- Home

- »

- Homecare & Decor

- »

-

U.S. Kids Storage Furniture Market, Industry Report, 2030GVR Report cover

![U.S. Kids Storage Furniture Market Size, Share & Trends Report]()

U.S. Kids Storage Furniture Market Size, Share & Trends Analysis Report By Type (Wardrobes, Bookshelves), By Material (Wood, Plastic), By Distribution Channel (Online, Offline), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-231-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Kids Storage Furniture Market Trends

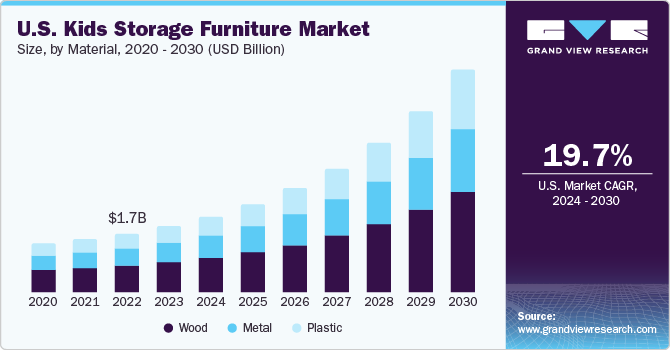

The U.S. kids storage furniture market size was estimated at USD 1.90 billion in 2023 and is expected to grow at a CAGR of 19.7% from 2024 to 2030. The market growth is attributed to the favorable demographic trends, rising living standards, and the increasing popularity of dedicated kids spaces within homes. Millennials, particularly parents, are emerging as a key demographic in the market, showing a growing inclination towards premium and upscale children's furniture. Moreover, millennial parents have become mindful of their long-term investments, often conducting thorough online research before making purchase decisions.

U.S. kids storage furniture market accounted for the share of 15.1% of the global kids storage furniture market revenue in 2023. An increasing number of young and millennial parents in the country is likely to favor the growth of the kid’s furniture market. According to the U.S. Census Bureau, the youngest millennials reached adulthood in 2020 and accounted for 28% of the U.S. population; they also accounted for 50% of the working population.

The kid furniture market includes a wide range of products, including beds, chairs, tables, dressers, and storage units specifically designed for children. The demand for kids furniture is primarily driven by factors such as rising disposable income, changing lifestyles, and a growing focus on providing specialized and aesthetically pleasing products for children.

With a rise in dual-income households, there is a higher demand for childcare services. There is a growing requirement for reliable and professional childcare solutions for children during working hours. This has increased the number of daycare and crèche facilities in both schools as well as office compounds, resulting in an increased demand for kids furniture in commercial spaces.

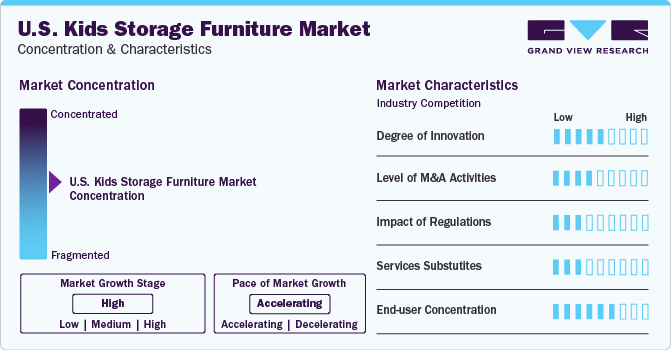

Market Concentration & Characteristics

The U.S. kids storage furniture market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. As technology becomes increasingly integrated into daily life, smart storage solutions have grown in popularity. Parents appreciate the educational and entertainment value that smart furniture can bring to a child's room, with features like built-in LED lights, interactive elements, and furniture with tech-friendly functionalities.

The collaboration introduces a line of kids furniture that avoids a typical "kid-specific" look, opting for neutral tones and high-quality materials. New entrants and emerging market players can focus on partnering with DTC brands to diversify their product offerings and explore new customer acquisition channels to increase sales.Key players in the market focus on offering designs that combine practical, playful, and modern elements. In November 2023, Belgian designer Anne-Sophie Rosseel’s brand House of RoRo introduced 'Interlockables,' a collection that stands out in terms of gender-neutrality, sustainability, and multifunctionality.

The end-user concentration is a significant factor in the U.S. kids storage furniture market. The increasing focus on safety-centric designs in the kid’s storage furniture market is propelling the market growth. Parents prioritize storage furniture that ensures the well-being of their children, with features like rounded edges, anti-tip mechanisms, and childproof locks. Manufacturers are responding by seamlessly integrating safety measures into their designs, making safety a fundamental aspect of their products.

Distribution Channel

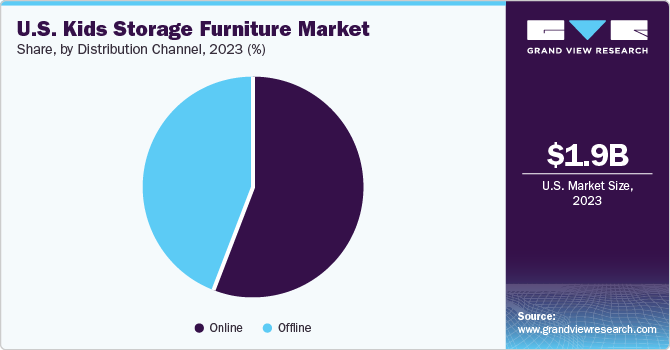

The offline sales of the kids storage furniture in the U.S. accounted for a revenue share of 55.98% in 2023. Offline stores offer customers the look and feel of the furniture and help them select furniture according to their requirements. Retail stores that offer furniture create a demo home environment in the store, helping customers visualize furniture in their home space. Moreover, the availability of furniture under one roof helps the customers shop for various needs.

The online distribution channel is projected to grow at a CAGR of 20.9% over the forecast period. The increasing online buying trend is driving the segment’s growth. The companies operating in the market can set up ties with third-party distributors and retail stores to increase their sales. Companies can also utilize online channels as a part of the indirect sales channel to enhance the customer base.

Type Insights

The kids bookshelves accounted for a revenue share of 31.84% in 2023. Growing demand for reading books has created a great opportunity for bookshelves. Given the varying weights of books, adjustable shelves in bookshelves help accommodate different sizes and prevent sagging or damage. This feature allows for easy customization of shelf heights, ensuring efficient organization and maximizing storage space.

The kids wardrobe market in the U.S. is expected to grow at a CAGR of 20.8% from 2024 to 2030. Wardrobes which prioritize safety, functionality, and aesthetics are typically preferred. Parents often opt for wardrobes with rounded edges and secure anchoring mechanisms to ensure child safety. In addition, adjustable shelves and hanging rails allow for flexible storage solutions as children's needs evolve.

Material Insights

The wooden kid's storage furniture market in the U.S. accounted for a revenue share of 46.16% in 2023. Every variety of wood possesses distinct characteristics that contribute varying degrees of warmth, emphasis, and beauty to its environment. Due to its natural patterns, each hardwood is one-of-a-kind, offering a unique product with no two pieces alike.

Rafa Kids is a contemporary children's furniture brand known for its innovative designs and high-quality craftsmanship. The company focuses on creating functional and stylish furniture pieces that encourage creativity and imagination in children's spaces.

The plastic kids storage furniture market in the U.S is expected to grow at a CAGR of 21.6% over the forecast period of 2024 to 2030. Plastic storage furniture for kids is lightweight, facilitating easy handling and promoting independence and organizational skills in children. In addition, its waterproof and weatherproof properties make it suitable for rainy days, while its rounded edges ensure safety for kids. It can be customized in various colors and designs to match children's preferences and room décor. Furthermore, its affordability ensures accessibility to families with different budgets.

Key U.S. Kids Storage Furniture Company Insights

Some of the key players operating in the market include Williams Sonoma, Inc., Billion Dollar Baby Co., and Delta Children's Products Corp.

-

Williams-Sonoma, Inc. is a premier specialty retailer renowned for high-quality home products. Its diverse family of brands, including Williams Sonoma, Pottery Barn, and West Elm, is recognized for stylish and functional offerings spanning various home segments. Since its inception, Williams-Sonoma, Inc. has evolved into a multi-channel global enterprise, embracing technologies like 3D imaging and augmented reality with the acquisition of Outward, Inc.

-

Billion Dollar Baby Co. is a family-owned and operated company. With seven distinct brands of kids furniture that suit varied tastes and budgets, it has grown into a diversified business. The portfolio includes award-winning and sustainable designs, available in major retailers such as Target and Amazon, as well as specialty stores like Crate and Barrel and Pottery Barn Kids. Billion Dollar Baby Co. encompasses multiple brands like Babyletto, DaVinci, Nursery Works, Namesake, Franklin & Ben, and Ubabub, offering in-house designed furniture. The company maintains partnerships with global suppliers and retailers who align with its values.

KidKraft, Circu Magical Furniture, and Crate and Barrel are some of the other participants in the U.S. kids storage furniture market,

-

Crate and Barrel is a home furnishing retailer, with brands like Crate & Kids, Crate & Barrel, CB2, and Hudson Grace. With a global presence encompassing over 100 stores and franchise partners in nine countries, the company stands is an international destination for contemporary and modern furniture, housewares, and décor.

-

KidKraft is a prominent player in the toy and furniture industry, dedicated to enhancing childhood experiences by creating spaces for kids. The company's extensive collection includes trains, dollhouses, swing sets, play kitchens, and indoor and outdoor furniture, consistently earning recognition and awards from industry experts. KidKraft's products are sold in over 90 countries. Designed to cater to diverse families, homes, and backyards, the products prioritize classic, imaginative play while incorporating elements of technology to meet modern-day kids needs.

Key U.S. Kids Storage Furniture Companies:

- Williams Sonoma, Inc.

- Billion Dollar Baby Co

- Delta Children's Products Corp.

- KidKraft

- Circu Magical Furniture

- Crate and Barrel

- Casa Kids

- American Signature

- Rooms To Go

- Graco

Recent Developments

- In January 2024, Crate and Barrel secured a lease for a fresh retail space spanning 23,400 square feet in Lawrenceville, Georgia (U.S.). With a presence in over nine countries, the company manages a network of over 100 stores and franchise partnerships. The upcoming store in Lawrenceville will be among the 15 outlets the company oversees in North America.

U.S. Kids Storage Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.17 billion

Revenue forecast in 2030

USD 6.38 billion

Growth rate

CAGR of 19.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, distribution channel

Country scope

U.S.

Key companies profiled

Williams Sonoma, Inc.; Billion Dollar Baby Co; Delta Children's Products Corp.; KidKraft; Circu Magical Furniture; Crate and Barrel; Casa Kids; American Signature; Rooms To Go; Graco

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Kids Storage Furniture Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. kids storage furniture market report based on type, material, and distribution channel:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wardrobes

-

Toy Storage

-

Bookshelves

-

Chests

-

Boxes & Baskets

-

Hooks & Hangers

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Metal

-

Plastic

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. kids storage furniture market was estimated at USD 1.90 billion in 2023 and is expected to reach USD 2.17 billion in 2024.

b. The U.S. kids storage furniture market is expected to grow at a compound annual growth rate of 19.7% from 2024 to 2030 to reach USD 6.38 billion by 2030.

b. Kids bookshelves dominated the U.S. kids storage furniture market with a share of around 31.8% in 2023. Growing demand for reading books has created a great opportunity for bookshelves. Given the varying weights of books, adjustable shelves in bookshelves help accommodate different sizes and prevent sagging or damage.

b. Some of the key players operating in the U.S. kids storage furniture market include Williams Sonoma, Inc.; Billion Dollar Baby Co; Delta Children's Products Corp.; KidKraft; Circu Magical Furniture; Crate and Barrel; Casa Kids; American Signature; Rooms To Go; Graco

b. The market growth is attributed to favorable demographic trends, rising living standards, and the increasing popularity of dedicated kids spaces within homes. Millennials, particularly parents, are emerging as a key demographic in the market, showing a growing inclination towards premium and upscale children's furniture

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."