- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Hangover Cure Products Market, Industry Report, 2030GVR Report cover

![U.S. Hangover Cure Products Market Size, Share & Trends Report]()

U.S. Hangover Cure Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Solution/Drinks, Tablets/Capsules, Powder, Patches), By Type (Hangover Prevention, Hangover Remedies), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-130-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Hangover Cure Products Market Trends

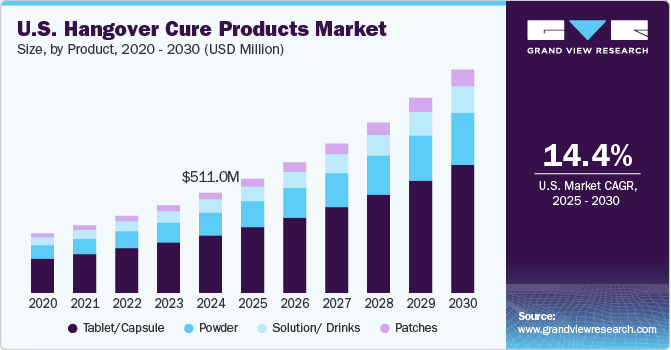

The U.S. hangover cure products market size was valued at USD 511.0 million in 2024 and is expected to grow at a CAGR of 14.4% from 2025 to 2030. The rising demand for effective remedies to alleviate alcohol-induced discomfort, along with consumers seeking convenient solutions to counteract the aftereffects of drinking, including headaches, nausea, and fatigue, is projected to drive the hangover cure products market during the forecast period.

Increasing consumption of alcoholic drinks in the U.S. is a major factor driving the growth of the industry for hangover cure products. Alcohol consumption is steadily increasing in several states, including California, Texas, Florida, New York, and Illinois. This can be attributed to the growing popularity of wine and beer among young consumers. Increasing availability and the launch of various alcoholic drinks are boosting their popularity.

Consumers have become more health-conscious and seek effective remedies to alleviate the discomfort of hangovers, which drives the market for hangover cure products. The market's growth potential and increasing consumer demand have attracted entrepreneurs and established companies alike, contributing to the overall profitability and expansion of the industry.

Convenience is paramount for consumers seeking hangover remedies, which has led to the rising popularity of on-the-go solutions. Single-serving and pre-packaged products, such as effervescent tablets, powdered mixes, and ready-to-drink beverages, have gained significant traction due to their inherent portability and ease of use across various settings. Given that alcohol is known to act as a diuretic, causing dehydration and electrolyte depletion, effervescent tablets have emerged as a favored method for addressing both hangover symptoms and dehydration. These tablets work more rapidly compared to regular aspirin pills and also encourage increased water consumption. This effectiveness in countering the dual impact of hangovers and dehydration has notably contributed to the growing popularity of such products among consumers.

Product Insights

Hangover cure tablets/capsules dominated the market with a share of 54.3% in 2024. The increasing penetration of tablets/capsules and the rising number of product launches in this category in the U.S. are expected to drive segmental growth. Furthermore, tablets/ capsules offer precise dosage control, ensuring users intake a consistent amount of active ingredients per dose, further augmenting their growth during the forecast period.

Hangover cure solution/drinks are expected to grow with the highest CAGR from 2025 to 2030, owing to increasing consumer preference for solution/drinks over other hangover cure products as these provide immediate and faster relief from hangover symptoms. Furthermore, advancements in the formulation and ingredients of these products are making them more effective and appealing to a broader audience. Additionally, the convenience of hangover cure drinks/solutions and their easy availability in various retail channels are likely to drive their growth over the forecast period.

Type Insights

Hangover remedies accounted for a share of around 73% in 2024. Hangover remedies offer quick relief from symptoms like headaches, nausea, and fatigue, aligning with consumers' desire for immediate solutions. This is coupled with the availability of a diverse range of remedies, including rehydration solutions, dietary supplements, herbal formulations, and more, which is anticipated to drive the segment’s growth over the forecast period in the U.S.

Moreover, lifestyle shifts and changing consumer preferences have also played a pivotal role in propelling the demand for hangover cure products. Modern lifestyles often involve a busy routine, and individuals seek quick and convenient solutions to counter the effects of drinking. Hangover cure products, such as pills, beverages, and supplements, offer the convenience of easy consumption and are often positioned as a convenient way to recover from the aftereffects of alcohol consumption.

Hangover prevention products are expected to grow at the fastest CAGR from 2025 to 2030. Consumers seek to avoid hangover discomfort by preventing its onset, driving demand for hangover cure products that offer pre-drinking support. Moreover, advancements in scientific research and a better understanding of the physiological processes involved in alcohol metabolism and its effects on the body have paved the way for developing more sophisticated hangover-prevention products. These products often incorporate a combination of vitamins, minerals, electrolytes, amino acids, herbal extracts, and other compounds that are believed to support the body's natural processes for metabolizing alcohol and mitigating its negative aftereffects.

Distribution Channel Insights

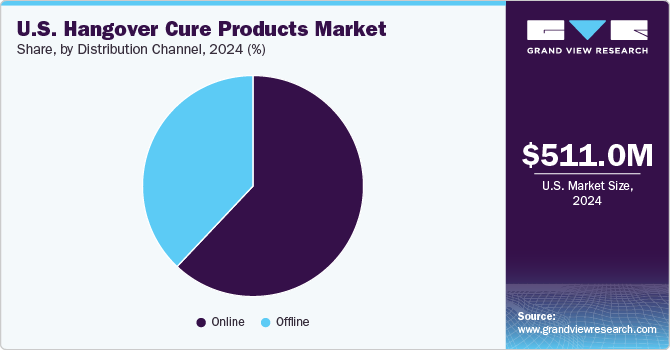

The sales of hangover cure products through online channels accounted for around 62% of revenue share in 2024. Numerous hangover cure products in the U.S. are exclusively sold by direct-to-consumer (DTC) brands that operate online. Furthermore, online shopping offers convenience, a wide variety of hangover cure products from different brands, and easy brand comparison. As a result, online channels will remain the dominant sales platform for hangover cure products in the U.S.

The offline channel of distribution is expected to register the fastest CAGR from 2025 to 2030, supported by manufacturers targeting liquor shops to enhance convenience and provide immediate availability of hangover remedies at the point of alcohol purchase.

Some of the popular brick-and-mortar stores selling hangover cure products are Chemist Warehouse, Priceline Pharmacy, Soul Pattinson, TerryWhite Chemmart, Brunet, Costco, The Drug Store Pharmacy, Familiprix, Jean Coutu, Katz Group of Companies, Lawtons, London Drugs, PharmaChoice, Pharmasave, Proxim, CVS Health, Walgreens Boots Alliance, and Rexall. Instant availability, increased product visibility at these stores, and physical verification are the three major factors propelling the sales of these products through offline channels.

Regional Insights

The Southeast region held the largest revenue share accounting for around 25% in 2024. The Southeast region of the U.S. has a strong social culture with a higher prevalence of alcohol consumption, especially during gatherings, events, and celebrations. Moreover, the region is home to popular tourist destinations, vibrant nightlife, and entertainment hubs, which contribute to increased alcohol consumption. This scenario is augmenting the demand for hangover cure products in the U.S. Southeast region.

The West region is expected to grow at a CAGR of 14.7% from 2025 to 2030. Higher alcohol consumption in the region contributes to a greater need for effective hangover remedies, thus driving the demand for hangover cure products in this region. The social and cultural aspects play a significant role in driving the market for hangover cure products. In the West, where cities like Los Angeles, San Francisco, and Seattle are known for their vibrant nightlife and party scenes, alcohol consumption is a common part of social gatherings and celebrations.

Key U.S. Hangover Cure Products Company Insights

The U.S. hangover cure products market is highly competitive, primarily due to the presence of numerous players in the industry. Many companies in the market are actively engaged in developing innovative products to meet the demands of consumers. Some market players include Bayer AG; More Labs; Flyby Ventures LLC; Cheers Health, Inc.; Himalaya Wellness; No Days Wasted; RallyPatch, LLC; drinkwel, LLC, among others. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, expansion, and others. Some of the initiatives include:

-

In May 2024, Sen-Jam Pharmaceutical, headquartered in New York, launched a Phase II clinical trial for SJP-001, a treatment designed to prevent hangovers. The therapy combines naproxen and fexofenadine to target inflammation linked to alcohol consumption. The trial, being conducted in Australia, follows encouraging early findings that showed SJP-001 reduced symptoms such as headache and thirst more effectively than a placebo.

-

In May 2022, Cheers Health, Inc. announced the launch of Relief for fast alleviation from discomfort caused by hangovers. The product is available in both pill and beverage forms and contains fast-acting CBD and robust doses of ginger infused in potent green tea. This blend also includes caffeine and L-theanine.

Key U.S. Hangover Cure Products Companies:

- Bayer AG

- More Labs

- Flyby Ventures LLC

- Cheers Health, Inc.

- Himalaya Wellness

- No Days Wasted

- RallyPatch, LLC

- drinkwel, LLC

U.S. Hangover Cure Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 583.2 million

Revenue forecast in 2030

USD 1.14 billion

Growth Rate (Revenue)

CAGR of 14.4% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Country scope

U.S.

Region scope

Southeast, Southwest, Northeast, West, Midwest

Key companies profiled

Bayer AG; More Labs; Flyby Ventures LLC; Cheers Health, Inc.; Himalaya Wellness; No Days Wasted; RallyPatch, LLC; drinkwel, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Hangover Cure Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. hangover cure products market report on the basis of product, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution/ Drinks

-

Tablets/ Capsules

-

Powder

-

Patches

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hangover Prevention

-

Hangover Remedies

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Pharmacy & Drug Stores

-

Airport Retail Stores

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Southeast

-

Southwest

-

Northeast

-

West

-

Midwest

-

Frequently Asked Questions About This Report

b. The U.S. hangover cure products market size was estimated at USD 511.0 million in 2024 and is expected to reach USD 719.6 million in 2025.

b. The U.S. hangover cure products market is expected to grow at a compound annual growth rate of 14.6% from 2025 to 2030 to reach USD 1.14 billion by 2030.

b. Southeast hangover cure products market held the largest revenue share accounting for around 25.10% in 2024. The Southeast region of the U.S. has a strong social culture with a higher prevalence of alcohol consumption, especially during gatherings, events, and celebrations. Moreover, the region is home to popular tourist destinations, vibrant nightlife, and entertainment hubs, which contribute to increased alcohol consumption. This scenario is augmenting the demand for hangover cure products in the U.S. Southeast region.

b. Some market players include Bayer AG; More Labs; Flyby Ventures LLC; Cheers Health, Inc.; Himalaya Wellness; No Days Wasted; RallyPatch, LLC; drinkwel, LLC, among others.

b. The rising demand for effective remedies to alleviate alcohol-induced discomfort, along with consumers seeking convenient solutions to counteract the aftereffects of drinking, including headaches, nausea, and fatigue, is projected to drive the hangover cure products market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.