- Home

- »

- Medical Devices

- »

-

U.S. Laparotomy Sponge Market Size, Industry Report, 2033GVR Report cover

![U.S. Laparotomy Sponge Market Size, Share & Trends Report]()

U.S. Laparotomy Sponge Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Radiopaque Laparotomy Sponge, Traditional Laparotomy Sponge, Radio-frequency Identification Laparotomy Sponge), By End-use (Hospitals & Clinics), And Segment Forecasts

- Report ID: GVR-4-68040-705-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Laparotomy Sponge Market Trends

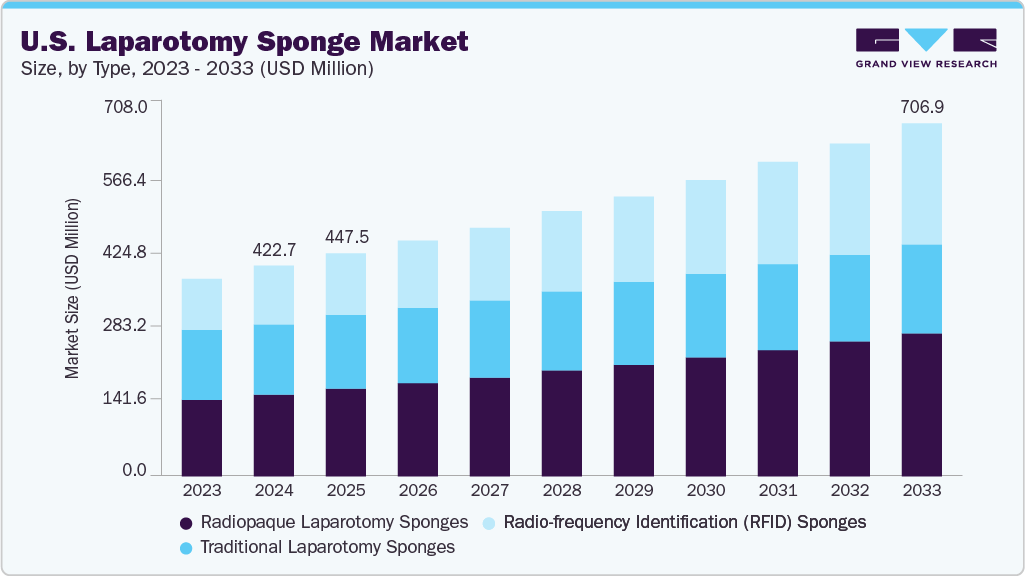

The U.S. laparotomy sponge market size was valued at USD 422.7 million in 2024 and is projected to reach USD 706.9 million by 2033, growing at a CAGR of 5.9% from 2025 to 2033. Key factors driving growth include a rise in abdominal surgeries due to conditions such as cancer and hernias, as well as an increase in C-sections. Demand is further enhanced by concerns regarding retained surgical items, which have led to the adoption of radiopaque and RFID-enabled sponges. Additionally, the growth is fueled by the aging population, increased surgical volumes in outpatient settings, and advancements in sponge design and materials, all supported by regulatory emphasis on surgical safety and infection control.

Additionally, the U.S. is witnessing heightened focus on surgical safety, particularly in preventing retained surgical items (RSIs). RSIs, especially sponges, are among the most common and dangerous surgical errors, leading to severe complications, repeat surgeries, infections, and even fatalities. For instance, according to the National Quality Forum (NQF), 2,000-4,000 cases of retained surgical items (RSIs) are reported yearly in the U.S., where sponges are the most frequently retained objects.

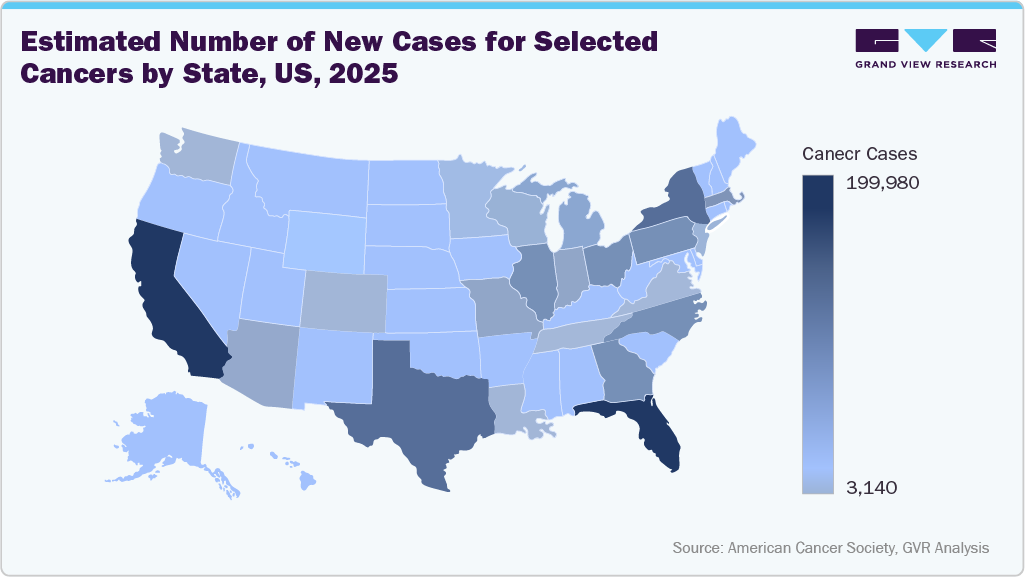

Laparotomy sponges are used in sterile, high-bleeding-risk operations, including resections. According to the American Cancer Society, approximately 106,180 new colorectal cases were recorded in the U.S., many of which require open (laparotomy) procedures, where sponges are essential for fluid management and tissue retraction.

Sustainability, ergonomic design, and targeted customization are emerging as influential factors in the evolution of laparotomy sponges in the U.S. healthcare market. As hospitals increasingly prioritize environmentally responsible procurement, manufacturers are responding by developing laparotomy sponges made with eco-friendly materials, reduced packaging waste, and biodegradable components. These innovations align with broader institutional goals of lowering medical waste and achieving greener operating room practices. In a market that has historically focused on functionality and cost, sustainability is now becoming a competitive differentiator, especially among large hospital systems aiming to meet ESG (Environmental, Social, and Governance) targets.

In parallel, ergonomic design and procedure-specific customization are enhancing surgical efficiency and safety. Modern laparotomy sponges are being developed with features such as reinforced edges for easier retrieval, improved texture for better fluid absorption, and color-coded systems to assist in intraoperative tracking. Some products are even customized based on surgical specialty-such as gynecologic oncology or trauma care, ensuring optimal size, shape, and absorbency for the intended use.

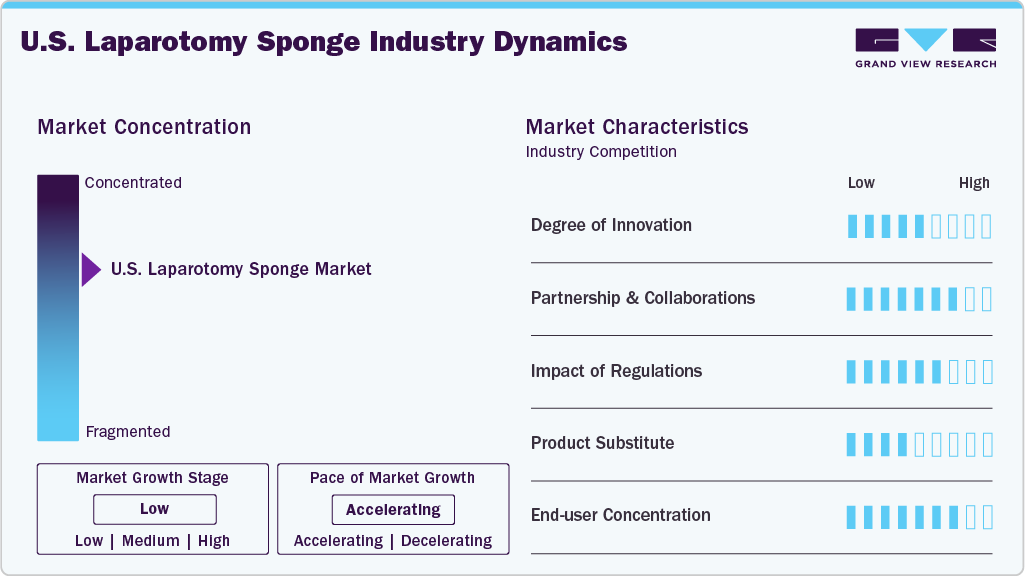

Market Concentration & Characteristics

The industry witnesses significant concentration, with key players focusing on expansion and product differentiation. Companies such as Integra LifeSciences, Stryker, and Cardinal Health hold significant market share. The market is characterized by steady growth driven by increasing surgical procedures, technological advancements, and a focus on patient safety.

The degree of innovation in the industry is moderate and steadily advancing, driven by the need to improve surgical safety and efficiency. While the basic function of sponges remains unchanged, significant innovations have emerged in materials, tracking technologies, and design. Radiopaque threads have become standard to enable X-ray detection, and newer technologies like radio-frequency identification (RFID) and barcode systems are being adopted to prevent retained surgical items (RSIs). These smart tracking solutions integrate with surgical count software to enhance compliance and reduce human error.

The industry is significantly influenced by regulatory frameworks that govern healthcare delivery and medical imaging practices. Regulation significantly impacts safety-oriented innovation and poses a compliance challenge for manufacturers. Agencies such as the U.S. Food and Drug Administration (FDA), the Joint Commission, and the Association of PeriOperative Registered Nurses (AORN) have set strict guidelines aimed at reducing retained surgical items (RSIs), with sponges being a major focus due to their high involvement in such incidents. These regulatory pressures have led to widespread adoption of radiopaque and radio-frequency identification (RFID) -tagged sponges, alongside mandatory counting protocols in hospitals.

The market has experienced notable growth in mergers and acquisitions, fueled by advancements in product innovation, safety integration, and market expansion. Top manufacturers collaborate with healthcare IT firms to integrate sponge-tracking technologies, like radio-frequency identification (RFID) and smart count software, into hospital systems. Partnerships, such as those with Stryker and its SurgiCount Safety-Sponge System, have promoted widespread adoption of error-prevention solutions in U.S. hospitals.

The industry faces a low threat of substitution, primarily in alternative hemostatic and absorbent technologies. Products such as hemostatic agents (e.g., oxidized regenerated cellulose, fibrin sealants), absorbent pads, and suction-based devices can sometimes reduce reliance on traditional sponges, especially in invasive surgeries. However, these substitutes are generally used in conjunction with, rather than as replacements for, laparotomy sponges.

In the U.S. laparotomy sponge market, demand is largely concentrated among hospitals, surgical centers, and specialty clinics, with hospitals accounting for the majority share due to high surgical volumes and the need for stringent safety protocols. Large healthcare networks dominate purchasing decisions, often opting for advanced sponge-tracking technologies like radio-frequency identification (RFID) and barcode systems to comply with patient safety regulations and reduce retained surgical item risks. Ambulatory surgical centers are emerging as a growing segment, driven by the shift toward outpatient procedures. This concentration allows suppliers to focus on long-term contracts and technology-driven product differentiation to maintain market competitiveness.

Product Insights

The radiopaque laparotomy sponge segment accounted for the largest market share in 2024, due to the growing focus on surgical safety and post-operative responsibility. Radiopaque laparotomy sponges come equipped with a detectable marker visible through X-ray imaging, facilitating the swift detection of retained surgical items (RSIs). This significantly lowers the risk of complications like infections, adhesions, or the need for re-operation. More hospitals and surgical centers are implementing radiopaque sponges to adhere to regulatory standards and enhance surgical outcomes.

The radio-frequency identification (RFID) laparotomy sponge is seeing substantial growth in the laparotomy sponge market. This growth is primarily due to their role in improving surgical safety and reducing retained surgical items (RSIs). Laparotomy sponges equipped with RFID chips enable real-time tracking and detection via specialized scanners, which decreases the need for manual counting and significantly lowers the risk of human error. Furthermore, RFID technology provides traceability and automatic documentation, streamlining post-operative audits and supporting litigation defense, increasing its demand within healthcare facilities.

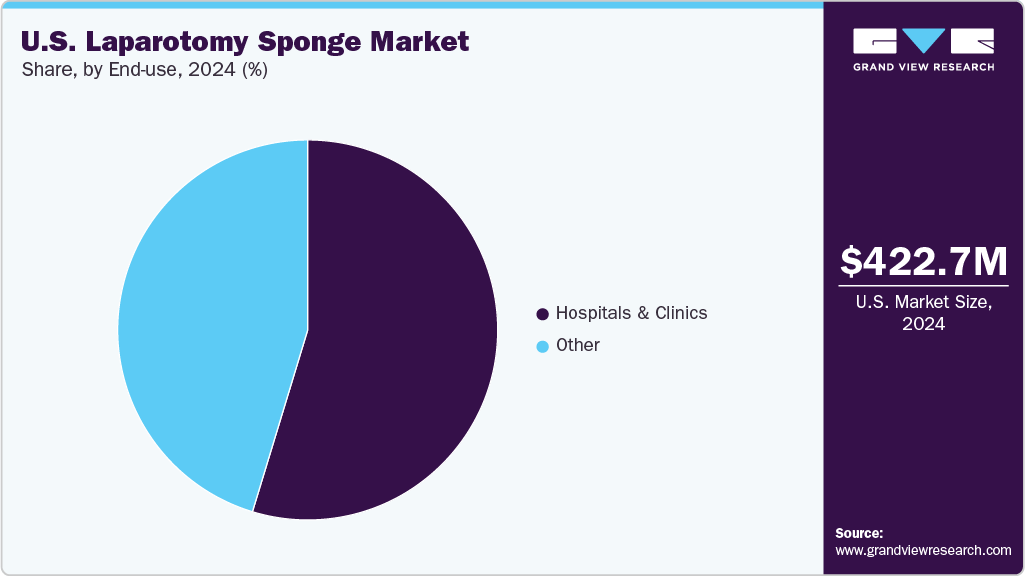

End-use Insights

The hospitals & clinics segment dominated the market in 2024, accounting for the largest revenue share. This is primarily due to the high volume and complexity of the surgical procedures they perform. As the primary centers for major open surgeries, including trauma, oncology, gastrointestinal, and obstetric cases, hospitals rely heavily on laparotomy sponges for bleeding control, tissue protection, and surgical visibility. They also adhere strictly to surgical safety protocols, which often mandate the use of radiopaque or RFID-enabled sponges to prevent retained surgical items (RSIs). Additionally, hospitals are more likely than outpatient or ambulatory centers to invest in advanced tracking systems and premium surgical supplies due to their higher budgets and compliance requirements from regulatory bodies like The Joint Commission.

The others segment is expected to experience a notable compound annual growth rate (CAGR) during the forecast period. This segment includes ambulatory centers, outpatient settings, and specialty clinics. This is attributed to the ongoing shift toward minimally invasive and same-day surgeries. These facilities are increasingly handling procedures that were once exclusive to hospitals, such as laparoscopic-assisted cancer resections and urgent abdominal interventions, especially as reimbursement policies and surgical technologies improve. With rising patient preference for shorter recovery times and lower costs, ASCs and outpatient settings are expanding their capacity and procedure volume. Their relatively untapped potential, high procedural throughput, and operational efficiency position this segment for rapid expansion in the coming years.

Key U.S. Laparotomy Sponge Company Insights

Key players operating in the U.S. laparotomy sponge market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Laparotomy Sponge Companies:

- Integra LifeSciences

- Medical Action Industries Inc.

- SDP Inc.

- Dukal, LLC

- Stryker

- Cardinal Health

- AllCare

- DeRoyal Industries Inc.

- Allmed Medical Products Co., Ltd.

- Premier Enterprises

Recent Development

-

In October 2023, a U.S. patent (20240136700, April 2024) detailed a surgical sponge with a laminated RFID tag featuring flexible tabs and an etched metal foil antenna. The tag is designed to enhance durability, signal strength, and X-ray visibility, improving tracking and reducing the risk of retained surgical items.

-

In November 2024, Stryker launched its next-generation SurgiCount+ system, integrating sponge tracking and blood loss estimation into a single platform to improve surgical safety and workflow efficiency. Combining SurgiCount’s RFID-enabled sponge tracking with the Triton system’s real-time blood loss analysis helps reduce surgical count errors-one of the most time-consuming safety tasks-by up to 10 minutes per procedure.

U.S. Laparotomy Sponge Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 447.5 million

Revenue forecast in 2033

USD 706.9 million

Growth rate

CAGR of 5.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

Integra LifeSciences; Medical Action Industries Inc.; SDP Inc.; Dukal, LLC; Stryker; Cardinal Health; AllCare; DeRoyal Industries Inc.; Allmed Medical Products Co.,Ltd.; Premier Enterprises

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laparotomy Sponge Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. laparotomy sponge market report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Radiopaque Laparotomy Sponge

-

Traditional Laparotomy Sponge

-

Radio-frequency Identification (RFID) Laparotomy Sponge

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. laparotomy sponge market size was valued at USD 422.7 million in 2024 and is expected to reach a value of USD 447.5 million in 2025.

b. The U.S. laparotomy sponge market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 706.9 million by 2033.

b. The radiopaque laparotomy sponge segment accounted for the largest revenue share in 2024, due to the growing focus on surgical safety and post-operative responsibility.

b. Some key players operating in the U.S. laparotomy sponge market include Integra LifeSciences, Medical Action Industries, Inc., SDP, Inc., Dukal, LLC, Stryker, Cardinal Health, AllCare, DeRoyal Industries, Inc., Allmed Medical Products Co., Ltd., and Premier Enterprises.

b. Key factors driving the growth of the U.S. laparotomy sponge market include a rise in abdominal surgeries due to conditions such as cancer and hernias, and an increase in C-sections. Demand is further enhanced by concerns regarding retained surgical items, which have led to the adoption of radiopaque and RFID-enabled sponges.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.