- Home

- »

- Next Generation Technologies

- »

-

U.S. Handheld Counter IED Market Size, Share Report, 2033GVR Report cover

![U.S. Handheld Counter IED Market Size, Share & Trends Report]()

U.S. Handheld Counter IED Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Portable Detectors, Handheld Scanners), By Detection Technology, By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-637-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Handheld Counter IED Market Trends

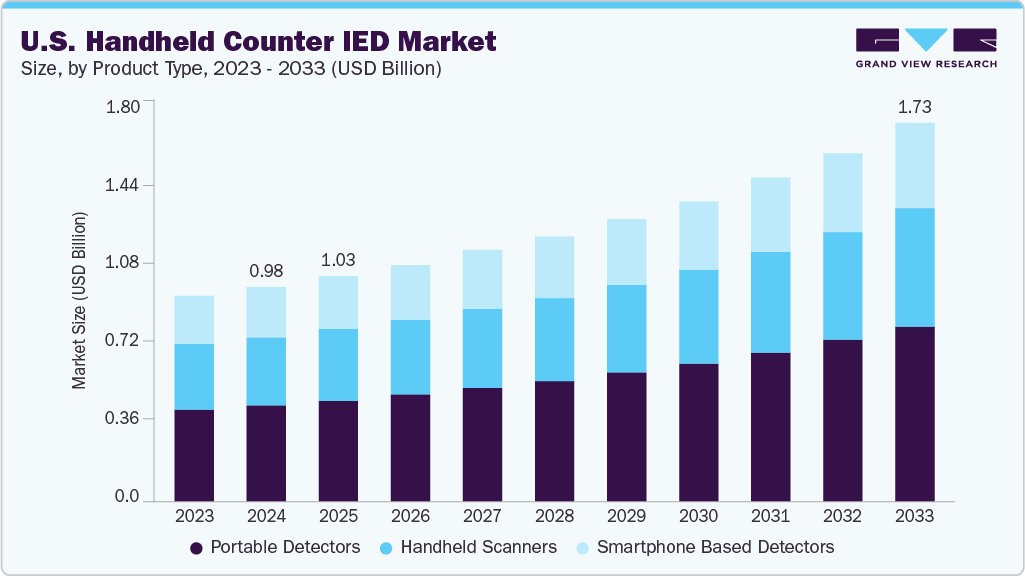

The U.S. handheld counter IED market size was estimated at USD 0.98 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2033. The persistent use of improvised explosive devices (IEDs) by insurgent groups and lone actors continues to pose a major security threat, particularly in conflict zones and urban environments. The U.S. military and homeland security agencies are actively investing in handheld C-IED technologies to neutralize threats in real time and prevent mass casualties. These devices offer immediate deployability and situational flexibility, which are crucial for on-ground counterterrorism operations. The market is being driven by the need for lightweight, rugged, and rapidly deployable detection tools suited for unpredictable environments.

Rapid detection technology innovations are transforming handheld C-IED systems' performance and usability. Today’s devices are no longer limited to one type of sensor; instead, they combine electromagnetic field detection, chemical trace sensors, infrared imaging, and acoustic analysis to provide a multi-modal approach to explosive threat detection. Artificial Intelligence (AI) and machine learning are being integrated to analyze sensor data in real time, reducing the rate of false alarms and improving threat classification. Enhanced data connectivity allows field operators to transmit findings to command centers for further analysis or remote support. Miniaturization of components has made these devices more lightweight and ergonomic, increasing adoption among foot soldiers and tactical teams. With these advancements, the market is seeing a shift toward smart, adaptive handheld systems that not only detect threats but also provide actionable insights on the nature and potential impact of the explosive device.

The growing application of handheld C-IED devices in civilian security and urban counterterrorism efforts. Airports, seaports, mass transit systems, sporting events, and government buildings have become potential soft targets for IED attacks. Consequently, federal and municipal agencies such as the Transportation Security Administration (TSA), Department of Homeland Security (DHS), and local police bomb squads are increasing their investment in portable explosive detection tools. These devices are designed for intuitive use by first responders, often requiring minimal training while maintaining high accuracy. The expansion of C-IED usage into civilian domains has also triggered the development of more ruggedized, user-friendly, and cost-effective solutions.

Federal investment and institutional support play a vital role in accelerating the adoption of handheld C-IED technologies. U.S. defense and security agencies-including the Department of Defense (DoD), JIDO, DHS, and various intelligence and customs authorities-have allocated substantial budgets toward counter-IED programs. These funds are directed toward both R&D efforts for next-generation detection systems and bulk procurement to equip frontline operatives across the country. Government solicitations frequently specify compactness, multi-threat detection capability, battery efficiency, and compatibility with existing tactical gear, driving suppliers to innovate on both form and function.

Tactical mobility and enhanced soldier safety are pivotal concerns influencing handheld C-IED system development. Modern military and law enforcement units require tools that can be easily carried, deployed quickly, and operated under stressful conditions. Handheld systems offer this flexibility, unlike vehicle-mounted or large-scale equipment, which may be constrained by terrain or environment. The latest models are designed with ergonomic grips, heads-up display interfaces, and modular attachments for integration with tactical vests or helmets. Some systems can also be paired with UAVs (drones) or robotic arms for remote scanning, further reducing operator risk.

Product Type Insights

Portable detectors segment dominated the market with a share of 45.20% in 2024. These systems are widely used by defense forces, bomb disposal units, and homeland security agencies because they offer robust detection capabilities across a range of explosive types, including buried or concealed IEDs. Their ability to function effectively in rugged terrain, high-temperature zones, or crowded urban areas has made them indispensable for routine patrols and rapid-response missions. With ongoing upgrades in sensor integration and battery life, portable detectors are increasingly favored in tactical and long-range field operations, especially where early threat detection and mobility are paramount.

The handheld scanners segment is expected to grow at a significant CAGR during the forecast period. Handheld scanners are emerging as a high-potential segment in the counter-IED market, driven by the growing need for lightweight, user-friendly, and rapidly deployable solutions. Unlike bulkier portable detectors, these compact devices are ideal for close-range inspections in confined or high-traffic environments such as airports, border checkpoints, or public events. Their rising adoption is supported by advancements in AI-powered imaging, touchless scanning, and real-time analytics, which allow frontline personnel to identify suspicious items with greater accuracy and speed. The simplicity of operation also makes handheld scanners suitable for use by non-specialist operators, such as local police or event security staff.

Detection Technology Insights

The electromagnetic field detection segment accounted for the largest share in 2024. Electromagnetic field (EMF) detection remains the dominating technology segment in the U.S. handheld counter-IED market due to its high reliability and widespread operational use across military and homeland security units. These systems detect disruptions in electromagnetic fields caused by concealed electronic components or wiring within IEDs. EMF detectors are especially effective in identifying command-detonated or radio-controlled devices, which are commonly used in asymmetric warfare. Their proven accuracy, ability to function in varied terrains, and minimal dependence on visual cues make them a preferred choice for field operations.

The acoustic detection segment is expected to grow at a significant CAGR during the forecast period. Acoustic detection is emerging as a promising technology in handheld counter-IED systems, driven by innovations in sound wave analysis and directional listening capabilities. This segment is gaining traction for its potential to detect IED-related activities such as movement, mechanical triggers, or concealed compartments by interpreting subtle acoustic signatures. Unlike traditional EMF-based systems, acoustic detection can be effective even when minimal electronic components are present or electromagnetic interference is high. Its non-invasive, passive nature is suitable for covert surveillance and checkpoint applications.

Application Insights

The military segment held the largest market share in 2024. The military segment continues to dominate the U.S. handheld counter-IED market, driven by persistent threats in both overseas operations and domestic training missions. The U.S. Department of Defense (DoD) prioritizes equipping soldiers with advanced, portable detection tools that can identify and neutralize IED threats in real time, especially in rugged, remote, or high-conflict environments like the Middle East and Africa. Handheld C-IED devices offer ground troops a critical first line of defense during route clearance, foot patrols, and base perimeter security. These tools are designed to integrate with existing tactical gear and withstand harsh battlefield conditions, making them indispensable in asymmetric warfare scenarios.

The homeland security segment is expected to register the fastest CAGR during the forecast period. The homeland security segment is emerging as a key growth area in the handheld counter-IED market, driven by rising concerns over domestic terrorism, lone-wolf attacks, and threats to critical infrastructure. Agencies such as the Department of Homeland Security (DHS), Transportation Security Administration (TSA), and local bomb squads are increasingly investing in compact, easy-to-operate detection tools for use in airports, mass transit systems, public gatherings, and government buildings. These handheld systems are valued for their portability and quick deployment, enabling rapid screening without causing major disruption to public operations.

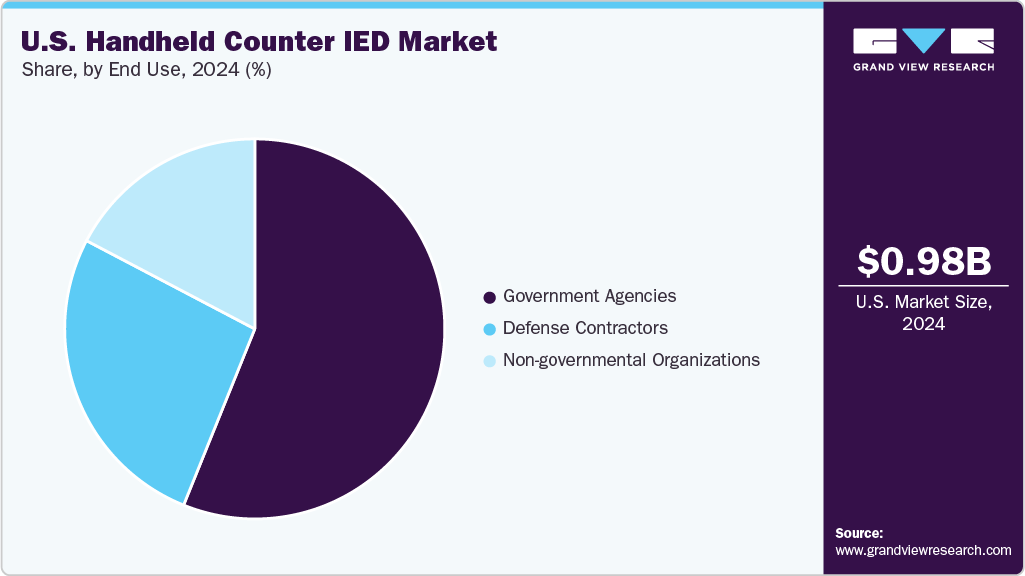

End Use Insights

The government agencies segment held the largest market share in 2024. Federal bodies such as the Department of Defense (DoD), Department of Homeland Security (DHS), Transportation Security Administration (TSA), and the FBI are the primary procurers of these devices. Their broad operational mandates require reliable, field-ready detection tools for use in diverse environments, from warzones and border patrol to large-scale public events. Government funding channels, including defense budgets and counterterrorism grants, consistently prioritize C-IED capabilities, ensuring sustained demand. These agencies also influence the technological direction of the market through their procurement specifications, pushing manufacturers to deliver highly secure, rugged, and interoperable handheld solutions.

The defense contractors segment is expected to register the fastest CAGR during the forecast period. These companies, ranging from prime contractors to specialized system integrators, are increasingly engaging in both R&D and field deployment support under subcontracting agreements with federal agencies. The rising demand for next-generation detection solutions and rapid prototyping, contractors are leveraging their technical expertise in sensor fusion, AI, and robotics to co-develop compact, intelligent handheld C-IED systems. Moreover, many defense firms are expanding their in-house testing capabilities to align their offerings with military-grade standards. Their role is further amplified by the government’s push for public-private partnerships in national security technology development.

Key U.S. Handheld Counter IED Company Insights

Some of the key companies in the U.S. handheld counter IED Market include L3Harris Technologies, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies, and others. To gain a competitive edge and expand their market share in the Handheld Counter-IED (C-IED) market, key players are actively pursuing strategic initiatives such as mergers, acquisitions, and partnerships with defense contractors, law enforcement agencies, and research institutions. These collaborations enable companies to enhance their technological capabilities by integrating multi-sensor systems, AI-driven threat analysis, and real-time communication features into their handheld devices.

-

L3Harris Technologies, stands out in the Handheld Counter-IED market through its innovation in sensor fusion and portable detection systems. Leveraging its expertise in aerospace, defense, and tactical communications, L3Harris offers compact, high-sensitivity handheld devices like the Fido series, which enable rapid and accurate detection of trace explosives.

-

Lockheed Martin holds a significant share of the handheld C-IED market through systems like Silent Guardian and other portable electromagnetic field detectors. The company supports multiple U.S. Army and Joint Improvised-Threat Defeat Organization (JIDO) initiatives and integrates electronic warfare capabilities into its detection solutions, making them a preferred partner for government contracts.

Key U.S. Handheld Counter IED Companies:

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Thales Group

- Chemring Group PLC

- Elbit Systems Ltd.

- BAE Systems PLC

- Sierra Nevada Corporation

Recent Developments

-

In October 2024, L3Harris Technologies and Palantir Technologies announced a strategic partnership in October 2024 to accelerate L3Harris’ digital transformation and develop advanced defense technologies. The collaboration combines L3Harris’ expertise in sensors and software-defined systems with Palantir’s Artificial Intelligence Platform (AIP) to enhance joint-all-domain connectivity and tactical decision-making. Key initiatives include support for U.S. Army programs like TITAN and integration of Palantir AIP into L3Harris operations.

-

In February 2024, Northrop Grumman has been awarded a four-year, USD 123.2 million contract to support the U.S. Navy, Air Force, and the Australian government with sustainment and engineering services for a counter-IED system. The contract focuses on the Joint Counter Radio-Controlled Improvised Explosive Device Increment One Block One (JCREW I1B1) system, which includes mounted, dismounted, and fixed-site variants. This system provides vital protection against radio-controlled IEDs for soldiers, vehicles, and infrastructure. The contract includes engineering support, other direct costs, and provisioned item orders, with a base value of USD 42.8 million. It will be funded through fiscal 2023-2024 RDT&E budgets and foreign military sales funds.

U.S. Handheld Counter IED Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.03 billion

Revenue forecast in 2033

USD 1.73 billion

Growth rate

CAGR of 6.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, detection technology, application, end-use

Key companies profiled

L3Harris Technologies, Inc.; Lockheed Martin Corporation; Northrop Grumman Corporation; Raytheon Technologies Corporation; General Dynamics Corporation; Thales Group; Chemring Group PLC; Elbit Systems Ltd.; BAE Systems PLC; Sierra Nevada Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Handheld Counter IED Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. handheld counter IED market report based on product type, detection technology, application, and end use:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Portable Detectors

-

Handheld Scanners

-

Smartphone Based Detectors

-

-

Detection Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Electromagnetic Field Detection

-

Infrared Detection

-

Acoustic Detection

-

Chemical Detection

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Military

-

Homeland Security

-

Law Enforcement

-

Civilian

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government Agencies

-

Defense Contractors

-

Non-Governmental Organizations

-

Frequently Asked Questions About This Report

b. The U.S. handheld counter IED market size was estimated at USD 0.98 billion in 2024 and is expected to reach USD 1.03 billion in 2025.

b. The U.S. handheld counter IED market size is expected to grow at a significant CAGR of 6.7% to reach USD 1.73 billion in 2033.

b. Portable detectors segment dominated the market with a share of 45.20% in 2024. These systems are widely used by defense forces, bomb disposal units, and homeland security agencies because they offer robust detection capabilities across a range of explosive types, including buried or concealed IEDs.

b. Some of the players in the U.S. handheld counter IED market are L3Harris Technologies, Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, General Dynamics Corporation, Thales Group, Chemring Group PLC, Elbit Systems Ltd., BAE Systems PLC, Sierra Nevada Corporation .

b. The growth of the market can be attributed to the integration of AI and advanced sensor fusion technologies to enhance real-time threat detection, accuracy, and operator safety in complex environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.