- Home

- »

- Medical Devices

- »

-

U.S. General Surgery Devices Market, Industry Report, 2030GVR Report cover

![U.S. General Surgery Devices Market Size, Share & Trends Report]()

U.S. General Surgery Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Orthopedic, Plastic Surgery, Cardiology, Ophthalmology), By Type, By End-use (Hospitals, Ambulatory Surgical Centres), And Segment Forecasts

- Report ID: GVR-4-68040-292-6

- Number of Report Pages: 86

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. General Surgery Devices Market Trends

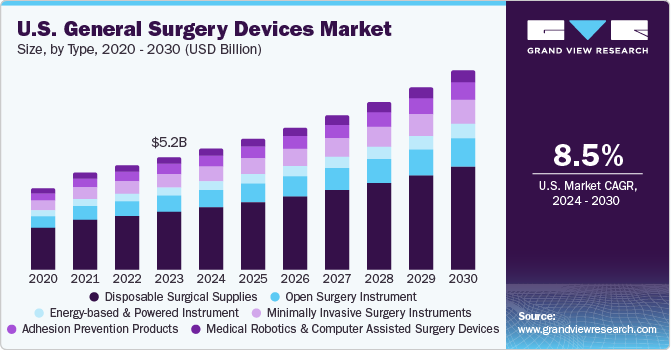

The U.S. general surgery devices market size was estimated at USD 5.22 billion in 2023 and is expected to expand at a CAGR of 8.52% from 2024 to 2030. Potential factors contributing to this growth include the increasing geriatric population, high demand for plastic surgeries, and growing prevalence of orthopedic disorders among individuals. Moreover, increasing number of invasive surgeries for various chronic diseases majorly contributing to market growth.

The major driving factors attributing to the market growth are sedentary lifestyle, poor nutrition, and lack of physical activity which further lead to chronic diseases such as cancer, diabetes, obesity, and cardiovascular diseases. According to the National Institute of Diabetes and Digestive and Kidney Diseases, Statistics, 42.7% of people are obese and 30.7 % of people are overweight in the U.S. Rising prevalence of obesity further contributes to increased demand for median sternotomy procedures thereby expected to drive the segment growth.

In addition, the growing geriatric population is one of the major driving factors fueling the market growth. As per the U.S. Census Bureau report, U.S. population aged 65 and over grew nearly five times faster than the total population over the 100 years from 1920 to 2020, according to 2020 Census. The number of geriatric population reported to be 55.8% in 2020. Thus, the rapidly rising geriatric population showcases significant opportunities in the sternal closure system.

Moreover, well-structured healthcare facilities and ample reimbursement coverages are likely to boost the market growth over the forecast years. The U.S. general surgery devices market accounted for around 35% of the global general surgery devices market in 2023. Advancements in surgical technologies and invasive cardiac surgeries have led to a growing need for specialized sternal closure systems that offer stability, reduced trauma, and enhanced patient outcomes.

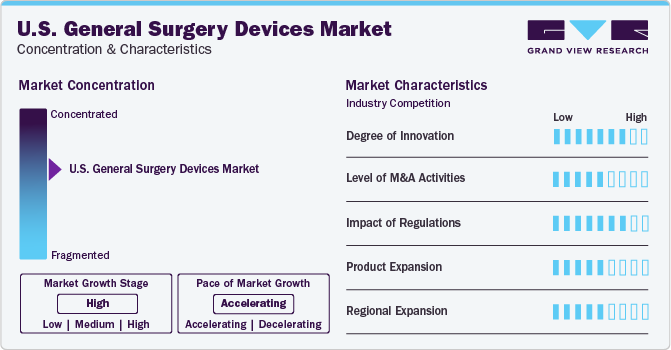

Market Concentration & Characteristics

The U.S. general surgery device industry is concentrated with a high degree of innovations, more number of merger and acquisition activities, and regional and product expansion initiatives undertaken by key companies.

Companies are increasingly focusing on launching new initiatives to maintain their leadership positions and strengthen their presence in this industry. In addition, they implement strategic approaches such as regional as well as product expansionis to serve a wide range of customers and capitalize on geographical growth opportunities. By introducing innovative products, companies can attract customers, drive revenue growth, and enhance their brand reputation in a wide array of geographical industries. For instance, in September 2022, Olympus Corporation introduced the THUNDERBEAT Open Fine Jaw Type X surgical energy devices for open surgery, featuring a new thermal shield to enhance safety during procedures. This innovative device will soon be launched in Europe and the U.S.

Numerous market industries are actively involved in acquiring smaller companies to expand their presence. This strategic approach enables firms to enhance their capabilities, broaden their product portfolios, and improve their competencies. For instance, in September 2022, CONMED Corporation announced its acquisition of Biorez, Inc., a medical device startup based in New Haven, CT. This acquisition, was valued at $85 million at closing with potential additional payments of up to $165 million over four years.

Regulations have the potential to impact companies in various ways, influencing both the demand and supply chain of products. The FDA's Center for Devices and Radiological Health (CDRH) oversees the regulation of companies involved in manufacturing, repackaging, relabeling, and/or importing medical devices distributed in the U.S.

Type Insights

Based on type, disposable Surgical Supplies dominated the market with a share of 52% in 2023 owing to the rising prevalence of chronic diseases such as cancer, orthopedic ailments, and cardiovascular disease. These diseases will likely increase the demand for surgeries required to cure chronic disease and growing preference for plastic surgeries are some of factors for its dominance. For instance, as per data released by the American Society of Plastic Surgeons (ASPS), approximately 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures were performed in the U.S. in 2022.

The energy-based & powered instrument segment is expected to grow at the fastest CAGR from 2024 to 2030 owing to its increasing popularity, various applications, and innovative product launches undertaken by prominent companies. For instance, in September 2023, US Medical Innovations (USMI) along with the Jerome Canady Research Institute for Advanced and Biological Technological Sciences (JCRI-ABTS) introduced the Canady Robotic AI Surgical System. This innovative system aims to enhance surgical precision and safety by targeting microscopic tumor cells during surgery while preserving healthy tissue.

Application Insights

Based on application, orthopedic surgery held the largest market share in 2023. This growth can be attributed to the presence of a high number of orthopedic surgeons and rising implementation of advanced orthopedic surgeries for better outcomes in patients. According to the U.S.Bureau of Labor Statistics, there are a total of 19, 060 orthopedic surgeons practicing in the U.S.Moreover, several key companies focusing on the development of advanced robotic surgeries showcase plenty of opportunities for this segment's growth.

The plastic surgery segment is expected to expand at the fastest CAGR of 8.9% over the forecast period. This growth will be driven by the rising preference of individuals for plastic and aesthetic surgeries to transform their appearance. As per data published by the Aesthetic Society, there is a 14% increase in aesthetic procedures in 2022. Such a surge in plastic and aesthetic surgeries will likely to boost the market growth over the forecast period.

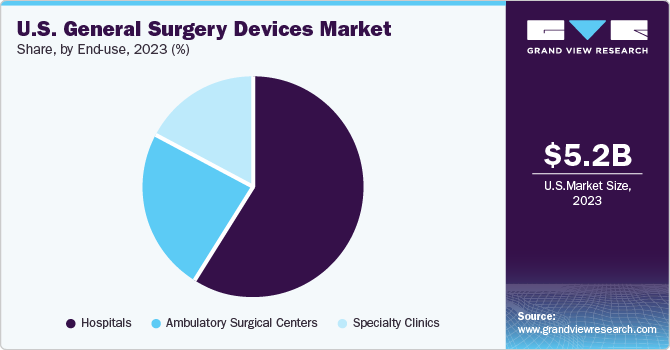

End-use Insights

Based on end-use, hospitals dominated the market with a share of 59% in 2023. This growth can be attributed to the high prevalence of surgeries performed in this region. According to the American Hospital Association, (AHA) Hospital Statistics, approximately 33.68 million hospital admissions are reported in 2024. Moreover, the presence of well-structured healthcare facilities and reimbursement coverages provided by government authorities will likely enhance the growth of this segment.

The ambulatory surgical center segment is anticipated to witness growth at the fastest CAGR from 2024 to 2030 owing to the rising public consciousness for one-day procedures and availability of best quality surgical devices within these centers.

Key U.S. General Surgery Device Company Insights

Major companie soperating in the U.S General surgery devices market include Johnson & Johnson Service, Inc., Conmed Corporation, Stryker,Integra LifeSciences, and Becton, Dickinson, and Company (BD) among others.

These companies prioritize advancing existing technologies to improve patient outcomes and enhance surgical efficiency. Additionally, companies engage in mergers and acquisitions, innovative product launches, and regional expansion efforts to drive market growth.

Key U.S. General Surgery Device Companies:

- Johnson & Johnson Service, Inc.

- Conmed Corporation

- Integra LifeSciences

- Becton, Dickinson, and Company (Bd)

- Cadence Inc

- Integer Holdings Corporation

- Stryker

- Boston Scientific Corporation

- 3M Healthcare

- Biomez, Inc.

Recent Developments

-

In September 2023, Stryker announced a plan to submit the OTTAVA robotic surgical system for an investigational device exemption (IDE) application to the U.S. Food & Drug Administration (FDA) in the second half of 2024 to initiate clinical trials.

-

In February 2023, Surgical, Inc. announced a partnership with Google Cloud to integrate Google Cloud's secure cloud data architecture and machine learning technologies. This partnership aims to enhance the capabilities of Asensus Surgical's Performance-Guided Surgery (PGS) framework through the Intelligent Surgical Unit.

-

In January 2023, Orthofix Medical Inc. along with SeaSpine Holdings Corporation announced the successful completion of their merger of equals following approval from both companies' stockholders.This strategic move combines the strengths of both companies to create a leading global spine and orthopedics entity.

U.S. General Surgery Devices MarketMarket Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.22 billion

Revenue Forecast in 2030

USD 9.24 billion

Growth rate

CAGR of 8.52% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use

Country scope

U.S.

Key companies profiled

Johnson & Johnson Service, Inc.; Conmed Corporation; Integra LifeSciences; Becton, Dickinson, and Company (Bd); Cadence Inc; Integer Holdings Corporation; Stryker; Boston Scientific Corporation; 3M Healthcare; Biomez, Inc., Orthofix Holdings Inc

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. General Surgery Devices Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. general surgery device market report based on, type, application, and end-use:

-

Type Outlook (Revenue in USD Million; 2018 - 2030)

-

Disposable Surgical Supplies

-

Surgical Non-woven

-

Disposable Surgical Masks

-

Surgical Drapes

-

Surgical Caps

-

Surgical Gowns

-

-

Examination & Surgical Gloves

-

General Surgery General Surgery Procedural Kits

-

Needles and Syringes

-

Venous Access Catheters

-

-

Open Surgery Instrument

-

Retractor

-

Dilator

-

Catheters

-

-

Energy-based & Powered Instrument

-

Powered Staplers

-

Drill System

-

-

Minimally Invasive Surgery Instruments

-

Laparoscope

-

Organ Retractor

-

-

Medical Robotics & Computer Assisted Surgery Devices

-

Adhesion Prevention Products

-

-

Application Outlook (Revenue in USD Million; 2018 - 2030)

-

Orthopedic Surgery

-

Cardiology

-

Ophthalmology

-

Wound Care

-

Audiology

-

Thoracic Surgery

-

Urology and Gynecology Surgery

-

Plastic Surgery

-

Neurosurgery

-

Others

-

-

End Use Outlook (Revenue in USD Million; 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

Frequently Asked Questions About This Report

b. The U.S. general surgery devices market size was estimated at USD 5.22 billion in 2023 and is expected to reach USD 18,381.4 million in 2024.

b. The U.S. general surgery devices market is expected to grow at a compound annual growth rate of 8.52% from 2024 to 2030 to reach USD 9.24 billion by 2030.

b. Based on type, disposable surgical supplies dominated the U.S. general surgery devices market with a share of 52% in 2023. This is attributable to rising demand and adoption of disposable surgical supplies.

b. Some key players operating in the general surgery devices market include Covidien Plc (Medtronic); Boston Scientific Corp.; B. Braun Melsungen AG; Conmed Corp.; Erbe Elektromedizin GmbH; Johnson & Johnson Service, Inc.; Integra LifeSciences; Smith & Nephew; 3M Healthcare; and CareFusion Corp.

b. Key factors that are driving the market growth include technological advancements, an increase in surgical procedures, and an increase in government initiatives across the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.