- Home

- »

- Pharmaceuticals

- »

-

U.S. Longevity & General Wellness Supplements Market 2033GVR Report cover

![U.S. Longevity & General Wellness Supplements Market Size, Share & Trends Report]()

U.S. Longevity & General Wellness Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Longevity Supplements, General Wellness Supplements), And Segment Forecasts, Consumer Behavior And Competitive Analysis

- Report ID: GVR-4-68040-667-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Longevity & General Wellness Supplements Market Summary

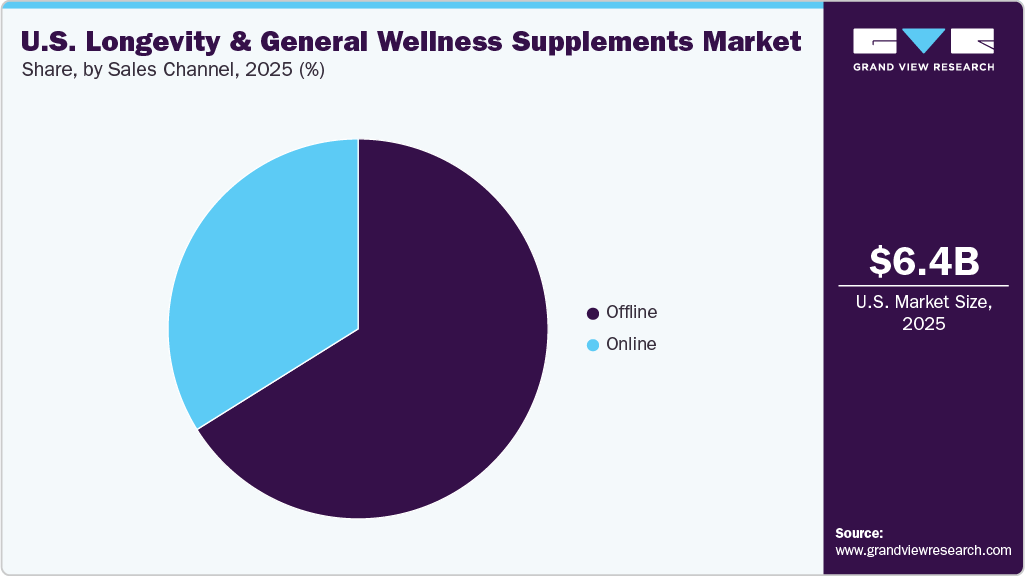

The U.S. longevity & general wellness supplements market size was valued at USD 6.35 billion in 2025 and is anticipated to reach USD 10.13 billion by 2033, expanding at a CAGR of 6.06% from 2026 to 2033. This sustained growth is driven by rising consumer awareness around preventive health, aging populations seeking to extend health spans, and increased interest in personalized wellness solutions.

Key Market Trends & Insights

- By application, general wellness supplements led the U.S. longevity and wellness supplements market in 2025 with the largest revenue share.

- The longevity supplements segment is projected to grow at the fastest CAGR of 8.91% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 6.35 Billion

- 2033 Projected Market Size: USD 10.13 Billion

- CAGR (2026-2033): 6.06%

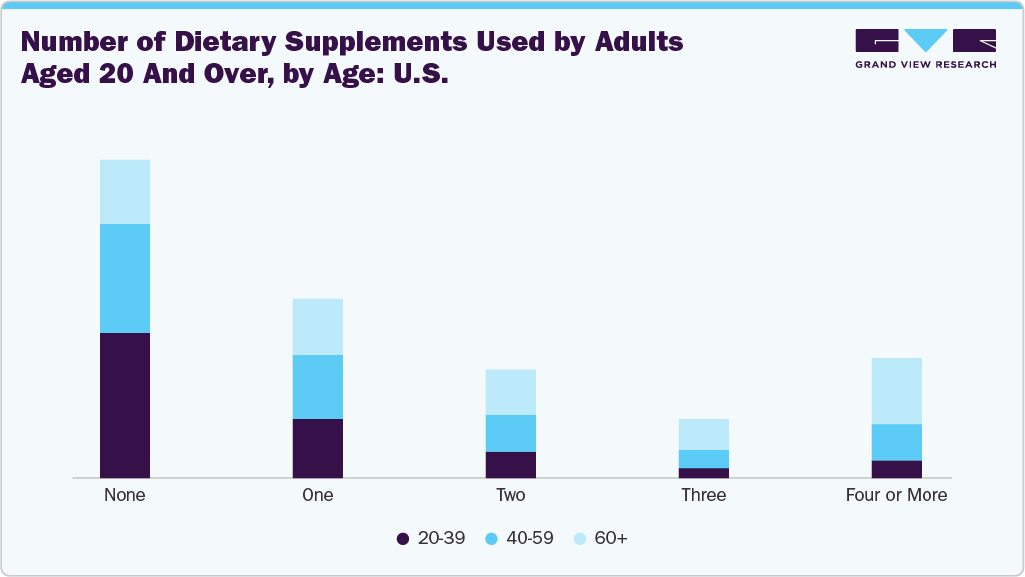

Evolving Consumer Demographics

The evolving demographic landscape in the U.S. is a major catalyst for the growing demand for longevity and general wellness supplements. According to U.S. Census data, as the Baby Boomer generation ages, the population of individuals 65 and older is projected to nearly double by 2060. This shift creates sustained demand for products supporting healthy aging, mobility, cognitive function, and chronic disease prevention.

Health and wellness are becoming increasingly important for the future, especially among the younger consumers, such as Millennials and Gen Z, who are the first to incorporate vitamins and other dietary supplements into their lives. Immunity, stress management, skin health, and even longevity support products are the focus of these youngsters. Such escalating cross-generation requests not only broaden the consumer pool but also facilitate the introduction of new, better, and more personalized formulations and delivery modes. As this trend prevails along with the old population, it is altering the playing field of the market and supplying the manufacturers who provide specific, scientifically proven wellness solutions for all ages with a steady growth opportunity.

Technology and Tailored Nutrition

The market for longevity and wellness supplements in the U.S. is changing and moving towards personalization with the help of consumers who ask for solutions that are specifically designed for their genetics, lifestyles, and health numbers. The progress in various technologies like wearables, home-testing, and AI platforms has empowered companies like Care/of, Persona Nutrition, and Rootine to provide individualized supplement regimens based on the insights obtained from DNA, blood, and microbiome.

Technology is also improving user engagement through mobile apps, digital dashboards, and adaptive subscription models. AI and predictive analytics are expected to further refine personalization by anticipating nutrient needs and optimizing dosages, positioning technology as a key driver of the future of preventive and longevity-focused supplementation in the U.S.

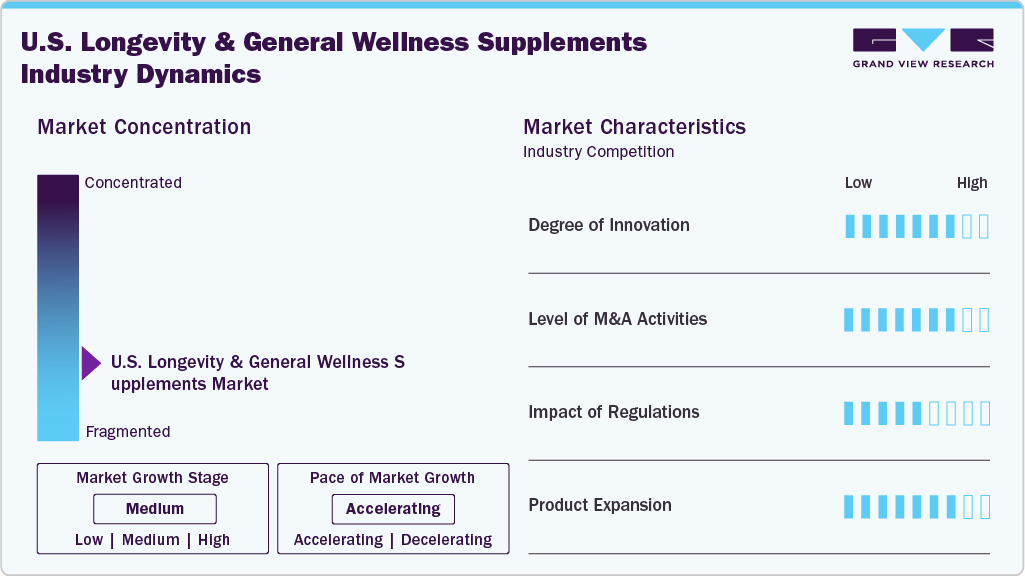

Market Concentration & Characteristics

The U.S. longevity and general wellness supplements industry is highly innovation-driven, with strong emphasis on advanced bioactive ingredients, personalized formulations, and novel delivery systems. Compounds such as NAD⁺ precursors (NMN, NR), senolytics, adaptogens, microbiome-focused blends, and algae-derived nutrients are gaining traction for their potential to support cellular aging and holistic wellness. Integration of AI-driven personalization and convenient formats like gummies and stick packs is further enhancing consumer appeal. For instance, in June 2025, RevGenetics launched Super-Z Advanced, a quercetin and zinc supplement with improved absorption, reflecting the broader shift toward science-backed, premium, and user-friendly wellness solutions beyond traditional vitamins.

M&A activity in the U.S. longevity and wellness supplements industry is accelerating as established brands and private equity firms seek to expand portfolios and access innovative technologies. For example, in February 2025, Cosette Pharmaceuticals acquired Mayne Pharma for USD 430 million, strengthening its position in women’s health and dermatology. Overall, this trend reflects ongoing market consolidation and growing demand for science-backed, personalized wellness solutions.

U.S. longevity and wellness supplements are regulated under DSHEA, allowing market entry without FDA pre-approval but requiring safety and compliant claims. While this supports innovation in products like NAD⁺ boosters and adaptogens, increased FDA scrutiny, particularly of anti-aging claims, is pushing brands toward higher transparency, validation, and quality standards.

The U.S. longevity and wellness supplements industry is evolving with product expansion driven by the demand for holistic and science-based solutions. The brands are not only offering multivitamins but also developing advanced formulations for cellular health, cognition, immunity, and gut health, while at the same time diversifying into convenient forms such as gummies, powders, and shots. For instance, in April 2025, Timeline launched its Mitopure Urolithin A gummies, reflecting the shift toward clinically validated, consumer-friendly longevity products.

Application Insights

The general wellness supplement segment led the U.S. longevity and wellness supplements market in 2025, driven by rising preventive health awareness and demand for immunity, stress relief, and clean-label, plant-based products. Product launches such as ProZenith’s 2025 natural weight-management supplement highlight the shift toward multifunctional, convenient formats like gummies and powders, supported by post-pandemic lifestyle changes and growing interest in holistic health.

The longevity supplements segment is projected to grow at the fastest CAGR, driven by rising interest in healthy aging and advances in science-backed ingredients such as NAD⁺ boosters, senolytics, and adaptogens. Product launches like Elysium Health’s Cofactor in 2025 highlight the focus on cellular vitality, supported by strong demand from older consumers and biohackers, as well as improved delivery formats.

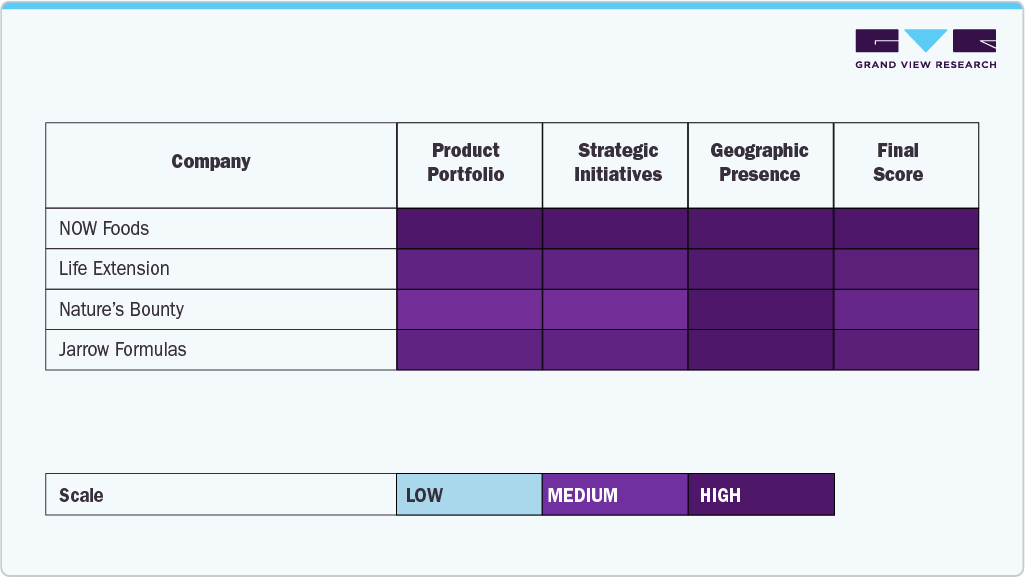

Key U.S. Longevity & General Wellness Supplements Company Insights

Leading brands such as NOW Foods, Life Extension, Nature’s Bounty, and Jarrow Formulas have secured dominant market positions by offering high-quality, science-backed supplements addressing immunity, cognitive health, anti-aging, and general wellness.

Companies like Thorne, Himalaya Wellness (U.S.), Pure Encapsulations, and Codeage LLC have strengthened their market presence by focusing on specialized, practitioner-recommended, personalized nutrition products.

As the market continues to evolve, the focus is on developing integrated, end-to-end solutions that combine supplementation with diagnostics, lifestyle coaching, and precision health strategies to support healthy aging and improved quality of life.

Key U.S. Longevity & General Wellness Supplements Companies:

- NOW Foods

- Life Extension

- Nature’s Bounty

- Jarrow Formulas

- Nature’s Way

- Thorne

- Himalaya Wellness (US)

- Pure Encapsulations

- Hims & Hers Health, Inc.

- Ro

- Elysium Health

- Niagen Bioscience

- ProHealth

- RevGenetics

- Codeage LLC

Recent Developments

-

In June 2025, Hims & Hers Health announced plans to acquire Zava, a UK-based digital health platform. This move follows U.S. headwinds in its weight‑loss drug business. It reflects the company’s push into new markets with personalized digital care for dermatology, weight management, sexual, and mental health.

-

In February 2025, UFC renewed its global partnership with Thorne in Las Vegas, retaining Thorne as Official Sports Performance Nutrition and Performance Institute partner, and elevating it as premier backer of UFC’s Anti‑Doping program.

-

In October 2024, Elysium Health launched VISION, a supplement designed to support eye longevity, performance, and protection. This formulation aims to enhance contrast sensitivity, filter high-energy blue light, and protect against oxidative stress, addressing age-related macular pigment decline.

U.S. Longevity & General Wellness Supplements Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.71 billion

Revenue forecast in 2033

USD 10.13 billion

Growth rate

CAGR of 6.06% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

U.S.

Key companies profiled

NOW Foods; Life Extension; Nature’s Bounty; Jarrow Formulas; Nature’s Way; Thorne; Himalaya Wellness (U.S.); Pure Encapsulations; Hims & Hers Health, Inc.; Ro; Elysium Health; Niagen Bioscience; ProHealth; RevGenetics; Codeage, LLC.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Longevity & General Wellness Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. longevity & general wellness supplements market report on the basis of application:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Longevity Supplements

-

Type

-

NMN

-

NR

-

NAD+

-

NADH

-

Resveratrol

-

Fisetin

-

Quercetin

-

Cucurmin

-

Collagen

-

Pterostilbene

-

Others

-

-

Sales Channel

-

Online

-

Direct to consumer

-

Other e-commerce channels

-

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies & Drug Stores

-

Others

-

-

-

-

General Wellness Supplements

-

Type

-

Vitamins

-

Multivitamins

-

Individual vitamins

-

Minerals

-

Amino acids

-

Probiotics

-

Collagen

-

Fish oils

-

Coenzyme Q10

-

Herbal extracts

-

Others

-

-

Sales Channel

-

Online

-

Direct to consumer

-

Other e-commerce channels

-

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies & Drug Stores

-

Others

-

-

-

-

Frequently Asked Questions About This Report

b. The U.S. longevity and general wellness supplements market size was estimated at USD 6.35 billion in 2025 and is expected to reach USD 6.71 billion in 2026.

b. The U.S. longevity and general wellness supplements market is expected to grow at a compound annual growth rate of 6.06% from 2026 to 2033 to reach USD 10.13 billion by 2033.

b. Offline segments dominated the U.S. longevity and general wellness supplements market with a share of 67% in 2024. This is attributable to the rising healthcare awareness and enhanced product offerings provided by offline channels.

b. Some key players operating in the U.S. longevity and general wellness supplements market include NOW Foods; Life Extension; Nature’s Bounty; Jarrow Formulas; Nature’s Way; Thorne; Himalaya Wellness (U.S.); Pure Encapsulations; Hims & Hers Health, Inc.; Ro; Elysium Health; Niagen Bioscience; ProHealth; RevGenetics; Codeage, LLC.

b. Key factors driving the market include rising consumer awareness of preventive health, aging populations seeking to extend their health spans, and increased interest in personalized wellness solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.