- Home

- »

- Medical Devices

- »

-

U.S. Intraoperative Imaging Market, Industry Report, 2030GVR Report cover

![U.S. Intraoperative Imaging Market Size, Share & Trends Report]()

U.S. Intraoperative Imaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (iCT, Intraoperative Ultrasound, iMRI, C-arms), By Application (Neurosurgery, Cardiovascular Surgery, Orthopedic Surgery), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-231-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Intraoperative Imaging Market Trends

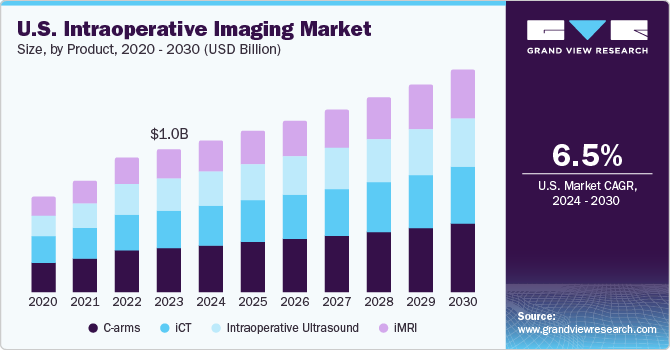

The U.S. intraoperative imaging market size was estimated at USD 1.00 billion in 2023 and is expected to grow at a CAGR of 6.49% from 2024 to 2030. The U.S. intraoperative imaging market is primarily driven by the increasing demand for minimally invasive surgeries, rising prevalence of chronic diseases, and advancements in imaging technologies. Additionally, the growing geriatric population and the increasing number of surgeries performed in hospitals and ambulatory surgical centers are also contributing to the market growth. Furthermore, the development of hybrid operating rooms and the incorporation of artificial intelligence technology in intraoperative imaging systems are expected to provide lucrative opportunities for market players in the coming years.

The U.S. market for intraoperative imaging is seeing a surge due to the rise in chronic illnesses and an aging population. The percentage of Americans aged 65 and above has risen from the previous years and is expected to reach 22 percent by 2050. This demographic shift has increased the risk of various diseases, including neurological, orthopedic, and cardiac disorders. For example, in 2022, there were over 6.2 million Alzheimer's cases and over 600,000 total knee replacements in the country. According to the American Heart Association, cardiovascular disease (CVD) remains the primary cause of death in the United States, with 928,741 fatalities recorded in 2020. Among the deaths caused by CVD, coronary heart disease (CHD) accounted for the highest percentage (41.2%), followed by stroke (17.3%), other CVD (16.8%), high blood pressure (12.9%), heart failure (9.2%), and diseases of the arteries (2.6%).

The U.S. intraoperative imaging market is experiencing growth due to the increasing adoption of minimally invasive surgeries and technological advancements. As minimally invasive procedures rely heavily on imaging for indirect visualization of the surgical field, this is a major factor contributing to the growth of the market. In addition, integrating intraoperative imaging with surgical navigation systems improves procedure guidance and drives innovation through mergers, acquisitions, and collaborations among healthcare institutions and manufacturers. An example of this is the recent acquisition of IMACTIS by GE HealthCare in January 2023. This acquisition will enhance the GE HealthCare portfolio by adding IMACTIS CT-Navigation, which is used for a wide variety of minimally invasive percutaneous procedures and will improve surgical precision and patient care.

Furthermore, The development of hybrid operating rooms and the incorporation of artificial intelligence technology in intraoperative imaging systems have been major drivers of growth in the market. Hybrid operating rooms, which combine traditional surgical equipment with advanced imaging technology, provide surgeons with real-time, high-resolution images that enable them to make more accurate and precise surgical decisions. This has led to increased demand for intraoperative imaging systems that incorporate advanced imaging technology, such as MRI and CT scanning, as well as artificial intelligence algorithms that can aid in image analysis and interpretation.

Presence of key players in the U.S. is also driving the market growth. These key players are conducting clinical trials to understand the effectiveness of intraoperative devices for various surgical procedures. For instance, Lumicell, Inc. announced the findings of their clinical trial in 2023, concerning the investigation of the Lumicell Direct Visualization System (DVS) in identifying residual breast cancer post lumpectomy. Therefore, the rising number of clinical trials on intraoperative imaging devices in the U.S. is expected to drive the overall market growth in the country.

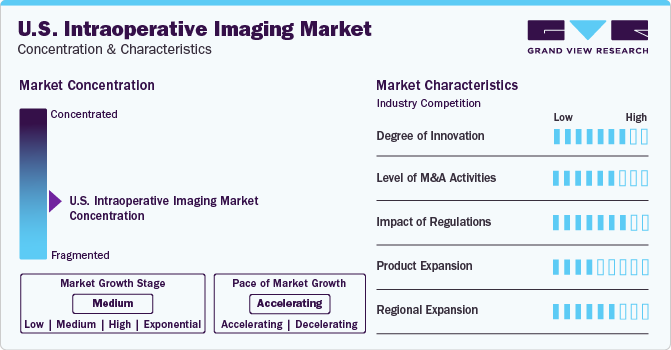

Market Concentration & Characteristics

The industry is fragmented, characterized by a high degree of innovation has experienced significant progress due to cutting-edge technological developments. Artificial intelligence, combined multimodal imaging techniques, and augmented and virtual reality technologies are major contributors to industry growth.

Numerous manufacturers in U.S. are engaging in merger and acquisition activity to expand their product offerings. This strategic movement also aims to broaden their technological skillset, enhance industry reach, and penetrate better geographically. For instance, in June 2023, GE HealthCare and DePuy Synthes, a Johnson & Johnson Orthopaedics Company, announced a distribution agreement and brought GE HealthCare’s OEC 3D Imaging System to the U.S. industry, along with DePuy Synthes’ extensive product portfolio.

Regulatory policies play a crucial role in shaping the intraoperative imaging industry and may influence the affordability and accessibility of these advanced devices for various healthcare settings. In the U.S., the Food and Drug Administration (FDA) regulates medical devices to ensure their safety and effectiveness for their intended uses.

Prominent manufacturers of intraoperative imaging systems in the U.S. have been focusing on research and development to develop products with advanced features, thus expanding their product portfolios. For instance, after extensive research on the technology, in March 2021, GE HealthCare received clearance from the FDA to launch OEC 3D, which is a surgical imaging system that can perform both 3D and 2D imaging that aims to establish a new standard for intraoperative 3D imaging for spine and orthopedic surgeries.

In the U.S., prominent companies in the intraoperative imaging industry are expanding their geographical reach to cater to the growing demand for advanced imaging technologies. In November 2022, Canon Inc. announced the establishment of Canon Healthcare USA, INC, aiming to strengthen its presence in the influential American medical industry. This move aimed to accelerate the growth of Canon’s medical business, focusing on diagnostics such as CT, MRI, and diagnostic ultrasound systems, as well as medical component businesses. By expanding its operations in the US, Canon aimed to contribute positively to the US intraoperative imaging industry.

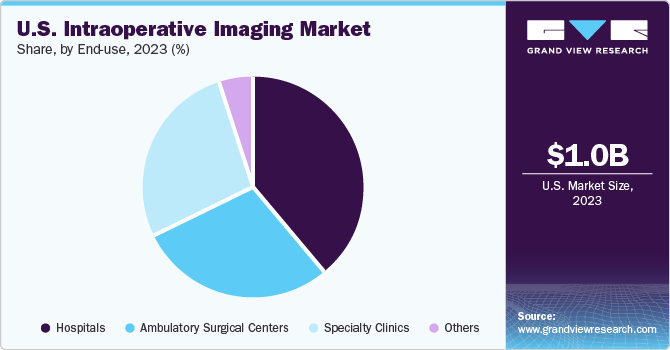

End-use Insights

Hospital segment have led the U.S. intraoperative imaging market on the basis of end-use by capturing 39.36% of the total revenue in 2023. This is mainly due to their larger surgical volumes, higher purchasing power, and the need for advanced imaging technologies to support specialties such as orthopedics, neurosurgery, and cardiovascular surgery. Furthermore, the significant usage of intraoperative imaging systems in hospital settings is aided by multiple factors, including the aging population and rise in degenerative joint diseases, as more orthopedic surgeries are performed in hospitals.

Ambulatory surgical centers (ASCs) are expected to witness the highest CAGR from 2024 to 2030, owing to the rapid technological developments in the market. ASCs offer affordability for patients and insurance providers and substantially lower healthcare costs. ASCs also have a lower infection risk compared to hospitals, due to their smaller size, reduced crowding, and shorter waiting times. In addition, patients usually experience shorter waiting times and a more streamlined experience in ASCs.

Product Insights

C-arms dominated the market and accounted for 30.83% of the revenue share in 2023, owing to the flexibility and convenience offered by mobile C-arms, which find applications in orthopedics, cardiology, emergencies, and general surgery, among others. The demand for C-arms in minimally invasive surgeries is rising due to their real-time imaging capabilities, which improve surgical precision and patient outcomes. Additionally, advancements in imaging technology have resulted in higher quality and more detailed images, which has boosted the use of C-arms in various surgical procedures. Another factor contributing to growth is the rising prevalence of chronic diseases, which has led to an increase in the number of surgeries performed globally. All these factors combined have made C-arms a valuable tool in modern surgical procedures, driving growth in the U.S. intraoperative imaging market.

The increasing demand for iMRI systems is estimated to make it the fastest-growing segment over the forecast period. iMRI helps neurosurgeons accurately locate abnormalities, protect critical structures, and enhance tumor removal precision. Its benefits in neurosurgery and related fields have led to increased adoption within the U.S. healthcare system. iMRI provides real-time images without the use of ionizing radiation, minimizing the chances of inaccuracy. As a result, the iMRI system has become a crucial tool for surgeons in various medical fields, including neurological surgeries, surgical oncology, radiation oncology, and ophthalmology.

Application Insights

Neurosurgery application has dominated the intraoperative imaging market in 2023 by capturing 31.80% revenue share. This is due to the increasing prevalence of neurological disorders and precise imaging technology for the treatment of neurological disorders such as epilepsy, stroke, Parkinson’s disease, brain tumors, and Alzheimer’s disease, among others. For instance, around 416 million people have Alzheimer’s disease in various stages of progression, which accounts around 22% of all people aged 50 and older, globally. Additionally, manufacturers such as IMRIS are developing advanced imaging technologies for advanced imaging technologies in neurosurgery that enhance high-quality imaging during surgical procedures in multi-room operating suites.

The orthopedic surgery segment is projected to experience the highest growth rate during the forecast period, primarily due to the increasing number of road accidents and the growing population of elderly individuals who suffer from bone degeneration. This has resulted in an upsurge in the number of orthopedic surgeries taking place across the country. For instance, the National Highway Traffic Safety Administration reported that around 19,515 individuals died in motor vehicle traffic accidents, reflecting a 3.3% decline as compared to the 20,190 fatalities reported in the first half of 2022. Fatalities witnessed a decline during both the first and second quarters of 2023. Furthermore, the use of intraoperative imaging systems that provide real-time guidance has contributed significantly to the increase in positive surgical outcomes, thereby impacting the growth of this segment.

Key U.S. Intraoperative Imaging Company Insights

The U.S. dominated the global intraoperative market and accounted for 29% of the total revenue share in 2023. The U.S. market is thus characterized by continuous strategic collaborations and mergers & acquisitions among key players. Companies actively pursue these moves to gain a competitive edge by exploiting untapped opportunities in the market.

GE HealthCare; Siemens Healthcare GmbH; Medtronic plc; Royal Philips; and Shimadzu Corporation (Medical Systems) are some of the significant companies in the U.S. intraoperative imaging market. The desire for these companies to expand product offerings, access new markets, achieve economies of scale, and strengthen competitive positions is moderately high.

Key U.S. Intraoperative Imaging Companies:

- GE HealthCare

- Siemens Healthcare GmbH

- Medtronic plc

- Royal Philips

- Shimadzu Corporation (Medical Systems)

- Brainlab AG

- IMRIS

- Canon Medical USA, INC.

- Shenzhen Anke High-tech Co.

- Mindray Ltd.

Recent Developments

-

In February 2024, Royal Philips introduced the Philips Image Guided Therapy Mobile C-arm System 9000-Zenition 90 Motorized, designed to enhance surgical care accessibility, which offers tailored capabilities for complex vascular needs and various clinical procedures and provides surgeons with table-side control, high-quality images, and automated workflows.

-

In December 2023, Royal Philips showcased its innovations at the Radiological Society of North America Scientific Sessions and Annual Meeting, focusing on enhancing workflows, efficiency, and clinical staff’s time in diagnostic imaging.

-

In November 2023, Canon Medical USA, INC. and Cleveland Clinic announced a strategic partnership to develop innovative medical imaging and healthcare IT technologies. They planned to establish a comprehensive imaging research center in Cleveland’s Innovation District, focusing on cardiology, neurology, and musculoskeletal medicine. This collaboration aimed to improve diagnosis, care, and outcomes for patients.

-

In July 2022, Siemens Healthineers received FDA clearance for the ARTIS icono ceiling, a ceiling-mounted angiography system offering excellent image guidance for various interventional radiology and cardiovascular procedures.

-

In July 2022, Canon Medical USA, INC announced its acquisition of NXC Imaging, a distributor and service provider of capital medical equipment, strengthening the company’s sales and service channels for imaging products in the U.S. Upper Midwest.

-

In September 2021, GE HealthCare acquired BK Medical, a pioneer in advanced surgical visualization. The company expects BK Medical’s expertise in intraoperative imaging and surgical navigation to help clinicians in minimally invasive and robotic surgeries and deep tissue visualization in neuro, abdominal, and urology procedures.

-

In March 2021, Mindray launched the ME8 Ultrasound System in the market. Known for its lightweight and thin design, this laptop-based machine features advanced software and hardware for optimal performance.

U.S. Intraoperative Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.06 billion

Revenue forecast in 2030

USD 1.55 billion

Growth rate

CAGR of 6.49% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

GE HealthCare; Siemens Healthcare GmbH; Medtronic plc; Royal Philips; Shimadzu Corporation (Medical Systems); Brainlab AG; IMRIS; Canon Medical USA, INC; Shenzhen Anke High-tech Co.; Mindray Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Intraoperative Imaging Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. intraoperative imaging market report based on product, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

iCT

-

Intraoperative Ultrasound

-

iMRI

-

C-arms

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery

-

Cardiovascular Surgery

-

Orthopedic Surgery

-

Trauma /Emergency Room Surgery

-

ENT Surgery

-

Oncology Surgery

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

Other End-users

-

Frequently Asked Questions About This Report

b. The U.S. intraoperative imaging market size was estimated at USD 1.00 billion in 2023 and is expected to reach USD 1.06 billion in 2020.

b. The U.S. intraoperative imaging market is expected to grow at a compound annual growth rate of 6.49% from 2024 to 2030 to reach USD 1.55 billion by 2030.

b. Neurosurgery application has dominated the U.S. intraoperative imaging market in 2023 by capturing 31.80% revenue share. This is due to the increasing prevalence of neurological disorders and precise imaging technology for the treatment of neurological disorders such as epilepsy, stroke, Parkinson’s disease, brain tumors, and Alzheimer’s disease, among others.

b. Some key players operating in the U.S. intraoperative imaging market include GE HealthCare; Siemens Healthcare GmbH; Medtronic plc; Royal Philips; Shimadzu Corporation (Medical Systems); Brainlab AG; IMRIS; Canon Medical USA, INC; Shenzhen Anke High-tech Co.; Mindray Ltd.

b. Key factors that are driving the market growth include increasing demand for minimally invasive surgeries, rising prevalence of chronic diseases, and advancements in imaging technologies. Additionally, the growing geriatric population and the increasing number of surgeries performed in hospitals and ambulatory surgical centers are also contributing to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.