- Home

- »

- Homecare & Decor

- »

-

Kids Storage Furniture Market Size And Share Report, 2030GVR Report cover

![Kids Storage Furniture Market Size, Share & Trends Report]()

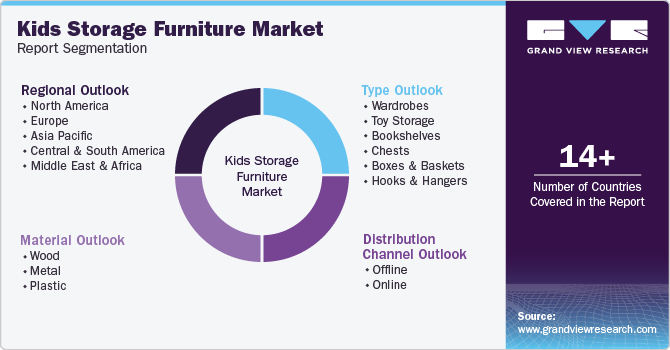

Kids Storage Furniture Market Size, Share & Trends Analysis Report By Type (Wardrobes, Toy Storage, Bookshelves, Chests, Boxes & Baskets), By Material (Wood, Metal, Plastic), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-027-9

- Number of Report Pages: 84

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Kids Storage Furniture Market Size & Trends

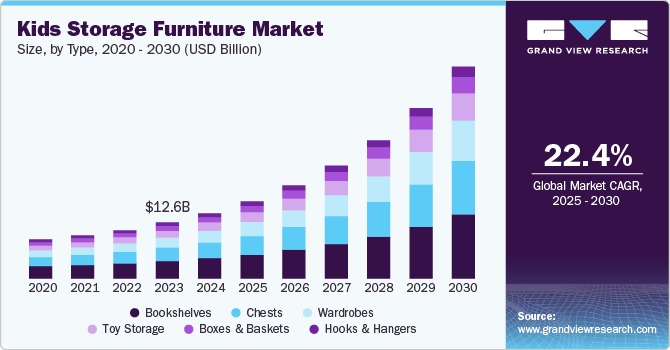

The global kids storage furniture market size was estimated at USD 14.65 billion in 2024 and is expected to grow at a CAGR of 22.4% from 2025 to 2030. Urbanization and smaller living spaces worldwide have amplified the need for compact, adaptable storage solutions. Furniture that offers dual functions, such as beds with built-in drawers or stackable bins, has become popular, allowing families to maximize room usage. Sustainability also influences consumer choices; parents often prefer versatile, long-lasting furniture that grows with the child. This trend toward multifunctional pieces meets both environmental and economic considerations, as it minimizes the need for frequent replacements. Design aesthetics are another factor, with parents looking for stylish storage furniture that aligns with contemporary home decor, ensuring kids' spaces are cohesive with the household’s style.

The evolving needs of modern families and a shift toward multifunctional, child-centered living spaces fuel the demand for kids' storage furniture. Parents today prioritize organized, structured environments that can support learning, play, and growth in increasingly compact homes, especially in urban areas. Storage furniture specifically designed for children helps families optimize space by incorporating shelves, drawers, and compartments that hold toys, books, clothes, and other essentials within reach. This not only fosters independence and organizational skills in children but also supports parents in creating well-managed spaces that adapt to their kids’ changing needs.

Furthermore, the rising focus on safety has led to a high demand for child-friendly furniture crafted from non-toxic materials with smooth edges and sturdy construction, ensuring both functionality and peace of mind. Many manufacturers are responding by designing modular, adaptable furniture that can evolve with the child, extending its usefulness through different developmental stages. These pieces often serve dual purposes, like beds with under-storage drawers or tables with built-in shelving, making them appealing for families looking to maximize limited space.

Additionally, the trend toward sustainable living also influences purchasing decisions. Parents are increasingly opting for durable, versatile furniture made from eco-friendly or sustainably sourced materials, aiming to reduce waste and the need for frequent replacements. Design aesthetics play a crucial role as well, as parents seek pieces that blend with contemporary home decor, incorporating neutral colors and minimalist designs that keep kids’ spaces visually appealing without clashing with overall household style.

Type Insights

Bookshelves accounted for about 31.20% of the market revenue in 2024. Bookshelves not only provide practical storage for books but also encourage children to develop an early habit of reading and organizing their belongings independently. Many bookshelves are designed with kid-friendly heights and safety features, allowing children to safely reach and manage their items. Furthermore, with design trends favoring multifunctional and aesthetic furniture, bookshelves for kids are crafted to enhance room decor, blending both functionality and style to suit modern homes.

Wardrobe sales is expected to grow at a CAGR of about 24.0% from 2025 to 2030. Wardrobes provide ample space for hanging clothes, storing shoes, and keeping accessories neatly arranged, making it easier for children to find and access their belongings independently. Many modern wardrobes are designed with adjustable compartments and safety features to meet the evolving needs of growing children. Additionally, with an emphasis on space optimization, parents favor compact, multifunctional wardrobes that blend practicality with a visually appealing design for children’s rooms.

Distribution Channel Insights

Offline sales accounted for a share of 44% in kids storage furniture market in 2024. Physical stores allow parents to examine quality, sturdiness, and safety features up close, ensuring the furniture meets their standards for children's spaces. Additionally, offline shopping provides immediate assistance from knowledgeable staff, which many parents value when making decisions about furniture for their children. The convenience of same-day pickup also attracts customers who prefer to deliver immediately.

Online sales are expected to grow at a CAGR of 23.6% from 2025 to 2030. Parents increasingly favor the ability to shop from home, saving time and avoiding the hassle of in-store visits. Online platforms offer a wide selection, allowing shoppers to easily find specific sizes, styles, and colors tailored to children's spaces. Furthermore, many online stores provide detailed product descriptions, customer reviews, and virtual tools that help buyers make informed decisions. Added conveniences such as doorstep delivery, flexible payment options, and simplified return policies also make online shopping particularly appealing, especially for parents balancing busy schedules.

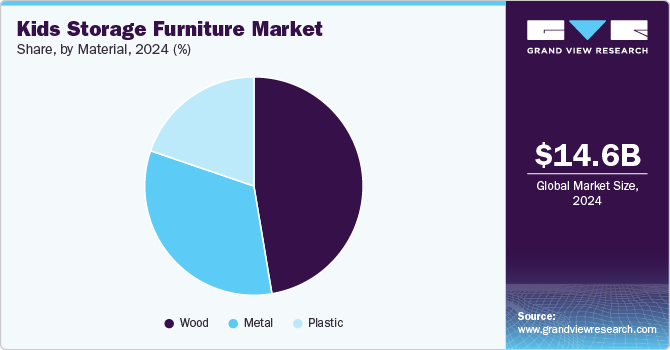

Material Insights

Wooden kids storage furniture accounted for a significant share of over 47% in market in 2024. Wood is valued for its sturdiness, which is essential in furniture designed to withstand active use by children. Additionally, wooden furniture is often made from sustainably sourced materials, appealing to environmentally conscious consumers. Wood also offers versatility in design, allowing for finishes that suit various styles, from classic to modern, making it a preferred choice for creating both functional and visually pleasing kids' storage solutions.

Plastic material furniture is projected to grow at a compound annual growth rate (CAGR) of approximately 24.1% from 2025 to 2030. Plastic furniture offers affordability and durability, ideal for children’s rooms where furniture might need to endure active use. Its lightweight nature makes plastic furniture easy to rearrange and handle, which is beneficial for spaces requiring flexibility. Additionally, plastic furniture’s variety of bright colors and fun designs appeals to children’s tastes and allows parents to create vibrant, engaging environments that are also easy to clean and maintain.

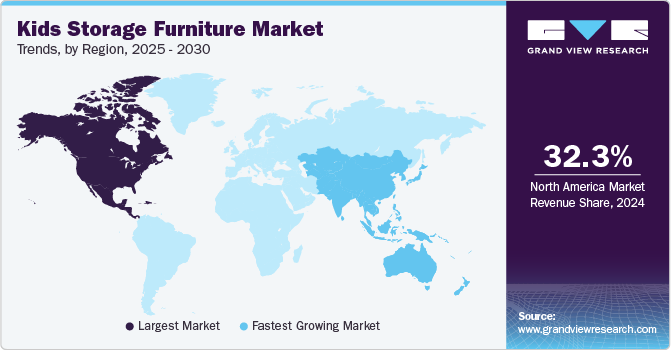

Regional Insights

The North America kids storage furniture market in accounted for a market share of around 32.48% in 2024 in the global market. Evolving family dynamics, with more emphasis on creating organized, multifunctional spaces for children’s activities at home, drive the demand for kids' storage furniture. As families prioritize effective storage for toys, books, clothes, and school supplies, there’s a growing preference for furniture that balances functionality with design. Parents increasingly seek durable, versatile furniture that grows with children, adapting to their changing needs. Additionally, the rising awareness of eco-friendly, sustainable options has led consumers to favor high-quality, long-lasting materials, reinforcing the value of kids' storage furniture in North American households.

U.S. Kids Storage Furniture Market Trends

In 2024, the kids storage furniture market in U.S. held a dominant share of over 45% of the North American market. With many families managing smaller living spaces, efficient storage solutions have become essential for keeping rooms tidy while maximizing floor space. Additionally, the trend towards sustainable, long-lasting products has led consumers to seek high-quality, durable furniture that can grow with their child’s needs. Parents in the U.S. also value aesthetically pleasing designs that complement home decor, adding to the appeal of kids' storage furniture.

Europe Kids Storage Furniture Market Trends

The kids storage furniture market in Europe accounted for a share of over 27% in 2024. European families often live in compact urban spaces, prompting a strong preference for furniture that maximizes storage without taking up too much room. Moreover, environmental awareness is particularly high in Europe, leading parents to seek out eco-friendly, responsibly sourced furniture for children’s spaces. Design preferences in Europe also emphasize quality and minimalism, driving demand for kids' furniture that is both functional and aesthetically aligned with modern European decor trends.

The kids storage furniture market in UK accounted for a share of over 25% Europe regional share in 2024. As families focus on creating organized, versatile spaces for children within typically smaller homes or apartments, the demand for kids' storage furniture increases. With an emphasis on functionality, UK parents are looking for compact, multi-functional storage solutions that optimize room space while promoting tidiness. Environmental consciousness is strong in the UK, leading to higher demand for sustainable, responsibly sourced materials in children’s furniture. Additionally, there’s a trend toward timeless, minimalist designs that complement modern British home decor, making stylish, durable storage furniture highly desirable.

Asia Pacific Kids Storage Furniture Market Trends

The kids storage furniture market in Asia Pacific is expected to grow at CAGR of 24.4% from 2025 to 2030. The increasing demand for kids' storage furniture is driven by urbanization, changing lifestyles, and an emphasis on functional, organized living spaces. Many families in metropolitan areas live in compact homes, where efficient storage solutions for children’s items, like toys, clothes, and books, are essential for maximizing space. As disposable incomes rise, there’s also a shift toward investing in high-quality, multi-functional furniture that adapts to children’s growth. Additionally, parents in the Asia Pacific are increasingly seeking child-safe, eco-friendly options that blend practicality with aesthetics, aligning with global trends in sustainable and stylish home decor. These preferences, combined with a strong focus on creating learning-friendly environments at home, have further fueled the demand for kids' storage furniture across the region.

With a strong trend toward smaller homes, parents are seeking compact, multi-functional storage solutions that keep children’s belongings organized without overwhelming the space. Rising incomes have also led to greater investment in quality furniture that offers durability and adaptability as children grow. Additionally, Chinese consumers increasingly value eco-friendly materials and safety features, aligning with their focus on sustainable, child-friendly home environments.

Key Kids Storage Furniture Company Insights

Some of the key companies include Williams Sonoma Inc., Million Dollar Baby Co.; Wayfair Inc.; Blu Dot

-

Williams-Sonoma, Inc. is an American retailer specializing in premium home furnishings and kitchenware. It is known for its high-quality products across brands like Pottery Barn Kids and West Elm Kids. In the kids' storage furniture market, Williams-Sonoma offers a range of stylish, functional storage solutions designed to meet the needs of modern families. These include modular shelving, toy organizers, bookcases, and multi-functional storage units that blend practicality with safe, durable materials. The company emphasizes eco-friendly practices and crafts pieces that align with various decor styles, making them popular for family-focused spaces.

-

Million Dollar Baby Co. is a family-owned company known for its premium children’s furniture, offering a variety of products that prioritize quality, safety, and style. Million Dollar Baby Co. provides functional and durable storage options, including dressers, shelving units, and organizers designed to fit seamlessly into children’s spaces. The brand emphasizes sustainability and child-safe materials, crafting furniture that combines practicality with elegant design. Their products are popular among parents seeking lasting, versatile storage solutions for kids' rooms.

Key Kids Storage Furniture Companies:

The following are the leading companies in the kids storage furniture market. These companies collectively hold the largest market share and dictate industry trends.

- Williams Sonoma Inc.

- Million Dollar Baby Co.

- Wayfair Inc.

- Blu Dot

- First Cry

- KidKraft

- Sorelle Furniture

- Circu Magical Furniture

- Crate and Barrel

- Casa Kids

View a comprehensive list of companies in the Kids Storage Furniture Market

Recent Developments

-

In August 2022, Aldi announced the launch of a new kids' furniture range aimed at decorating nurseries, featuring affordable and stylish pieces that include essentials like storage units, bookcases, and beds. The collection focuses on practicality with items designed to help organize children's spaces while adding a charming, modern touch to nursery decor. This furniture line provides parents with budget-friendly options that don’t compromise on aesthetics or functionality, aligning with Aldi’s reputation for accessible, quality home products.

Kids Storage Furniture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.34 billion

Revenue forecast in 2030

USD 47.62 billion

Growth rate

CAGR of 22.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Williams Sonoma Inc.; Million Dollar Baby Co.; Wayfair Inc.; Blu Dot; First Cry; KidKraft; Sorelle Furniture; Circu Magical Furniture; Crate and Barrel; Casa Kids

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Kids Storage Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kids storage furniture market report on the basis of type, material, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wardrobes

-

Toy Storage

-

Bookshelves

-

Chests

-

Boxes & Baskets

-

Hooks & Hangers

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Wood

-

Metal

-

Plastic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global kids storage furniture market was estimated at USD 14.65 billion in 2024 and is expected to reach USD 17.34 billion in 2025.

b. The global kids storage furniture market is expected to grow at a compound annual growth rate of 22.4% from 2025 to 2030 to reach USD 47.62 billion by 2030.

b. North America dominated the kids storage furniture market with a share of around 32.48% in 2024. This is owing to the growing urbanization and increase of purchase of toys, clothes, and accessories for kids.

b. Some of the key players operating in the kids storage furniture market include Williams Sonoma Inc.; Million Dollar Baby Co.; Wayfair Inc.; Blu Dot; First Cry; KidKraft; Sorelle Furniture; Circu Magical Furniture; Crate and Barrel; Casa Kids

b. Key factors that are driving the kids storage furniture market growth include the increasing consumer spending on home remodeling and growing consumer preference for aesthetic and utility-based furniture.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."