- Home

- »

- Technology

- »

-

U.S. Intelligent Traffic Management System Market Report, 2033GVR Report cover

![U.S. Intelligent Traffic Management System Market Size, Share & Trends Report]()

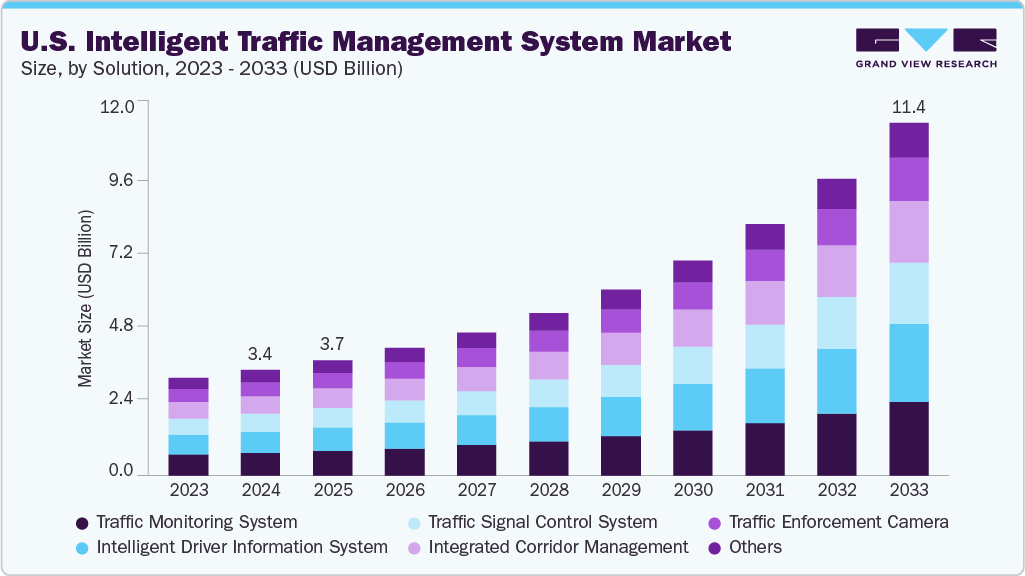

U.S. Intelligent Traffic Management System Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Traffic Monitoring System, Traffic Signal Control System, Traffic Enforcement Camera, Integrated Corridor Management, Intelligent Driver Information System, Others), And Segment Forecasts

- Report ID: GVR-4-68040-824-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Intelligent Traffic Management System Market Summary

The U.S. intelligent traffic management system market size was estimated at USD 3.41 billion in 2024 and is projected to reach USD 11.36 billion by 2033, growing at a CAGR of 15.0% from 2025 to 2033. The U.S. market is being driven by growing urbanization, rising vehicle ownership, and increasing congestion, which collectively prompt cities and agencies to seek smarter ways to move people and goods.

Key Market Trends & Insights

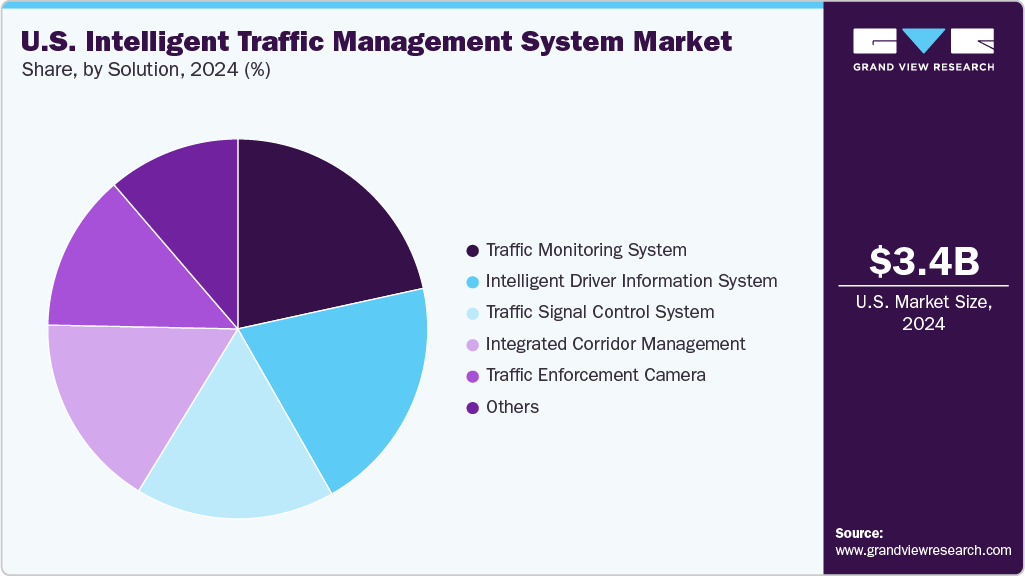

- By solution, the traffic monitoring system segment accounted for the largest share of 21.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.41 Billion

- 2033 Projected Market Size: USD 11.36 Billion

- CAGR (2025-2033): 15.0%

Municipalities are under pressure to reduce commute times, cut emissions, and improve road safety, which creates demand for systems that deliver real-time traffic monitoring, adaptive signal control, and multimodal management. Meanwhile, broader “smart city” initiatives and a greater public focus on resilience and air quality are encouraging adoption of coordinated traffic-management platforms at scale. These demand-side forces are reflected in market growth forecasts and rising procurement activity across metropolitan planning organizations.Technological trends shaping the market center on AI/ML for prediction and prescriptive control, edge computing to reduce latency for real-time responses, and richer sensor fusion to improve situational awareness. Vehicle-to-everything communications and cooperative ITS architectures are gaining traction as they enable infrastructure-to-vehicle warnings and more coordinated flow management, while open-source and modular software stacks are lowering integration friction for agencies.

Investment into U.S. ITS and traffic management is a mix of federal grants, state and local capital programs, and private sector contracts and venture funding for software and analytics firms. The Infrastructure Investment and Jobs Act and related discretionary programs have unlocked substantial funding streams for the modernization of transportation assets, giving agencies a longer funding horizon to plan ITS deployments and trials. In parallel, technology vendors and mobility service providers are raising private capital to commercialize AI-driven traffic analytics, connected-vehicle services, and cloud-native traffic platforms, accelerating product maturity and pilot rollout activity.

The U.S. intelligent traffic management system industry continues to face several structural barriers that slow widespread adoption. High upfront capital costs for roadside hardware, communication networks, and system integration continue to be a major challenge, particularly for mid-sized and smaller municipalities. The complexity of connecting new platforms with aging traffic infrastructure further increases implementation timelines and expenses. Budget constraints, competing infrastructure priorities, and construction cost inflation also limit the ability of cities to leverage available federal funding fully.

Solution Insights

The traffic monitoring system segment accounted for the largest share of 21.6% in 2024. The traffic monitoring segment in the market is expanding due to rising congestion levels across major metropolitan areas and the need for real-time visibility into roadway conditions. Cities are increasingly adopting advanced sensors, high-definition cameras, radar units, and traffic analytics platforms to improve situational awareness and manage peak-hour flow more efficiently. The shift toward data-driven decision-making, such as predictive congestion modeling and automated incident detection, further accelerates the deployment of these solutions.

The intelligent driver information system segment is expected to grow at the fastest CAGR during the forecast period. The growth of intelligent driver information systems is being driven by increasing consumer expectations for real-time, personalized travel information and a broader national emphasis on road safety and mobility efficiency. These systems provide drivers with up-to-date alerts on congestion, road closures, weather conditions, accidents, and optimal routing, reducing travel uncertainty and improving trip reliability. The expansion of connected vehicle technologies and vehicle-to-infrastructure communication is also enabling richer, more precise in-vehicle messaging.

Key U.S. Intelligent Traffic Management System Company Insights

Some of the key companies in the U.S. market include Iteris, Inc., ECONOLITE, TransCore, Cubic Corporation, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Iteris, Inc. is a provider of smart mobility and intelligent traffic management solutions, serving both public transportation agencies and private sector clients. The company leverages advanced detection sensors, telematics, big data analytics, and software-as-a-service platforms, such as the ClearMobility Cloud, to help optimize urban traffic flow, reduce congestion, and enhance road safety.

-

ECONOLITE is a provider of the intelligent traffic management system industry, recognized for its advanced solutions that optimize traffic flow, enhance safety, and support the transition to smarter urban mobility. With over nine decades of experience, ECONOLITE offers a comprehensive portfolio that includes traffic control cabinets, next-generation signal controllers, intelligent sensors for vehicle and pedestrian detection, and cutting-edge software such as its Centracs Mobility suite, which delivers real-time signal optimization, predictive analytics, and seamless integration with connected vehicle technologies.

Key U.S. Intelligent Traffic Management System Companies:

- Iteris, Inc.

- ECONOLITE

- TransCore

- Cubic Corporation

- Cisco Systems, Inc.

- SWARCO

- Yunex Traffic

- Kapsch TrafficCom AG

- Conduent Incorporated

- Miovision Technologies Incorporated

Recent Developments

-

In November 2025, Aeva Technologies, Inc. announced an exclusive partnership with D2 Traffic Technologies, marking a strategic transformation from being primarily a LiDAR sensor supplier to a full-stack solutions provider in the intelligent transportation systems (ITS) market. Through this collaboration, Aeva brings on board D2’s veteran team of ITS specialists to accelerate its market presence and develop unified, LiDAR-based infrastructure solutions for intersections, highways, and urban traffic corridors. The partnership enables Aeva to offer comprehensive capabilities encompassing sensing, perception, monitoring, and analytics, all of which are critical for enhancing traffic safety, reducing congestion, and supporting smarter urban mobility.

-

In April 2024, Umovity, a provider of end-to-end traffic management and transportation technology, partnered with Derq, an AI-driven intelligent transportation system (ITS) provider, to deliver a comprehensive traffic management and safety solution powered by artificial intelligence. This collaboration integrates Derq's INSIGHT platform, which uses AI for automated safety performance monitoring by analyzing real-time data from connected cameras and sensors, with Econolite's cloud-based Advanced Transportation Management System (ATMS), Centracs Mobility, part of the Umovity Tech Suite. The unified system enhances situational awareness for traffic managers by providing real-time safety scores and insights on crashes, near-misses, and compliance issues, allowing prompt adjustments to traffic signals at intersections to improve safety for all road users, especially vulnerable pedestrians and cyclists.

U.S. Intelligent Traffic Management System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.72 billion

Revenue forecast in 2033

USD 11.36 billion

Growth rate

CAGR of 15.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report industry

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution

Key companies profiled

Iteris, Inc.; ECONOLITE; TransCore; Cubic Corporation; Cisco Systems, Inc.; SWARCO; Yunex Traffic; Kapsch TrafficCom AG; Conduent Incorporated; Miovision Technologies Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Intelligent Traffic Management System Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. intelligent traffic management system market report based on solution.

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Traffic Monitoring System

-

Traffic Signal Control System

-

Traffic Enforcement Camera

-

Integrated Corridor Management

-

Intelligent Driver Information System

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. intelligent traffic management system market size was estimated at USD 3.41 billion in 2024 and is expected to reach USD 3.72 billion in 2025.

b. The U.S. intelligent traffic management system market is expected to grow at a compound annual growth rate of 15.0% from 2025 to 2033 to reach USD 11.36 billion by 2033.

b. The traffic monitoring system segment accounted for the largest share in 2024. The traffic monitoring segment in the U.S. intelligent traffic management system market is expanding due to rising congestion levels across major metropolitan areas and the need for real-time visibility into roadway conditions.

b. Some key players operating in the roadway intelligent transportation system market include Iteris, Inc.; ECONOLITE; TransCore; Cubic Corporation; Cisco Systems, Inc.; SWARCO; Yunex Traffic; Kapsch TrafficCom AG; Conduent Incorporated; Miovision Technologies Incorporated

b. The U.S. intelligent traffic management system market is being driven by growing urbanization, rising vehicle ownership, and increasing congestion, which collectively prompt cities and agencies to seek smarter ways to move people and goods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.