- Home

- »

- Organic Chemicals

- »

-

U.S. Isocyanates Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Isocyanates Market Size, Share & Trends Report]()

U.S. Isocyanates Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Bio-Based, Conventional), By Type (<65%, >65%), By Convention End Use, By Bio-Based End Use, And Segment Forecasts

- Report ID: GVR-4-68040-786-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Isocyanates Market Summary

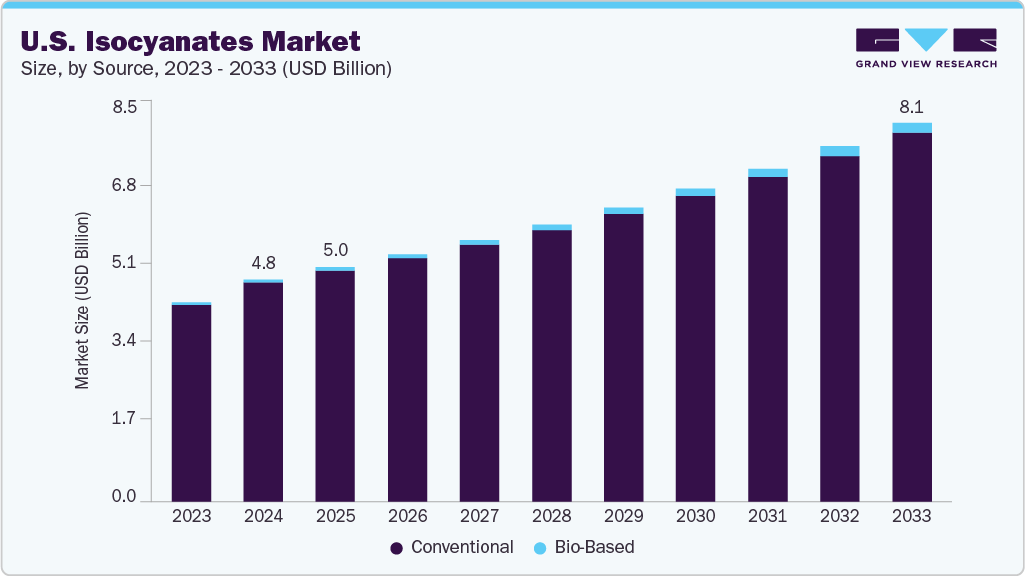

The U.S. isocyanates market size was estimated at USD 4,753.1 million in 2024 and is projected to reach USD 8,108.3 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The market growth is primarily driven by the increasing demand for polyurethane foams in the construction industry. Growing emphasis on energy-efficient insulation materials in residential and commercial buildings is fueling market growth.

Key Market Trends & Insights

- The U.S. isocyanates industry is expected to grow at the fastest CAGR of 6.2% from 2025 to 2033.

- By source, the conventional source segment held the largest revenue share of 98.6% in 2024.

- By bio-based end use, the military segment is expected to grow at the fastest CAGR of 6.4% from 2025 to 2033.

- By type, the >65% segment led the U.S. isocyanates market with the largest revenue share of 89.8% in 2024.

- By conventional end use, the industrial segment dominated the conventional end use segment with a revenue share of 84.2% in 2024

Market Size & Forecast

- 2024 Market Size: USD 4,753.1 Million

- 2033 Projected Market Size: USD 8,108.3 Million

- CAGR (2025-2033): 6.2%

Rising renovation and infrastructure modernization projects are further supporting Product adoption. This trend reflects the industry’s focus on durability, sustainability, and cost-effective thermal performance. A major growth driver for the U.S. isocyanates industry is the increasing use of lightweight and durable materials in the automotive sector. Manufacturers are adopting polyurethane components to reduce vehicle weight and improve fuel efficiency, aligning with federal emission standards. This shift is encouraging higher Production of MDI- and TDI-based polyurethane systems, strengthening market growth through the transportation value chain.

There is a strong opportunity to develop eco-friendly and bio-based isocyanates as environmental rules become stricter. Using renewable raw materials and cleaner Production methods can help companies stand out in the market. Investing in low-emission technologies will also improve brand image and meet customer demand for greener Products. This move toward sustainable materials can open up new business growth areas.

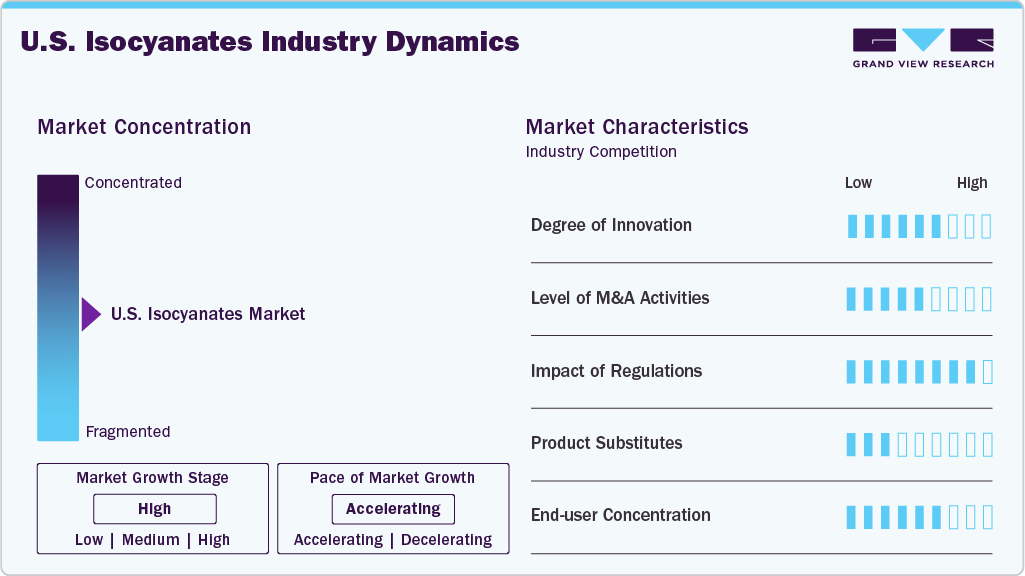

Market Concentration & Characteristics

The U.S. isocyanates market is moderately concentrated, with a few major players dominating Production and supply. These companies focus on high-quality polyurethane materials and long-term contracts with end use industries like construction and automotive. Strong technological capabilities, steady demand from key sectors, and growing efforts toward sustainable and low-emission Products characterize the market.

In terms of market characteristics, the market is also marked by high Product specialization, with different grades of isocyanates tailored for foams, coatings, adhesives, and sealants. Demand for stability comes from long-term contracts with the construction, automotive, and furniture industries. Additionally, the market shows gradual adoption of sustainable and low-emission Products, reflecting both regulatory influence and customer preference for environmentally friendly solutions.

Source Insights

The conventional segment led the U.S. isocyanates industry with the largest revenue share of 98.6% in 2024. This segment is dominant due to its established supply chains and consistent performance in industrial Bio-Based End Uses. It is widely used in the automotive, construction, and furniture industries because of its cost-effectiveness and reliability. Steady demand from large-scale manufacturing supports its market leadership. Despite the rise of bio-based alternatives, conventional isocyanates remain the backbone of the industry.

The bio-based segment is the fastest-growing segment, registering a CAGR of 14.5% during the forecast period. This growth is driven by rising demand for sustainable and low-emission products. Manufacturers are investing in renewable raw materials to meet stricter environmental regulations. Growing awareness among end users about eco-friendly construction and automotive materials is boosting adoption. This trend is expected to create new growth opportunities for innovative, green isocyanate solutions.

Type Insights

The >65% segment led the U.S. isocyanates market with the largest revenue share of 89.8% in 2024. This segment dominates due to its high reactivity and strong performance in large-scale polyurethane production. It is preferred in foam, insulation, and rigid structural Bio-Based End Uses where efficiency and durability are critical. Consistent industrial demand ensures its continued market leadership. Its reliability and widespread adoption make it the primary choice for most manufacturers.

The <65% segment is the fastest-growing segment with a CAGR of 0.5% during the forecast period. This growth is driven by demand for versatile formulations with moderate reactivity. Industries are increasingly using these products for specialized Bio-Based End Uses where flexibility and controlled curing are important. Rising innovation in coatings, adhesives, and sealants is supporting growth. This segment is attracting attention from manufacturers seeking to offer tailored solutions for niche Bio-Based End Uses.

Bio-Based End Use Insights

The industrial segment dominated the bio-based end use segment with a revenue share of 80.5% in 2024, because manufacturers rely on it for adhesives, foams, and sealants. Strong demand from large-scale production and well-established supply chains reinforces its dominant position. Its proven performance and reliability continue to make it the go-to option for many companies.

The military segment is the fastest-growing segment with a CAGR of 6.4% during the forecast period. This growth is driven by the need for high-performance, lightweight, and durable materials. Adoption of eco-friendly isocyanates in defense applications is increasing to meet both performance and sustainability goals. This growth reflects rising investment in advanced protective coatings and specialty foams.

Conventional End Use Insights

The industrial segment dominated the conventional end use segment with a revenue share of 84.2% in 2024, supported by its widespread use in large-scale polyurethane production. Steady demand from sectors like adhesives, sealants, and molded products ensures consistent growth. Its cost-effectiveness and proven performance keep it as the preferred choice for manufacturers.

The military segment is the fastest-growing segment with a CAGR of 5.7% during the forecast period, driven by increasing demand for high-strength and durable materials. Applications in protective coatings, specialty foams, and defense equipment are expanding rapidly. Rising focus on reliability and performance under extreme conditions fuels this segment’s growth.

Key U.S. Isocyanates Company Insights

Some of the key players operating in the market include Asahi Kasei, Aekyung Chemical, Covestro LLC., Dow Inc., BASF SE, Anhui Royal Chemical Co., Ltd, Hefei TNJ Chemical Industry Co., Ltd., Evonik Industries AG, KUMIAI CHEMICAL INDUSTRY CO., LTD., LANXESS, Mitsui Chemical Inc., SABIC, SAPICI S.p.A., and Vencorex.

-

BASF SE is one of the most comprehensive isocyanate portfolios, covering polyether and polyester grades. Its products support various applications, including rigid foams, adhesives, coatings, sealants, and elastomers. The company’s strong research capabilities and global supply chain ensure reliable performance and innovation for diverse industries.

-

Covestro LLC is a major producer of polyether isocyanates and polyurethane intermediates, focusing on sustainability and performance. Its portfolio serves various applications, including rigid and flexible foams, coatings, adhesives, sealants, and elastomers. The company emphasizes environmentally responsible solutions and continuous product innovation.

Key U.S. Isocyanates Companies:

- Asahi Kasei

- Aekyung Chemical

- Covestro LLC.

- Dow Inc.

- BASF SE

- Anhui Royal Chemical Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Evonik Industries AG

- KUMIAI CHEMICAL INDUSTRY CO., LTD.

- LANXESS

- Mitsui Chemical Inc.

- SABIC

- SAPICI S.p.A.

- Vencorex

Recent Developments

-

In October 2023, BASF began supplying biomass-balanced methylene diphenyl diisocyanate (MDI) from its plant in Korea, marking a significant step toward sustainable polyurethane production. The biomass-balanced approach replaces a portion of fossil feedstocks with renewable resources during manufacturing, reducing the carbon footprint of the end product. This development aligns with the rising demand for eco-friendly chemicals in various industries, including construction and automotive, and reflects the market’s shift toward renewable materials.

U.S. Isocyanates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,008.8 million

Revenue forecast in 2033

USD 8,108.3 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, type, bio-based end use, conventional end use

Country scope

U.S.

Key companies profiled

Asahi Kasei; Aekyung Chemical; Covestro LLC.; Dow Inc.; BASF SE;Anhui Royal Chemical Co., Ltd.; Hefei TNJ Chemical Industry Co., Ltd.; Evonik Industries AG; KUMIAI CHEMICAL INDUSTRY CO., LTD.; LANXESS; Mitsui Chemical Inc.; SABIC; SAPICI S.p.A.; Vencorex

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to the country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Isocyanates Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. isocyanates market report based on source, type, bio-based end use, and conventional end use:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Bio-Based

-

Conventional

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

<65%

-

>65%

-

-

Bio-Based End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Industrial

-

Paints & Coatings

-

Automobile

-

Construction

-

Others

-

-

Military

-

-

Conventional End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Industrial

-

Automotive

-

Building & Construction

-

Footwear

-

Furniture

-

Others

-

-

Military

-

Frequently Asked Questions About This Report

b. The U.S. Isocyanates market size was estimated at USD 4753.1 million in 2024 and is expected to reach USD 5008.8 million in 2025.

b. The U.S. Isocyanates market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 8108.3 million by 2033.

b. U.S. dominated the North America Isocyanates market with a share of 85.2% in 2024. The growth of isocyanate market is mainly driven by the surging demand for sustainable materials. Additionally, favorable government regulations promoting the use of bio-based isocyanates across various applications and their rising adoption in the automotive industry are expected to contribute to the market growth.

b. Leading players in the U.S. isocyanates market, including BASF SE, Covestro AG, Dow Inc., Huntsman Corporation, and Evonik Industries AG, dominate through extensive production capacities, integrated supply chains, and continuous investments in bio-based and specialty isocyanates to meet evolving sustainability and performance demands

b. Increasing focus on sustainability and the development of bio-based isocyanates are expected to drive innovation within the market. The rising demand for eco-friendly materials is prompting manufacturers to explore alternatives that reduce environmental impact while maintaining performance standards. Notably, industry leaders are actively investing in the development of bio-based isocyanates, aligning with global sustainability goals and enhancing their market position.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.