- Home

- »

- Medical Devices

- »

-

General Surgery Devices Market Size & Share Report, 2030GVR Report cover

![General Surgery Devices Market Size, Share & Trends Report]()

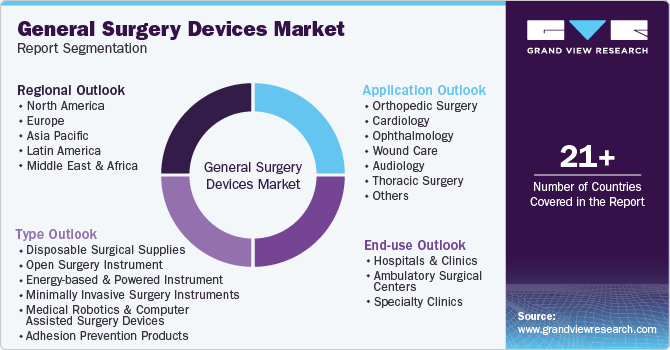

General Surgery Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Disposable Surgical Suppliers, Medical Robotics & Computer Assisted Surgical Devices), BY Application (Orthopedic, Cardiology), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-214-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

General Surgery Devices Market Summary

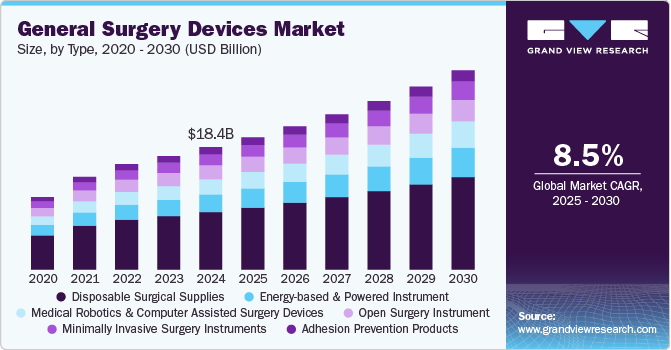

The global general surgery devices market was valued at USD 18.4 billion in 2024 and is projected to reach USD 30.0 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. Rising patient awareness and the high prevalence of cardiac conditions, gastrointestinal diseases, and osteoporosis are expected to boost the number of surgeries performed during the forecast period.

Key Market Trends & Insights

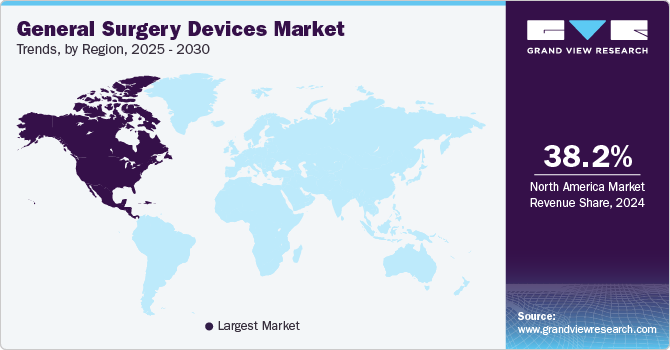

- The North America region held the largest market share, accounting for a 38.2% revenue share in 2024.

- By type, the disposable surgical supplies segment held the largest revenue share, accounted for around 47.1% in 2024.

- By application, the orthopedic surgery segment held the largest revenue share of around 20.7% in 2024.

- By end use, the orthopedic surgery segment held the largest revenue share of around 20.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.4 Billion

- 2030 Projected Market Size: USD 30.0 Billion

- CAGR (2025-2030): 8.5%

- North America: Largest Market in 2024

In addition, technological advancements and the adoption of innovative surgical techniques in emerging countries are likely to propel the general surgery devices market growth. The robotic and computer-assisted surgery sector, still in its early stages, is gradually gaining momentum. Currently, robotics is utilized in various general surgical procedures, including cholecystectomy, fundoplication, and Heller myotomy.

The growing acceptance of minimally invasive and robotic-assisted surgeries is expected to boost the market. According to the article "Trauma of Major Surgery," published by the National Center for Biotechnology Information (NCBI) in July 2020, approximately 310 million major surgeries are performed globally annually. Furthermore, research by Weinstein Legal, released in March 2020, indicates that nearly 30 million children and teenagers participate in youth sports annually, potentially leading to surgical emergencies and an increased demand for general surgery devices.

Health issues affecting the global population are shifting from infectious diseases to lifestyle-related conditions due to industrialization and significant lifestyle changes. This transition has led to a notable rise in health problems, including cardiovascular diseases, cancers, cerebrovascular diseases, and bone disorders in developed, developing, and less developed countries. As the number of vehicles and advanced gadgets increases, so do accident-related injuries. These trends are expected to persist, driving up the demand for general surgeries and surgical equipment worldwide. Consequently, numerous small and large manufacturers of general surgery devices are entering the market, recognizing their substantial growth potential.

Key drivers influencing the global market for general surgery devices include the growing geriatric population, the introduction of RFID and blockchain technologies, increasing demand from emerging nations, heightened awareness of surgical options, and the rising burden of health issues. The use of portable surgical instruments is becoming more common due to the population's higher risk of chronic diseases and the rising costs of hospital care. Consequently, more individuals are opting for home healthcare using portable surgical equipment, which is boosting market growth in developed regions. However, a significant challenge is the high cost of surgical equipment, driven by substantial investments needed to keep up with technological advancements. The acquisition and maintenance costs of advanced surgical devices are considerable, limiting market growth, especially in emerging and underdeveloped areas.

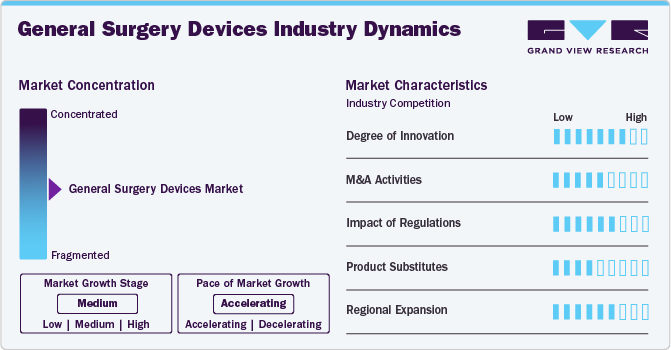

Market Concentration & Characteristics

The general surgery devices market is characterized by moderate to high industry concentration, with several key players dominating the landscape. Established manufacturers often lead in innovation, quality, and distribution networks, while emerging companies focus on niche markets and technological advancements. The market features a diverse range of products, including surgical instruments, robotic systems, and minimally invasive devices. Regulatory compliance and quality assurance are critical, influencing product development and market entry. In addition, the increasing demand for advanced surgical solutions and the growing geriatric population contribute to competitive dynamics, fostering ongoing innovation and collaboration among industry stakeholders.

The market exhibits a high degree of innovation, driven by advancements in technology and the demand for improved surgical outcomes. For instance, InnoVentum focuses on creating advanced surgical navigation systems that enhance precision in intricate procedures. In addition, the Norwegian government supports innovation by providing funding and initiatives aimed at modernizing the healthcare system.

Regulations play a crucial role in the market, ensuring product safety, efficacy, and quality. Regulatory bodies, such as the FDA and EMA, impose strict guidelines for device approval, requiring comprehensive clinical testing and documentation. Compliance with these regulations can be costly and time-consuming, influencing market entry for new manufacturers. However, adherence to regulations also fosters consumer trust and promotes innovation by encouraging companies to invest in research and development. Additionally, evolving regulations, such as those focused on minimally invasive technologies, drive advancements in surgical devices, shaping market dynamics and competitive strategies within the industry.

Mergers and acquisitions in the market are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in September 2023, the Acrotec Group, a Swiss company specializing in high-precision components, acquired Friedrich Daniels, a German manufacturer of surgical instruments and comprehensive solutions located in Solingen.

In the market, product substitutes can significantly impact market dynamics. Alternatives such as minimally invasive techniques and non-surgical interventions are increasingly popular, offering patients less invasive options with shorter recovery times. For instance, laparoscopic surgeries often replace traditional open surgeries, reducing the need for certain surgical instruments. In addition, advancements in technologies like robotic-assisted surgery may serve as substitutes for conventional devices, enhancing precision and efficiency. As healthcare providers adopt these alternatives, manufacturers must innovate continuously to remain competitive and meet evolving patient and provider preferences in surgical care.

The market is witnessing significant regional expansion, driven by increasing healthcare demands and advancements in surgical techniques. Emerging markets in Asia-Pacific and Latin America are experiencing rapid growth due to rising investments in healthcare infrastructure and a growing number of surgical procedures. For instance, in May 2024, Erbe Elektromedizin Gmbh inaugurated a new production facility in Rangendingen, Germany. The facility aims to enhance the company's manufacturing capabilities and foster innovation in medical technology. This expansion reflects Erbe's commitment to meeting the increasing global demand for medical devices while also prioritizing sustainability and efficiency in its operations. The new site is expected to support the development of advanced healthcare solutions.

Type Insights

The disposable surgical supplies segment held the largest revenue share, accounted for around 47.1% in 2024. This growth is driven by the increasing demand for hygiene and infection control in surgical procedures, as disposable items reduce the risk of cross-contamination. Hospitals and surgical centers are increasingly adopting single-use products due to their convenience, cost-effectiveness, and compliance with stringent safety regulations. In addition, the rising number of surgical procedures, coupled with heightened awareness of patient safety, further fuels the demand for disposable surgical supplies. This trend is expected to continue, solidifying the segment's leading position in the market.

The medical robotics & computer assisted surgery devices segment is projected to experience the fastest CAGR from 2025 to 2030. The availability of FDA-approved robotically assisted surgical devices in the market also contributes to the segment's growth. For instance, in March 2021, the U. S. Food and Drug Administration approved the Hominis Surgical System for marketing, a new robotic surgical device that can assist with transvaginal hysterectomy in specific patients. The Hominis Surgical System is designed for performing benign hysterectomy and salpingo-oophorectomy procedures.

Application Insights

The orthopedic surgery segment held the largest revenue share of around 20.7% in 2024. This expansion is fueled by several factors, including a growing incidence of musculoskeletal disorders, a rise in sports-related injuries, and an aging population that requires joint replacements and other orthopedic interventions. In addition, advancements in surgical techniques, such as minimally invasive procedures and the integration of robotics, enhance the efficacy and safety of orthopedic surgeries.

The cardiology segment in the general surgery devices market is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. Increasing cases of heart-related disorders, which generally require surgical procedures, are expected to drive the growth of the market. For instance, according to World Heart Report 2024 published by the World Heart Federation, in 2021, cardiovascular diseases caused 20.5 million deaths globally, affecting over 500 million people worldwide, representing nearly one-third of all deaths worldwide, and showing an overall increase.

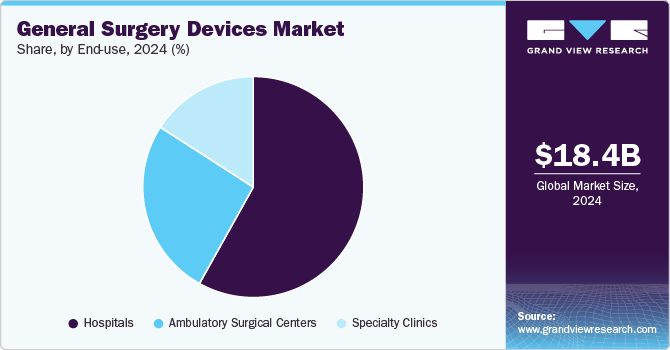

End-use Insights

The hospitals segment accounted for the largest revenue share of 58.1% in 2024. This trend can be attributed to several factors, including advancements in medical technology, which have made surgeries safer and more effective, and an aging population that often requires more surgical interventions. As hospitals expand their capabilities and improve patient care, the volume of elective and emergency surgeries is expected to increase further, driving the segment's growth and prompting investments in surgical equipment, staff training, and infrastructure enhancements

The ambulatory surgical centers segment is projected to witness the fastest from 2025 to 2030. An increase in preference for same-day surgery, a reduction in significant cost savings & wait times, and a rise in the number of patients requiring surgical interventions are among the factors driving the demand for minimally invasive surgical instruments including general surgery devices in ambulatory surgery centers. The increasing number of ambulatory surgical centers across the globe is contributing to the growth of the segment. For instance, Definitive Healthcare, LLC reported that in 2025, there were approximately 9,600 operational ambulatory surgical centers in the United States. These centers facilitate high numbers of surgeries in a brief timeframe, leading to market growth in the projected period.

Regional Insights

The North America general surgery devices market dominated the overall global market and accounted for 38.2% of revenue share in 2024. Key factors include significant healthcare investments, a robust network of established hospitals, and the presence of leading industry players in the U.S. According to the American Hospital Association's (AHA) 2024 report, approximately 6,200 operational hospitals in the U.S. These facilities perform millions of surgical procedures yearly to address various conditions, including orthopedic issues, neurological disorders, and injuries.

U.S. General Surgery Devices Market Trends

The general surgery devices market in U.S. held a significant share of North America's market in 2024. Demand for innovative, high-quality instruments is driven by advancements in technology and a focus on patient safety. The market features a mix of established manufacturers and emerging players. The increasing prevalence of minimally invasive surgeries across various specialties, including aesthetics, dentistry, orthopedics, thoracic surgery, cardiology, and gynecology, is projected to significantly drive market growth.

Europe General Surgery Devices Market Trends

The European general surgery devices market is witnessing rapid growth during the forecast period. The region's growth can be attributed to the increasing demand for advanced surgical devices and a notable rise in the number of surgical procedures performed for various medical conditions. For instance, according to the National Center for Biotechnology Information (NCBI) estimates, approximately 20 million surgeries are conducted annually in Europe. This upward trend in surgical interventions is expected to enhance demand for general surgery devices, thereby driving market growth.

The general surgery devices market in UK is witnessing significant growth due to the rising incidence of chronic diseases like diabetes, the expanding elderly population, and the adoption of biosimilars. For instance, according to the Department of Health & Social Care in the UK, the population aged 85 and older is expected to increase by one million between 2021 and 2036.Major companies such as Medtronic, Johnson & Johnson, and Stryker lead the market with comprehensive product portfolios encompassing advanced general devices, robotic systems, and cutting-edge technologies.

France general surgery devices market is witnessing growth, benefits from a comprehensive healthcare system, and advanced medical technology adoption. According to World Bank data, healthcare expenditure in France was approximately 12.31% of its GDP in 2021, reflecting the country's commitment to maintaining a robust healthcare infrastructure that effectively meets the needs of its citizens. With the aging population and an increasing prevalence of cardiovascular diseases, which the French Public Health Agency estimates to affect around 4 million individuals, the demand for general surgery devices is projected to rise during the forecast period.

The general surgery devices market in Germany is undergoing significant growth, driven by the country's manufacturers, who have built a strong reputation for delivering high-quality medical devices. This positive trend reflects a growing demand for reliable surgical instruments, as healthcare providers prioritize quality and precision in their tools. German manufacturers are continuously innovating to meet the needs of the medical community, reinforcing their position as leaders in the global market. As a result, the industry is well-positioned for continued expansion in response to advancements in healthcare practices and technologies.

Asia Pacific General Surgery Devices Market Trends

The Asia Pacific general surgery devices market is witnessing significant growth driven by rising healthcare investments, an expanding elderly population, and an increasing prevalence of chronic respiratory diseases. Countries like China, India, and Japan are key contributors, with growing adoption of advanced medical technologies and improving healthcare infrastructure. The APAC general surgery devices market is expected to expand due to the region's numerous FDA, TGA, and EMA-approved facilities.

The general surgery devices market in Japan is poised for substantial growth. The introduction of technologically advanced surgical devices and the continuous launch of new products in the country are also contributing to market expansion. Manufacturers are actively investing in research and development to create innovative tools that enhance precision, efficiency, and patient outcomes. For instance, in September 2022, Olympus Corporation introduced the THUNDERBEAT Open Fine Jaw Type X surgical energy device, specifically designed for open surgeries, including delicate procedures such as thyroidectomy.

China general surgery devices market is expected to grow in the Asia Pacific in 2023. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the general surgery devices market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, according to the National Bureau of Statistics of China, individuals aged 60 and above are expected to account for approximately 21.1% of the national population by 2024. This aging demographic is at a higher risk for chronic diseases that may necessitate surgical interventions, thereby driving demand for surgical devices.

The general surgery devices market in India is rapidly expanding, fueled by rising healthcare expenditures and an increasing number of surgical procedures. Companies are launching innovative tools for various procedures. For example, in August 2024, Johnson & Johnson MedTech's DePuy Synthes launched a cutting-edge robotics system and a standalone navigation platform with eCential Robotics. Increased government support for the healthcare sector through various grants and funding initiatives drives innovation and enhances the production of advanced surgical devices in the country, further propelling market growth.

Latin America General Surgery Devices Market Trends

The Latin American general surgery devices market is experiencing growth driven by increasing surgical procedures and rising healthcare investments. Surgical devices like forceps, dilators, and retractors are widely used in orthopedic, cardiac, and gynecological procedures in Latin America. The increasing geriatric population is driving higher demand for healthcare services. According to World Bank data, adults aged 65 and older represented about 9% of the population in 2024, projected to double by 2050.

Middle East & Africa General Surgery Devices Market Trends

The general surgery devices market in the MEA region is experiencing growth driven by increasing healthcare investments, a rising prevalence of chronic diseases, and the expansion of medical tourism, particularly in countries like Saudi Arabia, and UAE. Demand for advanced technologies, such as minimally invasive surgery (MIS) devices and robotic-assisted systems, is increasing in these nations, while cost-sensitive markets in Africa face challenges due to limited healthcare infrastructure and economic constraints.

Saudi Arabia general surgery devices market is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, according to the Saudi Arabian General Authority for Statistics, the population aged 65 and older is expected to reach approximately 4 million by 2030, reflecting a notable increase in demand for surgical devices as this demographic is more prone to various health conditions.

Key General Surgery Devices Company Insights

The market is highly competitive, with key players such as B. Braun Melsungen AG, BD; and Stryker holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key General Surgery Devices Companies:

The following are the leading companies in the general surgery devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic Plc

- Johnson & Johnson Service, Inc.

- Conmed Corporation

- Integra LifeSciences

- Smith & Nephew

- Becton, Dickinson and Company (Bd)

- B. Braun Melsungen Ag

- Cadence Inc

- Integer Holdings Corporation

- Olympus Corporation

- Stryker

- Boston Scientific Corporation

- Erbe Elektromedizin Gmbh

- 3M Healthcare

Recent Developments

-

In August 2024,Johnson & Johnson announced the launch of the MatrixSTERNUM Fixation System. This advanced plate and screw fixation system is designed to stabilize and secure the anterior chest wall following procedures such as open-heart surgery and chest surgery. The MatrixSTERNUM system aims to address patient needs in the operating room by offering enhanced locking strength, expedited chest fixation, and thinner, low-profile plates in comparison to competing products.

-

In October 2024, Smith & Nephew signed a co-marketing agreement with JointVue for its patented OrthoSonic 3D Surgery Planning Technology. JointVue's technology enables surgeons utilizing Smith+Nephew's CORI Surgical System to develop personalized surgical plans for robotic-assisted knee arthroplasty. This innovation may enhance patient satisfaction and improve operating room efficiency.

-

In September 2022, Solvay partnered with French startup Ostium to develop innovative materials for single-use surgical instruments. This collaboration aims to enhance the performance and safety of surgical tools, promoting sustainability in the medical field. The partnership reflects Solvay’s commitment to advancing healthcare through advanced materials technology and innovative solutions.

General Surgery Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.9 billion

Revenue forecast in 2030

USD 30.0 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe;, Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic Plc; Johnson & Johnson Service; Inc.; Conmed Corporation; Integra LifeSciences; Smith & Nephew; Becton; Dickinson and Company (Bd); B. Braun Melsungen Ag; Cadence Inc; Integer Holdings Corporation; Olympus Corporation; Stryker; Boston Scientific Corporation; Erbe Elektromedizin Gmbh; 3M Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global General Surgery Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global general surgery devices market report based on the type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Surgical Supplies

-

Surgical Non-woven

-

Disposable Surgical Masks

-

Surgical Drapes

-

Surgical Caps

-

Surgical Gowns

-

-

Examination & Surgical Gloves

-

General Surgery Procedural Kits

-

Needles and Syringes

-

Venous Access Catheters

-

-

Open Surgery Instrument

-

Retractor

-

Dilator

-

Catheters

-

-

Energy-based & Powered Instrument

-

Powered Staplers

-

Drill System

-

-

Minimally Invasive Surgery Instruments

-

Laparoscope

-

Organ Retractor

-

-

Medical Robotics & Computer Assisted Surgery Devices

-

Adhesion Prevention Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgery

-

Cardiology

-

Ophthalmology

-

Wound Care

-

Audiology

-

Thoracic Surgery

-

Urology and Gynecology Surgery

-

Plastic Surgery

-

Neurosurgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global general surgery devices market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 30.0 billion by 2030.

b. North America dominated the general surgery devices market with a share of 38.2% in 2024 This is attributable to favorable reimbursement policies, the presence of key companies, and supportive government initiatives.

b. Some key players operating in the general surgery devices market include Covidien Plc (Medtronic); Boston Scientific Corp.; B. Braun Melsungen AG; Conmed Corp.; Erbe Elektromedizin GmbH; Johnson & Johnson Service, Inc.; Integra LifeSciences; Smith & Nephew; 3M Healthcare; and CareFusion Corp.

b. Key factors that are driving the market growth include technological advancements, an increase in surgical procedures, and an increase in government initiatives across the world.

b. The global general surgery devices market size was estimated at USD 18.40 billion in 2024 and is expected to reach USD 19.88 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.