- Home

- »

- Medical Devices

- »

-

U.S. Long term Care Market Size & Share Report, 2030GVR Report cover

![U.S. Long Term Care Market Size, Share & Trends Report]()

U.S. Long Term Care Market Size, Share & Trends Analysis Report By Service (Skilled Nursing Facility, Home Healthcare, Assisted Living Facilities, Hospice & Palliative Care and Others), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-983-8

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

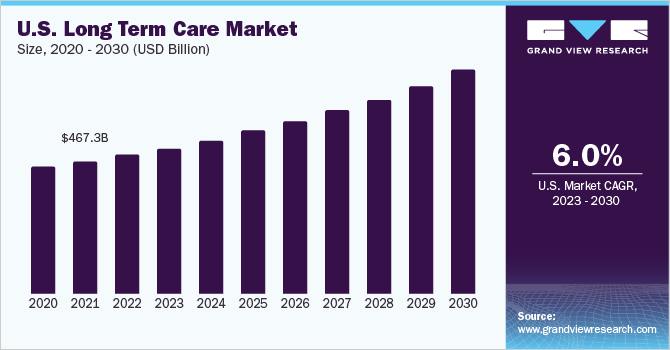

The U.S. long term care market size was valued at around USD 490.6 billion in 2022 and is expected to grow at a CAGR of 6.05% from 2023 to 2030. Demand for long-term care (LTC) has increased owing to the recognition of unmet needs of the elderly which are not fulfilled by hospital settings. According to estimates of the U.S. Department of Health and Human Services (HHS), around 69% of the U.S. population is expected to use long-term care services in their lives for an average of about three years, thus impelling their demand in the forthcoming times.

High geriatric population in the U.S. is rapidly rising due to increased life expectancy. In 2020, around 73 million adults in the U.S. were aged 65 and above, accounting for 16.5% of the country’s population as per the U.S. Census Bureau. The geriatric population in the U.S. has a high prevalence of chronic diseases driving the market. For instance, as per the Alzheimer’s Association, 6 million people in the U.S. aged 65 & above have dementia.

Technological developments in the long-term care industry are one of the major factors responsible for the expansion of these services across the U.S. Earlier, durable medical devices such as wheelchairs, walkers, and safety rugs were mostly used for care management. The development of sophisticated & easy-to-use devices and services such as internet-enabled home monitors, telemedicine, and apps for mobile health is likely to boost the market in the forecast period.

The adoption of telehealth applications by providers of long-term care services is helping the market transform into an organized sector, attracting the interest of investors and entrepreneurs. Important advantages of technology integrated service are the reduction in financial burden associated with medical procedures and a decrease in the requirement of institutional care. For instance, remote patient monitoring in-home care services enable doctors to review real-time data and consult patients, reducing the number of home visits & appointments and helping in reducing emergency hospital admissions

According to the American Association of Long-Term Care Insurance, more than 8 million U.S. citizens have long-term care insurance. Employers are taking initiative to provide long-term care services to their employees. For instance, Medtronic sponsors a group LTC insurance plan for its employees. This plan is aimed at protecting employees from high costs associated with long-term care services at home, in community care, and in assisted living facilities.

COVID-19 U.S. Long Term Care Market Impact: 1.4% decrease from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The initial phases of the pandemic witnessed long-term care facilities like nursing homes, hospice & assisted living facilities being hotspots for COVID-19 infections resulting in complete restriction on these facilities for new admission further leading to huge financial losses.

Vaccination, uplifting of social lockdowns, and relaxations in restrictions are expected to allow long-term care services in the U.S. to resume at full scale. The vaccinated chronic patients are likely to stay at LTC facilities.

The pandemic positively impacted the home healthcare segment. The risk of infection at long-term care facilities & the rapid advancement of home healthcare-related technologies during the COVID-19 pandemic resulted in increased preference for home healthcare services.

The telehealth services, remote patient monitoring & other technologies adopted during the pandemic for long-term care are expected to have great significance post-COVID due to the convenience & wide array of options available with the help of technology. The government is also taking initiatives for supporting the use of technology resulting in business growth.

The federal and state governments in the U.S. are undertaking initiatives to enhance the reach & quality of care services in the U.S. The federal government-initiated training & development programs for the workforce at care facilities, ensuring that the best services were provided at the facilities during the pandemic and in the future as well. For Instance, The CMS updated reimbursement for remote patient in 2021, facilitating better reimbursement for technology use

State governments are also actively undertaking initiatives for care services. For Instance, Washington State Legislature established a public insurance program, providing coverage for SNF, assisted living, hospice, and other care services, which would be applicable from 2025.

Service Insights

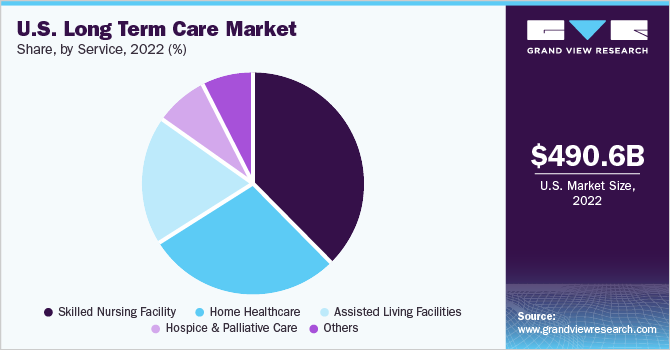

Based on service, the market is categorized into skilled nursing facilities, home healthcare care, assisted living facility, hospice & palliative care, and others. In 2022, skilled nursing facility accounted for the largest share of 36.49% due to the increasing demand for nursing care services because of the high prevalence of chronic diseases among the U.S. population.

Home healthcare held a significant share of the U.S. LTC market in 2022. Factors such as an increase in average life expectancy, a rise in incidences of chronic but manageable diseases, an increase in the geriatric population, and sufficient economic resources are contributing to the growth of the market for home healthcare. Adoption of home healthcare is high among people older than 65 years of age, individuals recently discharged from hospitals, mothers of newborns, mentally challenged adults, and individuals who want medical assistance for their parents within their homes.

The hospice & palliative care segment is expected to witness the highest growth with a CAGR of 9.03% over the forecast period. Disorders such as Alzheimer’s disease are major reasons for preference for assisted living facilities, which is followed by depression. Adults suffering from mental illness require assisted living to sustain themselves in mainstream society. In the U.S., mental illness is the most expensive disorder, costing about USD 201 billion annually. This is expected to translate into exponential growth in the assisted living industry in the times to come.

Key Companies & Market Share Insights

The U.S. long-term care market is highly competitive with the presence of serval small & big players at regional and national levels. The top players are adopting various strategies, such as market expansion, mergers & acquisitions, and partnerships to strengthen their presence in the market. For instance, in July 2021, Brookdale Senior Living, Inc. sold a significant stake in its outpatient therapy, hospice, and home health business to HCA Healthcare. Some of the prominent players in the U.S. long term care market include:

-

Brookdale Senior Living, Inc

-

Sunrise Senior Living, LLC

-

Kindred Healthcare

-

Amedisys, Inc

-

Genesis Healthcare, Inc

-

Capital Senior Living Corporation

-

Diversicare Healthcare Services, Inc

-

Home Instead, Inc

-

Senior Care Center

-

Atria’s Senior Living

U.S. Long Term Care Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 517.0 billion

Revenue forecast in 2030

USD 780.2 billion

Growth Rate

CAGR of 6.05 % from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service

Country scope

The U.S.

Key companies profiled

Brookdale Senior Living, Inc; Sunrise Senior Living, LLC; Kindred Healthcare; Amedisys, Inc; Genesis Healthcare, Inc; Capital Senior Living Corporation; Diversicare Healthcare Services, Inc; Home Instead, Inc; Senior Care Center; Atria Senior Living.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Long Term Care Market Report SegmentationThis report forecasts revenue growth at country level and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented U.S. long term care market report based on service:

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Skilled Nursing Facility

-

Home Healthcare

-

Assisted Living Facilities

-

Hospice & Palliative Care

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. long term care market size was estimated at USD 490.6 billion in 2022 and is expected to reach USD 517.0 billion in 2023.

b. The U.S. long term care market is expected to grow at a compound annual growth rate of 6.05% from 2023 to 2030 to reach USD 780.2 billion by 2030.

b. Skilled nursing facilities dominated the U.S. long-term care market with a share of 36.5% in 2022. This is attributable to the rising demand for home healthcare and the increasing prevalence of chronic diseases.

b. Some key players operating in the U.S. long term care market include Brookdale Senior Living, Inc.; Atria Senior Living Group; Sunrise Carlisle, LP; Senior Care Centers of America; Genesis Healthcare Corp.; Kindred Healthcare, Inc.; Home Instead Senior Care, Inc.; Amedisys, Inc.; Capital Senior Living Corporation; LHC Group; Almost Family, Inc.; and Diversicare Healthcare Services, Inc.

b. Key factors that are driving the U.S. long term care market growth include increased owing to the recognition of unmet needs of the elderly, which are not fulfilled by hospital settings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."