- Home

- »

- Medical Devices

- »

-

U.S. Hospital Linen Supply And Management Services Market, Industry Report, 2030GVR Report cover

![U.S. Hospital Linen Supply And Management Services Market Size, Share & Trends Report]()

U.S. Hospital Linen Supply And Management Services Market Size, Share & Trends Analysis Report By Product (Forceps, Retractors, Dilators), By Material (Orthopedic Surgery, Cardiology, Ophthalmology), By End-use, By Service Provider, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-240-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

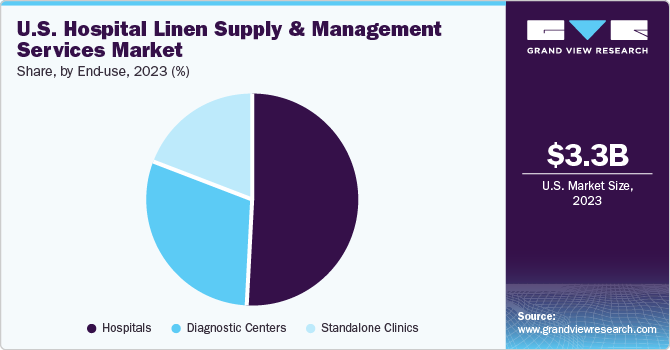

The U.S. hospital linen supply and management services market size was estimated at USD 3.3 billion in 2023 and is expected to grow at a CAGR of 8.7% from 2024 to 2030. The aspects contributing to the market growth include an increasing number of surgical procedures, growing outsourcing of hospital linen supplies & services, and rising cases of hospital-acquired infections (HAIs).

Outsourcing hospital linen supplies and management services is preferred and hence, this is likely to escalate the market's growth. Major competitors commonly include laundry services as value-added services, leading to increased revenue and market share for companies that opt for outsourcing. This approach allows healthcare organizations to concentrate on their core competencies while saving time and money on equipment, staff, and other laundry-related supplies. Building and maintaining an in-house laundry facility requires a substantial financial investment, making outsourcing a more cost-effective choice. Consequently, the trend towards outsourcing washing services to prominent companies is expected to grow, further boosting revenue and business expansion.

Increasing incidence of hospital-acquired infections and rising number of surgeries are anticipated to propel the demand for hospital gowns in the U.S. According to the Healthcare Information and Management Systems Society. Every day, one out of 25 patients in the U.S. develops a hospital-acquired infection. Hospital gowns can help prevent infection by providing a protective barrier against the transmission of microbes and infected fluids. Thus, increasing cases of hospital-acquired infections are expected to boost the demand for global hospital linen supply & management services market. In addition, an increase in the number of surgeries being performed in the U.S. is expected to fuel the market growth.

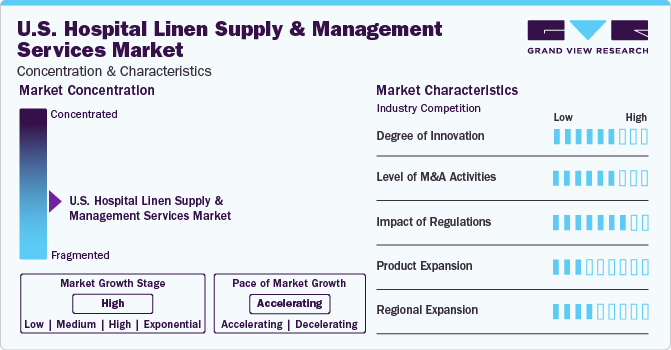

Market Concentration & Characteristics

The U.S. hospital linen supply and management services market is fragmented. This is due to high merger and acquisition activities, new product launches, regulatory approvals and regional expansion undertaken by players in the industry.

Key companies are increasingly prioritizing innovation and introducing new products to enhance their leadership positions and boost their reputation in the industry. This strategic approach aids in maintaining competitiveness in the market and adapting to various industry dynamics.

Prominent companies are strategically pursuing acquisitions to expand their market presence, enhance their capabilities, and diversify their product portfolios. This approach enables industries to capitalize on the strengths of acquired companies, gain access to new assets, and drive industry growth.

The regulatory requirements for the hygiene and safety of hospital linen supplies are strict. These stringent standards are implemented to ensure the highest levels of cleanliness and safety for patients and healthcare workers. The strict regulations cover various aspects of hospital linen, including materials, manufacturing processes, storage, and handling. Failure to adhere to these regulations can result in severe consequences, such as fines, loss of accreditation, or even legal action.

Some companies focus on regional and product expansion to broaden their customer base and take advantage of growth opportunities in different industries. This strategic approach provides opportunities to expand their presence across various regions, tailor their offerings to local market demands, and boost their market share by appealing to diverse customer segments.

Product Insights

The bed sheet & pillow covers segment dominated this market with a share of 46.0% in 2023. Bedsheets segment is analyzed for flat sheets, fitted sheets, bariatric sheets, hyperbaric sheets, gurney sheets, mortuary, and birthday sheets. These sheets possess stain-releasing features, making them long-lasting, thereby contributing to high demand in the market. Moreover, establishing a hospital reputation and neatness requires good hygiene practices for patients within healthcare settings, further boosting this segment's growth.

The bathing and cleaning accessories are anticipated to grow at the fastest CAGR from 2024 to 2030, owing to rising hygiene consciousness and sanitation practices among healthcare personnel. According to CDC recommendations, healthcare providers should often clean their hands during work. Thus, increasing awareness of patient health in healthcare settings will likely enhance opportunities for this segment over the forecast period.

Material Insights

Woven material held a significant share in 2023 due to the rising demand for woven healthcare supplies in hospitals, clinics, and healthcare settings. The woven healthcare supplies such as woven bandages, bed sheets and blankets. Moreover, the increasing manufacturing of these supplies by key companies is likely to fuel the segment’s growth in the market.

The non-woven segment is expected to grow at a considerable CAGR from 2024 to 2030. The growth is driven by the increasing popularity and convenience of non-woven supplies utilized in healthcare sectors. These supplies include protective materials such as hospital gowns, drapes, and sheets used during surgeries. The prevention of Hospital-Acquired Infections (HAIs) and the maintenance of hygiene in healthcare settings require the use of non-woven protective supplies, thereby driving market growth.

End-use Insights

Hospitals held the largest market share with 51.0% in 2023. This growth can be attributed to rising number of patient admissions due to various disease treatments and preventive surgeries. Rising hospitalizations led to increased hospital supplies, considerably boosting the market growth. Moreover, rising healthcare per capita expenditure for hospitals is expected to accelerate the market growth over the forecast period. For instance, according to the Center for Medicare &Medicaid Services Statistics, there will be an increase of USD 4.5 trillion in National health expenditure in 2022.

The diagnostic centers segment is projected to expand at the fastest CAGR from 2024 to 2030. The linen diagnostic centers require diagnostic pants, diagnostic gowns, bath blankets, towels, lab coats, scrubs, sheets, pillowcases, patient gowns, and washcloths. In addition, the linen can be rented from various companies, which are later washed and dry cleaned based on the industry’s hygiene standards.

Service Provider Insights

Based on service provider, the contractual service provider held the largest share in 2023. This growth is attributed to a rise in the number of services related to linen, increase in the number of hospitals, beds, and working professionals, and the rising preference for contractual laundry services. Contractual laundry is a cost-effective option for hospitals, as they do not install investigations and professionals for the services. Such attributes further accelerate the growth of the market.

The in-house services segment is anticipated to grow the fastest from 2024 to 2030. These services comprise washing, dry cleaning, and maintenance of linen within hospitals, diagnostic centers, or standalone clinics. Moreover, these services offer high reliability, efficiency, and cost-effectiveness, contributing to market growth over the forecast period.

Key U.S. Hospital Linen Supply And Management Services Company Insights

The market is being operated by some major companies, such as Unitex Textile Rental Services, Inc., Angelica Corporation, Healthcare Services Group, Inc., ImageFIRST Healthcare Laundry Specialists, Inc., and AmeriPride Services, Inc., among others.

To leverage the market growth, players engage in M&A activities, launch innovative products, and expand their regional product offerings. The key companies in the U.S. hospital linen supply and management services market always strive to improve their existing technologies to enhance patient outcomes and improve service efficiency.

Key U.S. Hospital Linen Supply And Management Services Companies:

- Unitex Textile Rental Services, Inc.

- Angelica Corporation

- Healthcare Services Group, Inc

- ImageFIRST Healthcare Laundry Specialists, Inc

- AmeriPride Services, Inc

- Braun Linen

- Crown Linen

- HID Global Corporation

- 3M Science

- Advanced Sterilization Services

- Baxter

Recent Developments

-

In January 2024, Healthcare Linen Services Group rewarded as America’s Greatest Workplaces for Diversity among others.

-

In November 2023, the Healthcare Linen Services announced expansion of production facility to serve add on manufacturing capabilities in the market.

-

In January 2023, York Capital Backed healthcare Linen Services Group announced agreement of acquisition with Linen King. This acquisition would expand company’s portfolio and increase customer engagement.

U.S. Hospital Linen Supply And Management Services Market Report Scope

Report Attribute

Details

Revenue Forecast in 2030

USD 6.0 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use. service provider

Country scope

U.S.

Key companies profiled

Unitex Textile Rental Services, Inc.; Angelica Corporation; Healthcare Services Group, Inc; ImageFIRST Healthcare Laundry Specialists, Inc; AmeriPride Services, Inc; Braun Linen; Crown Linen;

HID Global Corporation; 3M Science; Advanced Sterilization Services; Baxter

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hospital Linen Supply And Management Services Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hospital linen supply and management services market report based on product, material, end-use, and service provider:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bed Sheet & Pillow Covers

-

Blanket

-

Bed Covers

-

Bathing & Cleaning Accessories

-

Patient Repositioner

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Woven

-

Non-woven

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Standalone Clinics

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Contractual

-

Frequently Asked Questions About This Report

b. The U.S. hospital linen supply and management market size was estimated at USD 3.3 billion in 2023 and is expected to reach USD 3.6 billion in 2024.

b. The U.S. hospital linen supply and management market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 6.0 billion by 2030.

b. The bed sheet & pillow covers segment held the largest market share of 46% in 2023 and is anticipated to witness considerable growth over the forecast period. Bed sheets used in the hospitals are of various types such as flat sheets, fitted sheets, bariatric sheets, hyperbaric sheets, gurney sheets, mortuary sheets, and birthing sheets.

b. Some prominent players in the global hospital linen supply and management services market include Unitex Textile Rental Services; Inc., Emes Textiles Pvt. Ltd; Angelica; Elizabethtown Laundry Company; Healthcare Services Group; Inc.; ImageFIRST; Tetsudo Linen Service Co.; Ltd.; Celtic Linen; Swisslog Holding Ltd.

b. The growing number of surgeries globally is a key factor expected to drive the market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."