- Home

- »

- Medical Devices

- »

-

U.S. Hand-held Surgical Instruments Market, Industry Report, 2030GVR Report cover

![U.S. Hand-held Surgical Instruments Market Size, Share & Trends Report]()

U.S. Hand-held Surgical Instruments Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Forceps, Retractors, Dilators), By Application (Orthopedic Surgery, Cardiology, Ophthalmology), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-237-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

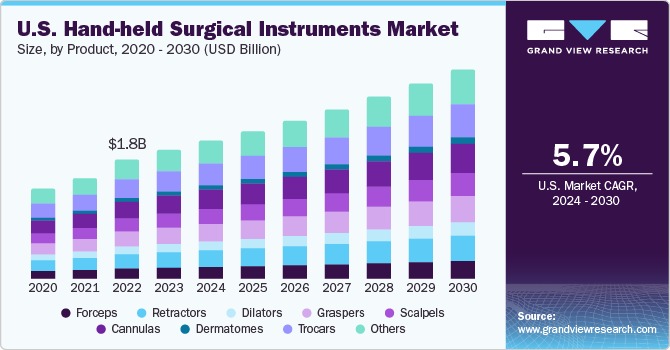

The U.S. hand-held surgical instruments market size was estimated at USD 1.9 billion in 2023 and is most likely to grow at a CAGR of 5.7% from 2024 to 2030. This can be due to rising prevalence of chronic conditions, rising geriatric population, and revving number of surgical procedures. Moreover, increasing the number of roads and other accidents further drives the market's growth.

The U.S. market accounted for over 33.0% of the global hand-held surgical instruments market. Growing road accidents significantly drive the increased demand for hand-held surgical instruments. In U.S., the National Highway Traffic Safety Administration (NHTSA) has reported that around 31,785 deaths were caused due to road accidents during the first nine months of 2022. As a result, the increase in road accidents and related injuries is expected to lead to more wound surgeries, which is likely to have a favorable effect on the long-term growth of the hand-held surgical instruments market. Such a trend signifies the role road safety and accident prevention measures play in shaping healthcare demands and market dynamics related to surgical instruments.

Moreover, the surge in chronic diseases, comprising cardiac, gastrointestinal, orthopedic, vascular, gynecological, urological, and thoracic conditions, is projected to fuel the demand for surgical interventions. In the U.S., lung cancer is considered the second most prevalent Cancer, necessitating minimally invasive thoracic surgery. Moreover, Cancer poses a huge burden on any country’s healthcare system as it is one of the leading causes of death. As per the statistics by the National Institute of Health, in 2023, 1,958,310 new cancer cases and 609,820 cancer deaths are anticipated to occur in the U.S. Thus, many surgical procedures performed in these end-use settings are attributed to large market share.

Concurrently, the escalating incidence of cardiovascular diseases is fueling a significant need for laparoscopic instruments. As per CDC statistics, approximately 655,000 deaths occur in America annually. Furthermore, the United States has witnessed a rise in hospital admissions due to the high prevalence of chronic medical conditions and fatal injuries. Chronic diseases, as highlighted by the CDC, are considered the primary causes of disability and mortality. In the U.S., statistics revealed that 4 out of 10 adults are affected by two or more chronic diseases, while 6 out of 10 adults suffer from some chronic disease.

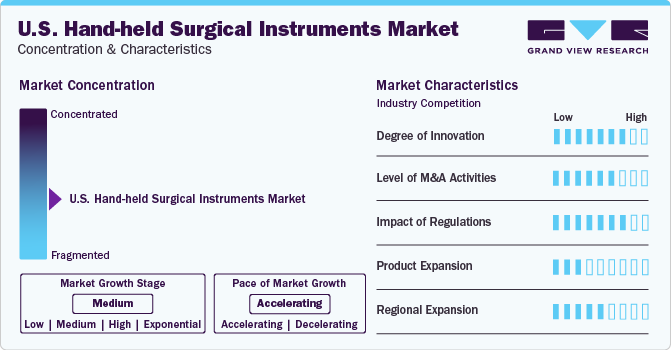

Market Concentration & Characteristics

The U.S. surgical equipment market is fragmented, and this is due to high merger and acquisition activities, new product launches, regulatory approvals and regional expansion undertaken by players in this industry.

Industries increasingly focus on innovation and new product launches to escalate their leadership positions and strengthen their market reputation. This strategic approach helps sustain market competitiveness and adapt to varied market dynamics. For instance, In November 2022, Johnson & Johnson launched the next-generation ECHELON 3000 Surgical stapler in the U.S. This novel stapler specialized for transect and wound stapling during open and minimally invasive surgical procedures.

The strategic move of acquisition undertaken by several industries offers expansion in the market, wide increases in their capabilities, and diversification of their product portfolios. This approach allows industries to leverage the strengths of acquired companies, get access to new markets, and drive growth effectively. For instance, In October 2022, Aspen Surgical announced the acquisition of Symmetry Surgical. This acquisition is projected to expand the company’s portfolio and diversify surgical categories. Also, allows new commercial capabilities and a rise in share.

The favorable regulatory framework in the U.S. is significantly driving market growth. Regulatory bodies such as the US FDA aim to identify the risk before product approval for commercialization. Moreover, these authorities focus on product safety and quality, ultimately impacting market growth and consumer confidence in the industry. For instance, in June 2023, US Medical Innovations, LLC announced FDA clearance approval for Canady Flex RoboWristTM. This surgical instrument is targeted for open and laparoscopic procedures in the U.S.

Only some industries are strategically focusing on regional and product expansion to serve a wide range of customers and capitalize on geographical market growth opportunities. This approach allows companies to strengthen their presence in different regions, adapt to local market needs, and enhance their market share by targeting diverse customer segments.

Product Insights

Based on product, trocars held the largest market share of 16.1% in 2023. Trocars are generally utilized for making puncture-like incisions in the outer tissue layer during laparoscopic operations and minimally invasive surgeries. As laparoscopy is preferred due to its rapid recovery rate, successful patient outcomes, and lesser risk of post-operative infections, the demand for instruments such as trocars is also increasing, boosting the market growth. For instance, as per the data published by North Kansas City Hospital, nearly 15 million laparoscopic procedures are performed in the U.S. annually. Such a surge in demand further fuels market growth.

The other segment is projected to grow at the fastest CAGR from 2024 to 2030. The other segments are further segmented into clamps, surgical staplers, and closure devices. Key companies ' rising innovation and product launches of these instruments are expected to boost market growth.

Application Insights

Based on applications, orthopedic surgery dominated this market, with the largest share of 18.4% in 2023. This growth can be attributed to the increasing prevalence of Musculoskeletal (MSK) conditions and advancements in minimally invasive surgical techniques. This surge is a growing demand for orthopedic interventions to address musculoskeletal conditions. Moreover, fractures are contributing to the overall burden of these conditions. For instance, as per the statistics by Ohio State University, around 6.3 million fractures occur annually in the U.S. Such rising incidences of fractures and other musculoskeletal disorders in the region are driving the segment growth.

The plastic surgery segment is anticipated to expand at the fastest CAGR from 2024 to 2030, owing to the rising popularity of plastic surgeries within the region. According to the American Society of Plastic Surgeons Statistics, cosmetic surgeries have increased by 19%, accounting for 576,485 procedures in 2022. In addition, increasing injuries and disabilities due to road accidents contribute to extensive surgical interventions. This is projected to enhance the number of plastic surgeries. Furthermore, advanced technologies and increasing disposable income in the U.S. propel the market growth of hand-held surgical instruments.

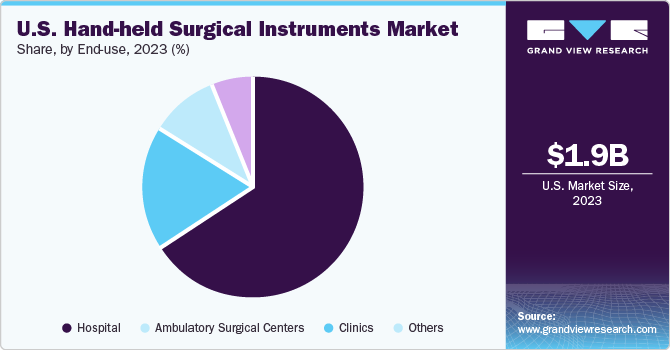

End-use Insights

Based on end-use, hospitals held the largest market share with 66.0% share in 2023. This growth can be attributed to rising incidences of invasive surgeries performed in hospital settings. According to the CDC, 125.7 million outpatient department visits were recorded in the U.S. With the increase in surgical procedures, such as angioplasty and kidney & liver transplants, and the incidence of trauma, increasing the demand for surgical instruments in hospitals. Moreover, the increasing elderly population, sedentary lifestyles, and the prevalence of smoking and alcohol consumption are key drivers behind the rise in non-communicable diseases such as cancer, diabetes, and cardiovascular conditions. According to the National Diabetes Statistics Report for 2022, approximately 37.3 million individuals in the U.S. were affected by diabetes.

The clinics segment is projected to grow fastest from 2024 to 2030. Frequent patient visits and availability of specialty clinics across the region drive the growth of this segment. The specialty clinics include dental, orthopedic, and dermatological clinics. There is a rise in skin cancer and melanoma incidences, resulting in a higher number of patient visits to dermatology clinics for cures. As per the American Cancer Society, approximately 1000 640 new melanoma incidences are estimated to be diagnosed in 2024. Furthermore, increasing aesthetic awareness among individuals is expected to accelerate the market growth.

Key U.S. Hand-held Surgical Instruments Company Insights

The key companies in U.S. hand-held surgical instruments market include Johnson & Johnson, Stryker, Boston Scientific, Inc., Zimmer Biomet Holdings, Inc., and Becton, Dickinson, and Company.

Leading U.S. hand-held surgical instruments market companies always focus on developing and upgrading existing technologies to enhance patient outcomes and significantly increase surgical efficiency. Moreover, M&A activities undertaken by market players, innovative product launches, and regional product expansion initiatives further leverage the market's growth.

Key U.S. Hand-held Surgical Instruments Companies:

- Johnson & Johnson

- Stryker

- Boston Scientific, Inc

- Hospira

- Integra LifeSciences

- Zimmer Biomet Holdings, Inc

- Becton, Dickinson and Company

- CooperSurgical, Inc

- Thompson Surgical Instruments, Inc

- Arthrex, Inc.

- Aspen Surgical

Recent Developments

-

In December 2023, the US-based Popular Equipment Finance announced the acquisition of a Quantum Surgical-manufactured Epione robot. The Epione robotic system is specialized for the early treatment of inoperable tumors especially in the abdomen (liver, kidney, and pancreas

-

In June 2023, STERIS plc announced the acquisition agreement with Becton, Dickinson, and Company for about USD 540 million. Under this acquisition, the STERIS Plc would buy surgical instrumentation, laparoscopic instrumentation, and sterilization facilities of BD.

-

In May 2023, US- based Think Surgical announced approval of FDA 510 (k) for TMINI miniature robotic model for total knee surgeries.

U.S. Hand-held Surgical Instruments Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.9 billion

Revenue Forecast in 2030

USD 2.8 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

Johnson & Johnson; Stryker; Boston Scientific. Inc;Hospira; Integra LifeSciences; Zimmer Biomet Holdings, Inc; Becton, Dickinson, and Company; CooperSurgical, Inc; Thompson Surgical Instruments, Inc; Arthrex, Inc.; Aspen Surgical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hand-held Surgical Instruments Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hand-held surgical instruments market report based on product, application, and end-use:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Forceps

-

Retractors

-

Dilators

-

Graspers

-

Scalpels

-

Cannulas

-

Dermatomes

-

Trocars

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgery

-

Cardiology

-

Ophthalmology

-

Wound Care

-

Audiology

-

Thoracic Surgery

-

Urology and Gynecology Surgery

-

Plastic Surgery

-

Neurosurgery

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hand-held surgical instruments market size was estimated at USD 1.9 billion in 2023 and is expected to reach USD 2.0 billion in 2024.

b. The U.S. hand-held surgical instruments market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 2.8 billion by 2030.

b. Trocars dominated the U.S. hand-held surgical instruments market with a share of 16.1% in 2023. This is attributable to the wide use and demand for trocars across the U.S.

b. Some key players operating in the U.S. hand-held surgical instruments market include Integra Life Sciences, Medtronic, B. Braun Melsungen AG, Zimmer Biomet Holdings, Inc., Johnson & Johnson Services Inc., BD (Becton, Dickinson, and Company), Smith & Nephew, CooperSurgical, Inc., Thompson Surgical Instruments, Inc., Arthrex, Inc., and Aspen Surgical.

b. Key factors that are driving the U.S. hand-held surgical instruments market growth include a surge in awareness about minimally invasive surgeries, improving healthcare infrastructure in emerging economies, and a rising number of hospitals and clinics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.