- Home

- »

- Healthcare IT

- »

-

U.S. Healthcare Generative AI Market, Industry Report, 2030GVR Report cover

![U.S. Healthcare Generative AI Market Size, Share & Trends Report]()

U.S. Healthcare Generative AI Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Function (Medical Imaging Analysis, Robot-assisted AI Surgery), By Application (Clinical, System), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-228-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Healthcare Generative AI Market Trends

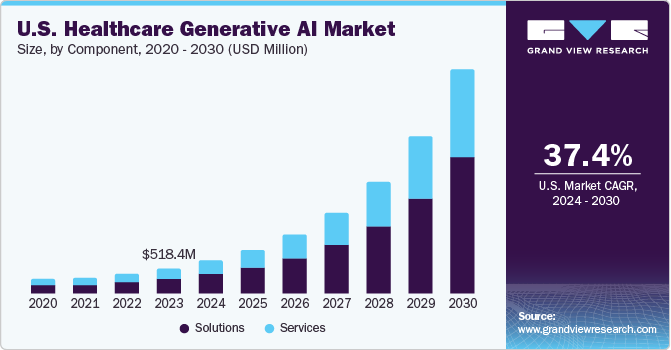

The U.S. healthcare generative AI market size was estimated at USD 518.4 million in 2023 and is projected to grow at a CAGR of 36.4% from 2024 to 2030. This growth is majorly attributed to the increasing awareness of remote patient monitoring and the adoption of AI technologies. Generative AI is transforming the medical field by offering healthcare providers insightful data that assists them in delivering the best possible treatment for their patients. It involves using generative models, artificial intelligence techniques to generate valuable data or content.

Models such as Variational Autoencoders and Generative Adversarial Networks can generate representative and novel data for medical image synthesis, personalized medicine, and designing various molecules for drug discovery. The increasing availability of healthcare data and the need for efficient and cost-effective solutions influence the demand for generative AI in the U.S. healthcare sector.

A subtype of AI called generative AI has the potential to revolutionize personalized medicine and medical diagnosis. They study existing data to create new samples for diagnostic imaging, simulate patient responses, and generate synthetic patient data for training and testing. The analytical ability of generative AI serves as a vital step for making medical decisions, especially when it comes to producing fresh information and solutions. It is an effective instrument for improving healthcare results because of its capacity to create medical pictures, synthesize medication molecules, and customize therapies based on personal health data.

COVID-19 accelerated the integration of generative AI into modern healthcare, minimizing waiting times in medical centers and avoiding in-person visits. The impact of COVID-19 also encouraged technological advancement in drug development and detection software with the help of generative artificial intelligence. For instance, Northwestern University developed an artificial intelligence algorithm called DeepCOVID-XR, which detects COVID-19 signs on a basic X-ray of the lungs. Compared to thoracic radiologists, the machine learning software can identify COVID-19 ten times faster and 1%-6% more correctly.

Generative AI improves real-time information collection by interacting with patients in understandable language, resolving uncertainties, and summarizing data for healthcare professionals. It can evaluate the proteins, chemicals, and DNA by analyzing the historical and present medical data and assist healthcare providers in simplifying the cause. Recent advancements in chatbots like Google's Bard and OpenAI's ChatGPT have significantly proved the ability of generative AI.

The transformative perspective of generative AI in addressing healthcare challenges is gaining attention from healthcare providers and healthcare generative AI startups. The ability of these models to synthesize realistic medical data and generate visiting notes, treatment codes, and medical summaries can reduce the burden of medical documentation. Additionally, it responds to inquiries concerning diagnosis, suggests courses of therapy, and enhances diagnostic capabilities, which is driving the integration and adoption of generative AI technologies across various healthcare facets. For instance, HCA Healthcare implemented a solution that uses Augmedix's app to create medical notes from physician-patient conversations. This app securely makes draft notes after each patient visit, which are reviewed and finalized before being transferred to the electronic health record, freeing up patient care time.

Market Concentration & Characteristics

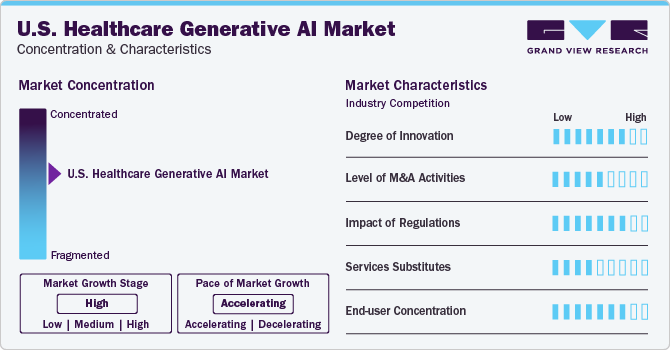

The market growth stage is high and the pace of growth is accelerating. The generative AI industry in the U.S. is distinguished by a high level of innovation owing to the accelerating rate of technical development, fueled by aspects such as the availability of massive healthcare data and improvements in machine learning algorithms. As a result, cutting-edge artificial intelligence applications are continuously developing.

The healthcare generative AI market is also characterized by moderate merger and acquisition (M&A) activity by the leading players. This is owing to several objectives, such as the necessity to consolidate in a market that is expanding quickly, the need to get access to new AI talent and technology, and the growing strategic significance of artificial intelligence.

The artificial intelligence market is also subject to increasing regulatory scrutiny. This is due to concerns about data privacy and potential negative impacts of AI, such as algorithmic bias and misplacement of data, which can result in wrong suggestions and diagnoses of diseases. As a result, the U.S. government is investing in governing the development and use of AI. These regulations could significantly impact the AI market, affecting the development and adoption of technologies.

There are limited direct product substitutes for generative AI in healthcare. However, many technologies can be used to achieve similar outcomes to AI, such as automation, rule-based systems, and expert systems. These technologies can be used as substitutes for AI in specific healthcare settings.

End-user concentration is a significant factor in this market. Since there are a number of end-users in the healthcare domain that are driving demand for AI solutions. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing generative AI solutions for these industries.

Component Insights

The solution segment dominated the market with a revenue share of around 58% in 2023 and is expected to grow at the fastest CAGR of 38.3% during the forecast period. This growth can be attributed to the widespread adoption of smart gadgets, wearable technologies, and sensor-equipped smartphones, which can potentially monitor patient behavior beyond professional settings. This enables artificial intelligence to give real-time surveillance and personalized treatment recommendations, better diagnostic results, faster medication development, and more accurate patient care. The advantages such as proven efficacy, cost-effectiveness, regulatory compliance, and smooth integration into existing healthcare infrastructures also contributed to the dominance of the segment.

Generative AI systems, which can create new content and analyze existing data, have gained popularity among professionals, including healthcare providers. These systems use historical data to identify patterns and predict future conditions. The ease of use and accessibility of these systems has led to a shift towards more targeted healthcare solutions. AI can also access health information exchanges (HIEs) to retrieve medical records, analyze them, and formulate inquiries based on the patient's medical background. In October 2023, Microsoft unveiled new AI and data tools to assist healthcare businesses in gaining insights and enhancing the experiences of physicians and patients through Microsoft Fabric and Azure AI.

Function Insights

The medical imaging analysis segment dominated the market with a revenue share of around 30% in 2023. This is largely driven by its ability to improve diagnostic accuracy and efficiency. Generative AI models, particularly Generative Adversarial Networks (GANs), generate high-fidelity medical images, enhancing datasets and image recognition algorithms. This innovation improves image interpretation, leading to accurate diagnoses and treatment plans and revolutionizing healthcare through improved diagnostic capabilities and patient care. In October 2023, the National Science Foundation in the U.S. announced an investment of USD 10.9 million in research to implement generative AI technologies.

The robot-assisted AI surgery segment is expected to grow with the fastest CAGR of 39.1% during the forecast period. It is a cutting-edge medical technique that uses artificial intelligence and robots to enhance surgical operations. Together with surgeons, robots that are outfitted with advanced computer vision systems and machine learning algorithms improve accuracy, control, and overall results. This novel method improves patient outcomes in various surgical specialties, from minimally invasive to complex treatments, by minimizing human error, invasiveness, and recovery durations. As per the report published in July 2023 by JAMA Internal Medicine, the journal of the American Medical Association, the U.S. court has not yet received any questions related to the liability for medical damage originating from AI-generated material.

Application Insights

The clinical segment dominated the market with a revenue share of over 60% in 2023 and is also expected to grow at the fastest CAGR of 37.7% from 2024 to 2030. This is attributed to prudent advances in information storage capacity, high computing power, and parallel processing capabilities to deliver high-end care. Generative AI is transforming the healthcare sector by integrating into specialized areas like cardiovascular care, dermatology, infectious disease, and oncology. It aids in precise diagnostics and personalized treatment planning in cardiovascular health, facilitates accurate diagnosis and treatment recommendations in dermatology, assists in pathogen identification in infectious diseases, and enhances clinical decision-making in oncology through genomic analysis with personalized therapy recommendations.

Digital health records, telemedicine, medication interaction management, and illness diagnosis are all being enhanced by artificial intelligence. It improves virtual telemedicine consultations, manages electronic health records, and analyzes vast medical data to identify precise diagnoses. It further forecasts unfavorable outcomes in pharmaceutical interactions, improving patient care and medication decision assistance. These factors contribute to the adoption of generative AI in the clinical segment. The Carolina-based UNC Health in the Southeastern region of the U.S. implemented a generative AI chatbot powered by Azure OpenAI Service to expedite administrative duties for healthcare providers by quickly accessing reference documents and materials.

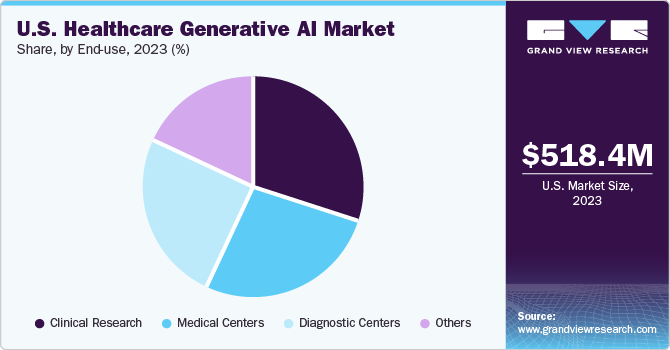

End-use Insights

The clinical research segment dominated the market with a revenue share of over 30% in 2023 and is also expected to grow at the fastest CAGR of 39.1% during the forecast period. This is attributable to the revolutionizing medication development, trial designs, and data analysis. It streamlines the research process by simulating clinical trial situations, optimizing procedures, and predicting outcomes. The development and approval of innovative medications and therapies are accelerated by data-driven decision-making, patient identification, and drug response prediction that results in faster and more economical trials, which contribute to the market growth of this segment. In May 2023, Microsoft Corporation introduced Microsoft Fabric, a comprehensive analytics platform that integrates all the necessary data and analytics tools for organizations.

Generative AI is being integrated into clinical decision support systems, providing healthcare professionals with data-driven insights to aid in diagnosis and treatment decisions, thereby improving clinical outcomes and enhancing patient care. Medical centers have implemented Generative AI early to improve drug development, individualized treatment regimens, diagnostic assistance, and medical imaging. This integration has encouraged research and development in the market to increase diagnostic efficiency and improve patient care. For instance, in the Western U.S., a California-based company, Incredible Health, integrated generative AI throughout its platform to expedite the employment process for nurses, saving hospital efforts and time.

Key U.S. Healthcare Generative AI Company Insights

Some of the key market players include HCA Healthcare, Microsoft Corporation; IBM Corporation, Google LLC

-

Microsoft Corporation provides wide range of generative AI capabilities and services, including speech recognition and language understanding. It also provides pertained models, SDKs, and APIs that help in building AI-based workflows for a variety of applications.

-

IBM Corporations’ subsidiary IBM Watson Health uses AI algorithms to estimate human perception in medical data analysis. The principal goal of healthcare-related AI applications is to examine relationships between patient outcomes and prevention or treatment techniques.

-

Neuralink Corporation, NioyaTech, and OpenAI are some of the other market participants.

-

OpenAi is a U.S. based AI research organization which provides wide range of solutions to streamline operations and enhance patient outcomes by harnessing the power of big data, machine learning and artificial intelligence.

Key U.S. Healthcare Generative AI Companies:

- Medtronic

- HCA Healthcare

- Neuralink Corporation

- Google LLC

- Microsoft Corporation

- IBM Watson

- Amazon Web Services, Inc.

- NioyaTech

- Oracle

- OpenAI

Recent Developments

-

In January 2024, Microsoft's Nuance Communications announced the DAX Copilot (DAX), an AI-powered solution that integrates with the EHR available with Epic Systems Corporation. This tool automates clinical documentation by improving access to compilation during patient exams which enhances healthcare outcomes.

-

In December 2023, Google introduced MedLM, a family of foundation AI models designed for healthcare use. These models are now available to Google Cloud customers in the US through the Vertex AI platform.

-

In September 2023, Oracle launched the Oracle Clinical Digital Assistant, a new generative AI services for healthcare organizations which is integrated with Oracle's EHR solutions, allows providers to use generative AI and voice commands to reduce manual work, allowing them to focus on patient care. Patients can also take self-service actions using voice commands.

-

In September 2023, Microsoft Corp. and Mercy partnered to utilize generative AI and other digital technologies to enhance patient care and patient experience, marking a significant shift in healthcare towards utilizing advanced digital technologies for consumer care delivery.

-

In August 2023, HCA Healthcare and Google Cloud partnered to utilize generative AI technology to enhance workflows, particularly in clinical documentation, allowing doctors and nurses to concentrate more on patient care by reducing administrative tasks.

-

In August 2023, Microsoft and Epic partnered to address the use of generative AI in healthcare by combining Microsoft's Azure OpenAI Service with Epic's deep understanding of clinical procedures and electronic health records to tackle pressing issues in healthcare

-

In July 2023, AWS HealthScribe, an AI-powered solution for healthcare software providers that helps doctors with paperwork, has been released by Amazon Web Services. The program assists clinicians in creating transcripts, drafting clinical notes, and analyzing patient discussions through the use of generative AI and voice recognition.

-

In March 2023, Enlitic introduced Enlitic Curie, a platform that makes it easy for radiology departments to manage their workflow. The platform hosts Curie|ENDEX, which utilizes NLP and computer vision for the analysis & processing of medical images, and Curie|ENCOG, which leverages AI to identify and protect Protected Health Information

-

Northwestern Medicine, Chicago's academic health system in the Midwestern region of U.S., employs Microsoft Fabric's healthcare data solutions to integrate clinical data, meet regulatory requirements, and unlock insights using generative AI, thereby enhancing patient care quality.

U.S. Healthcare Generative AI Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.56 billion

Growth rate

CAGR of 36.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, function, application, end-use

Country scope

U.S.

Key companies profiled

Medtronic; HCA Healthcare; Neuralink Corporation; Google LLC; Microsoft Corporation; IBM Watson; Amazon Web Services, Inc.; NioyaTech; Oracle; OpenAI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare Generative AI Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S healthcare generative AI market report based on component, function, application, and end-use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Virtual Nursing Assistants

-

Robot-Assisted AI Surgery

-

Administrative Process Optimization

-

Medical Imaging Analysis

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Research

-

Medical Centers

-

Diagnostic Centers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Cardiovascular

-

Dermatology

-

Infectious Disease

-

Oncology

-

-

System

-

Disease Diagnosis

-

Telemedicine

-

Electronic Health Records

-

Drug Interaction

-

-

Frequently Asked Questions About This Report

b. The U.S. healthcare generative AI market size was estimated at USD 518.4 million in 2023.

b. The U.S. healthcare generative AI market is expected to grow at a compound annual growth rate (CAGR) of 37.4% from 2024 to 2030 to reach USD 4.56 billion by 2030.

b. The clinical segment dominated with the largest market share of over 35% in 2023 owing to prudent advances in information storage capacity, high computing power, and parallel processing capabilities to deliver high-end care.

b. Some key players operating in the market include Medtronic; HCA Healthcare; Neuralink Corporation; Google LLC; Microsoft Corporation; IBM Watson; Amazon Web Services, Inc.; NioyaTech; Oracle; and OpenAI; among others.

b. Key factors driving the market growth include the growing adoption of AI technologies and the increasing awareness of remote patient monitoring. Generative AI is transforming the medical field by offering healthcare providers insightful data that assists them in delivering the best possible treatment for their patients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."