- Home

- »

- Paints, Coatings & Printing Inks

- »

-

U.S. Industrial Coatings Market Size & Share Report, 2030GVR Report cover

![U.S. Industrial Coatings Market Size, Share & Trends Report]()

U.S. Industrial Coatings Market Size, Share & Trends Analysis Report By Product (Acrylic, Alkyd), By Technology (Solvent Borne, Water Borne), By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-968-2

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

The U.S. industrial coatings market size was valued at USD 15.0 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.2% from 2022 to 2030. The demand for the product is anticipated to be driven by increasing demand in the automotive, aerospace, and electronics industries. The automotive industry in the U.S. is a critical component of its economic growth. The country is one of the largest motor vehicle markets globally. Around 4.5% of all U.S. jobs are supported by the auto industry. Although the automobile industry took a hit during the COVID-19 pandemic, the sector has bounced back to normalization. The U.S. auto industry spends around USD 18 billion annually on research and development.

Refinish and automotive coatings are the crucial end-use industries of the product. The product demand is anticipated to grow in the coming years, owing to the consumption of refinish coatings for automotive repair, maintenance, and aftermarket painting, on account of their visual appearance, corrosion resistance, and surface protection. The rapid growth of the automobile industry in the country, especially the electric vehicles segment, is anticipated to boost the demand for the product in the OEM application area during the forecast period.

In addition, increasing demand for industrial coatings from industries such as appliances, packaging, wood, building & construction, agriculture, and others is anticipated to fuel the market growth during the forecast period. Packaging applications which include cans, caps & closures, and various others are expected to impact the market growth positively in the coming years.

Characteristics such as product flexibility, resistance, CO2 retention to preserve freshness, and adhesion are driving the demand for the product in the packaging industry. Additionally, the rise in construction activities in the economy is impacting the product demand in this segment. Coatings are used in the construction industry to protect the surfaces from external elements such as acid rain, UV exposure, and corrosion.

Low pollution coating technologies are anticipated to be adopted, owing to strict government regulations regarding the environment, specifically air pollution, in countries such as the U.S., China, and western European countries. Government regulations have shifted the demand from solvent-based products towards eco-friendly or low-VOC products, which include powder coatings, curable coatings by UV, and water-based. Low-VOC products consist of fewer solvents that vanish during the application stage and achieves a greener environment with zero VOC emissions.

The COVID-19 pandemic and the resultant lockdowns in 2020 negatively impacted the growth of the market in the U.S. These coatings are used in the automotive, construction, and manufacturing industries, which witnessed shutdowns in 2020 to contain the virus spread. Most U.S. automobile manufacturing units had been closed due to the pandemic, thereby decreasing national sales. This negatively affected the growth of automotive original equipment manufacturers in the U.S. The fall in sales of new vehicles adversely impacted the demand for coatings by OEMs operating in the U.S. automotive industry.

Product Insights

Acrylic coatings dominated the market with 37.3% revenue share in 2021. The demand was attributed to the rise in product consumption in infrastructure and metal coating applications due to its characteristics such as UV light, fire, and abrasion resistance; and gloss retention. Also, acrylic industrial coating finds application in aerospace, automotive OEM, and various other end-use industries due to its characteristics of corrosion resistance, fast drying, barriers and inhibiting ability. Some other applications include machinery equipment, new construction, automotive, and intermodal containers.

The polyester segment is expected to register the second highest revenue-based CAGR of 3.2% during the forecast period. The growth can be attributed to its consumption in automotive, aerospace, and construction industries. These coatings offer mechanical, impact, UV, and chemical resistance, along with quick-drying and abrasion resistance properties. Furthermore, they exhibit high shrinkage during cure, excellent adhesion to carbon steel, and high elongation. The product is gaining significant market share owing to the absence of VOC content and low wastage.

Epoxy based products are widely used in wastewater treatment plants, shipbuilding, and construction, owing to their excellent properties such as resistance to blistering, cracking, stains, and extreme temperatures. These coatings offer corrosion resistance against sanitizing and chemical agents. It also protects against chemical attack, abrasion, and thermal shock.

Technology Insights

Solvent borne coatings accounted for 36.6% of the total revenue share in 2021, owing to the use of such coating in oil & gas, marine, automotive, and other industries. Lower drying times and improved functioning in open and humid environments are likely to contribute to segment growth during the projection period. Due to the expansion of the industrial sector, solvent-borne coating demand is predicted to increase in developing nations like China, India, and Brazil. However, strict VOC emission restrictions, notably in North America and Europe, are anticipated to pose a development hurdle for this market.

Water borne products are anticipated to register the highest CAGR of 3.7% on revenue basis during the projected period in the U.S. industrial coatings market. The growth can be witnessed due to its characteristic of preventing the development of surface skin by the evaporation of water in the coating layer. The products made of water are typically utilized in situations where solvent-based coatings are anticipated to react with the substrate.

They have great heat and corrosion resistance, making them perfect primers. Due to their low VOC content and low emissions of harmful air pollutants, they are also flame-resistant and toxic-free. Due to strict legislations governing the solvents included in coatings in the U.S. and other developed European nations, the use of water-based products is anticipated to rise. On the other hand, compared to their alternatives, coatings made of powder are more resilient and environment-friendly.

Since there is no solvent present, they have a very low VOC content and thus effectively and inexpensively comply with environmental protection laws. In order to prevent corrosion, offer abrasion protection, and create a consistent surface quality, powder-based coatings are frequently used in agricultural equipment, automobiles, machine components, mechanical parts, and building facades. During the projected period, there is anticipated to be a rise in the demand for low VOC or zero-emission industrial coatings in the U.S.

End-Use Insights

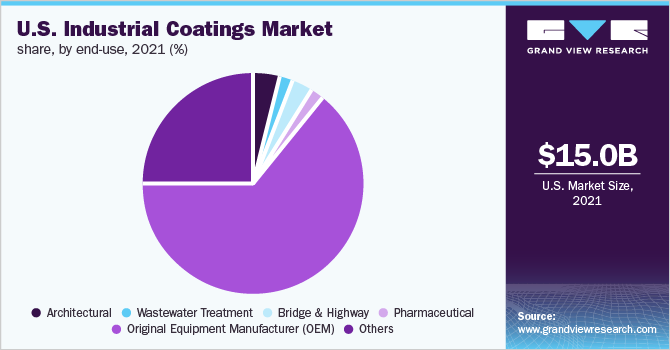

The original equipment manufacturers (OEM) segment dominated the market with 64.9% market revenue share, owing to the use of industrial coatings in products in factories, shops, or other structures as part of a production, manufacturing, repairing, or finishing process. In the automotive industry, OEM coatings are used in various parts of vehicles such as engines and brakes. It makes the parts look decorative, and prevent corrosion and wear and tear of the surface, thus increasing the automobile lifespan. These coatings are also widely used by OEM players operating in electronics and marine spaces.

The pharmaceutical segment is expected to witness the highest CAGR of 3.8% during the forecast period. This growth is attributed to the use of coatings in protecting floor, ceilings, tanks, and walls of laboratories. They offer corrosion resistance against sanitizing and chemical agents. They also protect against chemical attack, abrasion, and thermal shock. Coatings provide corrosion resistance in tank linings, as well as containment floors, sumps, slabs, and drains. Industrial coatings also keep the walls decorative in manufacturing areas.

Wastewater treatment plants have a high chemical exposure on the concrete of the storage tanks, filter beds, aerators, and troughs that constitutes a devastating side effect of wastewater treatment. Therefore, the equipment must be well protected from chemical reactions. The most commonly used coatings for wastewater treatment plants include epoxy, polyurethane, polyurea, and coal tar epoxy coatings.

Regional Insights

The West U.S. region dominated the market with more than 23% revenue share in 2021. This is attributed to the increase in construction activities in the region. According to the U.S. Census Bureau, the total state and local construction in Western U.S. in 2020 was valued at USD 90,712 million. The new non-residential construction added in 2020 was valued at USD 89,119 million.

The total construction sector in the Western U.S. climbed by 13% in 2021 and was majorly driven by manufacturing, education, and data center projects. California was the leading state in the West in terms of construction value in 2021, with an increase of 17% registered in construction compared to 2020.

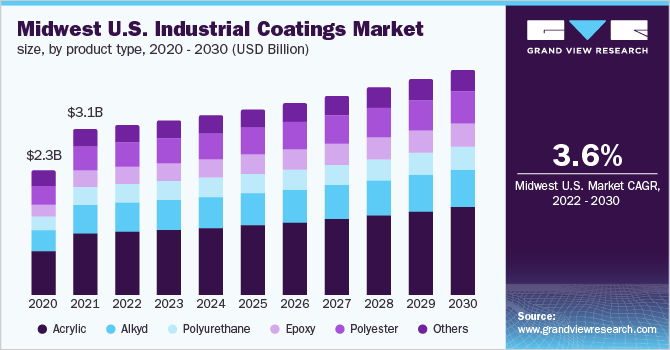

The Midwest U.S. region is expected to expand at 3.6% CAGR during the forecast period. Manufacturing, warehousing, and bridge & highway are among the other growth opportunities for the Midwest market comprising Indiana, Iowa, Illinois, Kansas, and other states. The major ongoing bridge & highway projects in Midwest U.S. include the renovation of the Sherman Minton Bridge in Indiana, which is expected to be completed by 2023, and the construction of a bridge along I-70 in Missouri, expected to be completed in 2024.

The demand for industrial coatings in the Northeast U.S. is driven by the bridge & highway end-use segment. The significant ongoing bridge construction projects in New Jersey include construction of a 3.92 km, high-level, two-track railway bridge over the Hackensack River, expected to be completed by 2026, and renovation of a bridge over the Shrewsbury River, expected to be completed by 2025.

Key Companies & Market Share Insights

The industrial coatings market in the U.S. is highly competitive, with the big international brands focusing on development of long-term relationships with the end-users. Increasing demand for industrial coatings have led to increased competition in the market. In order to withstand the competitive atmosphere, market participants are involved in adopting several strategic initiatives, including capacity expansion, acquisition, and broadening the geographical reach.

Companies such as RPM International Inc., PPG Industries Inc., Akzo Nobel N.V., BASF SE, and Hempel A/S have a high degree of integration across the value chain as they are also engaged in the production of industrial coatings. These companies have established themselves as key manufacturers and focus on research and development for novel uses of the product. Some of the top players in the U.S. industrial coatings market include:

-

Carboline Company

-

Belzona International Ltd.

-

US Coatings

-

Benjamin Moore & Co.

-

ICP Group

-

BEHR Process Corporation

-

Shawcor

-

RPM International Inc.

-

Lanco

-

Cloverdale Paint Inc.

-

PPG Industries Inc.

-

Akzo Nobel N.V.

-

The Sherwin Williams Company

-

Axalta Coating Systems LLC

-

Jotun

-

BASF SE

-

Henkel AG & Company KGaA

-

Nippon Paint Holdings Co., Ltd.

-

Hempel A/S

-

Beckers Group

-

The Chemours Company

-

Kansai Paint Co., Ltd.

-

Sika Corporation

U.S. Industrial Coatings Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 15.3 billion

Revenue forecast in 2030

USD 19.8 billion

Growth Rate

CAGR of 3.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-use, region

Regional scope

U.S.

Country scope

Northeast; Southwest; West; Southeast; Midwest

Key companies profiled

Carboline Company; Belzona International Ltd.; US Coatings; Benjamin Moore & Co.; ICP Group; BEHR Process Corporation; Shawcor; RPM International Inc.; Lanco; Cloverdale Paint Inc.; PPG Industries Inc.; Akzo Nobel N.V.; The Sherwin Williams Company; Axalta Coating Systems LLC; Jotun; BASF SE; Henkel AG & Company KGaA; Nippon Paint Holdings Co., Ltd.; Hempel A/S; Beckers Group; The Chemours Company; Kansai Paint Co., Ltd.; Sika Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Coatings Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. industrial coatings market report on the basis of product, technology, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Alkyd

-

Polyurethane

-

Epoxy

-

Polyester

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solvent Borne

-

Water Borne

-

Powder Borne

-

Others

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Architectural

-

Wastewater Treatment

-

Bridge & Highway

-

Pharmaceutical

-

Original Equipment Manufacturer (OEM)

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northeast

-

Southwest

-

West

-

Southeast

-

Midwest

-

-

Frequently Asked Questions About This Report

b. The U.S. industrial coatings market size was estimated at USD 15.0 billion in 2021 and is expected to reach USD 15.3 billion in 2022.

b. The U.S. industrial coatings market is expected to grow at a compound annual growth rate of 3.2% from 2018 to 2030 to reach USD 19.8 billion by 2030.

b. Acrylic product segment dominated the U.S. industrial coatings market with a share of 36.21% in 2021. This is attributable to product demand from various end-use industries such as general industries, automotive, oil & gas, and others.

b. Some key players operating in the U.S. industrial coatings market include Carboline Company, Axalta Coating Systems, LLC, Jotun, PPG Industries, Inc., and The Sherwin-Williams Company,

b. Key factors that are driving the U.S. industrial coatings market growth include rising demand for eco-friendly coatings, growing applications for OEM sector and automotive & vehicle refinish.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."