- Home

- »

- Conventional Energy

- »

-

U.S. Gas Turbine Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Gas Turbine Market Size, Share & Trends Report]()

U.S. Gas Turbine Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Combined Cycle, Open Cycle), By Capacity (<=200 MW, >200 MW), By End-use (Industrial, Power & Utility), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-232-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Gas Turbine Market Size & Trends

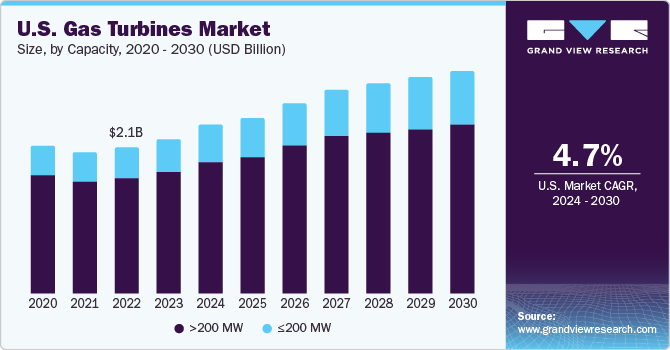

The U.S. gas turbine market size was estimated at USD 2.27 billion in 2023 and is anticipated to grow at a CAGR of 4.7% from 2024 to 2030. This growth is attributed to the country's well-established end-use industries, which are the main sources of demand for the gas turbine industry and are complemented by the nation's well-developed natural gas infrastructure. Furthermore, a shift in emphasis toward distributed power production technologies and the energy industry's rapid technological breakthroughs are driving the market growth.

A gas turbine is an engine that uses high temperatures to heat a mixture of fuel and ambient air, causing the turbine blades to spin and produce mechanical energy. A generator generates electrical energy by using the mechanical energy as well. The main application of gas turbines is the production of power. When it comes to providing electricity to the industry, running a basic cycle turbine power plant is far more expensive than importing it. Consequently, combined cycle power plants which are more efficient are used the most. One type of combined cycle power plant that can be used to generate both mechanical drive and electricity is the CHP plant. Although the energy mix of the nation is varied, the majority of primary energy output is derived from natural gas. Governments are putting a lot of effort into creating sustainable energy sources, which is expected to lead to a rise in the number of gas turbine installations. It is anticipated that the gas turbine market in the U.S. will develop significantly, driven by the government's growing endorsement of energy generation technologies that minimize carbon dioxide emissions.

Convenient economics and regulations & policies that favor the establishment of gas-based power plants across the country are major factors driving the shift from coal-based to gas-based power generation. Another essential component facilitating market expansion is the guarantee of a sustained fuel supply in the U.S. Gas turbines are highly efficient and produce less carbon emissions as compared to other combustion-based electricity generation applications. Important businesses such as Solar Turbines Inc. and General Electric are concentrating heavily on advancing technological advancements to raise the efficiency of their turbines. For instance, General Electric Vernova announced in February 2024 the launch of Proficy® for Sustainability Insights, a new software program intended to operationalize firms' sustainability objectives while assisting in maximizing output and profit. Artificial intelligence (AI)-based software can help industrial organizations monitor climate parameters needed for regulatory compliance and use resources more effectively throughout a plant or enterprise by merging sustainability and operational data.

Market Concentration & Characteristics

The level of innovation in the U.S. gas turbine sector is moderate. Turbine technology is always improving, as seen by gains in digitization, efficiency, and emissions reduction; yet, the industry's maturity limits the rate of innovation. For many years, gas turbines have been extensively utilized in industrial, aviation, and power production applications. This has led to gradual rather than revolutionary advancements in technology.

The market is experiencing a moderate amount of merger and acquisition activity. Due to the necessity to obtain complementary technologies, increase market share, and realize economies of scale, some key firms in the industry have consolidated. However, merger and acquisition activity is not as common or broad as in some other sectors due to the high capital needs and specialized nature of gas turbine manufacture. For instance, Solar Turbines, GRTZgaz Deutschland, and OGE collaborated to successfully test a low-emissions Titan 130 SoLoNOx solar gas turbine utilizing up to a 25 percent hydrogen blending rate as a primary mover on a natural gas compressor. Typically, natural gas drawn from the pipeline system powers these gas turbines.

The global gas turbine market is significantly impacted by regulations. Environmental laws that affect gas turbine technology adoption and spur innovation include efficiency restrictions and emissions limitations. Gas turbine producers also have to adhere to strict safety rules and compliance standards in sectors such as aviation and power production. Regulation changes have the potential to have a big impact on investment choices and market dynamics.

There are very less alternatives to gas turbines available for large-scale power generation and industrial uses. Due to their dependability, adaptability, and capacity to generate both baseload and peaking power, gas turbines continue to be an essential part of the energy mix, even as alternative energy sources such as renewables and energy storage technologies gain popularity. Microturbines and fuel cells are potential replacements in some specialized applications, such as distributed energy systems, but they don't directly compete with massive gas turbines.

Capacity Insights

The >200 MW segment led the market and accounted for the largest revenue share of 78.47% in 2023. This growth is attributed to the increasing global power generation operations as well as several of the world's largest economies' preference for gas-based power plants over coal-based ones. Gas turbines, particularly those with capacities greater than 200 MW, are primarily driven by the expansion of the power generation sector and a greater emphasis on employing renewable energy sources for electricity generation.

The ≤200 MW segment accounted for a significant market share in 2023 owing to the turbine's smaller size and easier operation and maintenance. The product is lighter due to its smaller size, which is perfect for offshore sites where the power-to-weight ratio is a crucial consideration when installing a turbine unit. It is anticipated that the oil and gas sector will soon pick up steam again. Due to its adaptability to various operating and environmental circumstances, small turbines are extensively used in the oil and gas industry.

End-use Insights

The Power & Utility segment accounted for the largest market share of 82.73% in 2023 owing to the growing global need for electricity. Key competitors remain pessimistic about the increasing demand for gas turbines in the power generating segment, although the market for gas turbines for power and utility end-use is expected to expand at a high rate throughout the projection period. One factor that is anticipated to have a major impact on the growth of the gas turbine market in this category is the volatility of natural gas prices. Furthermore, the world's population growth and urbanization are driving an increase in demand for power generation, which is increasing the use of gas turbines in the utility and power sectors.

The industrial segment witnessed significant growth in 2023. Due to strict pollution regulations, there is a growing need for gas turbines in the industrial sector. The market for gas turbines used in industrial applications is positively impacted by low natural gas costs. The demand has historically been predominantly driven by the expansion of industrial activity worldwide. Large-scale industrial operations including electricity generation, oil and gas production, and chemical processing frequently use industrial gas turbines. They are also employed in the aviation sector as a power source for both military and commercial aircraft.

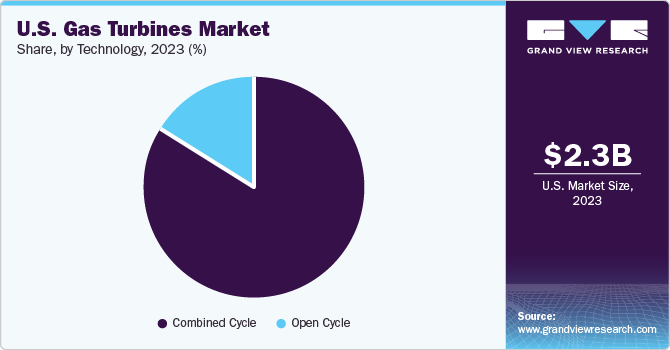

Technology Insights

The combined cycle segment accounted for the largest market share of 84.29% in 2023. This growth is attributed to its great efficiency, which enables power companies to extract significantly more power from the same amount of natural gas. CCGT plants have high energy conversion rates, between 50% and 60%. The segment's ability to improve the plant's overall efficiency will allow it to maintain its leadership and see the fastest compound annual growth rate (CAGR) between 2023 and 2030. In addition, compared to open-cycle technology, these turbines use less fuel to generate the necessary energy output. The integration of increasing amounts of renewable power, lower gas prices, and tighter regulations for coal plants are driving the shift to CCGT technology.

The open cycle segment held a significant market share in 2023. Due to their advantage over small-scale installation in terms of installation space requirements, open-cycle gas turbines are chosen. However, throughout the projected period, it is anticipated that their substantial energy losses will impede segment expansion due to poorer efficiency. Low efficiency due to high energy loss is anticipated to have a significant impact on this segment's industry share. Even though these systems take up less space, adverse environmental factors have a substantial impact on the component efficiency of these systems, which lowers the system efficiency overall as compared to combined cycle units.

Application Insights

The Power Generation segment dominated the market and accounted for the largest revenue share of 42.70% in 2023 owing to the global increase in electricity demand. Energy consumption has increased as a result of rapid industrialization and urbanization, especially in developing nations. Due to their efficiency and adaptability, gas turbines are widely employed in the power production industry, making them a desirable solution for supplying the expanding energy demand. Technology advancements have not only allowed gas turbines to satisfy the increasing electricity demand, but they have also increased their efficiency and dependability. Higher operating temperatures, better aerodynamics, and more sophisticated control systems are all features of modern gas turbine design, which raises efficiency and lowers emissions.

The Oil & Gas segment held a significant market share in 2023. This growth is attributed to the oil and gas industry's requirement for compression and pumping. The compressor stations that pump and deliver gas and oil to refineries are powered by gas turbines. The market's expansion can be ascribed to the rising need for energy and technological developments. The growing need for energy is one of the main factors propelling the gas turbine industry. The world's population is expanding, and so is the energy demand. Energy consumption in the oil and gas sector is significant, and gas turbines are a productive means of producing power for drilling, pumping, and processing activities.

The Aerospace segment witnessed substantial growth in 2023. In the aerospace sector, gas turbines, often known as turbofan engines, are widely utilized for aircraft propulsion. The rising demand for air travel globally is one of the main causes propelling their expansion. The demand for air travel has surged as air travel becomes more accessible in developing and impoverished nations. Due to their high power output and efficiency, gas turbines are a good fit for this application as they allow commercial aircraft to fly farther on less fuel.

Key U.S. Gas Turbine Company Insights

The gas turbine market in the U.S. is concentrated. Even though many manufacturers compete in different market areas, a few of large companies control a large portion of the market. High entry hurdles, the significant capital expenditures necessary for manufacturing, and the significance of scale in achieving cost competitiveness and technological leadership are the main drivers of this concentration.

Key players in the market include General Electric; Solar Turbines Incorporated; and Capstone Turbine Corporation

-

General Electric offers products and services for power generation and transmission through its GE business segment. Services provided by GE Electricity include gasification, nuclear energy, distributed electricity, and water and process technology. From individual producers to suppliers of oil and gas, it serves a variety of clients with services and technology to facilitate both on- and off-grid applications.

-

Solar Turbines Incorporated offers Gas turbine engines, generator sets, compressor sets, mechanical drive packages, and gas compressors are among the products. The company's products find employment in thermal energy processing plants, natural gas pipeline transmission, and the production of chemicals, food items, and pharmaceuticals.

TurbineAero; and Columbia Manufacturing, Inc. are other participants operating in the U.S. Gas Turbine Market

-

TurbineAero is one of the top independent providers of maintenance, repair, overhaul, leasing, and brokerage services for aircraft systems and components worldwide. With an emphasis on APUs and related products, the company's top-notch engineering and service capabilities are intended to offer clients specialized solutions that cater to their particular requirements and desires.

Key U.S. Gas Turbine Companies:

- General Electric

- Solar Turbines Incorporated

- Capstone Turbine Corporation

- Williams International

- TurbineAero

- Columbia Manufacturing, Inc.

- Sylvania

- Vericor Power

- Chromalloy Gas Turbine LLC

- Central Metal Fabricators, Inc.

Recent Developments

-

In February 2024, The Grid Solutions unit of GE Vernova (NYSE: GE) announced the introduction of GridBeats, a full suite of software-defined automation solutions designed to improve grid resilience and streamline grid digitalization. GridBeats is designed to provide utilities with cutting-edge capabilities for digitalizing substations, autonomously managing grid zones, and remotely controlling equipment and communication networks.

-

In December 2023, Solar Turbines and Chevron collaborated on a hydrogen-fueled gas turbine engine. By combining hydrogen with conventional fuels to run the engine, greenhouse gas emissions may be minimized. Future operations with reduced carbon turbine intensity may benefit from the collaboration's findings. The intention is to reduce the carbon intensity of current operations by blending hydrogen and natural gas on a wide scale, enabling the industry to make equipment improvements and prepare for the shift to an emerging hydrogen future.

U.S. Gas Turbine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.47 billion

Revenue forecast in 2030

USD 3.26 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in MW, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, capacity, end-use, application

Key companies profiled

General Electric; Solar Turbines Incorporated; Capstone Turbine Corporation; Williams International; TurbineAero; Columbia Manufacturing, Inc.; Sylvania; Vericor Power; Chromalloy Gas Turbine LLC; Central Metal Fabricators, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gas Turbine Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Gas Turbine market report based on Technology, capacity, end-use, and application:

-

Technology Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Open Cycle

-

Combined Cycle

-

-

Capacity Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

≤200 MW

-

>200 MW

-

-

End-use Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Power & Utility

-

Industrial

-

-

Application Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Power Generation

-

Marine

-

Aerospace

-

Process Plants

-

Frequently Asked Questions About This Report

b. The U.S. Gas Turbine Market was valued at USD 2.27 billion in the year 2023 and is expected to reach USD 2.47 billion in 2024.

b. The U.S. Gas Turbine Market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 3.26 billion by 2030.

b. The combined cycle segment accounted for the largest market share of 84.29% in 2023. This growth is attributed to its great efficiency, which enables power companies to extract significantly more power from the same amount of natural gas.

b. The key market player in the U.S. Gas Turbine Market includes General Electric; Solar Turbines Incorporated; Capstone Turbine Corporation; Williams International; TurbineAero; Columbia Manufacturing, Inc.; Sylvania; Vericor Power; Chromalloy Gas Turbine LLC; Central Metal Fabricators, Inc.

b. The key factors that are driving the U.S. Gas Turbine Market include, the country's well-established end-use industries, which are the main sources of demand for the gas turbine industry and are complemented by the nation's well-developed natural gas infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.