- Home

- »

- Next Generation Technologies

- »

-

Radio Frequency Identification Chips Market Report, 2033GVR Report cover

![Radio Frequency Identification Chips Market Size, Share & Trends Report]()

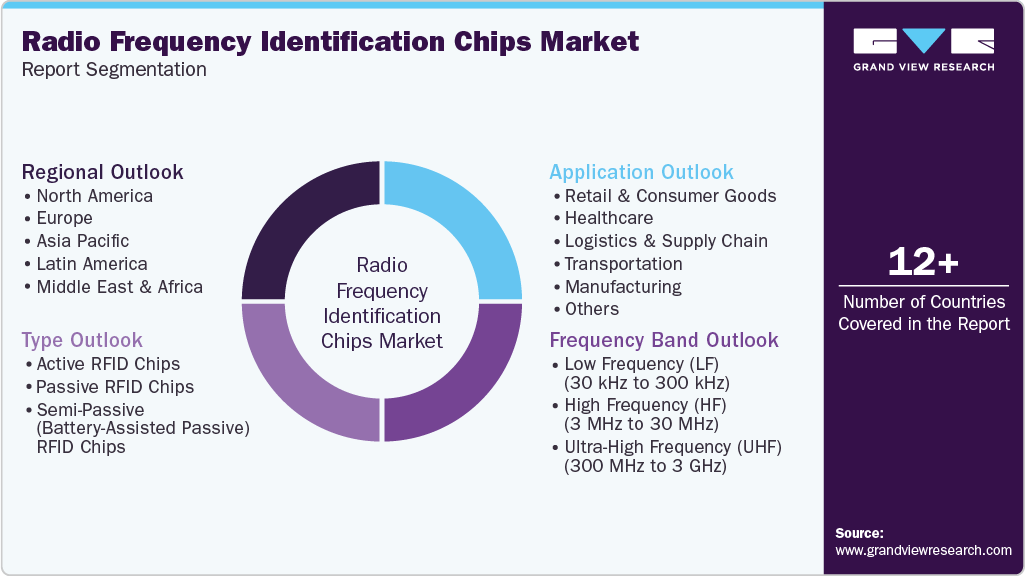

Radio Frequency Identification Chips Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Active RFID Chips, Passive RFID Chips), By Frequency Band, By Application (Retail & Consumer Goods, Healthcare, Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-657-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Radio Frequency Identification Chips Market Summary

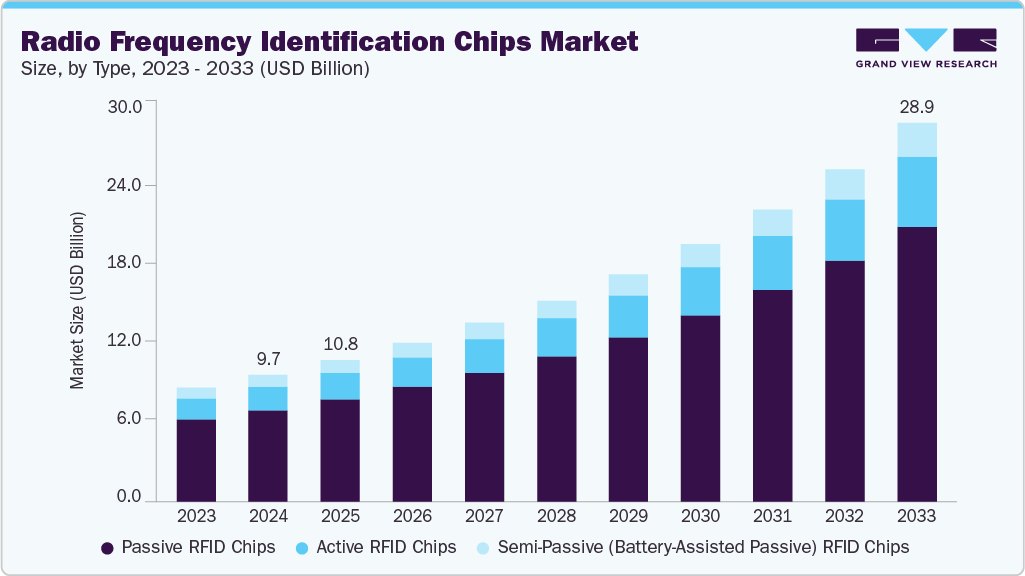

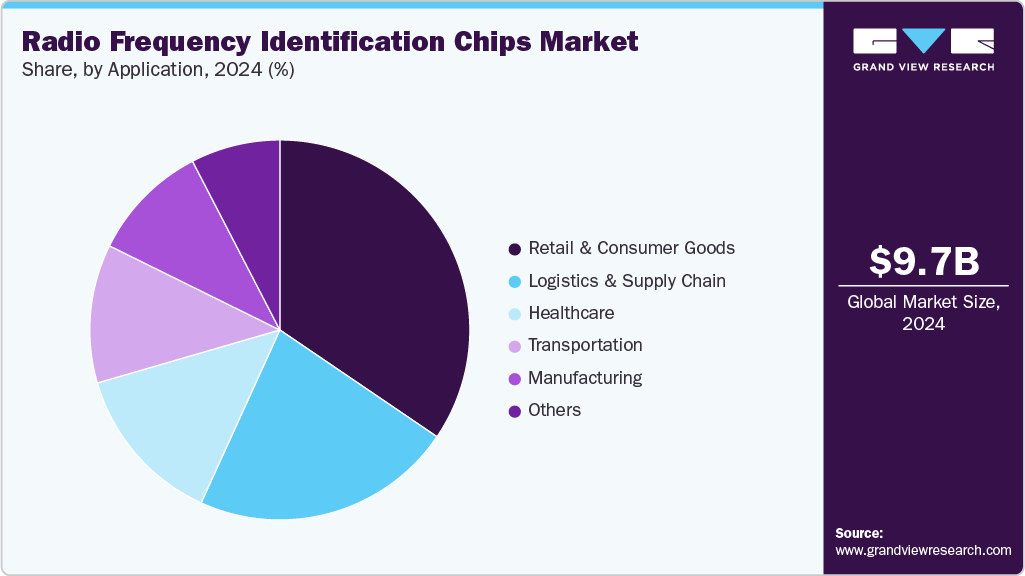

The global radio frequency identification chips market size was estimated at USD 9.71 billion in 2024 and is projected to reach USD 28.98 billion by 2033, growing at a CAGR of 13.1% from 2025 to 2033. The integration of RFID chips with IoT platforms and real-time analytics has emerged as a significant trend in the global market, driven by the growing demand for end-to-end supply chain visibility, increasing adoption of automated inventory management in retail and logistics, and the rising emphasis on product authentication and compliance in regulated industries such as healthcare.

Key Market Trends & Insights

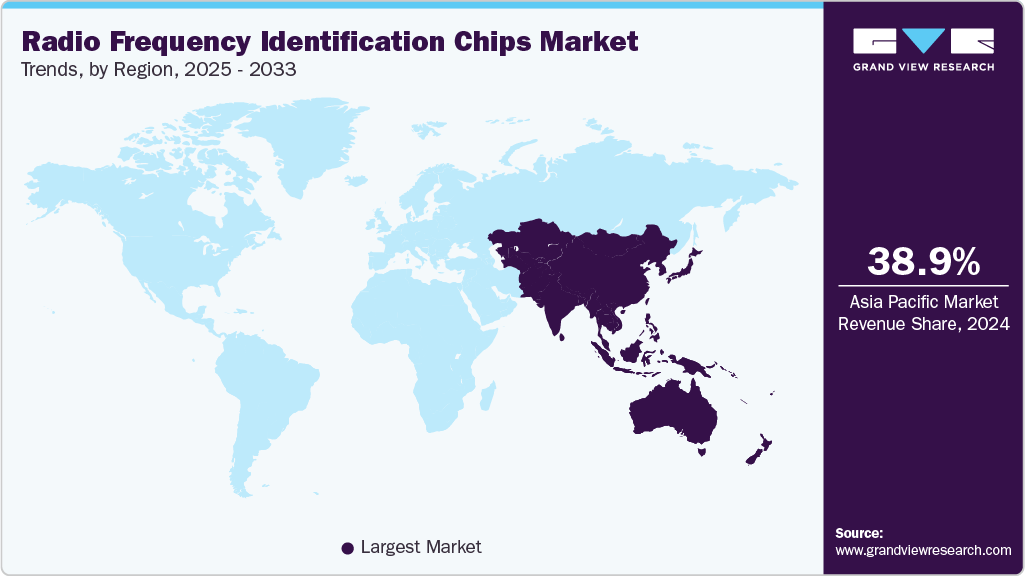

- The Asia Pacific radio frequency identification (RFID) chips market accounted for a 38.9% share of the overall market in 2024.

- The radio frequency identification (RFID) chips industry in China held a dominant position in 2024.

- By type, the passive RFID chips segment accounted for the largest share of 72.1% in 2024.

- By frequency band, the ultra-high frequency (UHF) (300 MHz to 3 GHz) segment held the largest market share in 2024.

- By application, the retail & consumer goods segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.71 Billion

- 2033 Projected Market Size: USD 28.98 Billion

- CAGR (2025-2033): 13.1%

- Asia Pacific: Largest market in 2024

Government regulations requiring RFID in critical supply chains have significantly boosted the market by enforcing wide-scale adoption across diverse sectors. For instance, the U.S. Department of Defense mandates passive RFID tags for all inbound shipments, enhancing inventory accuracy and reducing shrinkage across its vast supplier base. Similarly, the Department of Homeland Security's Container Security Initiative integrates RFID-enabled smart containers to detect illicit cargo. In addition, the FDA has established guidelines for RFID-based pharmaceutical tracking to combat counterfeiting. These mandates have collectively propelled the market growth by institutionalizing RFID as a compliance tool in high-security environments.

The healthcare sector is rapidly integrating radio frequency identification (RFID) to improve operational efficiency and patient outcomes, significantly boosting the market. RFID tracking of surgical instruments has reduced instances of retained surgical items, while automated inventory systems have minimized expired drug occurrences. Endorsement from health authorities and enforcement by regulatory bodies like the FDA have driven hospitals to adopt RFID for asset tracking, patient identification, and medication safety. This institutional backing has propelled the market growth in healthcare, as the demand for real-time visibility and accountability continues to escalate.

Smart city initiatives across countries such as the UAE, India, and Japan are incorporating RFID technology to streamline urban infrastructure, which has directly boosted the market. RFID is being deployed for toll collection, contactless transit systems, smart retail, and freight tracking, enhancing both efficiency and security. These investments improve traffic flow, waste collection, and logistics in densely populated cities. Government-backed infrastructure development plans have propelled the market growth by embedding RFID as a fundamental technology in future-ready urban ecosystems.

The fusion of RFID with IoT and Industry 4.0 technologies is a major force boosting the market across manufacturing and logistics. RFID enables real-time monitoring, non-line-of-sight asset identification, and just-in-time inventory management. National digitalization programs such as India’s Digital India and China’s Made in China 2025 are integrating radio frequency identification (RFID) for smart manufacturing, predictive maintenance, and supply chain automation. These strategic initiatives have propelled the market growth by driving adoption across industrial hubs, especially in Asia-Pacific.

Governments are leveraging RFID to support environmental sustainability and circular economy models, which have boosted the market by creating demand for traceability and efficiency in resource use. RFID is used in smart waste management systems to monitor container fill levels, track recyclable materials, and optimize collection routes. Moreover, regulations aimed at combating counterfeiting promote RFID-based product authentication. Government support for research into biodegradable and recyclable RFID materials has further propelled the market growth, aligning RFID adoption with global sustainability goals.

Type Insights

The passive RFID chips segment held the largest share of 72.1% in 2024 and is projected to grow at the fastest CAGR during the forecast period. Passive RFID chips are driving a paradigm shift in high-volume tagging across industries by offering a cost-effective, maintenance-free identification method. As businesses scale their automation capabilities, passive RFID has become foundational for real-time inventory tracking and asset management. Its adoption is being accelerated by the convergence of RFID with AI-enabled cloud platforms, allowing enterprises to gain unprecedented visibility into operations without incurring the power or battery costs of active tags. Retail, apparel, and healthcare providers are now embedding passive RFID tags at the manufacturing level, enabling seamless product lifecycle tracking from production to point of sale, thereby boosting the global market’s momentum.

The active RFID chips segment is expected to grow at a significant CAGR during the forecast period. Active RFID chips are becoming increasingly vital in mission-critical sectors where real-time monitoring, extended read ranges, and sensor integration are non-negotiable. Their deployment in defense, oil & gas, mining, and large logistics yards is enabling secure, autonomous tracking of high-value assets and personnel. The push for digitized infrastructure in heavy industries, especially with growing demand for real-time data and safety compliance, is amplifying the adoption of active RFID. These chips with onboard batteries and sensor capabilities are not just identifiers, but the are becoming integral to predictive maintenance, emergency response, and remote condition monitoring strategies across industrial landscapes.

Frequency Band Insights

The Ultra-High Frequency (UHF) (300 MHz to 3 GHz) segment held the largest market share in 2024. Ultra-High Frequency (UHF) RFID chips are shaping the next frontier of smart supply chains and agile inventory systems. Offering a superior range and faster data transmission, UHF is now the default choice for dynamic environments such as logistics, warehouses, and omnichannel retail. The technology's ability to handle bulk reading and real-time updates makes it indispensable for companies optimizing their last-mile operations and global traceability frameworks. UHF RFID is also gaining ground in agriculture and cold chain logistics, where remote, real-time tracking of pallets, crates, and containers can significantly reduce waste and improve delivery performance.

The High Frequency (HF) (3 MHz to 30 MHz) segment is projected to grow at a significant CAGR over the forecast period. High Frequency (HF) RFID chips, especially those integrated with NFC, are driving innovation in secure and contactless interactions. HF is at the core of smart cards, e-passports, library automation, and urban mobility solutions, where short-range communication and data encryption are critical. The surge in mobile-based contactless payments and digital identity verification is strengthening HF RFID’s relevance. In addition, as cities digitize public transport and universities expand smart campus models, HF technology is becoming a staple in touch-and-go environments where user convenience and authentication security converge.

Application Insights

The retail & consumer goods segment dominated the market in 2024 and is projected to grow at the fastest CAGR over the forecast period. Retail and consumer goods are propelling RFID chip demand into mainstream use, transforming traditional inventory management into intelligent, real-time ecosystems. Leading retailers are adopting RFID chips for item-level tracking, theft reduction, and enhanced in-store analytics. The drive to offer frictionless shopping experiences, like cashierless checkouts and personalized product recommendations, is further fueled by RFID-enabled automation. With growing consumer expectations for transparency and sustainability, retailers are also leveraging RFID for lifecycle tracking, return management, and anti-counterfeiting, making it a cornerstone of the modern retail infrastructure.

The logistics & supply chain segment is expected to grow at a significant CAGR during the forecast period. RFID chips are redefining logistics and supply chain operations by enabling real-time traceability, location accuracy, and shipment integrity from origin to destination. In a world where supply chain resiliency is paramount, RFID is helping companies monitor pallets, packages, and vehicles with unmatched precision. Integration with IoT platforms allows logistics managers to proactively respond to delays, temperature changes, and route deviations. With global trade intensifying and e-commerce reshaping fulfillment models, RFID chips are becoming indispensable for visibility, compliance, and speed, core pillars of the next-generation logistics network.

Regional Insights

APAC dominated the RFID chips market and accounted for the largest revenue share of about 38.9% in 2024 and is also the the fastest-growing regions with CAGR of 13.3%, fueled by national programs that emphasize digital transformation, smart infrastructure, and industrial automation. Governments in China, Japan, and India are embedding RFID into broader strategies like smart cities, Industry 4.0, and logistics modernization. These efforts are creating robust demand for RFID chips, particularly in areas like manufacturing, retail, and public transportation, making the region a global growth engine for RFID deployment.

China Radio Frequency Identification (RFID) chips industry is rapidly expanding its RFID footprint through the “Made in China 2025” initiative, which promotes smart manufacturing and high-efficiency logistics. RFID plays a key role in enabling real-time tracking and just-in-time inventory, which are essential for China's vast and dynamic supply chains. Backed by state funding and regulatory standardization, RFID deployment is accelerating across retail, warehousing, and transport systems, positioning China as a major consumer and producer of RFID chip technologies.

The Radio Frequency Identification (RFID) chips industry in Japan has long been an early adopter of RFID technology. The government supports initiatives to implement RFID tags across all products in major convenience store chains, with the goal of improving customer experience and inventory accuracy. Beyond retail, RFID is widely used in Japan’s public transportation systems and industrial automation, reflecting the country's forward-thinking approach to digital integration and infrastructure efficiency. Japan’s continuous innovation ensures its leadership in the RFID landscape.

North America Radio Frequency Identification Chips Market Trends

The North America Radio Frequency Identification (RFID) Chips industry accounted for 27.2% share of the overall market in 2024. North America stands as a global front-runner in the RFID chips market, due to strong government mandates and widespread deployment across key sectors such as defense, healthcare, and retail. In the U.S., the Department of Defense has played a pivotal role by mandating RFID tagging in its supply chains, directly impacting over 43,000 suppliers. Similarly, the Food and Drug Administration (FDA) actively supports RFID for enhancing pharmaceutical traceability and preventing counterfeit drugs. Their endorsement of RFID for serialization and authentication has fueled demand across the life sciences sector. These government-driven initiatives have not only created a stable regulatory foundation but also positioned North America as a mature and fast-evolving market for RFID chip adoption.

U.S. Radio Frequency Identification Chips Market Trends

The U.S. Radio Frequency Identification (RFID) Chips industry held a dominant position in 2024.This growth is driven by the increasing need for real-time visibility in supply chains, particularly in retail, healthcare, and manufacturing. Complex logistics systems, such as just-in-time production and omnichannel fulfillment, require accurate inventory tracking, where RFID excels. Federal mandates, including those from the Department of Defense and anti-counterfeit measures enforced by the FDA, continue to push industries toward RFID integration, solidifying the U.S. as a leading market for RFID technologies.

Europe Radio Frequency Identification Chips Market Trends

The Europe Radio Frequency Identification (RFID) Chips industry was identified as a lucrative region in 2024. Regulatory pressures, particularly around sustainability and traceability, are catalyzing this shift. For instance, the EU’s Digital Product Passport initiative mandates end-to-end tracking of products, creating strong incentives for RFID adoption. In addition, regional authorities such as Germany’s BSI have issued technical guidelines for secure and privacy-compliant RFID use, ensuring that deployment aligns with European data protection standards.

Germany’s Radio Frequency Identification (RFID) Chips industry’s adoption strategy reflects a careful balance between innovation and privacy. The Federal Office for Information Security (BSI) has introduced well-defined technical standards to ensure secure RFID applications across sectors like transport and workplace access systems. These government-led protocols are widely embraced by both public and private players, creating a trusted ecosystem that supports RFID chip growth, particularly in industrial automation and public infrastructure.

The Radio Frequency Identification (RFID) Chips industry in the UK has found unique use cases backed by government support. The Home Office’s “Chipping of Goods” trial showed notable success in reducing retail theft, especially in cases like Dell laptops, which saw zero thefts after being RFID-tagged. In addition, the Department of Trade and Industry’s investments under the “Next Wave Technologies and Markets Programme” have supported R&D in asset tracking and inventory management systems. These initiatives highlight the UK government’s commitment to leveraging RFID for security and supply chain innovation.

Key Radio Frequency Identification Chips Company Insights

Some of the major players in the Radio Frequency Identification (RFID) Chips industry include Alien Technology, LLC., Avery Dennison Corporation, EM Microelectronic, Identiv, Inc., Impinj, Inc., among others. The major players in the market hold their positions due to a combination of advanced chip design capabilities, strong intellectual property portfolios, and continuous investment in research and development. These companies have established robust global supply chains, enabling large-scale production and rapid delivery of high-performance RFID chips tailored for diverse applications such as retail, healthcare, logistics, and industrial automation. Their strategic collaborations with OEMs and IoT platform providers, along with participation in international standardization efforts, further reinforce their market leadership. Moreover, their commitment to technological innovation, such as energy-efficient chips, enhanced read range, and secure data protocols, continues to propel the RFID ecosystem forward.

-

Impinj, Inc. has established itself as a global leader in the RFID chips market through its strong focus on item-level connectivity and pioneering RAIN RFID technology. The company consistently introduces advanced reader and endpoint ICs that support low-power, high-speed data transmission, enhancing real-time tracking capabilities across supply chains, retail, healthcare, and logistics. Impinj’s deep integration of RFID with IoT systems and its comprehensive software platform allow for scalable deployments, making it a preferred choice for businesses aiming to achieve digital transformation. With a dedicated innovation roadmap and global deployment success, Impinj remains at the forefront of RFID chip evolution.

-

NXP Semiconductors plays a critical role in the RFID chips market by leveraging its extensive semiconductor expertise and strong position in automotive, industrial, and IoT verticals. The company offers a wide range of RFID chip solutions that support secure identification, access management, and asset tracking. Its strategic acquisitions and multi-billion-dollar investments in R&D, particularly in the context of smart mobility and connected infrastructure, have expanded its RFID portfolio significantly. By embedding RFID technology into smart cards, supply chains, and automotive platforms, NXP strengthens global adoption while contributing to enhanced operational efficiency, data security, and regulatory compliance.

Key Radio Frequency Identification Chips Companies:

The following are the leading companies in the radio frequency identification (RFID) chips market. These companies collectively hold the largest market share and dictate industry trends.

- Alien Technology, LLC.

- Avery Dennison Corporation

- EM Microelectronic

- Identiv, Inc.

- Impinj, Inc.

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- STMicroelectronics

- Texas Instruments Incorporated

Recent Developments

-

In June 2021, Impinj introduced three next-generation RAIN RFID reader chips, E310, E510, and E710, to address the growing demand for item-level connectivity across retail, logistics, supply chain, and consumer electronics sectors. These chips enable IoT device manufacturers to embed advanced RFID capabilities, offering enhanced read sensitivity, lower power consumption, and faster inventory performance. This strategic launch positions Impinj as a leader in integrating RFID chips with real-time IoT applications and is expected to significantly boost global RFID chip adoption.

-

In December 2024, NXP Semiconductors completed two key acquisitions-Aviva Links for $242.5 million to expand its in-vehicle high-speed networking capabilities and TTTech Auto for $625 million to strengthen its CoreRide platform for software-defined vehicles. In addition, NXP secured a loan from the European Investment Bank (EIB) at a 4.54% interest rate over six years to fund R&D across automotive, industrial, and IoT sectors, including RFID applications. These investments underscore NXP’s strategic focus on advancing RFID chip technology within connected and intelligent infrastructure.

Radio Frequency Identification Chips Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.84 billion

Revenue forecast in 2033

USD 28.98 billion

Growth rate

CAGR of 13.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, frequency band, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Alien Technology, LLC.; Avery Dennison Corporation; EM Microelectronic; Identiv, Inc.; Impinj, Inc.; Infineon Technologies AG; Murata Manufacturing Co., Ltd.; NXP Semiconductors; STMicroelectronics; Texas Instruments Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radio Frequency Identification Chips Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global radio frequency identification chips market report based on type, frequency band, application, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Active RFID Chips

-

Passive RFID Chips

-

Semi-Passive (Battery-Assisted Passive) RFID Chips

-

-

Frequency Band Outlook (Revenue, USD Million, 2021 - 2033)

-

Low Frequency (LF) (30 kHz to 300 kHz)

-

High Frequency (HF) (3 MHz to 30 MHz)

-

Ultra-High Frequency (UHF) (300 MHz to 3 GHz)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail & Consumer Goods

-

Healthcare

-

Logistics & Supply Chain

-

Transportation

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global radio frequency identification chips market size was estimated at USD 9.71 billion in 2024 and is expected to reach USD 10.84 billion in 2025.

b. The global global radio frequency identification chips market size is expected to grow at a significant CAGR of 13.1% to reach USD 28.98 billion in 2033.

b. Asia Pacific held the largest market share of 38.9% in 2024, fueled by national programs that emphasize digital transformation, smart infrastructure, and industrial automation. Governments in China, Japan, and India are embedding RFID into broader strategies like smart cities, Industry 4.0, and logistics modernization.

b. Some of the players in the RFID chips market are Alien Technology, LLC., Avery Dennison Corporation, EM Microelectronic, Identiv, Inc., Impinj, Inc., Infineon Technologies AG, Murata Manufacturing Co., Ltd., NXP Semiconductors, STMicroelectronics, and Texas Instruments Incorporated.

b. The key driving trend in the RFID Chips market is the rapid integration of RFID chips into IoT ecosystems to enable real-time asset tracking and smart inventory management. As industries such as retail, logistics, healthcare, and manufacturing increasingly adopt connected technologies, RFID chips are being leveraged for precise, automated data collection and supply chain visibility. This shift is propelling market growth, especially with the rising demand for low-power, compact, and high-frequency chips that support long-range communication and bulk item scanning in smart environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.