- Home

- »

- Medical Devices

- »

-

U.S. Humidifiers Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Humidifiers Market Size, Share & Trends Report]()

U.S. Humidifiers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Heated Humidifiers, Passover Humidifiers), By Distribution Channel (Online, Offline), By End Use (Hospitals, Outpatient Facilities), And Segment Forecasts

- Report ID: GVR-4-68040-303-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Humidifiers Market Summary

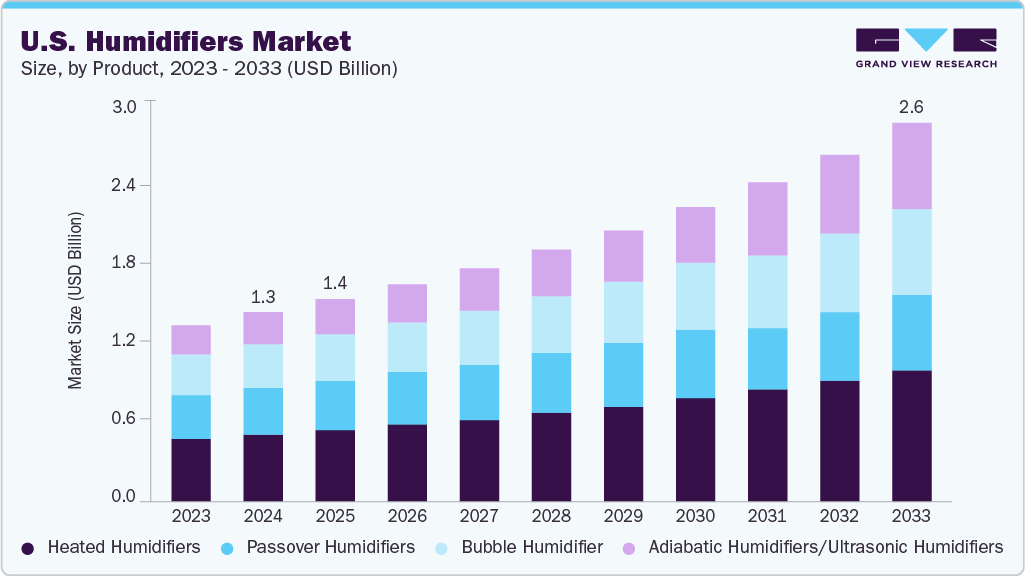

The U.S. humidifiers market size was estimated at USD 1.29 billion in 2024 and is projected to reach USD 2.60 billion by 2033, growing at a CAGR of 8.18% from 2025 to 2033. The rising prevalence of respiratory diseases and allergies, growing indoor air quality concerns, along with supportive regulatory updates and new product launches, are major factors driving market growth.

Key Market Trends & Insights

- By product, the heated humidifiers segment led the market with a share of over 35% in 2024.

- By distribution channel, the offline channel was the leading distribution channel segment in 2024.

- By end use, the hospitals segment accounted for the largest market share of around 55% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.29 Billion

- 2033 Projected Market Size: USD 2.60 Billion

- CAGR (2025-2033): 8.18%

Indoor air quality (IAQ) has become a significant concern, as poor indoor environments can contribute to skin irritation, respiratory discomfort, fatigue, and reduced productivity. Maintaining optimal humidity through humidifiers improves comfort and supports overall health by reducing dryness in the air. For instance, the Fellowes 2025 International Day of Clean Air Survey found that 45% of U.S. millennial and Gen Z employees would consider leaving their employer due to poor IAQ, with 68% expressing concern about long-term health effects and 77% reporting at least one workplace IAQ issue. This awareness encourages individuals and organizations to adopt humidifiers to create healthier, more comfortable indoor environments.

Furthermore, the high prevalence of allergies in the U.S. is fueling the adoption of humidifiers, as maintaining optimal indoor humidity can help reduce irritation of the skin, nasal passages, and respiratory system. For instance, according to the Asthma and Allergy Foundation of America (AAFA), approximately 80 million Americans suffer from allergies, with 25.7% of adults reporting seasonal allergies and 12.6% of children experiencing allergic skin conditions. This incidence of allergies is encouraging consumers to use humidifiers to create healthier and more comfortable indoor environments.

Smart Humidifiers: An Emerging Trend in the U.S. Humidifiers Market

Smart humidifiers are rapidly gaining popularity in the U.S. as consumers seek advanced solutions for maintaining optimal indoor air quality and enhancing comfort. These devices offer features such as app connectivity, voice control, and customizable humidity settings, allowing users to monitor and adjust their environment remotely. The growing adoption of smart home technologies, combined with increasing awareness of health and wellness, is driving demand for these intelligent, automated humidifiers that provide enhanced convenience and health benefits.

Smart Humidifiers

Company

Launch Date

Product Name

Key Features

Blueair

June 2025

2-in-1 Purify + Humidify DH3i

- Combines air purification and humidification, app-controlled, HEPASilent and InvisibleMist

Levoit

March 2025

OasisMist 450S Smart Humidifier

- Warm and cool mist settings, top-fill design, dual 360° nozzles, smart control via app

March 2023

OasisMist 1000S Smart Humidifier

- Smart control via app, 100-hour runtime, top-fill design, dual 360° nozzles

Market Concentration & Characteristics

The industry is characterized by high innovation, with companies developing advanced products to expand their offerings and stay competitive. In August 2025, Fisher & Paykel Healthcare launched the F&P my820 System, a new respiratory humidifier designed for home mechanical ventilation. It provides heated humidification for invasive and noninvasive ventilation and high-flow therapies for adult and pediatric patients, with adaptive temperature sensing for home use. The system is available in the U.S., Europe, Australasia, and Canada.

The industry players are using various strategies such as mergers and acquisitions, partnerships, collaborations, new product developments, and geographical expansion, which have significantly contributed to the level of M&A activities in the market. For instance, in June 2021, Teleflex Incorporated completed the divestiture of its respiratory business to Medline Industries, Inc. The transaction, valued at USD 286 million in cash, is considered a reduction of USD 12 million related to working capital that would not be transferred to Medline. Teleflex's divested respiratory product lines encompass Hudson RCI offerings for oxygen & active humidification, noninvasive ventilation, aerosol therapy, and incentive spirometers.

Regulations significantly impact the industry by ensuring safety, energy efficiency, and indoor air quality standards. Guidelines from agencies like the EPA and OSHA encourage the adoption of advanced humidifiers, including innovative models with air quality monitoring. In addition, ENERGY STAR and other energy-efficiency standards drive manufacturers to design eco-friendly, low-power devices. These regulatory measures boost consumer trust, promote healthier indoor environments, and increase demand for safe, efficient, and sustainable humidifiers.

Humidifiers are important respiratory devices used in healthcare settings, such as clinics and hospitals, and at home to maintain patient and medical professionals’ health. Even though medicines like those used for diseases like COPD can serve as external substitutes for therapeutic respiratory devices such as humidifiers, substitutes are limited. Hence, the threat of substitutes is expected to be low over the forecast period.

The level of regional expansion in the industry is moderate. While most companies are U.S.-based manufacturers they increasingly focus on strengthening operations in high-demand states and regions. For instance, in March 2022, Hamilton Medical announced the production of a HAMILTON-H900 humidifier at its facility in Reno, Nevada, catering to the U.S. market. The facility would expand its manufacturing capabilities to include heated breathing circuit sets and chambers. This initiative was expected to enhance efficiency in delivering products to customers in the U.S. Such initiatives highlight how players strategically localize production to serve regional demand better and reduce supply chain dependencies.

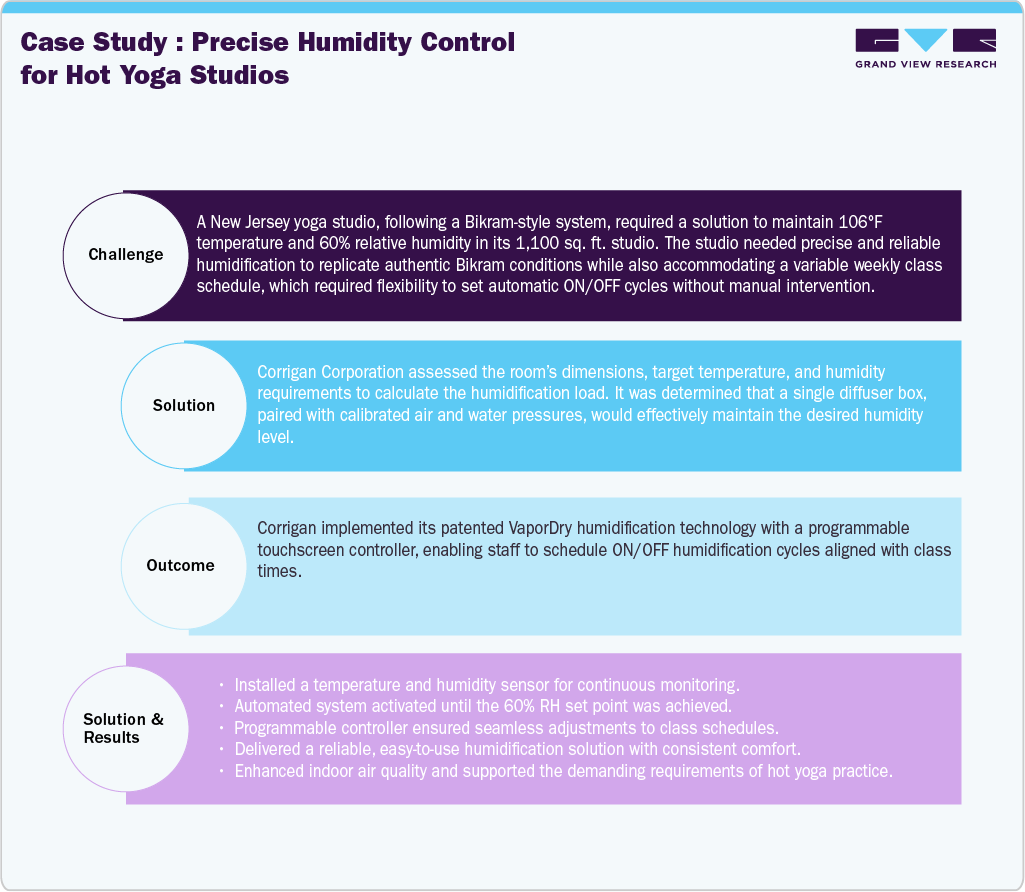

Case Study: Precise Humidity Control for Hot Yoga Studios

Key Takeaways:

“This case highlights how advanced humidification solutions are increasingly being adopted in fitness and wellness facilities in the U.S., beyond traditional residential and healthcare applications. Such specialized use cases highlight the role of humidifiers in creating optimal indoor environments tailored to niche requirements like hot yoga.”

Product Insights

The heated humidifier segment accounted for the largest revenue share of 35.5 % in 2024. The demand for heated humidifiers, specifically in children with tracheostomies who receive continuous mechanical ventilation, is driven by the need to prevent the drying of secretions. This is particularly crucial for infants who are more susceptible to respiratory complications. Heated humidifiers are sophisticated humidification systems widely employed in respiratory therapy to provide patients with warm and moist air. These humidifiers incorporate a heating element that warms the water before it is delivered as humidity. The demand for heated humidifiers stems from their ability to deliver optimal humidity levels and enhanced comfort during respiratory therapy.

The adiabatic/ultrasonic segment is expected to grow at the fastest CAGR over the forecast period. Typical types of adiabatic humidification are high-pressure atomizing, air/water atomizing, ultrasonic, and wetted media evaporative. Ultrasonic humidifiers, with their ability to add moisture efficiently, have gained popularity among consumers seeking home wellness solutions. In addition, technological advancements have led to the development of ultrasonic humidifiers with improved features.

Distribution Channel Insights

The offline channel segment held the largest revenue share in 2024, driven by consumer preference for physically inspecting products before purchase, specifically medical devices such as humidifiers. In addition, the immediate availability of products in offline sales channels, in-store demonstrations, and personalized assistance are further contributing to the segment's large share.

The online channel segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by an increasingly shifting toward e-commerce platforms, competitive pricing, and access to customer reviews. The surge in smartphone penetration, targeted digital marketing, and subscription-based delivery models further contributes to the segment's growth.

End Use Insights

The hospitals segment accounted for the largest revenue share of 55.46% in 2024. Hospitals and medical clinics are advised to maintain a relative humidity level between 40% and 60% to inhibit the growth of bacteria & other biological contaminants. This has raised the demand for humidifiers in hospitals. Furthermore, the rising number of patients with respiratory disorders, such as COPD and bronchitis, has raised the demand for humidifiers. As per the American Lung Association, in 2022, around 11.7 million people were diagnosed with COPD, chronic bronchitis, or emphysema. This number is expected to rise in the near future, propelling the market.

The homecare segment is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to the growing adoption of smart and portable humidifiers for personal use, the convenience of using humidifiers at home to improve indoor air quality, and growing consumer awareness of health and wellness.

Key U.S. Humidifiers Company Insights

Key players operating in the U.S. humidifiers market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key to propelling the market growth.

Key U.S. Humidifiers Companies:

- Fisher & Paykel Healthcare Limited

- Resmed

- Drägerwerk AG & Co. KGaA

- Koninklijke Philips N.V.

- Medline Industries, LP

- Hamilton Medical

- Armstrong Medical Ltd

- Intersurgical Ltd

- Teleflex Incorporated

- Medical Depot, Inc. dba Drive DeVilbiss Healthcare

- Precision Medical, Inc.

- acehealthcare

- CAREL INDUSTRIES S.p.A.

- Vapotherm

- Humidifirst, Inc.

- MEDICOP Medical Devices

Recent Developments

-

In November 2024, Homedics launched the Natura humidifier, a 1.3-gallon top-fill ultrasonic model that delivers warm or cool mist for spaces up to 402 sq. ft., runs up to 60 hours, features Clean Tank Technology, auto-shutoff, programmable humidity, and doubles as a planter with a removable compartment for plants.

“Natura has truly become one of my favorite products. It's not just a humidifier—it's a blend of wellness and design that we've carefully crafted to elevate any home. What makes it special is how it seamlessly merges top-tier performance with a modern, elegant aesthetic, plus the added touch of greenery that brings life into your space.”

said Daniel Kaufman, Head of Corporate Strategy at FKA Brands.

-

In October 2022, Medtronic announced separating its Patient Monitoring and Respiratory Interventions businesses into a new entity, NewCo. This strategic move aimed to enhance value for Medtronic and its shareholders by allowing the company to concentrate on long-term strategies for innovation-driven growth. The separation was expected to optimize focus and capital allocation, positioning NewCo to unlock its value.

-

In March 2021, Condair Group launched the Condair MC, an in-duct evaporative cooler and humidifier. This unit provides approximately 245kW of adiabatic cooling and up to 360kg/h of humidity to an AHU, requiring less than 0.15 kW of electrical energy.

-

In August 2022, TruSens launched a new series of high-performance humidifiers, which includes two models - N-300 and N-200. These models feature an improved and long-lasting water softening & demineralizing filter, resulting in reduced mineral accumulation and white dust formation. Both models come equipped with TruSens' exclusive SensorPod technology, which acts as a remote control & humidity monitor.

“Since launching in 2019, TruSens has rapidly attracted a loyal following based on our award-winning design, performance and simplicity. The new line of TruSens Humidifiers continues our pursuit of better air and is ideal for those seeking an exceptional humidifier with advanced features, long-lasting performance and a cleaner mist.”

- Amy Dixon, Senior Director, Marketing

U.S. Humidifiers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.38 billion

Revenue forecast in 2033

USD 2.60 billion

Growth rate

CAGR of 8.18% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in units (000’); revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end use

Key companies profiled

Fisher & Paykel Healthcare Limited; Resmed; Drägerwerk AG & Co. KGaA; Koninklijke Philips N.V.; Medline Industries, LP; Hamilton Medical; Armstrong Medical Ltd; Intersurgical Ltd; Teleflex Incorporated; Medical Depot, Inc. dba Drive DeVilbiss Healthcare; Precision Medical, Inc.; acehealthcare; CAREL INDUSTRIES S.p.A.; Vapotherm; Humidifirst, Inc.; MEDICOP Medical Devices.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Humidifiers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. humidifiers market report based on product, distribution channel, and end use.

-

Product Outlook (Unit Volume 000'; Revenue, USD Million, 2021 - 2033)

-

Heated Humidifiers

-

Integrated or Built in

-

Standalone

-

-

Adiabatic (High-pressure & ultrasonic)

-

Bubble Humidifiers

-

Passover Humidifiers

-

-

Distribution Channel Outlook (Unit Volume 000'; Revenue, USD Million, 2021 - 2033)

-

Offline Channels

-

Retail Stores

-

Supermarkets & Hypermarkets

-

Pharmacy & Health Stores

-

Exclusive Brand Stores / Showrooms

-

-

Online Channels

-

E-commerce Platforms

-

Company-owned Online Stores

-

Specialized Wellness & Home Appliance E-retailers

-

-

-

End Use Outlook (Unit Volume 000'; Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

Home Care

-

Frequently Asked Questions About This Report

b. The U.S. humidifiers market size was estimated at USD 1.29 billion in 2024 and is expected to reach USD 1.38 billion in 2025.

b. The U.S. humidifiers market is expected to grow at a compound annual growth rate of 8.18% from 2025 to 2033 to reach USD 2.60 billion by 2033.

b. In 2024, the heated humidifier segment accounted for the largest revenue share in the product segment of the market, with 35.5%. The demand for heated humidifiers, specifically in children with tracheostomies who receive continuous mechanical ventilation, is driven by the need to prevent the drying of secretions. This is particularly crucial for infants who are more susceptible to respiratory complications.

b. Some key players operating in the U.S. humidifier market market include Medtronic; Fisher & Paykel Healthcare Limited, Resmed, Drägerwerk AG & Co. KGaA, Koninklijke Philips N.V., Medline Industries, LP, Hamilton Medical, Armstrong Medical Ltd, Intersurgical Ltd, Teleflex Incorporated, Medical Depot, Inc. dba Drive DeVilbiss Healthcare, Precision Medical, Inc., acehealthcare, CAREL INDUSTRIES S.p.A., Vapotherm, Humidifirst, Inc., and MEDICOP Medical Devices.

b. Key factors that are driving the market growth include the rising prevalence of respiratory diseases and allergies, growing indoor air quality concerns, along with supportive regulatory updates and new product launches. In addition, the demand for heated humidifiers, specifically in children with tracheostomies who receive continuous mechanical ventilation, is driven by the need to prevent the drying of secretions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.