- Home

- »

- Smart Textiles

- »

-

U.S. Healthcare Personal Protective Equipment Market Report, 2030GVR Report cover

![U.S. Healthcare Personal Protective Equipment Market Size, Share & Trends Report]()

U.S. Healthcare Personal Protective Equipment Market Size, Share & Trends Analysis Report By Product (Protective Clothing, Respiratory Protection, Face Protection, Eye Protection, Hand Protection, Others), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-957-9

- Number of Report Pages: 127

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

U.S. Healthcare PPE Market Size & Trends

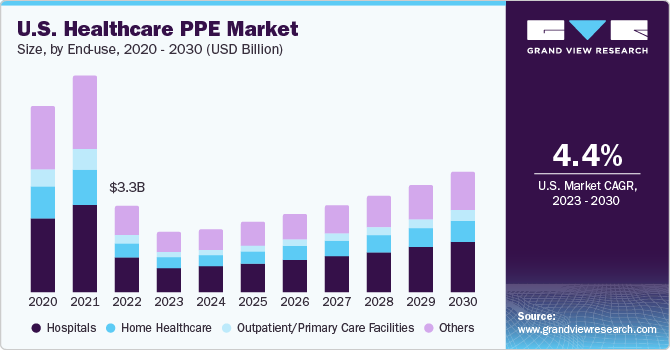

The U.S. healthcare personal protective equipment market size was valued at USD 3.27 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. Rising consciousness about the safety of workers in workshop environments is anticipated to drive the need for personal protective equipment (PPE) in the foreseeable future. The requirement for PPE experienced a substantial upswing during the COVID-19 pandemic due to its efficacy in safeguarding wearers from the virus. Moreover, limitations on imports stimulated the domestic manufacturing of PPE. In the U.S., rigorous regulations like the Families First Coronavirus Response Act were put into effect in 2020 to safeguard healthcare workers and mitigate the transmission of COVID-19.

The government of the U.S. has been actively involved in legislating worker health & safety laws. The U.S. Department of Labor has legislated Mine Safety and Health Act 1977 exclusively for the safety and health of the workers employed in mines. The act is supervised through Mine Safety and Health Administration (MSHA) since its jurisdiction is not covered under Occupational Safety and Health Administration (OSHA). These favorable regulations are estimated to drive the U.S. PPE market during the forecast period.

According to the Occupational Safety and Health Administration (OSHA), use of the personal protective equipment is expected to grow in end-use industries including chemical, construction, pharmaceutical, and healthcare. The increasing number of blue-collar professionals across numerous industrial sectors is expected to fuel the PPE demand.

Constant innovations, such as the introduction of lighter and more comfortable industrial protective clothing made of high-quality fabric, are expected to fuel the market expansion. Market growth is expected to be aided by the demand for PPE that combines safety with better aesthetics and technical innovation.

Companies have prioritized worker safety and established security guidelines to reduce workplace hazards, which is boosting the market growth. The COVID-19 outbreak had a positive impact on the U.S. PPE market growth in 2020.

End-use Insights

The hospitals segment accounted for the largest revenue share of 54.4% in 2022 and is expected to grow at the fastest CAGR of 4.8% during the forecast period, owing to rising demand for hand protection, respiratory protection, and protective clothing in the healthcare industry. Need for the protective clothing, specifically coveralls, and gowns, has augmented across the world, due to the rapid spread of the coronavirus.

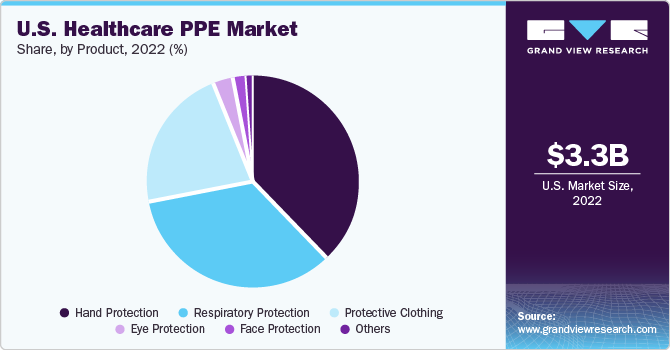

Product Insights

The hand protection segment held the largest revenue share of 38.5% in 2022. Gloves are used to provide protection from cuts, abrasions, burns, and chemicals. Risks linked with toxic materials, handling warm objects, and heavy-duty equipment are likely to drive demand for protective gloves in the construction, food processing, oil & gas, healthcare, and metal fabrication industries.

Air purifying respirators (APRs) are used against particulates such as fumes or smoke to protect employees against vapors and gases that are at atmospheric concentrations. They use canisters, cartridges, and filters to remove the gas contaminants, vapor, and particulate matter from the air. In addition, APR provides protection against asbestos.

The protective clothing segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. Protective clothing such as chemical defending, cleanroom clothing, heat & flame protection, and mechanical protective clothing, is the second-largest product segment. Rising accidents, deaths, and injuries are driving demand for protective clothing, supported by their characteristics such as high performance, better quality, high wear, and tear, etc.

Key Companies & Market Share Insights

The market is highly competitive, with large number of manufacturers accounting for a majority of market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. The following are some of the major participants in the U.S. healthcare personal protective equipment market:

-

Honeywell International Inc.

-

Lakeland Industries Inc.

-

DuPont

-

3M

-

Ansell Ltd.

-

Avon Rubber plc

-

Alpha Pro Tech Limited

-

Uvex Safety Group

-

Mine Safety Appliances (MSA) Company

-

Radians, Inc.

Recent Developments

-

In August 2020, 3M collaborated with Nissha medical technologies and developed an anti-fog face shield to improve the visibility and comfort of healthcare workers. This innovative product utilizes a hydrophobic film with inherent anti-wicking characteristics as its foundational material.

-

In May 2022, Honeywell International Inc. introduced a pair of novel respiratory protection solutions tailored specifically to the needs of healthcare practitioners. These two N95 respirators are designed to accommodate the facial features of those with smaller proportions. This recent product debut serves to broaden Honeywell's range of personal protective equipment (PPE) offerings.

U.S. Healthcare Personal Protective Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.59 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, product

Country scope

U.S.

Key companies profiled

Honeywell International Inc.; Lakeland Industries Inc.; DuPont; 3M; Ansell Ltd.; Avon Rubber plc; Alpha Pro Tech Limited; Uvex Safety Group; Mine Safety Appliances (MSA) Company; Radians, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare Personal Protective Equipment Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. healthcare personal protective equipment market report based on end-use, and product:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Healthcare

-

Outpatient/Primary Care Facilities

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protective Clothing

-

Coveralls

-

Gowns

-

Hazmat Suits

-

-

Respiratory Protection

-

Surgical Masks

-

Respirator Masks

-

Half Mask Respirators

-

Others

-

-

Face Protection

-

Eye Protection

-

Hand Protection

-

Disposable Gloves

-

Durable Gloves

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. healthcare personal protective equipment market size was estimated at USD 3.27 billion in 2022.

b. The U.S. healthcare personal protective equipment market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 4.59 billion by 2030.

b. Hospitals dominated the U.S. healthcare personal protective equipment market with a share of 54.4% in 2022. This is attributable to the rising prevalence of chronic diseases has increased the number of hospital visits and re-admissions.

b. Some of the key players operating in the U.S. healthcare personal protective equipment market include 3M, Alpha Pro Tech, Ansell Ltd., Medisca Inc., O&M Halyard, Inc., DuPont, Cardinal Health, Medline Industries, Inc., Kimberly-Clark Corporation, Honeywell International Inc.

b. Key factors that are driving the U.S. healthcare personal protective equipment market include the increasing number of hospital-induced infections coupled with the rising educational campaigns organized by the OSHA on occupational exposures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."