- Home

- »

- Pharmaceuticals

- »

-

U.S. Keytruda Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Keytruda Market Size, Share & Trends Report]()

U.S. Keytruda Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Lung Cancer, Breast Cancer, Melanoma, Hodgkin Lymphoma, Head & Neck Cancer, Gastric Cancer, Urothelial Cancer), By Payer, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-644-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Keytruda Market Size & Trends

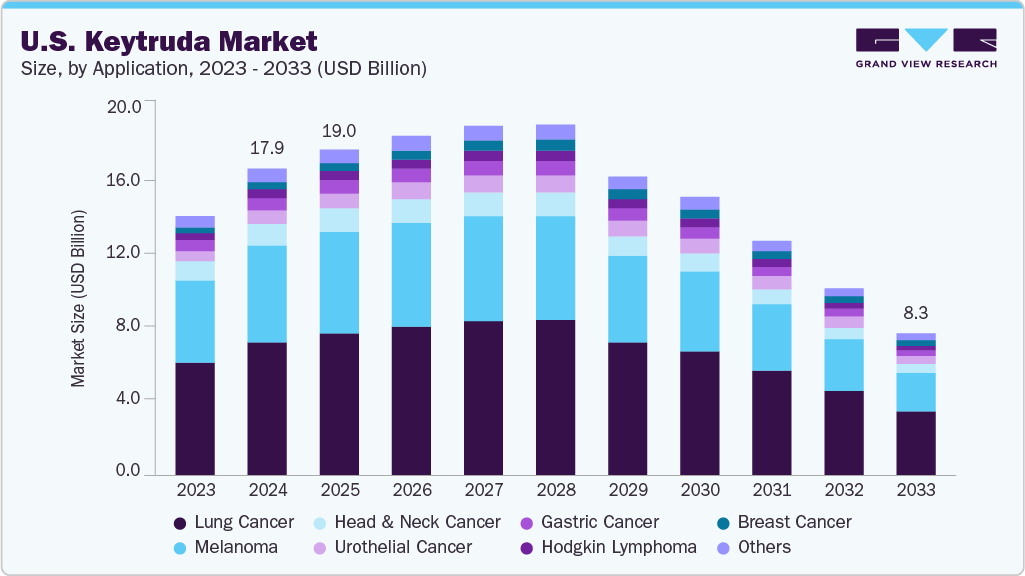

The U.S. keytruda market size was estimated at USD 17.87 billion in 2024 and is projected to decline at a CAGR of -3.12% from 2025 to 2033. The market faces challenges from the impending patent expiration in 2028, introducing biosimilar competition. Although the decline is expected, market activity remains supported by continued use in established indications and ongoing clinical evaluation in new tumor types.

The U.S. Keytruda industry, a cornerstone of oncology due to its efficacy in treating multiple cancers, is undergoing a transition. Keytruda, developed by Merck & Co., targets PD-1 to enhance immune responses against tumors. Its approvals for lung cancer, melanoma, and urothelial carcinoma have supported market dominance. However, a projected decline during the forecast period reflects growing challenges, particularly from biosimilar competition following its expected patent expiration in 2028. While the incidence of cancer continues to rise-estimated at 2 million new cases in the U.S. in 2024-pricing pressures are expected to limit market growth.

Keytruda’s use in both monotherapy and combination regimens continues to be a key factor supporting its market position. Expanding indications in the neoadjuvant and adjuvant settings, such as for triple-negative breast cancer, broadens the eligible patient population. Clinical trials, including KEYNOTE-689, have shown improved survival outcomes, boosting adoption. However, treatment costs that often exceed thousands of dollars per cycle create access barriers. To address this, Merck has developed a subcutaneous formulation, with regulatory submissions expected in 2025, aimed at increasing treatment convenience and preserving market share.

Additionally, emerging innovations are shaping Keytruda’s clinical use. Biomarker-driven approaches enhance its effectiveness in PD-L1-expressing tumors, and research into new combinations, such as with antibody-drug conjugates and checkpoint inhibitors, could broaden its reach. Despite this development pipeline, the market faces challenges from regulatory hurdles, pricing issues, and biosimilar litigation. Merck is exploring new applications, including colorectal cancer, to counter these risks. While the U.S. remains the top market in North America due to its advanced healthcare infrastructure, future growth will be influenced by competitive and economic pressures.

Pipeline Analysis

Merck & Co. is advancing Keytruda’s pipeline through clinical trials, exploring new applications and delivery methods to maintain its market position before biosimilars enter. A subcutaneous (SC) formulation is under FDA review, with a target decision date in 2025. Combination trials, such as KEYNOTE-A39 with Padcev for urothelial carcinoma, have demonstrated a doubling of median overall survival, supporting the strategy of expanding into new indications. Concurrent studies for colorectal and hepatocellular carcinoma aim to increase the therapeutic scope and sustain demand.

Merck’s pipeline emphasis includes combination regimens with antibody-drug conjugates, improving efficacy and potentially setting Keytruda apart from upcoming biosimilars. Biomarker-driven strategies, such as targeting PD-L1 expression and tumor mutational burden, are being investigated to enhance patient selection and extend treatment durations. These advancements are aimed at counteracting patient loss due to patent expiration in 2028.

However, regulatory uncertainties and potential setbacks in clinical trials could limit short-term growth. Merck’s partnerships with biotechnology companies help diversify its pipeline, supporting ongoing relevance. Despite competitive pressures, these strategic efforts seek to maintain Keytruda’s leadership in the U.S. oncology market through 2033.

Patent Expiry Analysis

Table: Patent Type and Expiration Data

Region

Protection Type

Expiry Year

Notes

U.S.

Patent (Composition)

2028

Covers pembrolizumab’s core formulation.

U.S.

Patent (Method of Use)

2031

Protects use in NSCLC combination therapy.

U.S.

Patent (Method of Use)

2032

Covers melanoma adjuvant therapy.

U.S.

Exclusivity (Orphan Drug)

2025

For Hodgkin lymphoma indication.

U.S.

Exclusivity (Biologic)

2026

12-year exclusivity for pembrolizumab.

Market Concentration & Characteristics

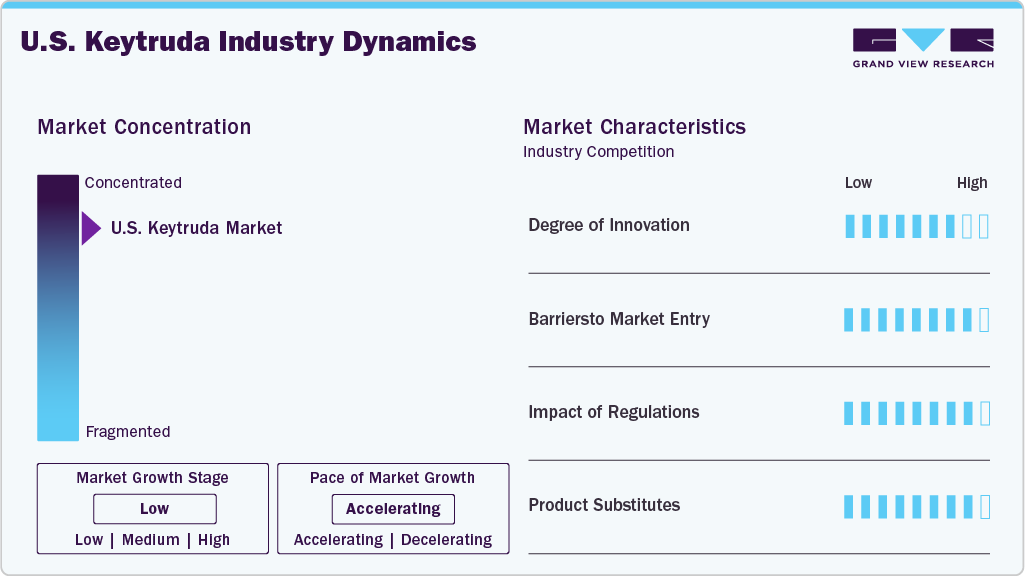

The U.S. Keytruda market is highly innovative, driven by Merck’s R&D in immunotherapy. Keytruda’s PD-1 inhibition mechanism has transformed oncology, with FDA approvals projected by 2024 for cancers such as NSCLC and melanoma. Ongoing trials investigate new combinations, including with mRNA vaccines, and a subcutaneous formulation to improve administration. Biomarker-driven therapies targeting PD-L1 and TMB enhance treatment precision. Merck’s USD 11.5 billion acquisition of Acceleron bolstered its oncology pipeline. However, innovation faces challenges from biosimilar development post-2028 patent expiration. Strategic partnerships with biotech firms and academic institutions sustain innovation, ensuring Keytruda’s competitive edge through 2033, despite emerging PD-1/PD-L1 inhibitors like Opdivo.

High barriers to entry define the U.S. Keytruda market. Developing immunotherapies requires large R&D investments, with clinical trials costing billions. Merck’s extensive patent portfolio, valid until 2034, delays biosimilar entry until 2028. Regulatory requirements, including the FDA’s strict approval process, further hinder new entrants. Established relationships with healthcare providers and payers favor existing companies. However, companies like Alvotech and Dr. Reddy’s are collaborating on biosimilars, signaling future competition. High treatment costs and reimbursement complexities also deter smaller firms. New entrants must navigate litigation risks over patent infringements, as Merck actively defends its exclusivity. These barriers protect Keytruda’s dominance but may ease post-2028.

The FDA’s regulatory framework significantly shapes the U.S. Keytruda market. Streamlined approvals, like the 2024 endometrial cancer indication, expand Keytruda’s reach. Priority review for head and neck cancer in February 2025 speeds up market access. However, after 2028, biosimilar approvals could reduce Merck’s revenue, similar to other biologics. The FDA’s orphan drug and biologic exclusivities, which expire by 2027, offer temporary protection. Reimbursement policies under Medicare and Medicaid affect adoption, with public payers expected to grow. Health technology assessments consider cost-effectiveness and may limit coverage in cost-sensitive settings. Merck’s regulatory expertise and lobbying efforts mitigate risks, but changing biosimilar guidelines may challenge market share.

Keytruda faces competition from PD-1/PD-L1 inhibitors like Opdivo (Bristol-Myers Squibb) and Tecentriq (Roche), which target similar indications. Opdivo’s approvals for NSCLC and melanoma create direct competition, but Keytruda’s broader indication portfolio maintains its lead. Next-generation immunotherapies and CAR-T therapies pose long-term threats by offering alternative mechanisms. Biosimilars, expected after 2028, will intensify pricing pressures.

Application Insights

The lung cancer segment dominated the U.S. Keytruda industry with the largest revenue share of 43.49% in 2024. This dominance is attributed to Keytruda’s proven efficacy in treating non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC), particularly as a first-line therapy. The FDA’s approvals for Keytruda in combination with chemotherapy have significantly boosted its adoption in lung cancer treatment protocols. The high incidence of lung cancer in the U.S., with 236,000 new cases reported in 2023 according to the American Cancer Society, underscores the substantial demand for effective therapies like Keytruda, reinforcing its leading position in this segment.

The breast cancer segment is projected to decline at a CAGR of -3.41% from 2025 to 2033. Despite recent FDA approvals in neoadjuvant and adjuvant settings that expanded its use for early-stage and high-risk patients, the market trajectory reflects increasing competitive and economic pressures. The KEYNOTE-522 trial showed improvements in event-free survival, leading to wider adoption initially. However, the presence of alternative therapies, cost-related challenges, and limited long-term data on survival benefits has tempered sustained growth. While breast cancer continues to affect over 300,000 women annually in the U.S., and Keytruda plays a role in addressing aggressive subtypes, its declining market share indicates that the therapy may face reduced prescribing rates in favor of emerging options or less costly alternatives. These dynamics suggest that although Keytruda contributed to early momentum in the segment, its long-term positioning in breast cancer treatment may weaken through 2033.

Payer Insights

The commercial/private insurance segment dominated the U.S. Keytruda market with the largest revenue share of 71.50% in 2024 due to widespread coverage among employer-sponsored plans. High treatment costs, often thousands per cycle, align with private insurers’ ability to negotiate pricing. Additionally, streamlined reimbursement processes, patient assistance programs, and preferred formulary placements further reinforced uptake through private channels, contributing to consistent patient access and revenue concentration.

The public insurance segment is projected to decline at a CAGR of -1.25% from 2025 to 2033. This decline reflects increased scrutiny of reimbursement budgets despite an aging population with higher cancer prevalence. While non-small cell lung cancer (NSCLC) and melanoma drive initial uptake, pricing constraints and cost-effectiveness evaluations are limiting long-term coverage expansion. Payer dynamics remain critical, with stricter health technology assessments influencing formulary access and treatment duration under public plans.

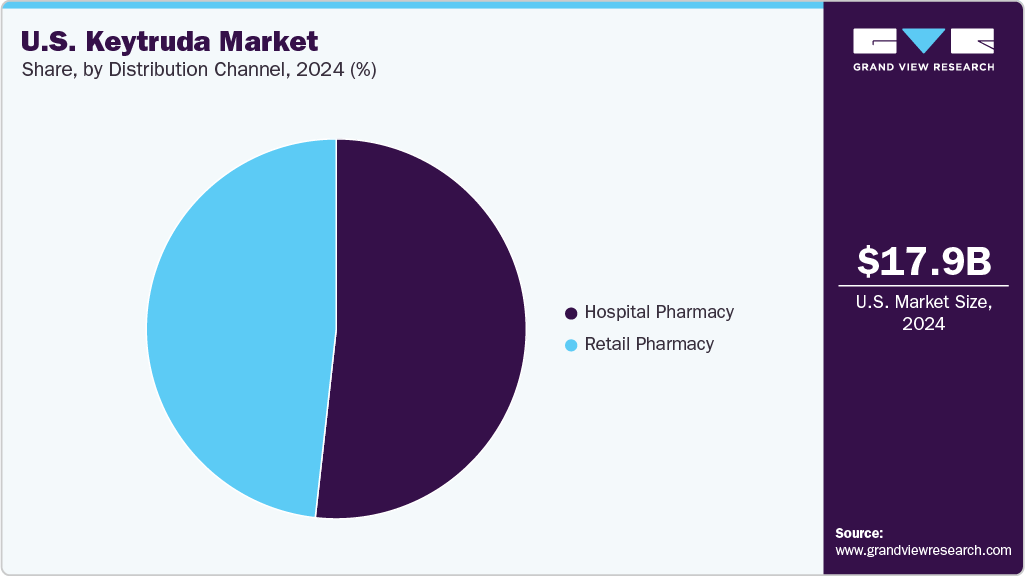

Distribution Channel Insights

The hospital pharmacy segment dominated the U.S. Keytruda industry with the largest revenue share of 51.77% in 2024, attributed to the requirement for specialized administration in oncology centers. Intravenous delivery mandates controlled environments, reinforcing hospital settings as the primary dispensing channel. Their role in handling complex immunotherapy regimens, coordinating multidisciplinary care, and managing patient compliance supports continued dominance in the distribution landscape. The centralized infrastructure of hospitals also enables monitoring for adverse events and adherence to treatment protocols, aligning with payer and regulatory requirements.

The specialty pharmacies segment is projected to decline at a CAGR of -1.99% from 2025 to 2033. The anticipated shift toward outpatient care and the potential FDA approval of a subcutaneous formulation by 2025 initially supported distribution through specialty channels. These pharmacies facilitate patient education and offer home delivery services, enhancing accessibility. However, overall revenue is expected to decline as biosimilar competition intensifies and pricing pressures impact margins across the channel.

Key U.S. Keytruda Company Insights

Merck & Co. holds exclusive control of the U.S. Keytruda market through a strong patent position valid until 2028. With over 40 FDA-approved indications as of 2024, the company continues to generate revenue across multiple cancer types. Strategic initiatives, including the acquisition of Acceleron Pharma in 2022 and a collaboration with Moderna, have expanded its oncology pipeline. Merck is also investing in lifecycle management through the development of a subcutaneous formulation and pursuing new indications. These measures are intended to offset projected revenue decline following the entry of biosimilars post-patent expiry. Despite these efforts, pricing pressure and market erosion are expected to weigh on long-term performance.

Key U.S. Keytruda Companies:

- Merck & Co., Inc.

Recent Developments

-

In June 2024, the FDA approved Keytruda in combination with chemotherapy for advanced endometrial cancer, demonstrating a 70% reduction in disease progression risk in the KEYNOTE-A18 trial, further broadening Keytruda’s oncology portfolio and enhancing treatment options.

-

In February 2025, the FDA granted Priority Review for Keytruda’s application in head and neck squamous cell carcinoma, accelerating its evaluation process. A decision on approval is anticipated by June 23, 2025, potentially expanding Keytruda’s indications in oncology.

-

In September 2024, Merck published KEYNOTE-006 trial data, revealing a 34% survival rate among advanced melanoma patients treated with Keytruda. This result underscores Keytruda’s efficacy, strengthening its position as a leading immunotherapy option in melanoma treatment.

U.S. Keytruda Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.02 billion

Revenue forecast in 2033

USD 8.26 billion

Growth rate

CAGR of -3.12% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, payer, distribution channel

Key companies profiled

Merck & Co., Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Keytruda Market Report Segmentation

This report forecasts revenue growth in the U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. Keytruda market report based on application, payer, and distribution channel:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Lung Cancer

-

Breast Cancer

-

Melanoma

-

Hodgkin Lymphoma

-

Head and Neck Cancer

-

Gastric Cancer

-

Urothelial Cancer

-

Others

-

-

Payer Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial/Private

-

Public

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Speciality

-

Frequently Asked Questions About This Report

b. The U.S. Keytruda market size was estimated at USD 17.87 billion in 2024 and is expected to reach USD 19.02 billion in 2025.

b. The U.S. Keytruda market is projected to decline at a CAGR of -3.12% from 2025 to 2033 to reach USD 8.25 billion by 2033.

b. Based on application, Lung cancer secsegment dominated the market with the largest revenue share of 43.49% in 2024. This dominance is attributed to Keytruda’s proven efficacy in treating non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC), particularly as a first-line therapy.

b. Merck & Co. holds exclusive control of the U.S. Keytruda market through a patent position valid until 2028. With over 40 FDA-approved indications as of 2024, the company continues to generate revenue across multiple cancer types.

b. The market faces challenges from impending patent expiration in 2028, introducing biosimilar competition. Although the decline is expected, market activity remains supported by continued use in established indications and ongoing clinical evaluation in new tumor types.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.