- Home

- »

- Medical Devices

- »

-

U.S. Intracranial Pressure Monitoring Devices Market, Industry Report, 2030GVR Report cover

![U.S. Intracranial Pressure Monitoring Devices Market Size, Share & Trends Report]()

U.S. Intracranial Pressure Monitoring Devices Market Size, Share & Trends Analysis Report By Technique (Invasive, Non-invasive), By Application (Traumatic Brain Injury, Intracerebral Hemorrhage), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-237-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. ICP Monitoring Devices Market Trends

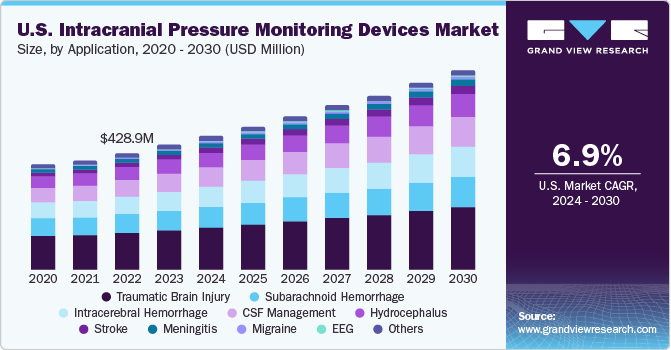

The U.S. intracranial pressure monitoring devices market size was valued at USD 516.54 million in 2023 and is expected to grow at a CAGR of 6.97% from 2024 to 2030. Increasing incidence of traumatic brain injury (TBI) and migraine is the high impact rendering driver for market growth. According to the Brain Aneurysm Foundation, more than 6.5 million people in the U.S. have an unruptured brain aneurysm. In addition, approximately, 30,000 people suffer an intracranial aneurysm rupture annually.

According to a report published by the American Association for the Surgery of Trauma in 2020, in U.S., TBI is a leading cause of death and disability among children & young adults. Each year, an estimated 1 million U.S. individuals suffer from TBI, among which, 230,000 are hospitalized, 50,000 die and 80,000 to 90,000 suffer from long-term disability. The U.S. intracranial pressure monitoring devices market accounted for 31% of the global intracranial pressure monitoring devices market in 2023.

As per the National Institute of Health, U.S., every year, around 795,000 people have a stroke, leading to 137,000 deaths. Furthermore, the Migraine Research Foundation stated in 2020 that nearly 35 million of the U.S. citizens suffer from migraine headaches and nearly 43% of women and 18% of men are expected to experience migraines. Thus, increasing cases of neurological disorders, such as TBI, migraine, and stroke, are likely to drive the market. In addition, favorable reimbursement structure and rising healthcare expenditure are supporting factors contributing to market growth.

Market Concentration & Characteristics

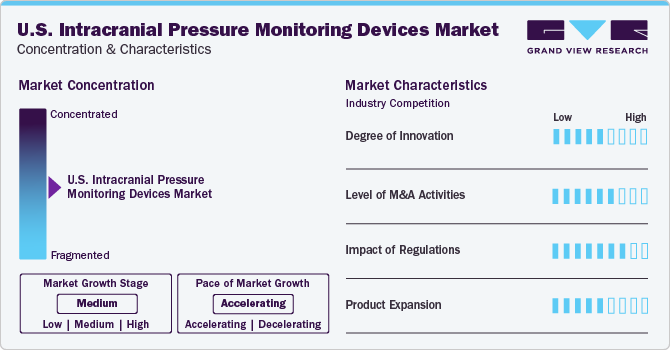

Companies are focusing on expanding their product portfolios to maximize revenue. Advanced devices developments, such as surgical robots, surgical microscopes, ophthalmic surgical devices, and neurosurgery devices, has led to a reduction in direct human interference in surgical procedures. Advanced intracranial pressure (ICP) monitoring devices are mitigating the limitations of earlier invasive tools, addressing issues like spontaneous shifts in baseline pressure and overcoming challenges related to leveling and de-bubbling in fluid-filled systems. For instance, in April 2019, Integra LifeSciences Corporation introduced its latest Codman Specialty surgical products at the American Association of Neurological Surgeons 2019 in California.

There is a trend of consolidation of technologies by big players in niche areas through mergers and acquisitions. . Companies such as Medtronic; Neural Analytics, Inc.; Integra Lifesciences; and Raumedic AG, are anticipated to remain unaffected, as they are adopting mergers & acquisitions as a growth strategy and increasing their product lines as well as technologies. For instance, in July 2019, Integra LifeSciences acquired Arkis Biosciences Inc. and Rebound Therapeutics. With this acquisition, Integra aimed to strengthen its product portfolio in neurocritical care and develop minimally invasive techniques for neurosurgery.

Intracranial pressure monitoring devices are regulated under the Food, Drug, and Cosmetic Act by FDA. These devices are regulated by the Center for Devices and Radiological Health (CDRG) and manufacturers need to comply with all the rules for approval of these devices. Various initiatives are being undertaken by different organizations. For instance, the Brain Aneurysm Foundation is actively involved in spreading awareness and helping prevent aneurysm. In addition, increased government spending on healthcare is also positively impacting the industry growth.

Technique Insights

The invasive techniques segment held the largest market share of 79.13 % in 2023 owing to invasive ICP measurement being performed at various intracranial anatomical locations. The Department of Clinical Neurosciences recommends using an intraventricular catheter with an external pressure transducer for accurate and cost-effective continuous ICP monitoring. This method also allows for therapeutic cerebrospinal fluid drainage and drug administration. This segment is further divided into two types- external ventricular drain and microtransducer.

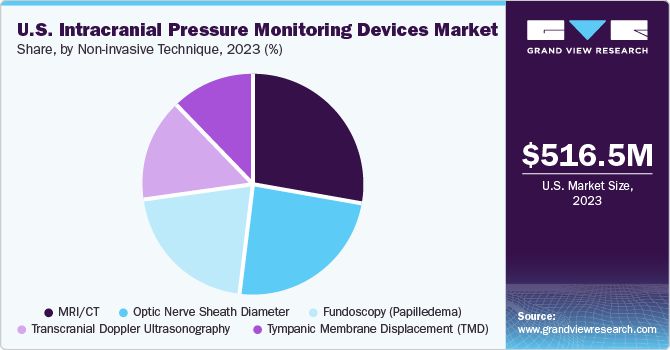

Non-invasive technique segment is expected to grow at the highest CAGR during the forecast period. It is associated with several complications such as infection, malfunction, hemorrhage, obstruction, and mispositioning of the catheter. Optic nerve sheath diameter, transcranial Doppler ultrasonography, and Magnetic Resonance Imaging/Computed Tomography (MRI/CT) are some of the promising noninvasive treatments expected to boost growth during the forecast period.

Application Insights

The traumatic brain injury segment held the largest market share of 31.48 % in 2023 as it is one of the leading causes of death worldwide. The most common cause of death in patients suffering from traumatic brain injury is elevated ICP. Success rate of the treatment is majorly based on the accuracy of ICP. Moreover, technological advancements are also projected to impact the market growth positively. For instance, In August 2020, IRRAS AB, introduced Hummingbird Solo, an extension to its Hummingbird ICP Monitoring product family. This new addition treated its first patient following the initial launch in December 2019.

The migraine segment is expected to register a considerable CAGR during the forecast period owing to the strong association between elevated ICP and obesity. Moreover, it is expected that the growing rate of obesity will increase the prevalence & socioeconomic disease burden. This in turn will demand the management of idiopathic intracranial hypertension. Monitoring techniques are improving, making it easier to diagnose and properly assess changes in papilledema and ICP, which, in turn, is expected to boost the demand for ICP monitoring devices in the coming years.

Key U.S. Intracranial Pressure Monitoring Devices Company Insights

Some of the prominent companies include Medtronic, Integra Lifesciences, Raumedic AG, Sophysa, Spiegelberg GmbH, Natus Medical, Gaeltec Devices, and Neural Analytics. Companies are increasingly focusing on product launches, technological advancements, and other growth strategies, such as mergers & acquisitions to strengthen their foothold in the market. These companies also offer products at competitive prices.

The manufacturing and R&D costs for intracranial pressure monitoring devices are high, which limits the number of new companies entering the market. However, the demand for cost-effective devices for neurological disorders is increasing, as a result, several new companies are entering the market. The development and usage of noninvasive methods for intracranial pressure monitoring are estimated to provide lucrative opportunities to key companies during the forecast period.

Key U.S. Intracranial Pressure Monitoring Devices Companies:

- Medtronic

- Integra Lifesciences

- Raumedic AG

- Sophysa

- Spiegelberg GmbH

- Natus Medical

- Gaeltec Devices

- Neural Analytics & Others

Recent Developments

-

In September 2023, MicroVention, Inc. received FDA 510(k) clearance for the SOFIA EX 5F 115 cm Intracranial Support Catheter. The unique design of this device allows trackability to intracranial locations in patients

-

In June 2023, Masimo announced that its Radius VSM received FDA 510(k) clearance. The devices allow clinicians to monitor a wide variety of physiological measurements such as noninvasive blood pressure, temperature, respiration rate

-

In May 2023, Stryker Corporation announced the acquisition of Endovascular Ltd which is involved in making neurointerventional devices. With this acquisition, Stryker aims to expand its product portfolio

U.S. Intracranial Pressure Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 516.54 million

Revenue forecast in 2030

USD 827.62 million

Growth rate

CAGR of 6.97% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, application

Country scope

U.S.

Medtronic; Integra Lifesciences; Raumedic AG; Sophysa; Spiegelberg GmbH; Natus Medical; Gaeltec Devices; Neural Analytics & Others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Intracranial Pressure Monitoring Devices Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. intracranial pressure monitoring devices market report based on technique, and application:

-

Technique Outlook (Revenue USD Million; 2018 - 2030)

-

Invasive

-

External Ventricular Drainage (EVD)

-

Microtransducer ICP Monitoring

-

-

Non-invasive

-

Transcranial Doppler Ultrasonography

-

Tympanic Membrane Displacement (TMD)

-

Optic Nerve Sheath Diameter

-

MRI/CT

-

Fundoscopy (papilledema)

-

-

-

Application Outlook (Revenue USD Million; 2018 - 2030)

-

Traumatic Brain Injury

-

Intracerebral Hemorrhage

-

Meningitis

-

Subarachnoid Hemorrhage

-

CSF Management

-

Migraine

-

Stroke

-

Hydrocephalus

-

EEG

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. intracranial pressure monitoring devices market size was estimated at USD 516.54 million in 2023 and is expected to reach USD 552.87 million in 2024.

b. The U.S. intracranial pressure monitoring devices market is expected to grow at a compound annual growth rate of 6.97% from 2024 to 2030 to reach USD 827.62 million by 2030.

b. The invasive techniques segment dominated the market for intracranial pressure monitoring devices and held the largest revenue share of 79.13% in 2023. This is due to the fact that invasive ICP measurement can be performed at various intracranial anatomical locations (i.e., intraventricular, intraparenchymal, epidural, subdural, and subarachnoidal).

b. Some of the prominent players in the global intracranial pressure monitoring devices market include Medtronic; Integra Lifesciences; Raumedic AG; Sophysa; Spiegelberg GmbH; Natus Medical; Gaeltec Devices; Neural Analytics

b. The growth of the market is attributed to the increasing prevalence of neurological disorders, the rapidly growing geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."