- Home

- »

- Next Generation Technologies

- »

-

U.S. Legal Services Market Size & Share, Report, 2030GVR Report cover

![U.S. Legal Services Market Size, Share & Trends Report]()

U.S. Legal Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Taxation, Real Estate), By Firm Size (Large Firms, Medium Firms), By Application, By Billing Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-070-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Legal Services Market Size & Trends

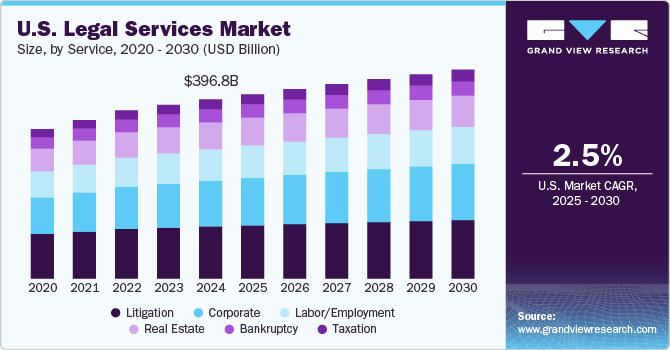

The U.S. legal services market size was estimated at USD 396.80 billion in 2024 and is projected to grow at a CAGR of 2.5% from 2025 to 2030. The market is primarily driven by evolving client demands, technological advancements, and shifting economic conditions in the U.S. In addition, the increasing litigation, corporate regulatory compliance, and the rise of alternative billing models are boosting the market expansion. Furthermore, the growing complexity of the legal landscape and the need for specialized expertise across various industries is expected to further fuel the market growth in the coming years.

The legal industry in the U.S. is witnessing a significant shift towards the integration of artificial intelligence (AI) technologies. Law firms are increasingly utilizing AI tools to streamline processes, enhance productivity, and improve efficiency in tasks such as document review, legal research, and case management. This trend is further driven by the need for cost-effective solutions that can handle repetitive tasks, allowing legal professionals to focus on more complex issues.

In addition, the growing adoption of cloud-based technology for ensuring data security is driving market growth. Private cloud solutions provide law firms with control over their data while safeguarding it from breaches and unauthorized access. The increasing number of data breaches across various industries in the U.S. has heightened awareness about cybersecurity risks, prompting firms to invest in robust cloud security measures to protect client confidentiality and comply with regulatory standards. This trend is expected to drive the market expansion.

Furthermore, alternative legal service providers (ALSPs) are expanding rapidly in the U.S., reflecting a shift in how legal services are delivered. ALSPs offer specialized services such as document review and compliance at competitive rates, making those attractive options for both law firms and corporate legal departments looking to optimize costs and resources. This trend indicates a growing acceptance of flexible service models that blur the lines between traditional law firms and alternative providers. This trend is expected to further boost the market growth in the coming years.

Moreover, the legal industry in the U.S. is undergoing a rapid digital transformation, with heightened concerns regarding cybersecurity with a notable increase in automation across various functions such as billing, research, and document management, which is expected to boost market expansion in the coming years. In addition, the expansion of third-party litigation financing is creating new opportunities for law firms in the U.S., allowing them to diversify their service offerings while managing financial risks associated with lengthy court cases, thereby driving market growth.

Service Insights

The litigation segment held the largest market share of over 29% in 2024, driven by the rise in high-stakes lawsuits in areas such as intellectual property disputes, product liability, and class-action cases. The increasing complexity of regulatory environments and the need for specialized legal representation in areas such as labor and employment law further bolster demand. In addition, individual plaintiffs and corporations are seeking experienced litigators to navigate complex courtroom procedures, contributing to the dominance of this segment.

The corporate segment is expected to witness the fastest CAGR from 2025 to 2030, primarily driven by an increase in corporate mergers, acquisitions, and restructuring activities. The evolving regulatory landscape, globalization of businesses, and the rise of compliance requirements in areas such as data privacy and environmental regulations are pushing corporations to seek comprehensive legal advice. Furthermore, legal counsel for contract negotiations, intellectual property rights, and corporate governance is becoming essential as companies aim to mitigate risks in an increasingly complex business environment, which is further expected to propel the segment’s growth significantly in the coming years.

Billing Type Insights

The hourly billing segment dominated the market in 2024, as it remains the most preferred billing method for complex legal cases such as litigation, corporate law, and intellectual property disputes. Clients often find it practical to pay for services based on the actual time spent on their cases, especially in unpredictable or intricate legal matters. Law firms benefit from this model as it provides consistent revenue and justifies the extensive time and expertise required to handle intricate legal procedures.

The subscription billing segment is projected to grow at the fastest CAGR from 2025 to 2030 as clients, particularly small-to-medium-sized businesses, increasingly favor predictable and transparent legal costs. This model appeals to companies seeking ongoing legal counsel for matters such as compliance, contract management, and employment law without the financial unpredictability associated with hourly billing. Subscription models also enhance client loyalty and offer law firms a steady stream of income through long-term retainers.

Firm Size Insights

The small firms segment held the largest market share in 2024, owing to their ability to offer flexible and cost-effective legal services to individuals, startups, and small businesses. These firms typically specialize in family law, real estate, criminal defense, and personal injury cases, providing tailored legal solutions at more affordable rates than large firms. Their personalized client service and niche expertise help small firms attract a steady flow of local clients who prefer closer attorney-client relationships.

The medium firms segment is expected to register a significant CAGR from 2025 to 2030. This growth can be attributed to their ability to bridge the gap between the affordability of small firms and the expertise of large firms. As businesses seek more specialized legal services without the overhead costs associated with large firms, medium firms are well-positioned to capture market share. Their growing focus on corporate law, intellectual property, and commercial litigation enables them to attract more clients from the corporate sector, especially those in need of cross-jurisdictional services.

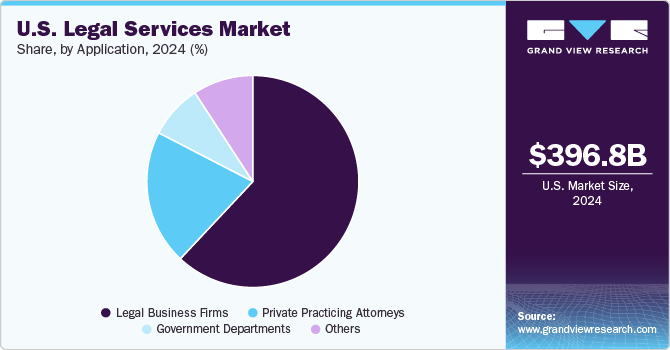

Application Insights

The legal business firms segment dominated the market in 2024, driven by the rising trend of outsourcing legal services to reduce operational costs and access specialized expertise. Large corporations increasingly prefer working with established legal firms for their in-depth knowledge of regulatory requirements, compliance, and litigation. The focus on cost-efficiency, risk mitigation, and legal process outsourcing by corporate clients further drives the demand for services provided by well-established legal business firms, thereby driving segmental growth.

The private practicing attorneys segment is expected to register the fastest CAGR from 2025 to 2030, primarily driven by the growing demand for personalized legal services from individuals and small businesses. With increasing legal complexities in areas such as estate planning, personal injury, and criminal law, more people are turning to private attorneys for tailored legal advice. The trend toward flexible payment structures and personalized, hands-on legal representation is expected to further boost the growth of this segment.

Key U.S. legal services Company Insights

Some of the key players operating in the market include Kirkland & Ellis LLP and Latham & Watkins LLP.

-

Kirkland & Ellis LLP, a U.S.-based law firm, specializes in corporate law, particularly in private equity, mergers and acquisitions (M&A), and complex litigation. With over 3,500 attorneys across 20 offices globally, the company is renowned for its high-profile clients. The firm's commitment to innovative legal solutions and exceptional client service has solidified its position as a leader in the legal industry.

-

Latham & Watkins LLP is a prominent law firm that offers a diverse range of services across various sectors, including corporate law, environmental law, and litigation. Its extensive experience in handling complex transactions and regulatory matters makes it a preferred choice for multinational corporations and financial institutions.

White & Case LLP & Morgan Lewis & Bockius LLP are some of the emerging participants in the U.S. Legal Services market.

-

White & Case LLP is an international law firm with a strong focus on cross-border transactions and litigation. The company is known for its expertise in international arbitration and project finance, making it a preferred choice for multinational corporations seeking legal counsel on complex global issues.

-

Morgan Lewis & Bockius LLP is an American law firm that operates from more than 30 offices worldwide and provides comprehensive legal services across various sectors, including labor and employment law, corporate governance, and litigation. Its client base includes Fortune 500 companies as well as emerging businesses

Key U.S. Legal Services Companies:

The following are the leading companies in the U.S. Legal Services market. These companies collectively hold the largest market share and dictate industry trends.

- Kirkland & Ellis LLP

- Latham & Watkins LLP

- DLA Piper

- Skadden, Arps, Slate, Meagher & Flom LLP

- Sidley Austin LLP

- White & Case LLP

- Morgan Lewis

- Gibson Dunn

- Cravath, Swaine & Moore LLP

- Wachtell, Lipton, Rosen & Katz

Recent Developments

-

In October 2024, White & Case LLP announced the promotion of 37 lawyers to its partnership, effective January 1, 2025. This new class includes representatives from 11 different practices and 21 offices across 14 countries, showcasing the firm's global reach.

-

In June 2024, Kirkland & Ellis LLP was recognized in the Chambers Crisis & Risk Management guide as a leading law firm in both Crisis Management in the U.S. and Environmental, Social & Governance (ESG) Risk globally. The firm’s Crisis Management team achieved a Band 1 ranking, receiving accolades for their exceptional service, while partners Alexandra Farmer and Rebecca Perlman were highlighted as top-ranked attorneys in ESG

-

In September 2023, DLA Piper announced the expansion of its legal services tailored for the space industry with the launch of its new Space Exploration and Innovation Practice. This initiative aims to create a comprehensive legal consulting framework for clients in the space sector, consolidating existing services into a unified offering.

U.S. Legal Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 408.42 billion

Revenue forecast in 2030

USD 462.67 billion

Growth rate

CAGR of 2.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report service

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, firm size, application, billing type

Country Scope

U.S.

Key companies profiled

Kirkland & Ellis LLP, Latham & Watkins LLP, DLA Piper, Skadden, Arps, Slate, Meagher & Flom LLP, Sidley Austin LLP, White & Case LLP, Morgan Lewis, Gibson Dunn, Cravath, Swaine & Moore LLP, and Wachtell, Lipton, Rosen & Katz

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Legal Services Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. legal services market report based on service, firm size, application, and billing type:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Taxation

-

Real Estate

-

Litigation

-

Bankruptcy

-

Labor/Employment

-

Corporate

-

-

Firm Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Firms

-

Medium Firms

-

Small Firms

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private Practicing Attorneys

-

Legal Business Firms

-

Government Departments

-

-

Billing Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hourly Billing

-

Flat Fee Billing

-

Contingency Fee Billing

-

Subscription Billing

-

Frequently Asked Questions About This Report

b. The U.S. legal services size was estimated at USD 396.80 billion in 2024 and is expected to reach USD 408.42 billion in 2025.

b. The U.S. legal services market is expected to grow at a compound annual growth rate of 2.5% from 2025 to 2030 to reach USD 462.67 billion by 2030.

b. Based on the application, the legal business firms sector segment dominated the U.S. legal services market with a share of over 62% in 2024. This is attributable to increasing investments by legal business firms in client education, pipeline management, local community activities, and public relations.

b. Some key players operating in the U.S. legal services market include Baker & McKenzie, Clifford Chance, Deloitte, DLA Piper, Ernst & Young (E&Y), Jones Day, and Kirkland & Ellis LLP

b. Key factors that are driving the U.S. legal services market growth include increasing need for legal services across small to large-scale enterprises and rising need among businesses to comply with regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.