- Home

- »

- Healthcare IT

- »

-

U.S. Healthcare Analytics Market Size, Industry Report, 2033GVR Report cover

![U.S. Healthcare Analytics Market Size, Share & Trends Report]()

U.S. Healthcare Analytics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Descriptive Analysis, Predictive Analysis), By Component (Software, Hardware), By Delivery Mode, By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-725-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Healthcare Analytics Market Summary

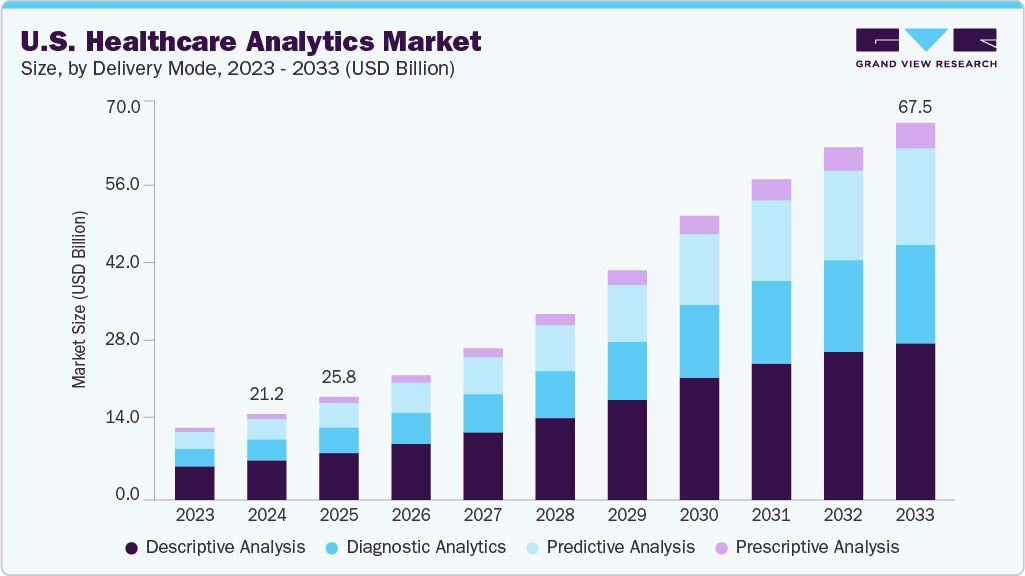

The U.S. healthcare analytics market size was estimated at USD 21.21 billion in 2024 and is projected to reach USD 67.48 billion by 2033, growing at a CAGR of 12.76% from 2025 to 2033. This growth is attributed to the rising need for cost containment, value-based care adoption, and regulatory mandates for data interoperability.

Key Market Trends & Insights

- By type, the descriptive analytics segment led the market with a share of over 45.05% in 2024.

- By component, the services segment accounted for a revenue share of 42.36% in 2024.

- By delivery mode, the on-premises segment held the largest revenue share of 47.00% in 2024.

- By application, the financial segment held the largest revenue share in 2024.

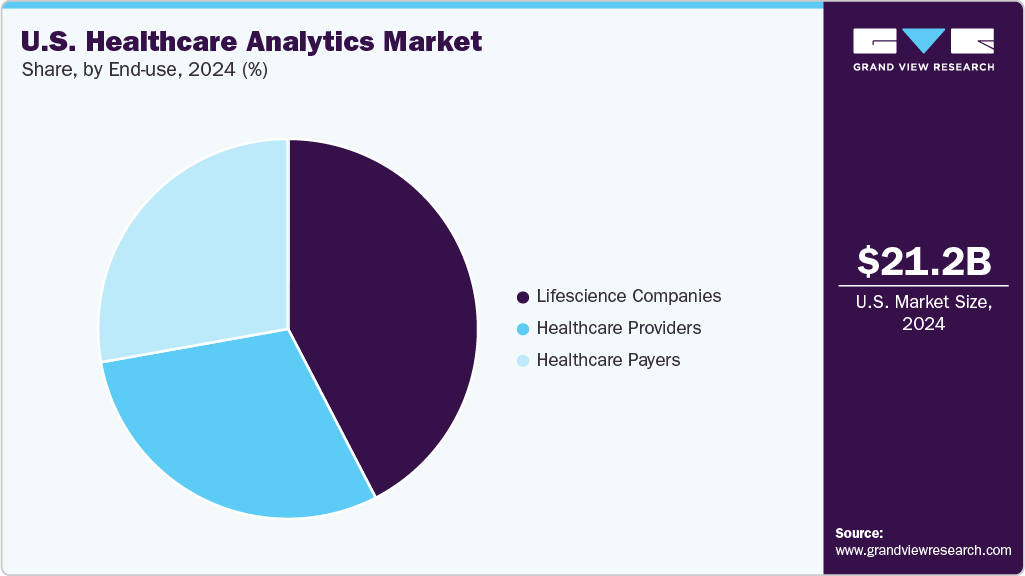

- By end use, the life science companies’ segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.21 Billion

- 2033 Projected Market Size: USD 67.48 Billion

- CAGR (2025-2033): 12.76%

Increasing use of AI and predictive analytics to improve clinical outcomes, manage population health, and streamline operations further fuels demand. In addition, expanding EHR adoption and payer-provider alignment accelerate market penetration. The U.S. healthcare analytics industry is expanding rapidly, driven by government incentives that promote widespread digitization and interoperability. According to The Assistant Secretary for Technology Policy/Office, as of 2021, nearly all non-federal acute care hospitals (96%) and about 78% of office-based physicians had implemented certified electronic health records (EHRs), a significant increase from 2011, when adoption was just 28% for hospitals and 34% for physicians. This swift transition has established a solid digital foundation for analytics, further strengthened by policies focused on improving data exchange across healthcare environments. Meanwhile, healthcare leaders are adopting value-based care, using analytics to link reimbursement with outcomes, lower readmission rates, and enhance population health management.

A rapid rate of technological advancements and massive investments by the healthcare industry into IT development and digitization have been key factors for the monumental growth of the healthcare analytics industry. In January 2021, Optum, Inc. collaborated with Change Healthcare to advance the technology-enabled healthcare platform. Both companies provide their consumers with data analytics solutions, software, and a technology-advanced healthcare platform. Analytical platforms that are currently being deployed by healthcare institutions across the globe help in patient management, their retention, due to which better care can be delivered. Deployment of healthcare analytical platforms not only increases the productivity of staff, but overall patient management has been improved, and the burden on caregivers has been minimized.

Integration of AI in the U.S. healthcare analytics market

The integration of AI into healthcare analytics is driving transformative improvements across clinical, operational, and financial domains. Machine learning and natural language processing tools are increasingly used for predictive modeling, population health management, and workflow optimization. For instance, in July 2025, Ambience Healthcare raised USD 243 million in a Series C funding round led by Oak HC/FT and Andreessen Horowitz to scale its AI platform that automates documentation, coding, and clinical workflows across health systems.

The platform integrates with major EHRs, supports over 100 specialties, and is used by leading U.S. health systems to reduce administrative burden and improve clinical and revenue-cycle performance. Ambience has achieved high customer satisfaction and validated ROI through improved coding accuracy and compliance. This demonstrates how AI-enabled analytics solutions are no longer experimental but are now embedded in core healthcare operations, delivering measurable efficiency gains and strengthening the foundation for value-based care.

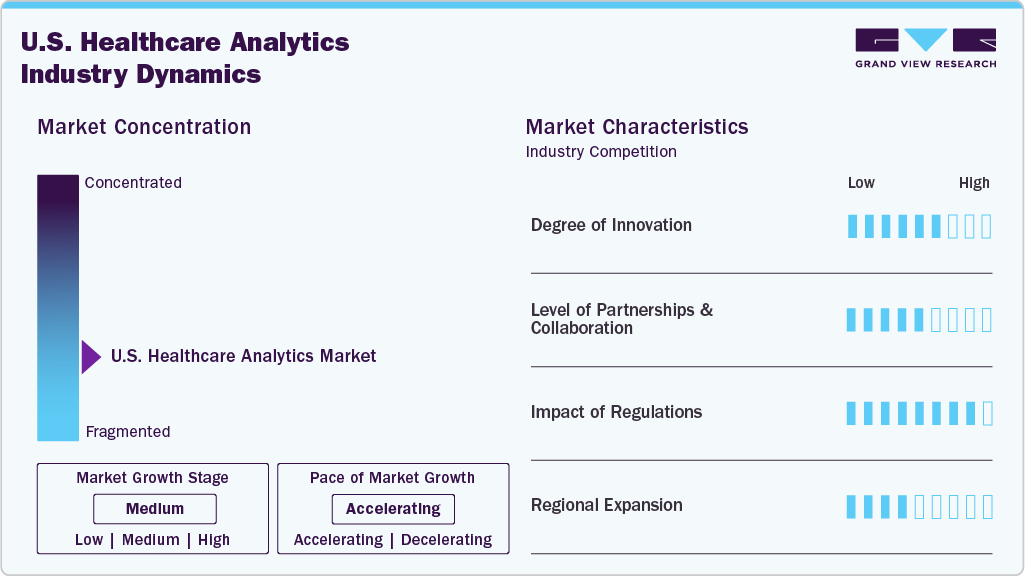

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the U.S. healthcare analytics market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation in the U.S. healthcare analytics industry is high, driven by federal policies supporting interoperability, the shift toward value-based care, and rising demand for AI-driven insights to improve patient outcomes and operational efficiency. Healthcare organizations are increasingly deploying predictive analytics, population health management tools, and AI-enabled platforms that integrate seamlessly with EHRs to reduce administrative burden and optimize care delivery. For instance, in October 2024, Oracle launched Oracle Analytics Intelligence for Life Sciences, an AI-powered platform that unifies diverse data to accelerate insights and optimize therapeutic strategies in life sciences. The platform supports multidisciplinary research and enhances clinical decision-making on Oracle Cloud Infrastructure.

The level of partnerships and collaboration activities in the U.S. healthcare analytics market is high, reflecting the sector’s emphasis on interoperability, advanced data sharing, and accelerating innovation to support value-based care. For instance, in June 2025, Mathematica and Tuva Health announced a partnership to improve healthcare data analytics for government and public health agencies by combining Mathematica’s advanced algorithms with Tuva Health’s open-source data model. This collaboration enables faster, higher-quality insights, empowering agencies to make evidence-based decisions and further strengthening the role of partnerships in shaping the future of U.S. healthcare analytics.

The impact of regulations on the U.S. healthcare analytics market is high, as federal policies and compliance frameworks shape how data is collected, shared, and protected. The Health Insurance Portability and Accountability Act (HIPAA) establishes strict standards for patient privacy and data security, while the HITECH Act incentivized widespread adoption of electronic health records (EHRs).

The 21st Century Cures Act and the ONC’s Interoperability and Information Blocking Rule mandate seamless data exchange and grant patients greater control over their health information. In addition, regulations such as the CMS Quality Payment Program link reimbursement to outcome-based care, further driving the adoption of advanced analytics to support compliance, value-based care, and performance measurement.

The level of regional expansion in the U.S. healthcare analytics industry is moderate. While most companies operate nationally, there is a growing focus on expanding into specific high-opportunity regions such as California, Texas, Florida, and New York, where large insured populations and advanced Medicaid or value-based care programs exist.

Type Insights

Descriptive analysis held the largest market share of 45.05% in 2024. Descriptive analytics has been widely used during the pandemic to study historical data and patient histories to study the spread of the virus, which has been a key factor driving growth in this segment. Descriptive analytics has proved to be a valuable tool for understanding what happened by accessing historical data and turning it into actionable insights. In addition, hospitals are using it to monitor the performance of insurance claims by detecting irregularities and errors in the claims. Many organizations are using descriptive analysis tools to increase market growth potential.

Predictive analysis is the fastest-growing analytics type segment since it uses data sets created by descriptive analytics to analyze data for actionable future insights. More and more companies are adopting analytics for better growth prospects, which has been a key propellant for the growth of this segment. It has become necessary to adopt these platforms to predict future trends in the market for the company to take appropriate measures that foster the overall growth of this segment.

Component Insights

The services segment dominated the U.S. healthcare analytics market with a share of 42.36% in 2024. The healthcare industry has been investing a substantial amount of capital in the IT industry to develop platforms and digitize data for analytics. A majority of companies need a data analytics component, so they are outsourcing the data analytics aspect of their IT. This has resulted in the growth of data analytics companies offering a complete set of services to companies. An increase in services offered by data analytics companies has been responsible for segment growth.

The services segment is anticipated to register the fastest CAGR of 10.86% over the forecast period, due to an increase in patient load in the health industry and a rise in disease prevalence, which has resulted in massive amounts of clinical data generated, insurmountable pressure on the industry to give better care, better results and cost-effective treatments to patients is further propelling this market towards growth. The need to adopt analytical methods and tools for better patient monitoring and delivering better treatments is the key growth driver for the segment.

Delivery Mode Insights

The on-premises segment dominated the U.S. healthcare analytics industry with a revenue share in 2024. Most institutions are currently installing software and tools to store data at their premises due to the ease of access and security, resulting in a large market share of this type of delivery. Current systems in small organizations are practical, but when scaled up, they can take time and effort to manage data if an organization is dealing with a large dataset. This can mean a large capital investment in data storage and security.

The cloud-based segment is projected to grow at the fastest CAGR over the forecast period, due to ease of storage, less capital investment, and increased flexibility and efficiency; these factors also add up to continuous growth in this delivery mode. Cloud-based storage can also be on-premises, but the issue of scalability comes into the picture, even though public cloud storage solutions are a key factor for the growth of cloud-based storage solutions, becoming the fastest-growing sub-segment. Limitations of the same include less privacy and more security concerns regarding loss of data.

Application Insights

Financial applications held the largest share of the U.S. healthcare analytics market in 2024. Healthcare institutions and organizations are continually striving to minimize the cost of treatment while delivering better care to patients, attributed to the growth of this segment. The financial segment is anticipated to grow at the fastest rate over the forecast period. Thus, companies perform better by reducing costs and preventing fraud.

Healthcare institutions incur costs in the form of insurance claims, which can also be fraudulent. To mitigate such risks and minimize such occurrences, healthcare organizations deploy analytical tools for predictive and descriptive analysis to deliver better care to patients, reduce the overall costs of operations, and minimize fraud in insurance claims. The need to perform financially well has been a key driver for adopting this application type.

End Use Insights

Life science companies dominated the U.S. healthcare analytics industry with a revenue share in 2024. The largest users of analytical tools and platforms are life-science companies for reducing their product costs, increasing profit margins, producing better products, and driving faster adoption and growth in the segment. Companies constantly invest in improving their product portfolios and offerings to cater to a wider population. This gives rise to a need for analytical tools to better understand and predict the market and drive value-based decisions.

Healthcare providers are expected to register the fastest growth over the forecast period, driven by the pressing need to enhance patient outcomes, optimize resource utilization, and reduce costs under value-based care models. Growing adoption of EHR systems, advanced clinical decision support tools, and AI-powered platforms enables providers to transform raw clinical and operational data into actionable insights.

Key U.S. Healthcare Analytics Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key U.S. Healthcare Analytics Companies:

- McKesson Corporation

- Optum, Inc.

- IBM

- Oracle

- SAS Institute, Inc.

- IQVIA

- Verisk Analytics, Inc.

- Elsevier

- Medeanalytics, Inc.

- Truven Health Analytics, Inc.

- llscripts Healthcare Solutions, Inc.

Recent Developments

-

In December 2024, Tuva Health launched the world's first open-source healthcare data transformation platform with USD 5 million in seed funding. The platform enables payers, providers, and pharmaceutical companies to transform claims and EHR data into analytics-ready tables, promoting transparency, scalability, and collaborative innovation to improve patient care and operational efficiency.

“Healthcare organizations have lacked a flexible, scalable, and transparent analytics solution to enhance patient outcomes and improve operational efficiency, Tuva Health’s model addresses this need, providing a comprehensive solution that meets the growing demand for innovation in healthcare.”

- Sean Doolan, Founder and Managing Partner of Virtue.

-

In October 2024, Clarify Health launched the Clarify Performance IQ Suite, the industry’s first fully AI-enabled predictive analytics application that spans cost, quality, and utilization assessment to provide actionable insights for health plans and providers to optimize networks, contain costs, and improve care quality.

“Our industry continues to struggle with delivering more effective care for each dollar spent. The Clarify Performance IQ Suite integrates the critical components needed to optimize provider performance and contain costs. With over 20 patents and expanded data coverage, we’ve invested significantly in developing fully integrated measures and benchmarks.”

- Todd Gottula, Founder and President of Clarify Health.

-

In May 8, 2024, Aetion launched Aetion Discover, a new application that provides fast, reliable, and scalable descriptive analytics for healthcare data, enabling users to generate swift hypotheses and insights across biopharmaceutical and medtech lifecycles. It offers speed, auditability, compatibility, and an intuitive interface to support data-driven decision-making.

“Time and time again, we heard our customers' interest in expanding our technology toward 'everyday insights,' and, importantly, for this [visual] exploration work to readily extend into advanced evidence generation when needed. We're glad to bring our software to a wider set of use cases, to create essential insights and efficiencies across user groups. Like all Aetion offerings, Discover is based in the latest and best science and works across a wide range of real-world data”

- Dr. Jeremy Rassen, Aetion president, co-founder, and chief technology officer.

-

In June 2025, Kythera Labs announced strategic partnerships with healthcare analytics firms Preverity and GAM to provide advanced data integration, de-identification, and data mastering services through its Wayfinder Platform. This collaboration enables secure, compliant, and comprehensive healthcare analytics that improve patient safety, risk management, and operational efficiency.

“These partnerships demonstrate the critical need for robust data infrastructure in healthcare analytics. We're providing the essential data backbone that enables Preverity and GAM to focus on what they do best delivering specialized analytics insights while we handle the complex challenges of data integration, privacy protection, and data quality management."

-Jeff McDonald, CEO and Co-Founder of Kythera Labs.

U.S. Healthcare Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.82 billion

Revenue forecast in 2033

USD 67.48 billion

Growth Rate

CAGR of 12.76% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, delivery mode, application, end use

Key companies profiled

McKesson Corporation, Optum, Inc., IBM, Oracle, SAS Institute, Inc., IQVIA, Verisk Analytics, Inc., Elsevier, MedeAnalytics, Inc., Truven Health Analytics, Inc., Allscripts Healthcare Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare Analytics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. healthcare analytics market report based on type, component, delivery mode, application, and end use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Descriptive Analysis

-

Diagnostic Analytics

-

Predictive Analysis

-

Prescriptive Analysis

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Hardware

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premises

-

Web-hosted

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical

-

Financial

-

Operational & Administrative

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare Payers

-

Healthcare Providers

-

Life Science Companies

-

Frequently Asked Questions About This Report

b. The U.S. healthcare analytics market size was estimated at USD 21.21 billion in 2024 and is projected to reach USD 25.82 billion by 2025

b. The global U.S. healthcare analytics market is expected to grow at a compound annual growth rate of 12.76% from 2025 to 2033 to reach USD 67.48 billion by 2033.

b. Descriptive analysis held the largest market share of 45.05% in 2024. Descriptive analytics has been widely used during the pandemic to study historical data and patient histories to study the spread of the virus, which has been a key factor driving growth in this segment

b. The key players in U.S. healthcare analytics market include McKesson Corporation, Optum, Inc., IBM, Oracle, SAS Institute, Inc., IQVIA, Verisk Analytics, Inc., Elsevier, MedeAnalytics, Inc., Truven Health Analytics, Inc., Allscripts Healthcare Solutions, Inc.

b. The factors driving the U.S. healthcare analytics market include rising need for cost containment, value-based care adoption, and regulatory mandates for data interoperability. Increasing use of AI and predictive analytics to improve clinical outcomes, manage population health, and streamline operations further fuels demand. In addition, expanding EHR adoption and payer-provider alignment accelerate market penetration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.