- Home

- »

- Next Generation Technologies

- »

-

U.S. In-app Advertising Market Size, Industry Report, 2030GVR Report cover

![U.S. In-app Advertising Market Size, Share & Trends Report]()

U.S. In-app Advertising Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Banner Ads, Interstitial Ads), By Platform, By Application (Entertainment, Gaming, Social, Payment & Ticketing, News), And Segment Forecasts

- Report ID: GVR-4-68040-247-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. In-app Advertising Market Size & Trends

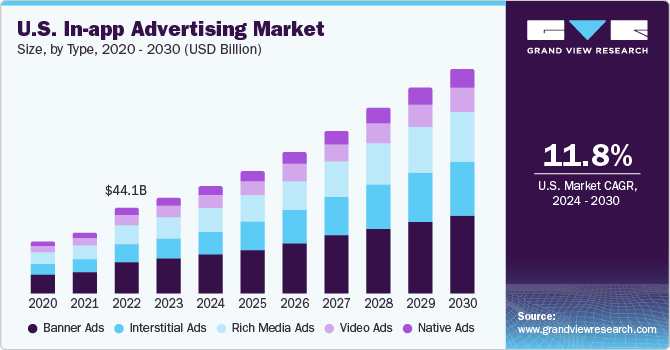

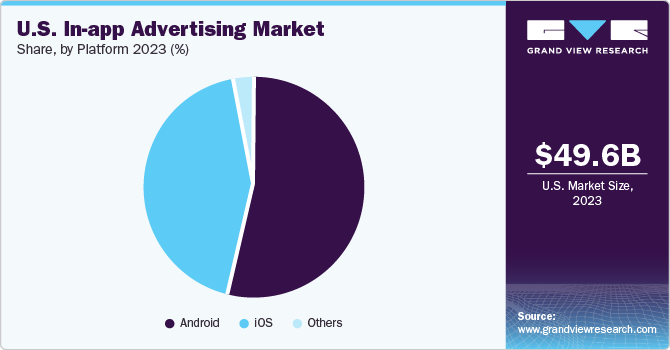

The U.S. in-app advertising market size was valued at USD 49.6 billion in 2023 and is expected to grow at a CAGR of 11.8% from 2024 to 2030. Due to the rising usage of smartphones, companies are focusing on mobile advertisements for brand promotion and product sales with the help of banners, short videos, and interstitials, adding to the market growth in the region. In-app advertisements help marketers reach out to a bigger user base than mobile web advertising by targeting potential customers through usage patterns, age, interests, and location data analysis.

In 2023, the U.S. accounted for over 27% of the global in-app advertising market. The rapidly growing online gaming and e-commerce industries have a direct and significant impact on the market. Businesses are spending more on in-app advertisements owing to their higher click-through rate than mobile web advertising. In-app advertising also allows app developers to build an effective revenue generation strategy by displaying advertisements on mobile applications.

In-app advertising is gaining popularity owing to the rapidly growing demand for mobile-based advertising across numerous industries and sectors such as entertainment, education, and retail. It allows advertisers to display several advertisements, such as pop-up videos and banners, in mobile applications to connect with their audience. The increasing popularity of B2C, C2C, and B2B e-commerce websites is further driving the market growth.

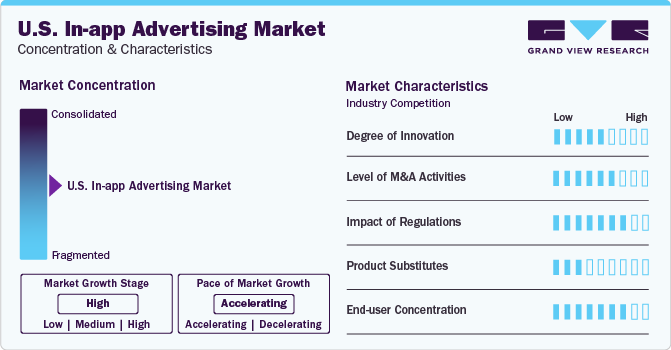

Market Concentration & Characteristics

Level of innovation is moderate to high in the U.S. in-app advertising market. The introduction of blockchain technology platforms is allowing developers to enhance the capabilities of in-app advertising. The increasing rate of smartphone penetration and the continued integration of the latest technologies, such as Internet of Things (IoT), with mobile devices are contributing significantly toward innovations in market.

Marketers and advertisers operating in the market have to abide by the requirements specified in data privacy and security regulations. For such ads, advertisers first need to collect data directly from an app user. This may cover user behavior, preferences, geography, interaction with a mobile app, purchase history, ad impressions, or any other information potentially used to deliver a personalized experience. The Interactive Advertising Bureau (IAB) and Media Rating Council (MRC) are some of the concerned bodies.

Merger and acquisition activities are also frequent in the market in order to expand market presence and enhance service offerings. For instance, in July 2022, Tremor International Ltd. acquired Amobee, Inc., a provider of digital marketing technology, for USD 239 million. The acquisition has helped Tremor International Ltd. to enhance its data-driven offerings, expand its market presence and focus on core areas, including data, video, and CTV.

The market is characterized by a moderate level of end-use concentration as several industries and industry verticals are opting for in-app advertising as the key marketing and promotion strategy for their products and solutions. The outbreak of the COVID-19 pandemic has prompted several vendors to switch from conventional advertisement channels to in-app advertisement channels in response to the lockdowns imposed in various economies.

Type Insights

Based on type, the banner ads segment dominated the market with the largest revenue share of around 36.0% in 2023. Banner ads offer several benefits, such as affordability, easy implementation, and supporting all types of applications and mobile devices. Banner ads also help marketers gain traffic, spread brand awareness, and sale their products. Banner ads are also popular for offering good returns on investments.

Interstitial ads are expected to grow with the highest CAGR over the forecast period. These ads are full-page advertisements provided in the middle of screens during mobile app navigation. The interstitial ads enable advertisers to offer the best creativities as they are displayed full-screen and create user engagement better than native or banner ads. Interstitial ads are among the most popular ad formats used by developers and marketers because of their high impression rate, as larger size means larger impression.

Application Insights

The entertainment segment dominated the market with the largest revenue share in 2023 and is expected to maintain its dominance during the forecast period. Entertainment applications are becoming increasingly popular and advertisers are utilizing these platforms to reach their targeted audience by utilizing information such as viewing habits, age, location, gender, and other demographics to utilize the performance of their advertising campaigns. The ability to reach out to targeted audiences effectively and offer advanced analytics to optimize future advertising campaigns offers lucrative growth opportunities for the entertainment segment in the in-app advertising market.

Gaming is another major segment of the market. Game developers use different types of game advertising strategies and advertising formats to make money and get paid by displaying ads to their users. They incorporate these ads into their games to push mobile game ad revenue, such as offerwall ads, rewarded video ads, and interstitial ads. Rising game subscriptions via Google Play Pass and Apple Arcade are expected to further drive the growth of the segment as new revenue streams open to gaming apps.

Platform Insights

Based on platforms, the market can be segmented into android, iOS, and others. The android segment dominated the market with the largest revenue share in 2023. Android is a familiar, user-friendly, and open-source operating system that allows different devices to run on the platform. Marketers usually target high-end android devices based on device models to target high-quality users.

The iOS segment captured the second largest market share in 2023. This is mainly because iOS users spend more money on the purchase of apps compared to android users. iOS devices are more reliable, have a better user interface, better features, and multitasking facility. The rising demand for utility, gaming, educational, and business apps, among others, suggest the promising future growth prospects of iOS app-based devices.

Key U.S. In-app Advertising Company Insights

Some of the leading companies in the market include Google AdMob (Google LLC), BYYD Inc., Facebook, Flurry (Yahoo Inc.), BYYD, and Verizon Media.

-

BYYD is an integrated mobile Demand-Side Platform (DSP) solution provider that enables advertisers to connect with clients globally. The platform is integrated with Real Time Bidding (RTB) technology. The company’s platform allows users to buy mobile inventory on tablets and smartphones in apps, games, and mobile web across the globe. The company operates its business through three business areas, namely advertising, app marketing, and mobile.

-

Flurry operates its mobile analytics, monetization, and in-app advertising business across multiple industries, including Information Technology (IT), iOS, analytics, mobile, and software. It offers applications to support the analytical solutions of businesses, thereby enabling them to monitor the mobile users' preferences, trends, and habits across numerous mobile applications.

Amobee, Inc., Glispa GmbH, AppLovin, Chartboost, Inc., Verizon Media, etc. are some emerging companies in the U.S. in-app advertising market.

-

Verizon Media offers solutions for advertisers, publishers, enterprise, and global partners, including Microsoft News, MSN, Outlook, and Xbox. Its subsidiaries include AOL, Flurry, Yahoo!, EdgeCast, BrightRoll, Weblogs, Inc., and Yahoo India Private Ltd.

-

Chartboost is an in-app programmatic advertising and monetization platform provider engaged in providing solutions across industries such as advertising, apps, and gaming. The platform drives customer engagement through statics, videos, and playables. The company also offers Chartboost SDK for both iOS and Android devices, which allows developers to monetize their mobile apps and connect advertisers to the in-app inventory.

Key U.S. In-app Advertising Companies:

- ironSource (Unity Software Inc.)

- Google AdMob (Google LLC)

- BYYD Inc

- Flurry (Yahoo Inc.)

- Verizon Media

- Tune Inc.

- Tapjoy

- Amobee, Inc.

- Glispa GmbH

- AppLovin

- Chartboost, Inc

- Smaato, Inc.

- Leadbolt

Recent Developments

-

In September 2023, Unity completed its merger with ironSource. This merger is expected to allow Unity to support developers through the entire development cycle as they develop immersive and real-time apps and 3D experiences into successful businesses.

-

In July 2021, Smaato was acquired by Media and Games Invest. Together with Verve Group, Smaato completes the tech stack with omnichannel offerings across web, in-app, DOOH, and CTV. Smaato’s digital ad tech platform and ad server is a self-serve omnichannel monetization solution offering publishers the ability to manage their entire ad stack in one place.

U.S. In-app Advertising Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 110.2 billion

Growth rate

CAGR of 11.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, application

Country scope

U.S.

Key companies profiled

ironSource (Unity Software Inc.), Google AdMob (Google LLC), BYYD Inc., Flurry (Yahoo Inc.), TUNE, Inc., Amobee, Inc., InMobi, Glispa GmbH, AppLovin, Chartboost, Inc, Smaato., Inc., Leadbolt

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. In-app Advertising Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. in-app advertising market report based on type, platform, and application:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banner Ads

-

Interstitial Ads

-

Rich Media Ads

-

Video Ads

-

Native Ads

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Entertainment

-

Gaming

-

Social

-

Online Shopping

-

Payment & Ticketing

-

News

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. in-app advertising market size was estimated at USD 49.6 billion in 2023 and is expected to reach USD 56.5 billion in 2024.

b. The U.S. in-app advertising market is expected to grow at a compound annual growth rate of 11.8% from 2024 to 2030 to reach USD 110.2 billion by 2030.

b. The banner ads segment dominated the market with the largest revenue share of around 36.0% in 2023 owing to their rising demand driven by various benefits, such as affordability, easy implementation, and supporting all types of applications and mobile devices.

b. Some key players operating in the U.S. in-app advertising market include ironSource (Unity Software Inc.), Google AdMob (Google LLC), BYYD Inc., Flurry (Yahoo Inc.), TUNE, Inc., Amobee, Inc.

b. Key factors that are driving the U.S. in-app advertising market growth include rising adoption of smartphones and increased preference to the mobile advertisements for brand promotion and product sales.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.