- Home

- »

- Next Generation Technologies

- »

-

U.S. LiDAR Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. LiDAR Market Size, Share & Trends Report]()

U.S. LiDAR Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Airborne, Mobile & UAV, Terrestrial), By Component(Laser Scanners, Navigation (IMU), GPS, ADAS), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-511-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. LiDAR Market Size & Trends

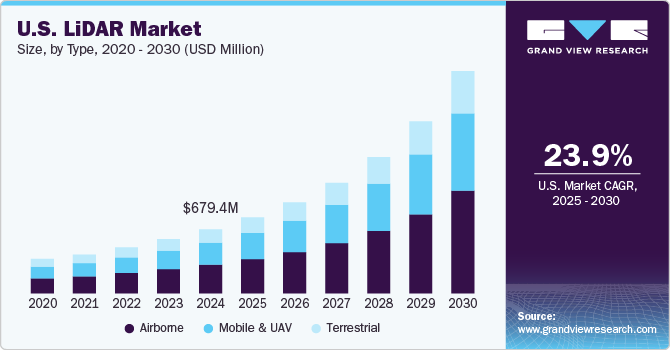

The U.S. LiDAR market size was estimated at USD 679.4 million in 2024 and is expected to grow at a CAGR of 23.9% from 2025 to 2030. This growth can be attributed to the increasing demand for high-precision mapping and surveying in the construction, agriculture, and transportation industries. Advancements in LiDAR technology, such as improved accuracy and reduced costs, have made it more accessible for a wide range of applications. Moreover, LiDAR integration with drones and autonomous vehicles is driving market expansion.

The automotive sector in the U.S. stands out as a significant contributor in the industry, with LiDAR being integral to advanced driver-assistance systems (ADAS) and autonomous driving technologies. Companies are investing heavily in research and development to enhance the capabilities of LiDAR systems, making them more efficient and cost-effective. Furthermore, the integration of AI with LiDAR technology is enhancing data analysis capabilities, providing actionable insights for urban development and infrastructure projects. In addition to automotive applications, LiDAR is widely used in construction, agriculture, forestry, and environmental monitoring. Its ability to generate high-resolution data facilitates precision farming practices and effective forest management strategies. The U.S. market is characterized by a strong presence of key players such as Velodyne LiDAR, Teledyne Technologies, and Trimble Inc., who are leading innovations in this space.

As smart city initiatives gain momentum and environmental concerns heighten, the demand for LiDAR technology is expected to increase significantly. This trend underscores the importance of LiDAR as a critical tool for modernizing infrastructure and enhancing public safety through improved data collection and analysis capabilities.

Additionally, advancements in miniaturization and cost reduction are opening up new opportunities for LiDAR applications. Smaller, more affordable sensors are becoming available for use in drones, allowing for rapid aerial mapping and surveying in hard-to-reach areas. This is especially valuable for applications in environmental monitoring, disaster management, and forestry management. The U.S. market is also benefiting from increased government investments in infrastructure development and smart city initiatives. LiDAR’s ability to assist in the efficient planning, monitoring, and maintenance of urban areas is making it a key technology for modernizing cities.

Type Insights

The airborne segment dominated the U.S. LiDAR industry with a revenue share of over 44.9% in 2024. Airborne LiDAR holds a dominant position in the U.S. market and is also the fastest-growing segment, driven by its extensive use in large-scale mapping, urban planning, and environmental monitoring. The ability of airborne LiDAR to cover vast areas with high accuracy makes it an essential tool for applications such as topographic mapping, flood risk assessment, and forest management. The integration of LiDAR systems with advanced drones and aircraft has further enhanced its utility, enabling cost-effective and efficient data acquisition. The rise of smart city initiatives and infrastructure development projects in the U.S. is another key factor propelling the growth of airborne LiDAR.

The mobile & UAV accounted to hold significant market share in 2024. The mobile and Unmanned Aerial Vehicle (UAV) LiDAR segment is experiencing significant growth in the U.S., primarily due to its versatility and ability to collect data in dynamic environments. Mobile LiDAR systems, mounted on vehicles, are widely used for road mapping, urban modeling, and autonomous vehicle navigation. UAV-based LiDAR has gained traction in industries like agriculture, construction, and mining, where flexibility and accessibility are critical. The reduced cost of UAV platforms and advancements in compact LiDAR sensors have made this technology more accessible to a broader range of industries.

Component Insights

The laser scanners segment dominated the U.S. LiDAR market with a revenue share in 2024. The rise of customized language models customized to specific industries is driving innovation in enterprise generative AI, with a focus on enhancing text generation, comprehension, and ensuring data privacy. For instance, in July 2024, Fujitsu and Cohere, a U.S.-based artificial intelligence company, partnered to develop Takane, a Japanese language model for private cloud use, providing secure generative AI solutions for enterprises. This collaboration combines Fujitsu's AI expertise with Cohere’s advanced language models to boost productivity in industries such as finance and government.

The Navigation (IMU) segment is projected to hold prominent market share in 2024. The navigation (Inertial Measurement Unit, or IMU) segment is experiencing significant growth in the U.S. LiDAR industry due to its critical role in ensuring accurate positioning and orientation of LiDAR systems. IMUs are essential for applications requiring precise georeferencing, such as autonomous vehicles, aerial surveys, and marine navigation. The growing adoption of autonomous systems in transportation and defense has been a major driver for this segment. Advances in IMU technology, including improved accuracy, smaller size, and reduced power consumption, have further fueled its growth

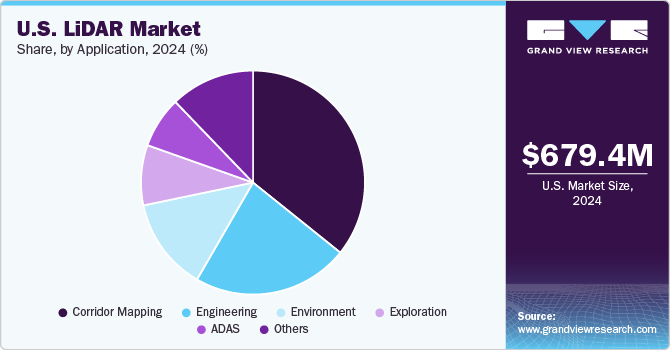

Application Insights

The corridor mapping segment dominated the market with the largest revenue share in 2024. Corridor mapping represents the dominant segment in the U.S. LiDAR market due to its extensive adoption in infrastructure development and maintenance projects. This application includes mapping of highways, railways, powerlines, and pipelines, where LiDAR’s precision ensures efficient planning and monitoring. However, challenges such as high equipment costs and complexities in data processing may hinder broader adoption. Additionally, the need for skilled personnel to interpret LiDAR data and integrate it with Geographic Information Systems (GIS) remains a constraint. Despite these challenges, advances in LiDAR technology, including miniaturization and improved processing capabilities, continue to support the segment's dominance.

The ADAS segment accounted to register a significant CAGR over the forecast period. The Advanced Driver Assistance Systems (ADAS) segment is the fastest-growing application of LiDAR in the U.S., fueled by the rapid development of autonomous vehicles and enhanced driver safety systems. LiDAR’s precision in detecting obstacles, mapping surroundings, and providing real-time 3D imagery has made it a cornerstone of ADAS technology. Major automotive manufacturers and tech companies are investing heavily in LiDAR-enabled ADAS to meet consumer demands for safer vehicles and comply with stringent safety regulations. However, the high cost of LiDAR systems and the need to reduce their size for integration into vehicles pose significant challenges.

Key U.S. LiDAR Company Insights

The U.S. LiDAR industry is characterized by fierce competition, dominated by a few major global players who possess significant market control. The focus revolves around developing groundbreaking products and promoting cooperation among key players within the industry. For instance, In May 2024, Luminar Technologies, Inc. introduced its next-generation LiDAR sensor, Luminar Halo, customized for widespread use in mainstream consumer vehicles. The new sensor promises major enhancements in performance, size, thermal efficiency, and cost.

Similarly, in January 2025, Aeva Inc. and Torc Robotics, a U.S.-based software company, have expanded their collaboration to advance autonomous truck technology, focusing on safety architecture and long-range sensing for L4 autonomous trucking. The partnership includes sharing 4D LiDAR sensing data and using a Freightliner Cascadia vehicle platform, with a goal to commercialize autonomous trucks by 2027.

Key U.S. LiDAR Companies:

The following are the leading companies in the U.S. LiDAR market. These companies collectively hold the largest market share and dictate industry trends.

- Aeva Inc.

- AEye, Inc.

- Baraja Pty Ltd.

- Cepton, Inc.

- FARO Technologies, Inc.

- Innoviz Technologies Ltd

- Leica Geosystems AG

- Luminar Technologies, Inc.

- Ouster Inc.

- Quanergy Systems Inc.

- SICK AG

- Teledyne Optech

- Trimble Inc.

Recent Development

-

In October 2024, Aeva Inc. has been selected by a major European passenger vehicle OEM to provide its advanced 4D LiDAR technology as part of an automated vehicle validation program. This initiative is aimed at fostering the development of next-generation vehicle automation systems through the utilization of Aeva’s Aerie II sensors.

-

In October 2024, AEye has teamed up with LighTekton and Accelight Technologies to introduce its 4Sight LiDAR solutions to the market in China, focusing on autonomous trucking and railway systems. This collaboration aims to improve safety and efficiency in China’s transportation infrastructure, utilizing AEye’s ultra-long range LiDAR platform.

-

In May 2024, Cepton launched StudioViz, a proprietary LiDAR simulation platform designed to streamline the adoption of LiDAR technology for ADAS and AV development, reducing implementation costs for automotive OEMs. StudioViz allows users to create virtual environments, visualize high-fidelity LiDAR data, and assess sensor fusion to accelerate the development of perception solutions.

-

In March 2024, AEye Inc. launched Apollo, the inaugural product in its 4Sight Flex family, delivering top-tier range and resolution in a compact, energy-efficient, and cost-effective design for both automotive and non-automotive uses. This LiDAR sensor supports L2+, L3, and L4 applications, with integration options available behind the windshield.

U.S. LiDAR Market Report Scope

Report Attribute

Details

Market size in 2025

USD 806.1 million

Revenue forecast in 2030

USD 2,358.2 million

Growth rate

CAGR of 23.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Market revenue in USD million CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

type, component, application

Key companies profiled

Aeva Inc.; AEye, Inc.; Baraja Pty Ltd.; Cepton, Inc.; FARO Technologies, Inc.; Innoviz Technologies Ltd; Leica Geosystems AG; Luminar Technologies, Inc.; Ouster Inc.; Quanergy Systems Inc.; SICK AG; Teledyne Optech; Trimble Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

U.S. LiDAR Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. LiDAR market report based on type, component, and application:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Airborne

-

Mobile & UAV

-

Terrestrial

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Laser Scanners

-

Navigation (IMU)

-

GPS

-

ADAS

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Corridor Mapping

-

Engineering

-

Environment

-

Exploration

-

ADAS

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. LiDAR market size was estimated at USD 679.4 million in 2024 and is expected to reach USD 806.1 billion in 2025.

b. The global U.S. LiDAR market is expected to grow at a compound annual growth rate of 23.9% from 2025 to 2030 to reach USD 2,358.2 million by 2030.

b. Airborne dominated the U.S. LiDAR market with a share in 2024. Airborne LiDAR holds a dominant position in the U.S. market and is also the fastest-growing segment, driven by its extensive use in large-scale mapping, urban planning, and environmental monitoring. The ability of airborne LiDAR to cover vast areas with high accuracy makes it an essential tool for applications such as topographic mapping, flood risk assessment, and forest management.

b. Some key players operating in the U.S. LiDAR market include Aeva Inc.;AEye, Inc.; Baraja Pty Ltd.; Cepton, Inc.; FARO Technologies, Inc.; Innoviz Technologies Ltd; Leica Geosystems AG; Luminar Technologies, Inc.; Ouster Inc.; Quanergy Systems Inc.; SICK AG; Teledyne Optech; Trimble Inc.

b. The automotive sector in the U.S. stands out as a significant contributor in the industry, with LiDAR being integral to advanced driver-assistance systems (ADAS) and autonomous driving technologies. Companies are investing heavily in research and development to enhance the capabilities of LiDAR systems, making them more efficient and cost-effective.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.