Industry Insights

The U.S. ingredients market size was valued at USD 27.73 billion in 2015. Increasing demand from a wide range of end-use industries in the country is the major factor expected to boost the U.S. ingredient industry over the forecast period.

Ingredients play major roles in a wide range of industries. In the packed food & bakery segment, it maintains & improves safety and freshness, taste, appearance and provides texture. Demand for specialty ingredients in processed foods, nutraceuticals, and consumer goods that add value to the by-products are estimated to witness dramatic growth over the next few years.

Moreover, a rising population with celiac disease in the country having a preference towards gluten-free foods and others with sensitivity to gluten are some of the major trends that are steering demand in the food & beverage sector.

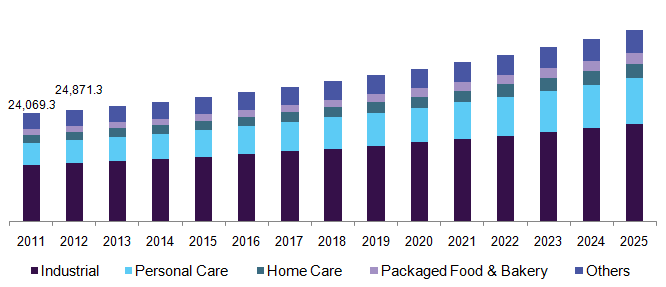

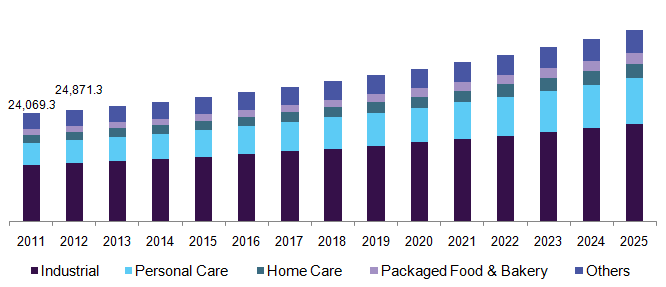

U.S. ingredient market revenue by end-use, 2014 - 2025 (USD Million)

In the U.S. personal care industry, the relevance of ingredients has increased significantly in the past few years in different sections of cosmetic products, explicitly used for specific purposes to cater to the varying demand. The rising consumer consciousness concerning the use of synthetic chemicals in the cosmetics, toiletries and other homecare products have provided significant opportunities for the market expansion in the country.

The increasing demand for mild products is anticipated to drive the demand for natural ingredients in the personal care & homecare segment over the forecast period. The use of industrial ingredients in oilfield chemicals, pulp & paper chemicals, textile chemicals, lubricant additives, metalworking fluids, and water management chemicals are anticipated to generate the highest demand for these products in the next eight years.

Development of new innovative technologies along with constant improvements of the formulations of finished products based on the consumer preferences and changing regulatory trends are steering industry growth. Some of the major technological advancements include “MicroMAX” technique that masks the fishy flavor and extends the shelf life of omega-3 oils developed by Commonwealth Scientific and Industrial Research Organization (CSIRO). Another patented protein engineering technology developed by Codexis, “CodeEvolver”, enables the rapid development of highly optimized proteins, custom-designed for specific applications.

However, the presence of stringent regulations in the country is a matter of concern. Since the past few years, ingredient manufacturers have been facing increasing U.S. federal and regulatory compliances. Issues related to ingredient production, quality, grade, and safety for every end-use market, increasing the complexity of insurance claims, supply chains growing longer while consumers are demanding improved quality and safety are some the key changes faced by the industry participants.

The industry has witnessed a significant increase in the ingredient imports to the U.S. especially for the pharmaceuticals sector from countries such as China and India. Alongside, the domestic production has also been increasing over the past decade owing to the rising demand, and the same trend is expected to continue over the forecast period.

End-Use Insights

The industrial segment end-use segment was the largest segment in 2015 and is expected to reach a net worth exceeding USD 21 billion by 2025 growing at a CAGR of 4.3% from 2016 to 2025. Growing market for metalworking processes such as forming, cutting and welding across a wide number of applications, such as foundry, ships, automotive, milling, aircraft and industrial machinery, is anticipated to drive the demand for industrial ingredients over the forecast period.

The increasing popularity of the metalworking fluids for improvising the surface finish and tool life is expected to be a favorable factor for the market growth in metalworking fluids applications over the forecast period. Favorable regulation, extensive application, and continuous innovation are expected to be the key driving factors for the growth of industrial fixings in the U.S. over the forecast period.

Industrial segment was followed by the personal care segment. It is expected to be the fastest growing segment with a CAGR of around 5.5% from 2016 to 2025. In the last decade, there has been a considerable shift in the U.S. demographics. This has led to a significant rise in demand, for multicultural and multi-ethnic cosmetic items, majorly in the hair care, perfume, and aroma segment.

These factors have led to the momentous demand for personal care and cosmetic fixings from the finished product manufacturers. As many groups in the country are significantly outspent by the Hispanic community fora wide range of personal care products, this trend is expanding rapidly across various ethnic groups in the country.

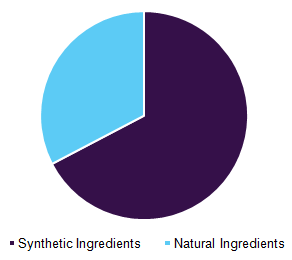

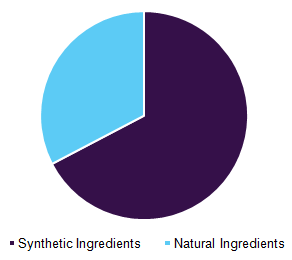

U.S. personal care ingredient market revenue, by product source, 2015 (%)

Moreover, the demand for ingredients designed for specific finished product requirements and preferences have been seen mounting, in the country from the manufacturers. Companies such as L’Oréal, are pushing the multicultural U.S. market along with shifting focus towards innovative product development and promotional campaigns. Whereas, the drugstores along with other retailers are focusing on greater shelf space for ethnic beauty items and collaborating with various well-known personalities and celebrities on store-exclusive beauty product lines.

Competitive Insights

Key players include BASF, DuPont, PPG Industries, Sherwin-Williams, Arkema, Evonik and Ashland Inc. The U.S. ingredients industry is highly competitive on account of the presence of several fully-integrated conglomerates having well-established distribution channels not only in the region but also globally.

The regulatory trends in the country have been more favorable towards the natural and green ingredients in comparison to the synthetic ones. The major concern in the region is regarding the formulation process of organic raw materials with the minimal utilization of artificial chemicals and adhering to the regulatory requirements.

Recent Developments

-

In May 2023, Evonik partnered with Safic-Alcan to enhance the provision of advanced food ingredients. This partnership allowed the nutraceutical goods of Evonik to reach customers in Europe, Turkey, and Egypt. AvailOm®, BIOTICSTM, and Healthberry® will be delivered to clients by extending the offerings to suit the customer demands

-

In October 2022, Ashland launched Nutrapress, an organic chewable base for nutraceuticals. It is a revolutionary, all-in-one supplement solution that includes an organic binder, sweetener, flow aid, and lubricant, hence an effective contribution in the U.S. ingredients market

-

In September 2022, BASF partnered with Ingredi to launch innovative personal care products. This partnership intended to introduce innovative ingredients for products in the personal care industry as well as create an ecosystem of partners to assist clients

Report Scope

|

Attribute

|

Details

|

|

Base year for estimation

|

2016

|

|

Actual estimates/Historical data

|

2011 - 2016

|

|

Forecast period

|

2017 - 2025

|

|

Market representation

|

Revenue in USD Million and CAGR from 2016 to 2025

|

|

Country scope

|

U.S.

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors and trends

|

|

15% free customization scope (equivalent to 5 analyst working days)

|

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments covered in the report

This report forecasts revenue growth in the U.S. and provides an analysis of the latest trends in each of the sub-segments from 2011 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. ingredients market on the basis of end-use. The end-use categories have been further bifurcated into product source and type.