- Home

- »

- Advanced Interior Materials

- »

-

U.S. HVAC Systems Market Size, Industry Report, 2033GVR Report cover

![U.S. HVAC Systems Market Size, Share & Trends Report]()

U.S. HVAC Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment (Heating, Cooling, Ventilation), By Application (Residential, Commercial, Industrial), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-3-68038-837-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. HVAC Systems Market Summary

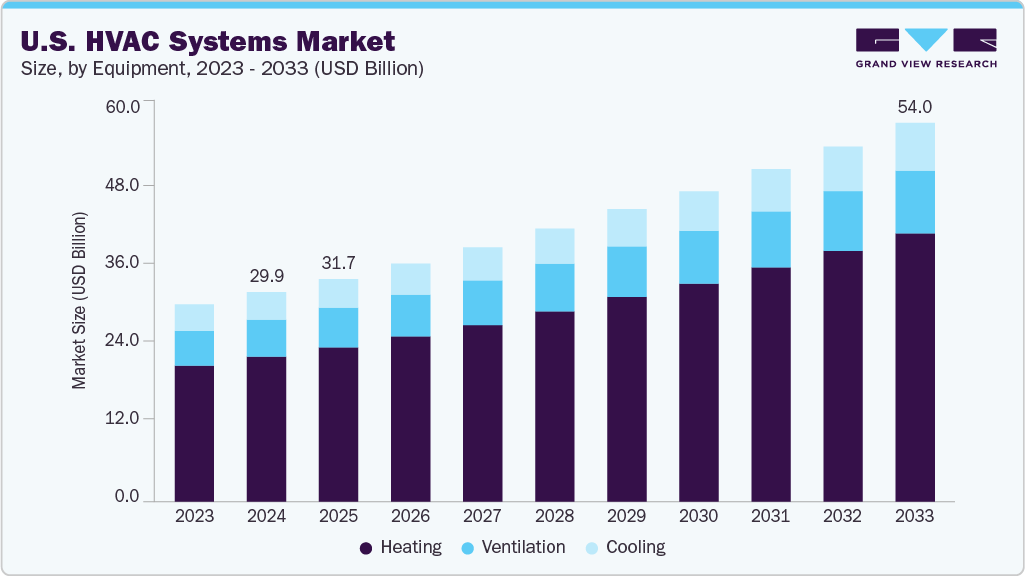

The U.S. HVAC systems market size was estimated at USD 29.89 billion in 2024 and is projected to reach USD 54.02 billion by 2033, growing at a CAGR of 6.9% from 2025 to 2033. The market's growth is driven by increasing residential and commercial construction, urban sprawl, and a heightened demand for indoor comfort across diverse climate zones.

Key Market Trends & Insights

- The HVAC systems market in the U.S. is expected to grow at a rapid CAGR of 6.9% from 2025 to 2033.

- By equipment, the heating equipment segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033 in terms of revenue.

- By application, the commercial segment is expected to grow at a significant CAGR of 7.4% from 2025 to 2033 in terms of revenue.

- By distribution channel, the online segment is expected to grow at a significant CAGR of 7.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 29.89 Billion

- 2033 Projected Market Size: USD 54.02 Billion

- CAGR (2025-2033): 6.9%

Federal and state energy efficiency mandates and incentives promoting smart, low-emission technologies support the modernization of U.S. HVAC infrastructure. Government policies, especially under programs like the Inflation Reduction Act, Energy Star Rebates, and state-level clean energy goals, are strengthening the U.S. HVAC market outlook. In addition, concerns over air quality and the impact of climate change are spurring investments in filtration, ventilation, and climate-resilient HVAC systems.

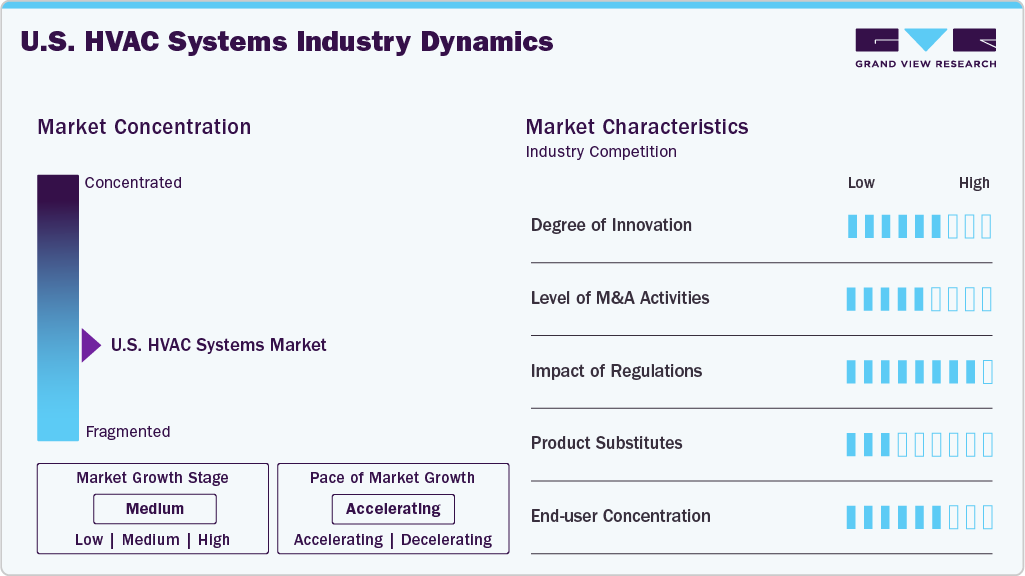

Market Concentration & Characteristics

The U.S. HVAC systems industry is moderately fragmented, featuring a strong presence of both multinational leaders and regional specialists. Major players such as Carrier, Trane Technologies, Johnson Controls, and Daikin dominate large commercial and institutional segments, including hospitals and corporate campuses. Meanwhile, smaller OEMs and local contractors focus on single-family homes, retail stores, and regional projects.

Demand is shifting decisively toward sustainable and electrified systems, encouraged by carbon neutrality targets and refrigerant phasedowns per the Kigali Amendment. Innovation focuses on heat pumps, inverter-driven systems, smart zoning controls, and building automation systems integrated with AI. Compliance with standards such as ASHRAE 90.1 and LEED certifications is critical, especially in urban areas and government-backed developments.

The U.S. HVAC systems industry is witnessing a steady rise in mergers and acquisitions as major players seek to expand their product portfolios and regional presence. Strategic acquisitions are focused on integrating smart technologies, enhancing service capabilities, and entering high-growth segments like heat pumps and building automation. Large OEMs are acquiring niche firms specializing in energy management and IoT-based solutions.

Supply chain constraints persist for components like electronic expansion valves, low-GWP refrigerants, and semiconductors, which impact cost and delivery schedules. However, opportunities remain robust in data centers, retrofits, and healthcare, with growing emphasis on predictive maintenance and lifecycle service offerings powered by remote diagnostics and digital twin technologies.

Drivers, Opportunities & Restraints

U.S. market growth is supported by rising demand for energy-efficient and climate-resilient HVAC solutions across sectors. Federal and local incentives for energy upgrades, such as rebates on heat pumps and smart thermostats, are helping consumers and businesses transition to eco-friendly systems. In addition, stricter building energy codes and emissions regulations are prompting early adoption of low-carbon HVAC technologies.

However, high upfront costs and labor shortages continue to hinder the rapid penetration of advanced HVAC systems, especially in rural and cost-sensitive areas. Skilled workforce limitations can delay installation timelines and reduce the effectiveness of advanced systems if improperly installed.

The U.S. push toward net-zero buildings unlocks innovation opportunities in low-GWP refrigerants, energy recovery ventilation, and cloud-integrated monitoring platforms. With institutional buyers, such as schools and government buildings, increasingly setting sustainability benchmarks, HVAC vendors ramp up R&D in smart, scalable, and carbon-reducing systems.

Equipment Insights

The heating equipment segment dominated the market in 2024, accounting for 69.2% of the market share, driven by adoption in colder regions such as the Midwest and Northeast. The transition from natural gas furnaces to electric and hybrid heat pumps is gaining momentum, aided by government subsidies and utility rebates under national electrification goals. The popularity of dual-fuel systems is also rising to accommodate fluctuating temperatures and grid conditions.

Meanwhile, the cooling segment is expanding steadily, propelled by rising temperatures, especially in the South and West, and the growth of data centers, healthcare facilities, and temperature-sensitive manufacturing. Consumers increasingly opt for zoned cooling, inverter-driven mini-splits, and smart air conditioners that integrate with home automation platforms. Cooling equipment embedded with load-shifting capabilities is also being supported through utility incentive programs to reduce peak demand.

Distribution Channel Insights

The retail stores segment dominated the market in 2024, accounting for 48.1% of the market share, supported by widespread consumer preference for in-person consultation, bundled service packages, and post-purchase support. Big-box retailers and local dealerships provide installation and maintenance services, making them attractive to residential and small business customers.

However, the online channel is experiencing the fastest growth, driven by digitization and a younger, more tech-savvy customer base. HVAC e-commerce is expanding, with platforms offering direct-to-consumer ordering, virtual consultations, and product comparison tools. Manufacturers are also enhancing their online presence with custom configurators, interactive sizing tools, and chat-based technical support, creating a more informed and confident buyer experience.

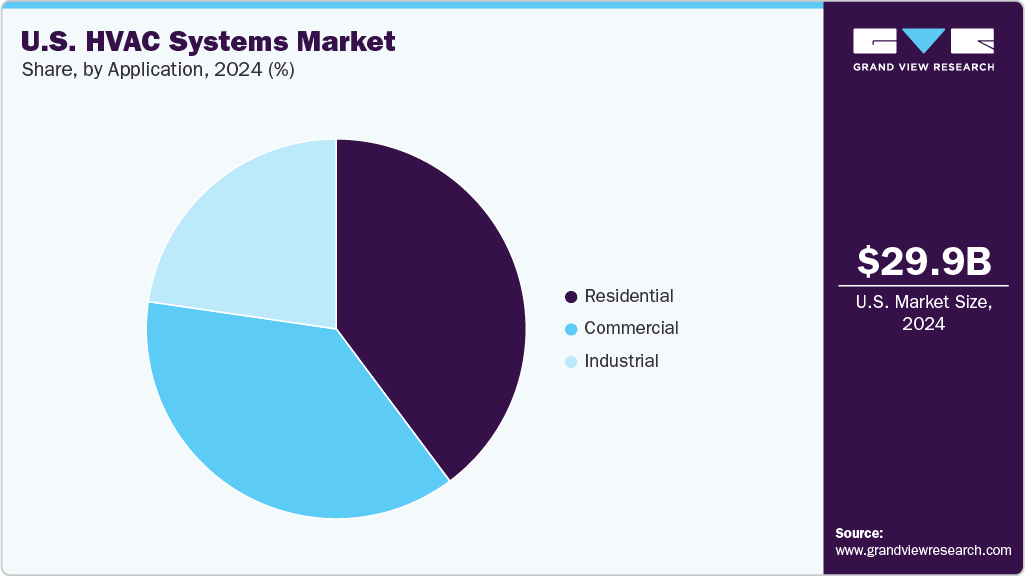

Application Insights

The residential segment dominated the market in 2024, accounting for a 39.8% market share, driven by housing starts, suburban development, and growing consumer interest in smart HVAC upgrades. Products like ductless mini-splits, smart thermostats, and variable-speed systems are in demand for new constructions and retrofit projects. Energy tax credits and green home certifications (like ENERGY STAR and Zero Energy Ready Homes) incentivize the adoption of efficient systems.

The commercial segment is the fastest growing, driven by increased investment in office buildings, educational facilities, hotels, and healthcare infrastructure. The U.S. market’s emphasis on occupant health, indoor air quality (IAQ), and energy benchmarking (e.g., ENERGY STAR Portfolio Manager, LEED) is accelerating the U.S. HVAC systems' replacement and upgrade cycle in commercial buildings.

Key U.S. HVAC Systems Company Insights

Some key players operating in the market include Carrier Corporation and Daikin Industries, Ltd.

-

Carrier Corporation provides heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to the retail, commercial, transport, and foodservice sectors. It was acquired by United Technologies Corporation in 1979; however, it was separated into a separate business in April 2020.

-

Daikin Industries, Ltd. offers air conditioning systems, room heating and heat pump hot water supply systems, room air conditioning systems, packaged air conditioning systems, and air conditioning systems for plants, facilities, and office buildings.

Key U.S. HVAC Systems Companies:

- Carrier Corporation

- DAIKIN INDUSTRIES Ltd.

- Fujitsu

- Haier Group

- Panasonic Corporation

- Johnson Controls

- LG Electronics

- Lennox International Inc.

- Trane

- Midea

Recent Developments

-

In February 2025, Midea finalized its purchase of ARBONIA Climate to expand its reach in the European and U.S. HVAC market. By combining ARBONIA Climate with its existing subsidiary, Clivet, Midea is creating a new entity called MBT Climate. This new group will capitalize on ARBONIA Climate's expertise in sustainable heating and cooling technologies and Midea's robust R&D to offer a wider range of localized U.S. HVAC solutions.

-

In February 2025, Carrier Ventures invested strategically in ZutaCore, a company specializing in liquid cooling systems for data centers. The collaboration focuses on improving cooling efficiency for high-density computing, especially as AI demands grow. ZutaCore’s technology supports energy savings and increased server performance, helping to reduce data center emissions.

U.S. HVAC Systems Market Report Scope

Report Attribute

Details

Market size in 2025

USD 31.71 billion

Revenue forecast in 2033

USD 54.02 billion

Growth rate

CAGR of 6.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, distribution channel

Country Scope

U.S.

Key companies profiled

Carrier Corporation; DAIKIN INDUSTRIES Ltd.; Fujitsu; Haier Group; Panasonic Corporation; Johnson Controls; LG Electronics; Lennox International Inc.; Trane; Midea

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. HVAC Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the U.S. HVAC systems market report based on equipment, application, and distribution channel:

-

Equipment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Heating

-

Heat Pump

-

Furnace

-

Unitary Heaters

-

Boilers

-

Electric Baseboards

-

Heating Cables

-

Others

-

-

Ventilation

-

Air Purifier

-

Dehumidifier

-

Air Handling Units

-

Ventilation Fans

-

Others

-

-

Cooling

-

Air Conditioning

-

Chillers

-

Cooling Towers

-

Others

-

-

-

Application Outlook (Revenue, USD Billion; 2021 - 2033)

-

Residential

-

By Equipment

-

-

Commercial

-

By Equipment

-

-

Industrial

-

By Equipment

-

-

-

Distribution Channel Outlook (Revenue, USD Billion; 2021 - 2033)

-

Online

-

Retail Stores

-

Wholesale Stores

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. HVAC systems market size was estimated at USD 29.89 billion in 2024 and is expected to reach USD 31.71 billion in 2025.

b. The U.S. HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2033 to reach USD 54.02 billion by 2033.

b. The commercial equipment segment is expected to expand at the fastest CAGR from 2025 to 2033 in the U.S. Increasing demand for energy-efficiency equipment coupled with the growing real estate market is projected to fuel the market.

b. West region dominated the market in 2024 by accounting for a significant revenue share of the market. The growing population is expected to drive the demand for commercial, industrial, and residential projects in the western region projected to drive the demand for HVAC systems over the forecast period.

b. Key factors driving the U.S. HVAC systems market include rising construction activity, growing demand for energy-efficient solutions, and government incentives promoting sustainable technologies. Technological advancements and stricter environmental regulations are further accelerating system upgrades and new installations.

b. Some of the key players operating in the U.S. HVAC systems market are Carrier Corporation, DAIKIN INDUSTRIES Ltd., Fujitsu, Haier Group, Panasonic Corporation, Johnson Controls, LG Electronics, Lennox International Inc., Trane, Midea.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.