- Home

- »

- Homecare & Decor

- »

-

U.S. Industrial Ceiling Fan Market, Industry Report, 2030GVR Report cover

![U.S. Industrial Ceiling Fan Market Size, Share & Trends Report]()

U.S. Industrial Ceiling Fan Market (2025 - 2030) Size, Share & Trends Analysis Report By Size (6 Ft - 12 Ft, 12 Ft - 16 Ft, 16 Ft - 20 Ft, 20 Ft - 24 Ft), By Application (Agriculture, Commercial & Industrial Spaces), By Distribution Channel (Retail Stores), And Segment Forecasts

- Report ID: GVR-4-68040-123-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Industrial Ceiling Fan Market Trends

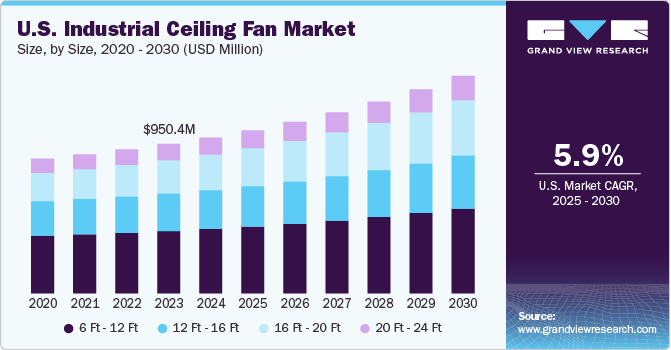

The U.S. industrial ceiling fan market size was valued at USD 990.5 million in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2030. The market is witnessing robust growth, driven by increasing demand across a variety of sectors such as manufacturing, warehousing, and commercial spaces. As businesses seek cost-effective solutions to improve energy efficiency and ventilation, industrial ceiling fans have emerged as a preferred option due to their ability to enhance air circulation in large, high-ceiling environments. These fans not only help in maintaining comfortable working conditions but also contribute to significant energy savings by reducing the load on HVAC systems. The adoption of industrial ceiling fans has become increasingly prevalent, particularly in sectors that operate vast indoor spaces, reinforcing their critical role in optimizing operational efficiency.

Technological advancements have also played a key role in the growth of the market. Modern industrial ceiling fans are equipped with advanced features such as variable speed controls, energy-efficient motors, and integration with smart building systems. These innovations have made them more appealing to industries focused on sustainable operations, as they align with broader trends toward reducing energy consumption and lowering carbon footprints. The incorporation of Internet of Things (IoT) capabilities further enhances their attractiveness by allowing for real-time monitoring and automation, adding to their value proposition.

The rising trend of urbanization and the expansion of commercial and industrial infrastructure in the U.S. have further fueled demand for industrial ceiling fans. As new manufacturing plants, distribution centers, and warehouses are established to meet the growing needs of e-commerce and logistics, the need for effective ventilation and climate control solutions is paramount. Industrial ceiling fans, with their ability to provide consistent airflow and reduce heat buildup, are becoming essential components in the design of these large-scale facilities, underscoring their importance in modern industrial architecture.

Moreover, the U.S. government’s focus on energy-efficient practices and sustainability initiatives has provided additional impetus for the adoption of industrial ceiling fans. Policies aimed at reducing energy consumption in commercial and industrial buildings have encouraged businesses to invest in energy-saving technologies, including industrial fans. These regulatory drivers, combined with increasing awareness of environmental responsibility, are anticipated to support sustained growth in the market over the coming years.

As reported by the U.S. Bureau of Labor Statistics, the number of warehouse establishments in the U.S. surpassed 21,000 as of 2023, reflecting a notable increase from over 19,000 in 2020. This steady expansion in warehousing infrastructure has directly contributed to the rising demand for industrial ceiling fans, as these facilities require efficient and cost-effective climate control solutions to maintain optimal operational environments. The larger number of warehouses, driven by the growth of e-commerce and logistics sectors, has heightened the need for advanced ventilation systems, positioning industrial ceiling fans as a critical component in enhancing air circulation, reducing energy consumption, and improving overall facility management. This trend underscores the integral role of industrial ceiling fans in supporting the operational efficiency of modern warehouse spaces across the U.S.

Industrial ceiling fans have advanced significantly, evolving beyond traditional ventilation systems. Modern innovations now feature cutting-edge sensors and automated control systems that dynamically adjust fan speed and direction in response to indoor conditions such as temperature, humidity, and occupancy levels. This intelligent approach maximizes ventilation efficiency while significantly reducing energy wastage, ensuring optimal performance in large-scale industrial environments.

For example, U.S.-based Lamps Plus, Inc., headquartered in Los Angeles, offers the Minka Aire series of ceiling fans, which are equipped with handheld remote controls and smart energy-efficient features. These high-volume, low-speed (HVLS) fans are engineered to deliver optimal airflow and cooling for expansive spaces, incorporating advanced technologies that enhance both functionality and operational efficiency.

In addition, the growing focus on sustainability and energy conservation has further accelerated the adoption of energy-efficient industrial ceiling fans. These fans play a pivotal role in reducing overall energy consumption, aligning with industry-wide efforts to minimize environmental impact and support sustainability initiatives in large commercial and industrial facilities.

Size Insights

The industrial ceiling fans of size 6 Ft - 12 Ft held a market share of 41.36% in 2024. This is attributed to their versatility and suitability across a broad range of industrial and commercial applications. Fans within this size range offer an optimal balance between airflow capacity and energy efficiency, making them particularly effective for medium to large spaces such as warehouses, manufacturing facilities, and commercial buildings. Their ability to provide uniform air distribution while maintaining moderate energy consumption makes them a preferred choice for industries focused on enhancing operational efficiency without incurring excessive utility costs.

The demand for industrial ceiling fans of size 16 Ft - 20 Ft is anticipated to grow at a CAGR of 7.9% from 2025 to 2030. In expansive spaces, ceiling fans within the 16 to 20-foot range are highly effective in circulating air, ensuring consistent temperature distribution, and minimizing energy consumption. These fans play a crucial role in reducing condensation, improving air quality, and creating a more comfortable environment for occupants. By optimizing airflow, they contribute to lower energy costs and foster a healthier, more breathable atmosphere. Moreover, strategic initiatives by leading manufacturers, such as product innovations and enhanced energy-efficient designs, are anticipated to further drive demand for these large-scale fans, reinforcing robust market growth in the industrial sector.

Application Insights

The demand for industrial ceiling fans in commercial and industrial spaces accounted for a market share of 31.76% in 2024. Commercial and industrial facilities necessitate ceiling fans with airflow capacities exceeding 10,000 CFM to ensure efficient ventilation and climate control. In environments such as warehouses and manufacturing facilities, excessive heat exposure can lead to significant economic losses, reduced labor productivity, and compromised worker well-being. The need to mitigate these challenges has driven the growing demand for high-capacity industrial and commercial ceiling fans in the U.S., as they play a critical role in maintaining optimal working conditions, enhancing productivity, and supporting overall operational efficiency in these large-scale settings.

The demand for industrial ceiling fans at malls and shopping centers is expected to grow at a CAGR of 7.8% from 2025 to 2030. The demand for industrial ceiling fans in malls and shopping centers is largely fueled by their capacity to regulate temperatures efficiently, enhance air circulation, and deliver energy savings, all while improving the overall visitor experience. As sustainability becomes an increasing priority, these fans have gained traction as an energy-efficient alternative to traditional air conditioning systems. Their ability to reduce energy consumption while maintaining a comfortable indoor environment has positioned industrial ceiling fans as a favored solution for large commercial spaces focused on both operational efficiency and environmental responsibility.

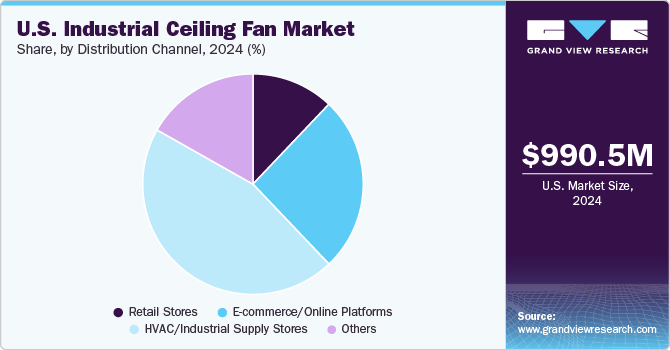

Distribution Channel Insights

The HVAC/industrial supply stores contributed a market share of 45.28% in 2024. Authorized dealers across the U.S. are increasingly offering not only installation services but also expert product recommendations customized to various application-specific needs. For example, R. Williamson & Associates LLC., a service provider and supplier based in Illinois, provides comprehensive solutions for air movement and pollution control operations. The company supplies and installs industrial ceiling fans from leading manufacturers such as Hunter Industrial Fans, Envira-North Systems Ltd., Canarm, and Hartzell Air Movement. By offering tailored solutions and a diverse product portfolio, these dealers play a critical role in meeting the specific ventilation needs of industrial and commercial clients.

The sales through e-commerce/online platforms channels are expected to grow at a CAGR of 6.9% from 2025 to 2030. Shoppers can now conveniently browse and compare a wide range of industrial ceiling fans, access comprehensive product details, and review customer feedback through online platforms. This online distribution model not only offers competitive pricing, often lower than traditional retail channels but also streamlines logistics with doorstep delivery. Additionally, wholesalers and distributors are increasingly adopting bulk procurement models to efficiently fulfill client and customer demands. For instance, W.W. Grainger, Inc., a U.S.-based manufacturer and wholesaler, facilitates bulk orders through its online platform for various industrial equipment, including industrial ceiling fans of all sizes, enhancing accessibility and service efficiency.

Key U.S. Industrial Ceiling Fan Company Insights

The competitive landscape of the market is characterized by the presence of several well-established manufacturers and emerging players, all vying to expand their market share through product innovation, strategic partnerships, and advanced distribution channels. Key market participants, such as Hunter Industrial Fans, Big Ass Fans, and Envira-North Systems, are focusing on developing energy-efficient, technologically advanced products that cater to the evolving needs of industrial and commercial clients.

Additionally, companies are leveraging smart technologies, such as IoT-enabled control systems and automated airflow management, to differentiate their offerings and meet the growing demand for sustainable solutions. Strategic collaborations with authorized dealers and service providers are also playing a crucial role in enhancing customer engagement and expanding geographical reach. As the market becomes more competitive, players are increasingly investing in R&D, optimizing supply chain operations, and enhancing after-sales services to maintain a competitive edge.

Key U.S. Industrial Ceiling Fan Companies:

- KALE FANS

- SkyBlade Fans

- Hunter Fan Company

- MacroAir Technologies, Inc.

- Rite-Hite

- Big Ass Fans

- Patterson Fan Company, Inc.

- ChopAir

- VividAir

- Humongous Fan

- CoolBoss, LLC

- Canarm Ltd.

Recent Developments

-

In July 2023, CoolBoss, LLC introduced the Tempest and Windstorm series of high-volume, low-speed (HVLS) industrial overhead fans. These series are engineered to create optimal temperature conditions within expansive indoor environments while substantially lowering energy costs. The fans are available in diameters ranging from 11.5 to 24 feet, making them suitable for various large-scale applications. Additionally, the fan blades are manufactured from high-strength, fatigue-resistant aluminum alloy, ensuring durability and enhanced performance in demanding industrial settings.

U.S. Industrial Ceiling Fan Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,036.6 million

Revenue forecast in 2030

USD 1,382.9 million

Growth rate

CAGR of 5.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, application, distribution channel

Key companies profiled

KALE FANS; SkyBlade Fans; Hunter Fan Company; MacroAir Technologies, Inc.; Rite-Hite; Big Ass Fans; Patterson Fan Company, Inc.; ChopAir; VividAir; Humongous Fan; CoolBoss, LLC; and Canarm Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Ceiling Fan Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. industrial ceiling fan market on the basis of size, application, and distribution channel:

-

Size Outlook (Revenue, USD Million; 2018 - 2030)

-

6 Ft- 12 Ft

-

12 Ft - 16 Ft

-

16 Ft - 20 Ft

-

20 Ft - 24 Ft

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Agriculture

-

Commercial and Industrial Spaces

-

Malls and Shopping Centers

-

Educational Institutions

-

Sports Arenas and Gymnasiums

-

Atriums and Event Spaces

-

Food Processing Facilities

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Retail Stores

-

E-commerce/Online Platforms

-

HVAC/Industrial Supply Stores

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. industrial ceiling fan market was estimated at USD 990.5 million in 2024 and is expected to reach USD 1,036.6 million in 2025.

b. The U.S. industrial ceiling fan market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 1,382.9 million by 2030.

b. In 2024, industrial ceiling fans of size 6 Ft—12 Ft held a market share of 41.36%. This is attributed to their versatility and suitability across a wide range of industrial and commercial applications.

b. Some of the key players operating in the U.S. industrial ceiling fan market include KALE FANS; SkyBlade Fans; Hunter Fan Company; MacroAir Technologies, Inc.; Rite-Hite; Big Ass Fans; Patterson Fan Company, Inc.; ChopAir; VividAir; Humongous Fan; CoolBoss, LLC; and Canarm Ltd.

b. The growth of the U.S. industrial ceiling fan market is majorly driven by increasing demand across various sectors, such as manufacturing, warehousing, and commercial spaces, and the expansion of commercial and industrial infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.