- Home

- »

- Healthcare IT

- »

-

U.S. Herbalist & Herbal Practitioner Market Size Report, 2033GVR Report cover

![U.S. Herbalist & Herbal Practitioner Market Size, Share & Trends Report]()

U.S. Herbalist & Herbal Practitioner Market (2025 - 2033) Size, Share & Trends Analysis Report By Practice Settings (Solo Herbal Practice, Naturopathic & CAM Clinics, Integrative Health Centers, Telehealth Platforms), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-680-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

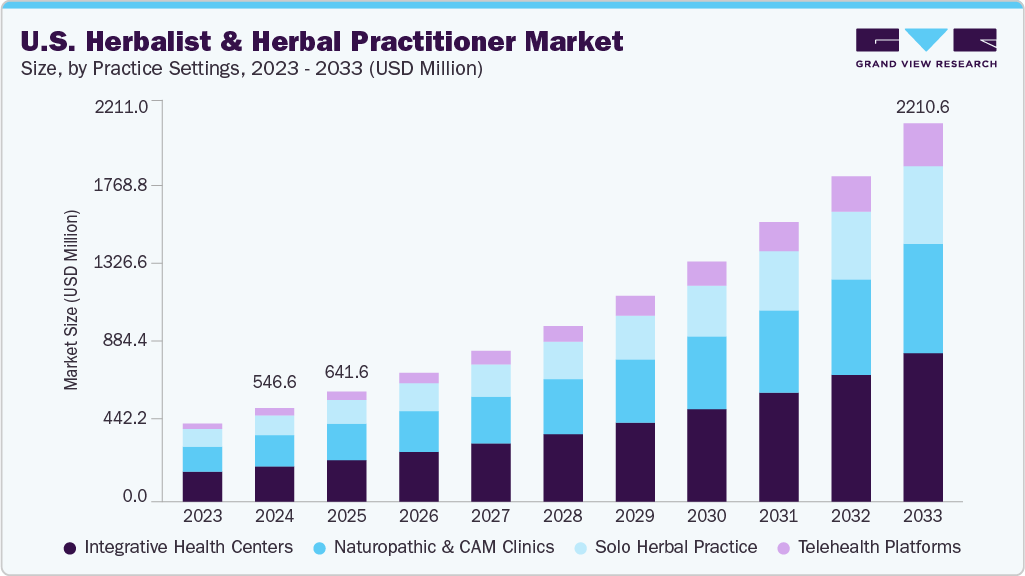

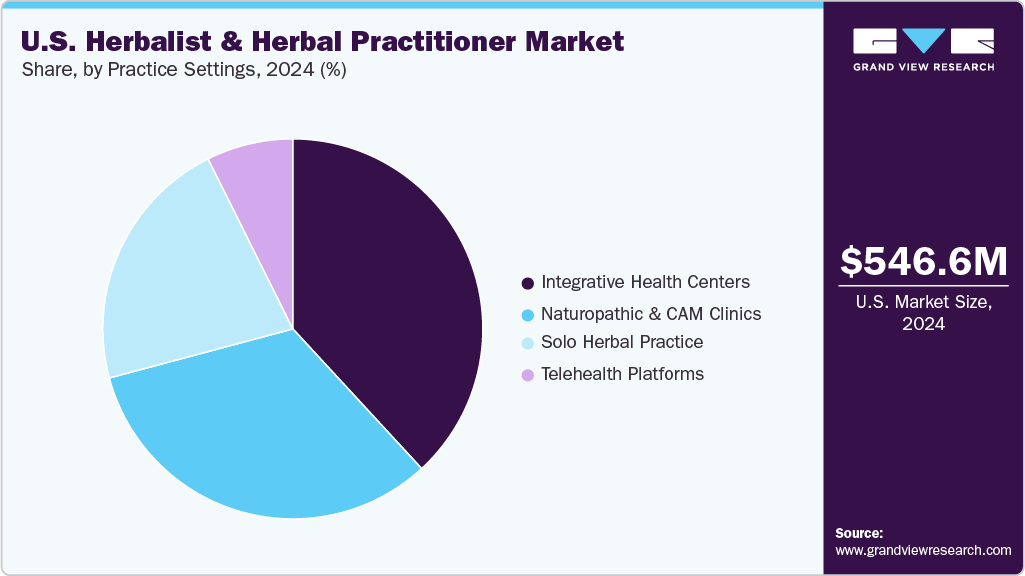

The U.S. herbalist & herbal practitioner market was estimated at USD 546.61 million in 2024 and is expected to reach USD 2,210.59 million by 2033, registering a CAGR of 16.7% from 2025 to 2033. This growth is driven by a shift in consumer preferences toward holistic and preventive approaches to health. As awareness of the limitations of symptom-based conventional medicine continues to rise, more individuals are turning to herbalists for personalized care rooted in traditional botanical knowledge and lifestyle modification. This trend is particularly evident among health-conscious populations seeking natural, low-intervention solutions for chronic conditions such as stress, inflammation, and digestive disorders. Herbalists are increasingly viewed as trusted guides in the pursuit of wellness, offering customized protocols that align with evolving public interest in sustainable and plant-based living.

The increasing demand for personalized and holistic healthcare in the U.S. serves as a significant driver for the growth and professionalization of U.S. herbalists and herbal practitioners. As more individuals seek natural, preventive, and root-cause approaches to wellness, professionally trained herbal practitioners are gaining recognition as credible providers of integrative health solutions. This shift is rooted in a broader transformation in U.S. healthcare preferences, where consumers are increasingly turning away from conventional symptom-based treatments and embracing individualized consultations that combine traditional botanical knowledge with modern health requirements.

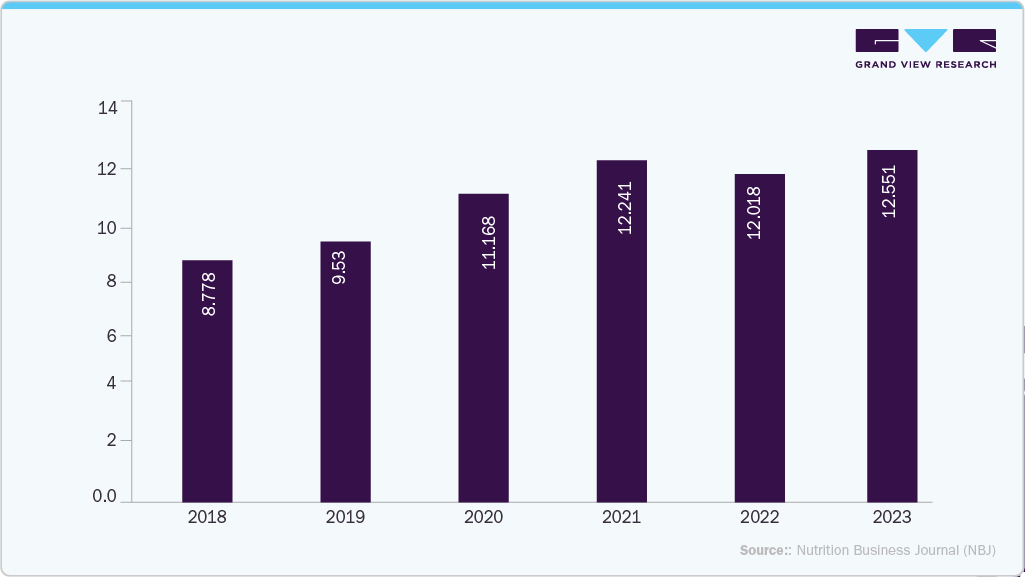

Moreover, the evolving preference for holistic care is also reflected in consumer spending patterns. According to a 2023 report by the American Botanical Council, retail sales of herbal dietary supplements in the U.S. reached USD 12.55 billion in 2023, marking a 4.4 percent increase compared to 2022.

This figure shows increased consumer confidence in herbal health solutions and indicates growing public trust in herbal methods, which boosts the career prospects of clinical herbal practitioners.

Furthermore, the integration of telehealth into the care delivery models used by herbalists and herbal practitioners has become a pivotal factor in expanding their professional footprint. Increasing digital health literacy, patient demand for convenience, and growing acceptance of video-based care have all contributed to the standardization of remote herbal consultations. Herbalists have adapted their practices to include teleconsultation tools, expanding their reach and flexibility.

The increasing availability of accredited educational programs and professional credentialing options is playing a pivotal role in the advancement of the U.S. herbalist and herbal practitioner market. As public interest in natural and preventive health solutions grows, there is a corresponding demand for qualified herbalist practitioners capable of delivering safe and evidence-informed care. In response, academic institutions and certifying bodies have expanded access to structured training pathways that support both clinical competence and public trust, thereby shaping the professional landscape of the herbalist workforce.

One prominent example is Bastyr University, which offers a Bachelor of Science in Herbal Sciences. The program integrates coursework in botanical identification, phytochemistry, Western and Chinese materia medica, and herb-drug interactions. Students also complete an 88-hour practicum in either clinical care or herbal product preparation. Bastyr’s campus herb garden, which contains more than 350 plant species from global herbal traditions, supports the hands-on nature of the curriculum and its focus on multicultural approaches to herbal medicine. Graduates from such programs contribute directly to the expansion of the practitioner base, thereby strengthening the supply side of the market.

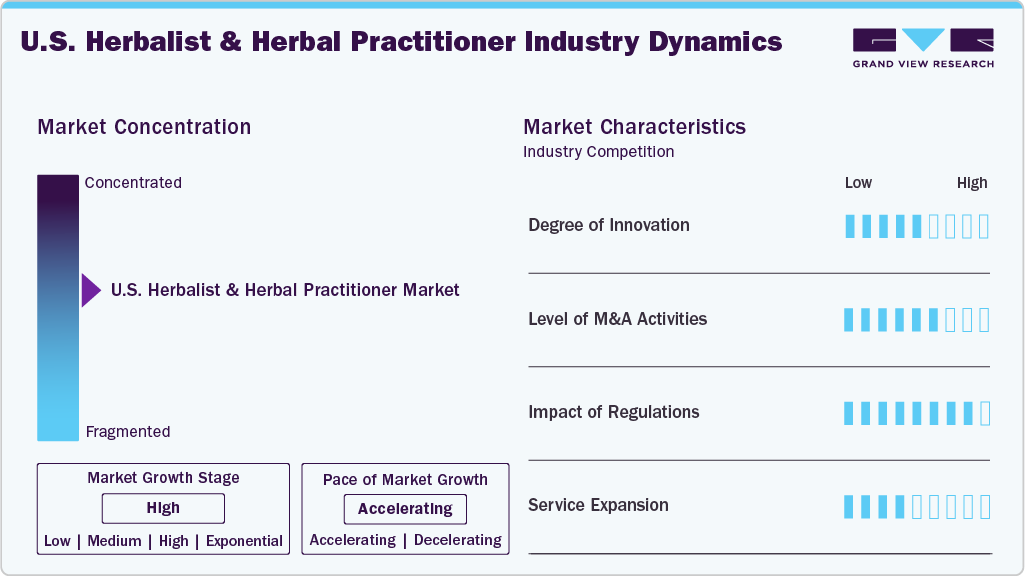

Market Concentration & Characteristics

The U.S. herbalist and herbal practitioner market reflects a moderate degree of innovation, as practitioners increasingly integrate traditional herbal wisdom with modern clinical approaches and scientific research to enhance patient care.Many are adopting evidence-informed practices, utilizing digital health records to track herbal protocols, and engaging in continuing education to stay updated on new botanical research and safety standards. Collaboration with integrative healthcare providers, participation in clinical studies, and the use of advanced diagnostic tools are also expanding the professional scope of herbalists, allowing them to tailor more precise, individualized treatment plans.

Several key market players are devising business growth strategies through mergers and acquisitions (M&A). These companies can expand their business geographies through M&A activity.

Regulations exert a considerable influence on the U.S. herbalist and herbal practitioner market, affecting the scope of practice, professional recognition, and integration within the broader healthcare system. The absence of standardized national licensure contributes to variability in practice authority across states, creating both opportunities and uncertainties for practitioners. Regulatory frameworks, such as the Dietary Supplement Health and Education Act (DSHEA), indirectly shape the market by defining permissible claims and safety standards for herbal substances, thereby impacting the credibility and public perception of herbal practice.

The U.S. herbalist and herbal practitioner market is experiencing service expansion as practitioners broaden their offerings beyond traditional herbal consultations to include integrative health assessments, personalized wellness plans, and collaborations with other healthcare professionals. Many are incorporating modern diagnostic tools, educational workshops, and lifestyle counselling to provide comprehensive care that addresses both prevention and chronic conditions.

Practice Settings Insights

The integrative health centers segment held the largest revenue share of 38.15% in 2024. Integrative health centers affiliated with hospitals, academic institutions, or corporate wellness programs are increasingly incorporating herbalists into comprehensive care teams. These centers offer a unique model by combining herbal therapies with conventional medical services within a unified clinical setting, thereby promoting patient-centered, preventive, and evidence-informed care.Institutional integration of herbal services is gaining momentum. The Osher Center for Integrative Medicine is a leading example, affiliated with Brigham and Women’s Hospital and Harvard Medical School. The Osher Center includes dietary herbs, vitamins, and supplements among its clinical services, offered alongside acupuncture, chiropractic care, massage therapy, and mindfulness-based interventions.

The telehealth platforms segment is expected to grow at a significant CAGR over the forecast period. The shift toward digital healthcare delivery has enabled herbalists to expand their geographic reach and serve clients in remote or underserved regions where in-person consultations may not be readily accessible. Virtual consultations also provide a convenient option for clients seeking ongoing support, personalized herbal formulations, or follow-ups without travel constraints. According to a 2023 survey by Holistic Primary Care, nearly 60% of holistic medical practitioners routinely offer remote consultations, with 90% reporting satisfaction with the virtual care model.

Regional Insights

West U.S. Herbalist & Herbal Practitioner Market Trends

West regiondominated the U.S. herbalist & herbal practitioner industry in 2024 and accounted for the largest revenue share of 28.31%. The Western U.S., comprising Pacific and Mountain states, continues to serve as a leading region in the adoption of complementary and integrative health practices, including herbalism. This growth is supported by strong consumer demand for practitioner-based services, including herbal consultations integrated with naturopathy, acupuncture, and other mind-body therapies.

Midwest U.S. herbalist & herbal practitioner market is anticipated to register the fastest growth during the forecast period. Increasing public interest in holistic health and self-reliant wellness practices is contributing to a steady rise in the presence and demand for herbalists and herbal practitioners. This trend is strengthened by a regional emphasis on community resilience, seasonal living, and locally adapted health strategies. In both urban and rural areas, consumers are seeking alternatives that align with natural remedies, traditional knowledge, and practical accessibility areas where herbalists are uniquely positioned to provide value.

Northeast U.S. herbalist & herbal practitioner market is anticipated to register considerable growth during the forecast period. The Northeast region of the U.S. presents a unique environment that supports the growth of the herbalist and herbal practitioner market, primarily due to its strong healthcare infrastructure, high educational attainment, and urban population density. This region is home to numerous academic medical centers and integrative health institutions that create an ecosystem where evidence-based complementary therapies, including herbal medicine, are increasingly integrated into conventional care models.

Key U.S. Herbalist & Herbal Practitioner Company Insights

The U.S. herbalist & herbal practitioner market is moderately consolidated with presence of small and large players.The market players undertake several strategic initiatives, such as partnerships & collaborations, service launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key U.S. Herbalist & Herbal Practitioner Companies:

- Bastyr University (Bastyr Center for Natural Health)

- Remède Naturopathics

- Arizona Prohealth (AZP)

- Icahn School of Medicine at Mount Sinai

- Sutter Health

- The Regents of the University of California

- Cleveland Clinic

- Mayo Foundation for Medical Education and Research (MFMER)

- Scripps Health

- Pellegrino Healing Center

- Collective Health Center

Recent Developments

-

In February 2024, the Regents of the University of California launched a "Nature Rx" program, a groundbreaking initiative where healthcare providers prescribe time in nature to students as part of their holistic care regimen. This program, a collaboration between UC Davis Student Health and Counseling Services (SHCS), the UC Davis Arboretum and Public Garden, and Healthy UC Davis, recognizes the therapeutic benefits of nature for health and well-being.

-

In January 2024, the New England School of Acupuncture (NESA) at Massachusetts College of Pharmacy and Health Sciences (MCPHS) established an affiliation program with the Cleveland Clinic, providing students with clinical placement opportunities at a major hospital system. This partnership allows NESA students to gain real-world experience in a top medical facility, expanding their regional footprint and offering "wonderful opportunities" for students. "We have a Chinese herbal medicine program. We have a dispensary at our school. We provide patients in our treatment center on the campus grounds with formulas. But for a hospital to have cleared all of the barriers to providing Chinese herbal medicine to their patients right in a hospital setting is cutting edge," said Broderick, a licensed acupuncturist and Director of Clinical Education

-

In November 2023, Sutter Alta Bates Summit Medical Center launched a TCM clinical training program, a first within the Sutter Health system, to integrate Eastern traditions with Western medicine. This two-year program prepares students to formulate and prescribe therapies such as herbal medicine, acupuncture, and cupping. The program is designed to assist patients with various conditions in settings such as the emergency department, ICU, palliative care, and cancer centers.

U.S. Herbalist & Herbal Practitioner Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 641.58 billion

Revenue forecast in 2033

USD 2,210.59 billion

Growth rate

CAGR of 16.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Practice settings, region

Country scope

U.S.

Bastyr University (Bastyr Center for Natural Health); Remède Naturopathics; Arizona Prohealth (AZP); Icahn School of Medicine at Mount Sinai; Sutter Health; The Regents of the University of California; Cleveland Clinic; Mayo Foundation for Medical Education and Research (MFMER); Scripps Health; Pellegrino Healing Center; Collective Health Center

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Herbalist & Herbal Practitioner Market Report Segmentation

This report forecasts revenue growth, country and regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. herbalist & herbal practitioner market report based on practice settings and region.

-

Practice Settings Outlook (Revenue, USD Million, 2021 - 2033)

-

Solo Herbal Practice

-

Naturopathic & CAM Clinics

-

Integrative Health Centers

-

Telehealth Platforms

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

West

-

Northeast

-

Southeast

-

Southwest

-

Midwest

-

Frequently Asked Questions About This Report

b. The U.S. herbalist & herbal practitioner market size was estimated at USD 546.61 million in 2024 and is expected to reach USD 641.58 million in 2025.

b. The U.S. herbalist & herbal practitioner market is expected to grow at a compound annual growth rate of 16.7% from 2025 to 2033 to reach USD 2,210.59 million by 2033.

b. The integrative health centers segment held the largest revenue share of 38.15% in 2024. Integrative health centers affiliated with hospitals, academic institutions, or corporate wellness programs are increasingly incorporating herbalists into comprehensive care teams.

b. The key industry participants in the U.S. herbalist & herbal practitioner market include Bastyr University (Bastyr Center for Natural Health), Remède Naturopathics, Arizona Prohealth (AZP), Icahn School of Medicine at Mount Sinai, Sutter Health, The Regents of the University of California, Cleveland Clinic, Mayo Foundation for Medical Education and Research (MFMER), Scripps Health, Pellegrino Healing Center, Collective Health Center

b. Rising consumer preference for holistic and preventive healthcare, and increasing availability of accredited herbal education and licensing paths are some of the drivers of this market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.