- Home

- »

- Petrochemicals

- »

-

Lubricant Additives Market Size, Share, Growth Report, 2030GVR Report cover

![Lubricant Additives Market Size, Share & Trends Report]()

Lubricant Additives Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Dispersants, Viscosity Index Modifiers, Detergents), By Application (Automotive, Industrial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-837-4

- Number of Report Pages: 64

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lubricant Additives Market Summary

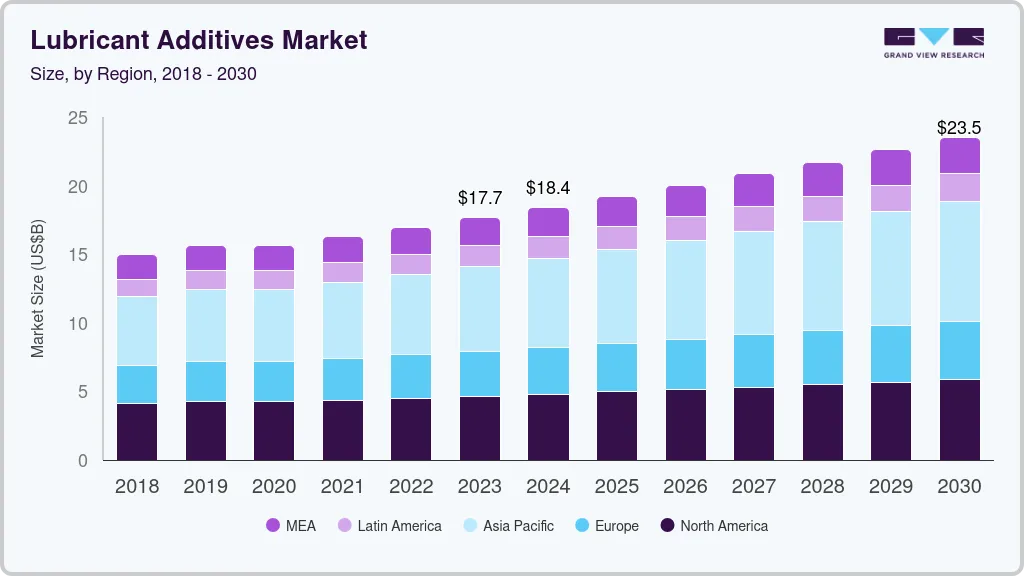

The global lubricant additives market size was estimated at USD 17.70 billion in 2023 and is projected to reach USD 23.53 billion by 2030, growing at a CAGR of 4.2% from 2024 to 2030. This is attributable to increasing industrial machinery sales, particularly, automation & robotic equipment and high-end equipment (3D printers, clean energy machines).

Key Market Trends & Insights

- The Asia Pacific lubricant additives market held a substantial share of 36.03% by volume in 2023.

- The China lubricant additives market is expected to grow over the forecast period.

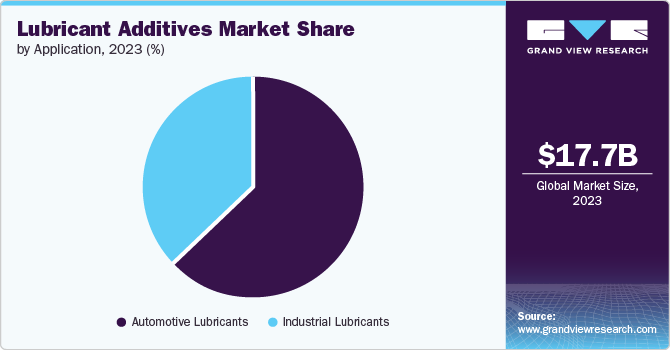

- By application, the automotive lubricants segment dominated the market with a revenue share of 62.86% in 2023.

- By product, the viscosity index improvers segment held a lion’s share of 22.9%, by revenue, in 2023.

Market Size & Forecast

- 2023 Market Size: USD 17.70 Billion

- 2030 Projected Market Size: USD 23.53 Billion

- CAGR (2024-2030): 4.2%

- Asia Pacific: Largest market in 2023

The growth in industrial machinery sales is expected to surge the demand for lubricating oils such as turbine oils, metalworking fluids, general industrial oils, and greases.

Lubricant additives significantly improve the viscosity of the oil. They act as antioxidants and corrosion inhibitors in combustion engines and reduce oil decomposition. Also, increasing additive usage in base oil blending ensures longer service life and performance. Thus, these additives play an essential role in the automotive industry by improving oil viscosity and acting as corrosion & oxygen inhibitors for combustion engines.

Rising sales of industrial machinery is a key growth driver. Post pandemic recovery and subsequent shift in supply hubs from China to Vietnam, India etc. as a part of ‘China plus one’ activities, have resulted in the setting up of new manufacturing facilities. These investments in manufacturing are largely attributable to automotive, electronics, consumer goods, and construction materials. These new facilities require a considerable amount of new machinery to be installed and operated, thereby providing the impetus for industrial lubricant sales. The onset of rising lubricant demand will also propel the need for higher volumes of additive components & packages for the formulation of the former.

Moreover, the rising sales of automobiles are bolstering the demand for various lubricants such as engine oils, brake fluids, transmission oils, coolants, and greases. This surge in demand, coupled with increased supply volumes, is a primary catalyst for the need for additive components and packages tailored specifically for automotive lubricants.

In addition, as the global transition toward electric vehicles (EVs) and hybrids intensifies to curb carbon emissions, there will be a significant shift in lubricant demand. Conventional formulations designed for internal combustion (IC) engines will become obsolete, necessitating the development of new-age lubricants.

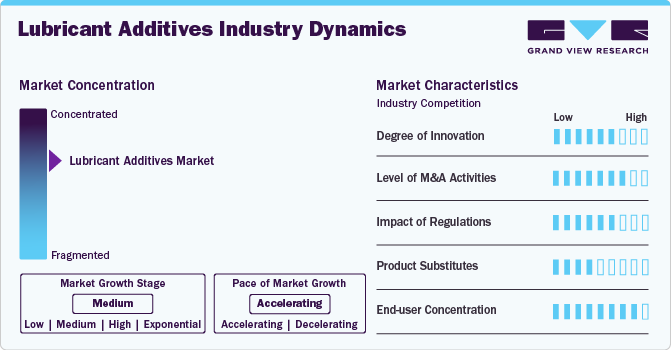

Market Concentration & Characteristics

The global lubricant additives market demonstrates characteristics akin to a moderately consolidated landscape with the presence of a few players such as BASF SE, Evonik Industries AG, Chevron Oronite Company LLC, Eni S.p.A., and few other medium regional players from all over the world.

The market growth stage is medium, and the pace of the market growth is accelerating. The product market is characterized by a high degree of innovation. Ongoing research and development activities in boosting performance of lubricant additives coupled with robust innovation in ionic liquids to be used as additives to improve the tribological performance of lubricants is further expected to bolster the industry growth in the coming years.

Major key players operating in the lubricant additive industry have entailed mergers & acquisitions or joint-venture collaborations, suggesting a trend toward industry consolidation. Furthermore, the industry participants are signing agreements to further improve their integration across the value chain.

The global lubricants industry is scrutinized by stringent regulations ranging from their production to use and disposal. The additives used in lubricant manufacturing are checked for their toxicity and potential to harm the environment. Some of the regulatory bodies influencing market dynamics include OSHA, EPA, REACH, ASTM International, CEC, Institute of Petroleum, ILSAC

Historically, additive manufacturers have collaborated to test major additive classes extensively, generating data on numerous chemical classes representing the primary additive families found in engine lubricants. An example of this collaborative effort is the Consortia or Substance Information Exchange (SIEF) activity, aimed at registering substances under REACH in 2010 and 2013, along with voluntary participation in national and international chemical initiatives like the US EPA High Product Volume and ICCA SIDS.

Application Insights

The automotive lubricants segment dominated the market with a revenue share of 62.86% in 2023 on account of consumers’ preference towards high-performance operational efficient engine fuel. Lubricant additives such as dispersants, viscosity index improvers, antioxidants & friction modifiers are widely utilized in automobile fuel systems, both gasoline & diesel engines, owing to their excellent oxidative stability, greater solvency & low volatility. These lubricant additives enhance fuel economy & temperature performance, maintain engine cleanliness, address current diesel fuel deficiencies & also prolong the lifespan of the lubricants themselves.

Moreover, rapidly developing industrial & automotive sectors in China, India & Japan are major drivers of lubricant additives growth in Asia Pacific. The government has formulated various regulations to promote fuel efficiency in the automotive industry which has further boosted high-performance lubricant additives consumption. Furthermore, growing disposable income among consumers has fuelled the production of passenger cars & heavy-duty vehicles which in turn has resulted in increased volume of lubricants consumption.

Product Insights

The viscosity index improvers segment held a lion’s share of 22.9%, by revenue, in 2023. Viscosity index improvers are polymeric additives that are added to reduce the impact of increasing temperature on the viscosity of lubricants. These additives are widely used in gear oils, multi-grade engine oils, automatic transmission fluids, hydraulic fluids, greases, and power steering fluids. The additives allow the fluid to flow more liberally at a low temperature so it can get to the bearings quicker.

Dispersants are widely used to protect from sludge, varnish, and other deposits formation on surfaces. Dispersants are primarily used in heavy-duty engine oils and gasoline engines, which account for 70 to 80% of their total use in engine protection. They are also used in aviation piston engine oils, natural gas engine oils, gear lubricants, and automatic transmission fluids. Also, these additives are effective in medium-speed as well as high-temperature supercharged engines.

Detergents are additives that adhere to oil and dirt-insoluble products formed as oxidation by-products during the combustion process. They also provide suspension and prevent the build-up of deposits of critical engine surfaces. Abundant feedstock availability and cheap labor cost coupled with increasing demand for industrial and automotive additives in machinery and machine castings are anticipated to fuel demand for detergent additives.

Regional Insights

The North American lubricant additives market displays ample potential, driven by the implementation of rigorous environmental regulations aimed at minimizing carbon emissions. Consequently, there is an expected increase in demand for lubricant additives within various industries, as they play a crucial role in reducing machinery wear and tear, acting as coolants, and enhancing overall vehicle efficiency.

U.S. Lubricant Additives Market Trends

The U.S. market has witnessed numerous federal regulations over the past few years to limit the fuel efficiency of fleets. Vehicle manufacturers thus require more powerful engine oils made from lubricant additives to reduce the maintenance needs of automobiles. This, in turn, is likely to foster the demand for lubricant additives in automotive applications in the U.S.

Asia Pacific Lubricant Additives Market Trends

The Asia Pacific lubricant additives market held a substantial share of 36.03% by volume in 2023. This is characterized by a large amount of skilled labor at low costs, along with easy availability of land and resources. The shift in the production landscape towards emerging economies of the Asia Pacific, particularly China, India, Thailand, Vietnam, and Indonesia is expected to positively influence lubricant additives market growth over the forecast period.

The China lubricant additives market is expected to grow over the forecast period. China has rich sources of petrochemical reserves coupled with easy availability of highly skilled labor. Also, it is one of the most densely populated regions, leading to a high demand for housing facilities and growth in the residential construction sector, thereby propelling the lubricants consumption in building machinery & equipment such as excavators, bulldozers, and others.

Europe Lubricant Additives Market Trends

The European automotive industry is a significant exporter of compact, lightweight passenger cars worldwide. This, along with the rapid growth of the freight transportation sector due to the expansion of the retail industry, is a major driver of the lubricant additives market. Additionally, the increasing number of re-refineries and growing awareness about fuel economy further contribute to the demand for lubricant additives in the region.

The Russia Lubricant Additives Market is projected to witness growth from 2024 to 2030. Stringent fuel & carbon emission regulations such as the Corporate Average Fuel Economy (CAFE) and other regulations by the Russia Environmental Protection Agency are promoting lightweight materials in automobiles to reduce weight & improve the overall efficiency & performance of these vehicles. This, in turn, is expected to boost the lubricant additives market in Russia over the forecast period.

South America Lubricant Additives Market Trends

The automotive and manufacturing industries in this region are experiencing growth, largely due to government initiatives and investments aimed at stimulating production levels. There is an increasing awareness of vehicle maintenance and performance, which is expected to drive the consumption of lubricants and additives in the automotive sector.

The Brazil lubricant additives market is anticipated to grow during the forecast period. Brazil’s manufacturing competitiveness is expected to strengthen over the next several years. With significant investments in infrastructure and favorable tax policies for Brazilian manufacturers, there will be a considerable need for industrial lubricants to cater to the rising industrialization in the country.

Central America Lubricant Additives Market Trends

The mining sector's robust growth in the region has increased the demand for lubricants due to extensive use of heavy machinery and equipment. Additionally, the expanding presence of motor vehicles, natural gas power plants, and industrial machinery has heightened the demand for lubricant additives, bolstering regional market growth.

The Costa Rica lubricant additives market is expected to grow significantly over the forecast period. The government bodies in Costa Rica have enabled more funds into the automotive & manufacturing sectors, thereby creating a healthy demand for lubricant additives. Moreover, rising awareness regarding the advantages of additives further fosters high-performance lubricant consumption.

Middle East Lubricant Additives Market Trends

The Middle East's lubricant additives market is influenced by automotive and transport products, with varying demand for high-performance vehicles. Fuel quality, particularly high sulfur content, and relatively lax emissions standards are key factors. Economic and political challenges, along with slow development of emissions legislation, add complexity. Nonetheless, the market holds significant growth potential for lubricant additives.

Saudi Arabia lubricant additives market is expected to witness steady growth during the forecast period. Implementation of stringent emission & pollution control regulations in the Middle East, such as the Euro II & V standards, along with others implemented by the ASEAN, The International Council on Clean Transportation, and others are positively impacting the demand for lubricant additives in Saudi Arabia.

Africa Lubricant Additives Market Trends

The rising demand for renewable energy sources to offset declining crude oil reserves and address the global energy crisis is driving the industrial lubricant additives market in the region. Automotive lubricant additives are expected to remain dominant due to increasing vehicle sales supporting population growth and trade activities.

The South Africa lubricant additives market is anticipated to grow from 2024 to 2030. South Africa has been generating vast demand for lubricants in recent years, owing to the rise in cost-effective solutions that are expected to meet the burgeoning demand for all grades in the country, along with the expansion of the automotive & manufacturing industries.

Key Lubricant Additives Company Insights:

The global market is moderately consolidated in nature dominated by major players such as Chevron Oronite Company LLC, Afton Chemical Corp., Eni S.p.A., BASF SE, and Evonik Industries AG. The players face intense competition from each other as well as from regional players, who have strong distribution networks and good knowledge of suppliers and regulations.

-

The BASF SE company was formed in 1865 and is headquartered in Mannheim, Germany. It operates under six business divisions, including Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, Agricultural Solutions. The company has 49 global and regional business units and helps in developing strategies for 70 strategic business units.

-

Chevron Oronite was established in 1917 and is headquartered in California, U.S. It is primarily involved in the manufacturing and marketing of lubricant, fuel additives, and chemicals designed to help enhance the performance of all types of transportation and industrial equipment. The company mainly caters to automotive & transportation, marine, railroad and inland marine, industrial, and driveline fluids applications.

Infinium International Ltd., Lehmann & Voss & Co. KG., Lubrizol Corp., and The Elco Corp. are some of the emerging market participants in the global lubricant additives market.

-

Infineum International Limited was established in 1999 and is headquartered in Abingdon, England. It is a specialty chemicals company which is equipped with strong R&D capabilities and is formed as a joint venture between Shell and ExxonMobil. With the expertise of both the companies in formulation, production, and marketing of petroleum additives for lubricants, it has become an emerging player in the global lubricant additives industry.

-

Lubrizol was founded in 1928 and is headquartered in Ohio, U.S. The company mainly operates in two business segments, namely, Lubrizol Additives and Lubrizol Advanced Materials. The Lubrizol Additives segment enables efficient, reliable, and durable equipment performance. Its industrial fluids ensure high efficiency for power generation, compressors, hydraulic equipment, oil field services, etc.

Key Lubricant Additives Companies:

The following are the leading companies in the lubricant additives market. These companies collectively hold the largest market share and dictate industry trends.

- Afton Chemical Corp.

- BASF SE

- BRB International B.V.

- Chevron Oronite Company LLC

- Daelim Co. Ltd.

- Deutsche Oelfabrik Gesellschaft Fur Chemische Erzeugnisse M.B.H. & Co. Kg

- Dorf-Ketal Chemicals India Pvt. Ltd.

- Dover Chemical Corp.

- The Elco Corp. (Italmatch Chemicals S.p.A.)

- Eni S.p.A.

- Evonik Industries AG

- Infinium International Ltd.

- Jinzhou Kangtai Lubricant Additives Co. Ltd.

- King Industries, Inc.

- LANXESS AG

- Lehmann & Voss & Co. KG.

- Lubrizol Corp.

- Metall-Chemie GmbH & Co. KG

- Xinxiang Richful Lube Additive Co. Ltd.

- RT Vanderbilt Holding Company, Inc.

Recent Developments

-

In May 2024, Lubrizol launched Lubrizol CV9660, a new low-SAPS Heavy Duty lubricant technology which caters to higher performance levels as well as delivering an easy solution for multiple viscosity profiles.

-

In March 2024, Evonik signed an agreement with Tongyi Petrochemical to promote green development in the lubricant industry. The focus is to create a low-carbon lubricant solution on recent trends in the lubricant industry.

Lubricant Additives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.4 billion

Revenue forecast in 2030

USD 23.53 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Russia; China; India; Japan; Brazil; Argentina; Venezuela; Colombia; Chile; Costa Rica; Guatemala; Saudi Arabia; UAE; Bahrain; Oman; Kuwait; Qatar; South Africa; Nigeria; Egypt

Key companies profiled

Afton Chemical Corp.; BASF SE; BRB International B.V.; Chevron Oronite Company LLC; Daelim Co. Ltd.; Deutsche Oelfabrik Gesellschaft Fur Chemische; Erzeugnisse M.B.H. & Co. Kg; Dorf-Ketal Chemicals India Pvt. Ltd.; Dover Chemical Corp.; The Elco Corp. (Italmatch Chemicals S.p.A.); Eni S.p.A.; Evonik Industries AG; Infinium International Ltd.; Jinzhou Kangtai Lubricant Additives Co. Ltd.; King Industries, Inc.; LANXESS AG; Lehmann & Voss & Co. KG.; Lubrizol Corp.; Metall-Chemie GmbH & Co. KG; Xinxiang Richful Lube Additive Co. Ltd.; RT Vanderbilt Holding Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lubricant Additives Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lubricant additives market report on product, application, and country.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Dispersants

-

Viscosity Index Improvers

-

Detergents

-

Anti-wear Additives

-

Antioxidants

-

Friction Modifiers

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Automotive Lubricants

-

Heavy Duty Motor Oil

-

Passenger Car Motor Oil

-

Others

-

-

Industrial Lubricants

-

General Industrial Oil

-

Industrial Engine Oil

-

Metalworking Fluids

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

Argentina

-

Venezuela

-

Colombia

-

Chile

-

-

Central America

-

Costa Rica

-

Guatemala

-

-

Middle East

-

Saudi Arabia

-

UAE

-

Bahrain

-

Oman

-

Kuwait

-

Qatar

-

-

Africa

-

South Africa

-

Nigeria

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global lubricant additives market size was estimated at USD 17.7 billion in 2023 and is expected to reach USD 18.4 billion in 2024.

b. The global lubricant additives market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 23.53 billion by 2030.

b. Asia Pacific dominated the lubricant additives market with a share of 36.03% in 2023. This is attributable to large amount of skilled labor at low costs, shift in production landscape in emerging countries, along with easy availability of land and resources.

b. Some key players operating in the lubricant additives market include Chevron Oronite Company LLC, Afton Chemical Corp., Eni S.p.A., BASF SE, and Evonik Industries AG.

b. Key factors that are driving the market growth include increasing sales of industrial machinery, particularly, automation & robotic equipment and high-end equipment (3D printers, clean energy machines).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.