- Home

- »

- Medical Devices

- »

-

U.S. Kidney Preservation Market Size, Industry Report, 2030GVR Report cover

![U.S. Kidney Preservation Market Size, Share & Trends Report]()

U.S. Kidney Preservation Market (2025 - 2030) Size, Share & Trends Analysis Report By Preservation Solution (University of Wisconsin Solution, Celsior Solution), By Technique (Static Cold Storage), By Donor Type, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-606-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Kidney Preservation Market Trends

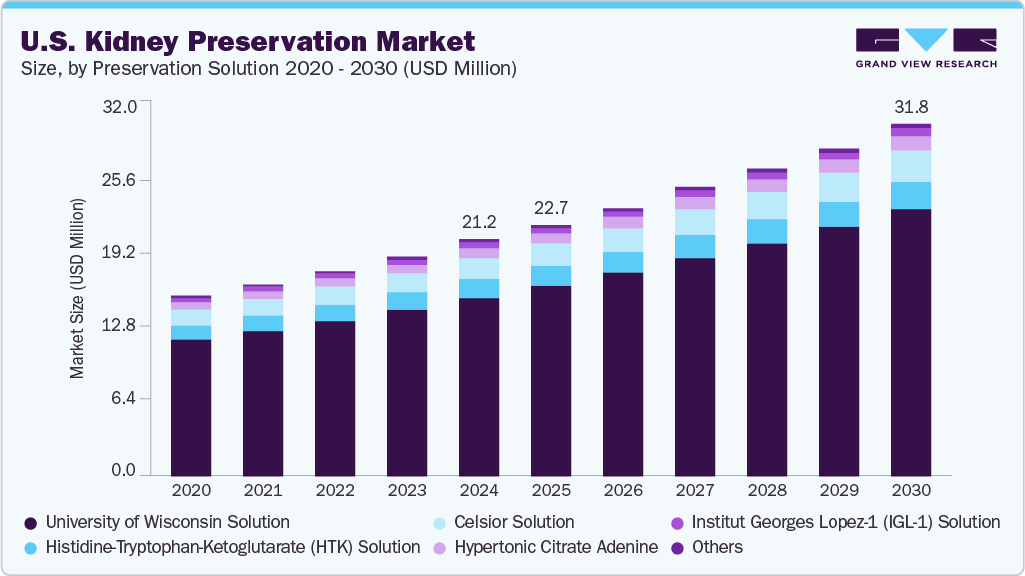

The U.S. kidney preservation market size was estimated at USD 21.2 million in 2024 and is expected to grow at a CAGR of 6.97% from 2025 to 2030. The market growth is driven by several factors, including the rising incidence of end-stage renal disease (ESRD) and chronic conditions such as diabetes and hypertension. The increasing demand for kidney transplants also fuels market growth. Advances in preservation technologies, such as normothermic machine perfusion, enhance organ viability during transportation and storage. Government initiatives supporting organ donation programs further boost the market.

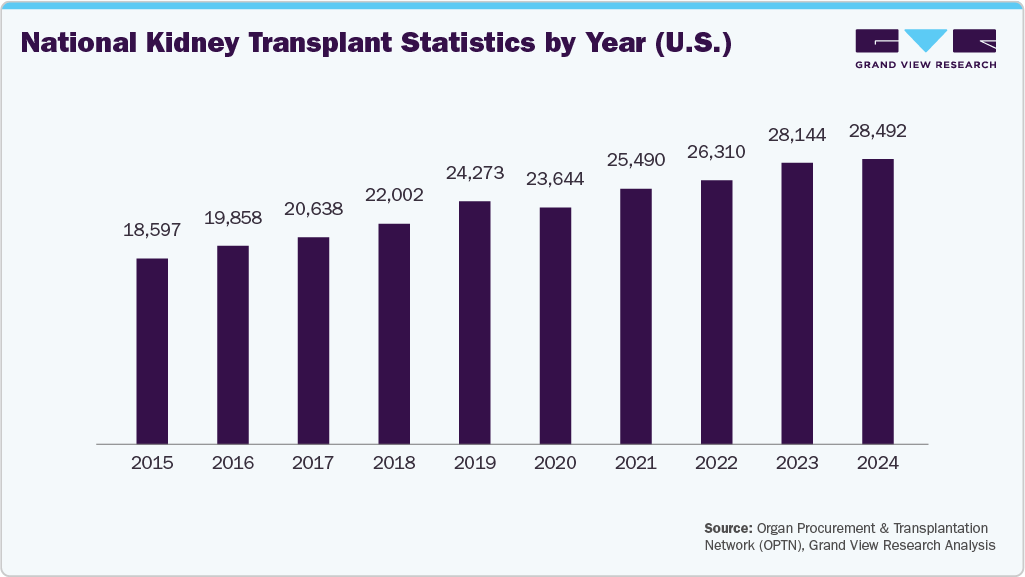

A major driver of the U.S. kidney preservation market's expansion is the consistent rise in deceased donor transplants, which has led to a greater need for reliable preservation solutions. For instance, according to the Organ Procurement & Transplantation Network (OPTN), the deceased donor transplants in the U.S. increased from 12,279 in 2014 to 22,074 in 2024. According to recent trends, the number of deceased donors has increased due to a combination of opioid-related deaths and expanded donor acceptance criteria. As organ procurement organizations (OPOs) prioritize the recovery of kidneys from donors with varying physiological profiles, including those with AKI or comorbidities, reliance on advanced preservation becomes critical to optimize transplant outcomes. Additionally, the 2021 shift to a distance-based kidney allocation policy by UNOS has increased the geographic radius of organ distribution, further intensifying the importance of extended preservation techniques.

Similarly, the number of kidney transplants in the U.S. is witnessing a significant surge, which is expected to continue over the forecast period, thereby increasing the demand for advanced kidney preservation solutions.

Moreover, the growth of the U.S. kidney preservation market is also driven by a rise in government and organizational initiatives aimed at boosting kidney donation rates. Federal programs such as the Advancing American Kidney Health Initiative and policy reforms by the Centers for Medicare & Medicaid Services (CMS) have prioritized expanding access to transplantation by incentivizing organ procurement organizations (OPOs) to increase recovery and utilization of viable kidneys.

In 2024, the Gift of Life Donor Program led U.S. organ procurement organizations by coordinating 947 kidney transplants, marking its ninth consecutive year at the forefront. Celebrating its 50th anniversary, the Philadelphia-based organization has facilitated over 21,000 kidney transplants. Such initiatives by various organizations are further expected to increase the number of kidney donations in the country, thereby driving demand for preservation solutions over the forecast period.

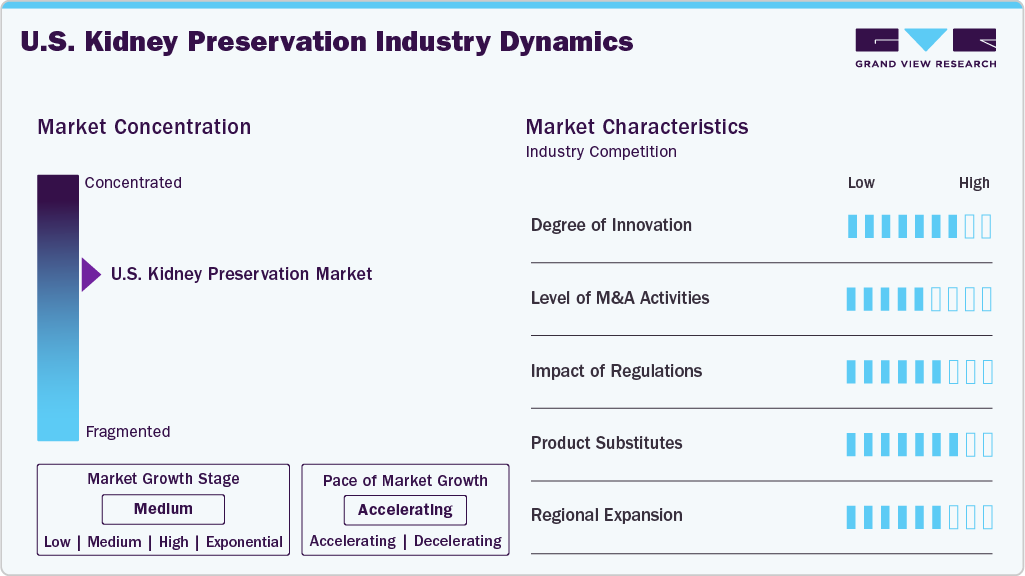

Market Concentration & Characteristics

The U.S. kidney preservation industry is characterized by increasing investments, a growing focus on innovation, a supportive regulatory framework, and an evolving competitive landscape. Moreover, the rising incidence of end-stage renal disease (ESRD) and chronic conditions such as diabetes and hypertension further shapes the market.

The U.S. kidney preservation industry is witnessing a significant degree of innovation, driven by advancements in surgical techniques, immunosuppressive therapies, and organ preservation methods. The innovation in this market is largely focused on improving graft survival rates, reducing complications, and increasing the availability of donor kidneys. Moreover, the increasing investment in the development of advanced technologies and solutions for kidney preservation is further expected to drive innovation over the forecast period. For instance, in February 2025, the National Kidney Foundation (NKF) Innovation Fund invested in NorthernLight, a medical device company, to advance next-generation kidney preservation technology. This investment aims to improve kidney transplantation outcomes by enhancing preservation techniques. NorthernLight's technology has the potential to increase the availability of kidneys for transplantation. The NKF Innovation Fund supports innovative solutions to improve kidney health and transplantation.

Mergers and acquisitions in the U.S. kidney preservation market are accelerating, driven by the need for consolidation and improved patient care. For instance, in August 2024, Getinge announced the acquisition of Paragonix to significantly enhance its healthcare portfolio and address critical needs in solid organ transplantation. This strategic move aims to expand access to Paragonix's advanced organ preservation systems. Integration is expected to encourage innovations by combining organ containment and blood perfusion technologies.

The U.S. market for kidney preservation is significantly influenced by regulatory frameworks that aim to ensure the safety and efficacy of transplant procedures and related products. The regulatory environment is characterized by stringent guidelines set by organizations such as the U.S. Food and Drug Administration (FDA) and the Organ Procurement and Transplantation Network (OPTN). The FDA plays a crucial role in regulating the approval process for organ preservation solutions and technologies. Compliance with these regulations requires significant investment in research, development, and administrative processes.

The market faces a significant threat from substitutes that can significantly influence treatment options for patients. The primary substitutes include dialysis, advancements in immunosuppressive drugs, and emerging technologies such as xenotransplantation and bioengineered kidneys. Dialysis is a significantly prevalent treatment modality for ESRD patients, offering a substitute for transplantation in terms of survival. Bioengineered kidneys, another emerging technology, aim to create functional kidney tissue or whole organs for transplantation, potentially revolutionizing the treatment landscape.

The evolving donor organ availability landscape and growing awareness of kidney disease drive regional expansion in the U.S. kidney preservation industry. The Midwest and Northeast regions are witnessing a significant rise in transplants, which is driven by state-level initiatives aimed at improving organ donation rates. Additionally, the increasing accessibility of regional transplant centers has facilitated better access to care for patients in underserved areas, enhancing patient outcomes through improved pre- and post-operative support.

Preservation Solution Insights

The University of Wisconsin (UW) accounted for the largest revenue share of 75.7% in 2024 due to its effective composition and clinical validation. The UW solution has gained significant preference in kidney transplants because of its superior ability to maintain organ viability during cold storage. Its unique formulation, which includes components such as lactobionate and raffinose, minimizes cellular swelling and oxidative damage, thereby enhancing graft survival and function. Moreover, the solution’s proven performance in reducing delayed graft function and supporting better post-transplant outcomes has further contributed to its high adoption rates.

Celsior solution is expected to witness the fastest growth due to its superior efficacy in extended organ preservation and rising clinical adoption in transplant centers. Celsior offers enhanced antioxidant properties and superior buffering capacity, which help mitigate ischemia-reperfusion injury during kidney transplantation. These attributes are witnessing demand due to the increasing demand for marginal and extended criteria donor kidneys, where preservation quality is crucial. Additionally, ongoing advancements in transplant protocols and surgeons' preference for solutions that support longer cold ischemia times are further favoring Celsior’s adoption.

Technique Insights

Normothermic Machine Perfusion (NMP) accounted for the largest revenue share and is expected to witness the fastest CAGR over the forecast period, due to its ability to address key limitations associated with traditional static cold storage. NMP maintains the organ at physiological temperature, allowing continuous oxygen and nutrient supply, which supports cellular metabolism and reduces ischemic injury. This technique enables real-time assessment of organ viability, giving transplant teams critical information before implantation and expanding the pool of usable donor kidneys. As healthcare systems increasingly prioritize long-term cost-effectiveness and clinical outcomes, the demand for NMPs is expected to witness growth over the forecast period.

The Static Cold Storage (SCS) segment also held a significant market share in 2024, owing to its cost-effectiveness, simplicity, and widespread clinical acceptance. This method involves cooling the organ to reduce its metabolic rate, thereby preserving its viability for transplantation without the need for complex equipment. While more advanced methods like hypothermic machine perfusion are gaining attention for marginal or extended criteria donors, static cold storage remains the preferred choice for standard donor kidneys due to its reliability and ease of integration into existing workflows.

Donor Type Insights

The living kidney donors dominated the market in 2024 owing to their several clinical and logistical advantages. Kidneys from living donors are generally healthier and have shorter ischemia times, which leads to better transplant outcomes, including improved graft survival and reduced complications. Furthermore, living donations allow for scheduled procedures, enabling optimal pre-transplant preparation and the use of advanced preservation techniques such as hypothermic machine perfusion. This planned approach enhances the quality of organ preservation and minimizes cold ischemia injury. The growing emphasis on value-based care in the U.S. healthcare system also supports living donations, as they often result in lower long-term costs due to better post-transplant outcomes, thereby fueling the segment's growth.

The Donation after Circulatory Death (DCD) is expected to witness the fastest growth over the forecast period, due to a combination of clinical advancements and evolving organ procurement practices. With the significant shortage of transplantable kidneys, DCD has emerged as a crucial strategy to expand the donor pool beyond traditional Donation after Brain Death (DBD) sources. Furthermore, national transplant initiatives and updated organ allocation policies have increased the acceptance and utilization of DCD kidneys by transplant centers.

End Use Insights

Transplant centers and hospitals dominated the end use segment due to their central role in organ transplantation procedures and their access to advanced preservation technologies. These facilities are equipped with specialized infrastructure, such as dedicated transplant units and trained surgical teams, enabling them to manage complex kidney transplant workflows. Additionally, the integration of cutting-edge organ preservation techniques, such as hypothermic and normothermic machine perfusion, is more feasible in hospital settings due to greater financial and technological resources, further fueling the segment growth

Organ Procurement Organizations (OPOs) are expected to witness the fastest growth over the forecast period, due to their central role in organ recovery, preservation, and allocation. OPOs directly handle the logistics of kidney procurement and transport, which drives demand for advanced preservation solutions. The increasing number of registered donors and growing public awareness about organ donation are expanding the volume of kidneys retrieved for transplantation, boosting the operational intensity of OPOs. Additionally, ongoing advancements in preservation technologies, such as hypothermic machine perfusion and normothermic perfusion, are being rapidly adopted by OPOs to improve organ viability and reduce cold ischemia time, thereby fueling the segment growth.

Key U.S. Kidney Preservation Company Insights

Leading market players include TransMedics Inc.; XVIVO; Bridge to Life Ltd.; and Paragonix. These companies have utilized their technological expertise to enhance their presence in this growing market. Their strategies emphasize the development of effective solutions, and improved accessibility, and ensuring widespread adoption of their advanced preservation solutions.

Key U.S. Kidney Preservation Companies:

- TransMedics Inc.

- XVIVO

- Bridge to Life Ltd.

- Paragonix Technologies Inc.

- OrganOx Limited

- Organ Recovery Systems

- Institut Georges Lopez (IGL)

- Preservation Solutions, Inc.

- Global Transplant Solutions

- Essential Pharmaceuticals LLC

Recent Developments

-

In January 2025,Paragonix Technologies announced the world's first in-human use of the KidneyVault renal perfusion system, a device designed to preserve kidneys for transplantation. The system aims to improve kidney preservation and reduce the risk of graft failure.

-

In October 2024,Paragonix Technologies received FDA 510(k) clearance for its KidneyVault Portable Renal Perfusion System, a device designed to preserve kidneys for transplantation. The system aims to improve kidney preservation and transplantation outcomes. The clearance enables the use of the KidneyVault system in clinical settings.

U.S. Kidney Preservation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.7 million

Revenue forecast in 2030

USD 31.8 million

Growth Rate

CAGR of 6.97% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, technique, donor type, end use

Country scope

U.S.

Key companies profiled

TransMedics Inc.; XVIVO; Bridge to Life Ltd.; Paragonix Technologies Inc.; OrganOx Limited; Organ Recovery Systems; Institut Georges Lopez (IGL); Preservation Solutions, Inc.; Global Transplant Solutions; Essential Pharmaceuticals LLC

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Kidney Preservation Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. kidney preservation market report based on preservation solution, technique, donor type, and end use.

-

Preservation Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

University of Wisconsin (UW)

-

Histidine-Tryptophan-Ketoglutarate (HTK) Solution

-

Celsior Solution

-

Hypertonic Citrate Adenine (HC-A) Solution

-

Institute Georges Lopez (IGL-1) Solution

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Static Cold Storage

-

Hypothermic Machine Perfusion

-

Normothermic Machine Perfusion

-

Other

-

-

Donor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Criteria Donor (SCD)

-

Expanded Criteria Donor (ECD)

-

Donation after Brain Death (DBD)

-

Donation after Circulatory Death (DCD)

-

Living Donor

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transplant Centers / Hospitals

-

Organ Procurement Organizations (OPOs)

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. kidney preservation market size was estimated at USD 21.2 million in 2024 and is expected to reach USD 22.7 million in 2025.

b. The U.S. kidney preservation market is expected to grow at a compound annual growth rate of 6.97% from 2025 to 2030 to reach USD 31.8 million by 2030.

b. Normothermic Machine Perfusion (NMP) accounted for the largest revenue share and is expected to witness the fastest growth due to its ability to address key limitations associated with traditional static cold storage.

b. Some key players operating in the U.S. kidney preservation market include TransMedics Inc.; XVIVO; Bridge to Life Ltd.; Paragonix Technologies Inc.; OrganOx Limited; Organ Recovery Systems; Institut Georges Lopez (IGL); Preservation Solutions, Inc.; Global Transplant Solutions; Essential Pharmaceuticals LLC

b. Key factors that are driving the market growth include the rising incidence of end-stage renal disease (ESRD) and chronic conditions such as diabetes and hypertension. The increasing demand for kidney transplants also fuels market growth. Government initiatives supporting organ donation programs further boost the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.