements in GaN fabrication technologies are key drivers of market expansion, positioning China as a prominent force in the global GaN semiconductor market.

Europe Gallium Nitride Semiconductor Devices Market Trends

The gallium nitride semiconductor devices market in Europe is expected to grow at a significant CAGR of 26.4% from 2025 to 2030. GaN technology finds traction in sectors like renewable energy, automotive, and telecommunications as Europe focuses on reducing energy consumption and carbon emissions. Europe's robust semiconductor industry and supportive regulatory framework drive market expansion, establishing the region as a hub for GaN research, development, and manufacturing.

Germany gallium nitride (GaN) semiconductor devices market is expected to grow at a significant CAGR from 2025 to 2030. Germany, with its robust automotive industry and growing focus on renewable energy sources, presents a fertile ground for the adoption of GaN-based devices, thereby contributing to the growth of the market.

Key Gallium Nitride Semiconductor Devices Companies Insights

Key players operating in the gallium nitride (GaN) semiconductor devices market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Gallium Nitride Semiconductor Devices Companies:

The following are the leading companies in the gallium nitride semiconductor devices market. These companies collectively hold the largest market share and dictate industry trends.

- Fujitsu Ltd.

- Efficient Power Conversion Corporation

- Transphorm, Inc.

- Infineon Technologies AG

- NXP Semiconductors.

- Qorvo, Inc

- Texas Instruments Incorporated.

- Toshiba Corporation

- GaN Systems

- NTT Advanced Technology Corporation.

Recent Developments

-

In April 2024, Transphorm, Inc., a GaN power semiconductor provider, and Weltrend Semiconductor Inc. announced the introduction of two new GaN System-in-Packages (SiPs). These latest additions, namely the WT7162RHUG24C and WT7162RHUG24B, combine Weltrend’s high-frequency multi-mode (QR/Valley Switching) Flyback PWM controller with Transphorm's 480 mΩ and 150 mΩ SuperGaN FETs, respectively. This collaboration builds upon Weltrend’s flagship GaN SiP unveiled last year, collectively establishing the first SiP product family based on Transphorm’s SuperGaN platform.

-

In March 2024, Efficient Power Conversion Corporation launched EPC2361, a groundbreaking gallium nitride (GaN) field-effect transistor (FET) boasting the lowest on-resistance on the market at 100V, 1mΩ. This innovation promises to double the power density when compared to EPC's previous-generation products. The EPC2361 exhibits an impressive typical RDS (on) of only 1mΩ, housed in a thermally enhanced QFN package with an exposed top, occupying a mere footprint of 3mm x 5mm.

-

In January 2024, Transphorm Inc. launched two new 650V SuperGaN devices packaged in a 4-lead TO-247 package (TO-247-4L). These new FETs, named TP65H035G4YS and TP65H050G4YS, boast on-resistances of 35mΩ and 50mΩ, respectively, featuring a Kelvin-source terminal that enables customers to achieve versatile switching capabilities with reduced energy losses.

Gallium Nitride (GaN) Semiconductor Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.72 billion

Revenue forecast in 2030

USD 12.47 billion

Growth rate

CAGR of 27.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, wafer size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Fujitsu Ltd.; Efficient Power Conversion Corporation; Transphorm, Inc.; Infineon Technologies AG; NXP Semiconductors.; Qorvo, Inc.; Texas Instruments Incorporated.; Toshiba Corporation; GaN Systems; NTT Advanced Technology Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gallium Nitride (GaN) Semiconductor Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gallium nitride (GaN) semiconductor devices market report based on product, component, wafer size, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

GaN Radio Frequency Devices

-

Opto-semiconductors

-

Power Semiconductors

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Transistor

-

Diode

-

Rectifier

-

Power IC

-

Others

-

-

Wafer Size Outlook (Revenue, USD Million, 2018 - 2030)

-

2-inch

-

4-inch

-

6-inch

-

8-inch

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Defense & Aerospace

-

Healthcare

-

Industrial & Power

-

Information & Communication Technology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gallium nitride semiconductor devices market size was estimated at USD 3.06 billion in 2024 and is expected to reach USD 3.72 billion in 2024.

b. The global gallium nitride semiconductor devices market is expected to grow at a compound annual growth rate of 27.4% from 2025 to 2030 to reach USD 12.47 billion by 2030.

b. North America dominated the GaN semiconductor devices market with a share of 34.3% in 2024. This is attributable to increasing investments by the defense & aerospace industry in research & development are the key drivers for market growth in the region.

b. Some key players operating in the GaN semiconductor devices market include NXP Semiconductor N.V., GaN Systems, Inc., Efficient Power Conversion Corporation, Inc., Toshiba Corporation, Qorvo, Inc., Cree, Inc., Fujitsu Ltd., and Texas Instruments, Inc., among others.

b. The key factor that is driving the gallium nitride semiconductor devices market growth includes the accelerating demand for power electronics that consume less power and are energy efficient.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.