- Home

- »

- Advanced Interior Materials

- »

-

U.S. Low-pressure Die Casting Machine Market Report, 2030GVR Report cover

![U.S. Low-pressure Die Casting Machine Market Size, Share & Trends Report]()

U.S. Low-pressure Die Casting Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Type (Horizontal & Vertical), By End-use (Automotive, Aerospace, Electronics, Construction), And Segment Forecasts

- Report ID: GVR-4-68040-626-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

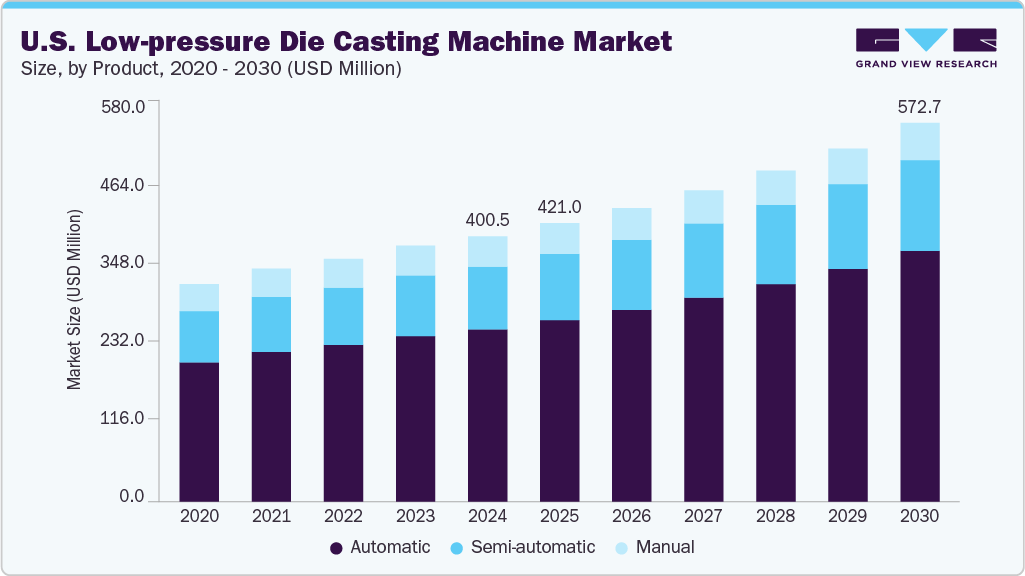

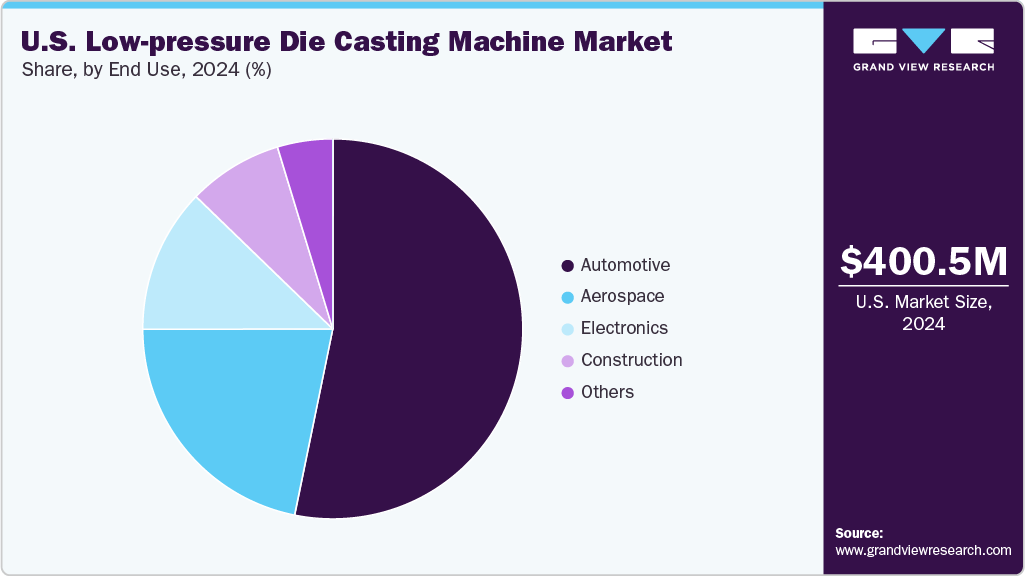

The U.S. low-pressure die casting machine market size was valued at USD 400.5 million in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. The U.S. low-pressure die casting machine (LPDC) machine market is experiencing steady growth, driven by increasing demand for lightweight and high-precision metal components across automotive, aerospace, and industrial manufacturing industries. As manufacturers strive to enhance fuel efficiency and reduce emissions, especially in the automotive sector, the adoption of LPDC machines is gaining momentum.

The U.S. LPDC machine market is primarily driven by the rising demand for lightweight and durable metal components, particularly in the automotive and aerospace industries. With increasing regulatory pressure to improve fuel efficiency and reduce emissions, manufacturers are turning to aluminum and magnesium parts produced through low-pressure die casting. This method allows for the creation of complex geometries with excellent mechanical properties, supporting the production of high-performance parts that contribute to overall vehicle weight reduction and enhanced operational efficiency.

Another driver is the growing adoption of automation and advanced manufacturing technologies. Modern LPDC machines are increasingly equipped with features such as real-time monitoring, precise control systems, and integration with Industry 4.0 frameworks. These advancements enhance production speed, consistency, and quality while minimizing material waste and labor costs. Moreover, the push for more sustainable and energy-efficient production processes is encouraging investment in LPDC equipment, as it offers a cleaner and more controlled alternative to traditional casting methods.

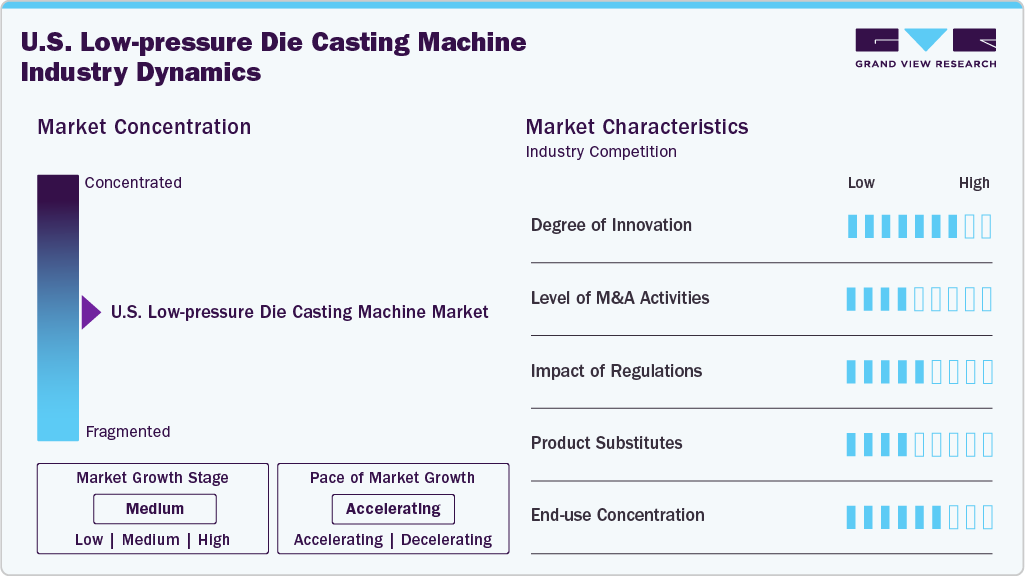

Market Concentration & Characteristics

The U.S. low-pressure die-casting machine market growth is moderate, and the pace of growth is accelerating. The market is characterized by a high degree of innovation, driven by the growing demand for automated, energy-efficient, and digitally integrated casting solutions. Industry 4.0 technologies, such as real-time data monitoring, predictive maintenance, and advanced robotics, are increasingly incorporated into machines. Innovations are also seen in process control, thermal management, and sustainability as companies seek to meet the evolving demands of sectors like automotive and aerospace.

Mergers and acquisitions in the U.S. LPDC machine market have been moderate. Larger players acquire smaller firms to strengthen their market position and expand their portfolio in high-growth sectors like electric vehicles and industrial automation. While LPDC competes with other casting methods like high-pressure die casting and gravity die casting, specific advantages of LDPC, such as reduced porosity and improved mechanical properties for complex geometries, limit the viability of direct substitutes in many applications. Substitutes are more relevant in low-cost or non-precision applications.

Regulations related to environmental standards, worker safety, and energy efficiency significantly influence the market. The push toward decarbonization in manufacturing and compliance with U.S. Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) standards has encouraged investment in efficient casting equipment. The LPDC machine market in the U.S. is concentrated in the automotive and aerospace sectors, with the automotive segment alone accounting for over half the revenue. These industries’ demand for lightweight, high-precision metal parts favors market growth. While electronics and industrial machinery are emerging segments, the dominance of transportation-related applications makes end-use concentration high.

Product Insights

The automatic segment dominated the U.S. LPDC machine market, which held the largest revenue share of 64.9% in 2024 and is expected to grow at the fastest CAGR of 6.7% from 2025 to 2030. This growth is fueled by increasing demand for fully automated, high-efficiency casting solutions in large-scale manufacturing operations. Automatic LPDC machines offer enhanced precision, repeatability, and faster cycle times, which make them ideal for high-volume production in the automotive and aerospace sectors. The demand for this product is also driven by advancements in robotics, real-time process control, and integration with smart manufacturing systems to improve productivity and reduce human error.

The semi-automatic segment plays a significant role, particularly among small to mid-sized manufacturers. These machines provide a balance between automation and manual control, offering cost-effective solutions for businesses with moderate production volume or custom part requirements. Semi-automatic LPDC machines are favored for their flexibility and lower initial investment, making them suitable for operations with varying batch sizes or frequent design changes.

Type Insights

The horizontal segment held the largest revenue share in the U.S. LPDC machine market in 2024, owing to its widespread use in producing complex, high-precision components, such as automotive wheels, engine parts, and structural components. These machines offer superior mold-filling capabilities and uniform metal distribution. Moreover, these machines are well-suited for high-volume manufacturing as the horizontal design facilitates efficient automation integration, which enhances production speed and consistency. As industries prioritize accuracy and scale, the demand for horizontal LPDC machines continues to grow, supported by advancements in machine design, sensor integration, and smart process controls.

The vertical segment is gaining traction in applications requiring gravity-assisted metal flow or specific casting orientations. These machines are often used in niche manufacturing settings or for producing parts with unique geometries. The vertical LPDC segment benefits from a compact footprint and efficient mold changeover, which makes it especially suitable for facilities with space constraints or flexible production needs. The segment is evolving with enhancements in operational flexibility, material compatibility, and user-friendly interfaces, allowing it to maintain relevance in specialized and small-batch production environments.

End Use Insights

The automotive segment held the largest revenue share in the U.S. LPDC machine industry in 2024. This dominance is driven by the industry’s push toward lightweight vehicle components to meet fuel efficiency and emission standards. LPDC machines are extensively used to manufacture high-precision aluminum parts, such as engine blocks, transmission housings, and structural components. The growing adoption of electric vehicles (EVs) further amplifies demand as manufacturers seek efficient methods to produce lightweight, thermally conductive parts critical for battery systems and electric drivetrains. Continued investment in automation and advanced casting technologies is expected to support sustained growth in this segment.

The electronics segment is expected to grow at the fastest CAGR from 2025 to 2030. Increasing miniaturization of electronic devices and demand for durable, heat-resistant metal housings are driving the use of LPDC technology in this segment. LPDC machines enable the production of intricate and lightweight enclosures and components that meet structural and thermal performance requirements. As the consumer and industrial electronics sectors evolve and incorporate more compact and high-performance designs, the need for precision casting solutions is expected to surge over the coming years.

Key U.S. Low-pressure Die Casting Machine Company Insights

Companies in the U.S. LPDC machine industry offer advanced solutions tailored to automotive, aerospace, and industrial applications. These companies focus on automation, energy efficiency, and integration with digital manufacturing systems to meet evolving industry demands. Strategic partnerships, technological upgrades, and after-sales support are key strategies adopted by the participants to stay abreast of the competition in the market.

-

Buhler: Buhler is a prominent die-casting machinery player known for its advanced LPDC solutions tailored to automotive and industrial applications. In the U.S., Buhler’s focus lies in energy-efficient systems, automation, and digital monitoring capabilities, helping manufacturers streamline operations and reduce scrap. Its commitment to Industry 4.0 integration and sustainability has strengthened its position in automotive lightweight and EV component manufacturing.

-

ItalpresseGauss: ItalpresseGauss is a leading provider of LPDC machines and solutions. The company emphasizes high-performance, automated systems suitable for aluminum casting in sectors like automotive and aerospace. In the U.S., it has expanded its footprint through service hubs and smart foundry solutions like the HMe platform, offering predictive maintenance and real-time analytics to enhance productivity and machine uptime.

Key U.S. Low-pressure Die Casting Machine Companies:

- CPC Group

- Dynacast

- The Schaefer Group

- ItalpresseGauss

- LPM Group

- Bent River Machine

- Kurtz Ersa, Inc.

- Shibaura Machine

- Buhler

- Idra S.r.l.

Recent Developments

-

In February 2025, Architect Equity announced the acquisition of Gibbs Die Casting Corporation. This represents a strategic move to scale operations, improve financial stability, and pursue expansion in lightweight die casting technologies.

-

In January 2025, MAGMA Foundry Technologies Inc. (MAGMA Inc.) announced its plan to open a new branch in the first quarter of 2025. With this expansion, the company aims to provide services for developing and educating current customers and build strategic partnerships and client engagement initiatives.

-

In December 2024, Rheocast Company, a manufacturer of aluminum and brass high-pressure die castings, rebranded to Fall River Die Cast. The rebranding reflects the company's commitment to growth and modernization.

U.S. Low-pressure Die Casting Machine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 400.5 million

Revenue forecast in 2030

USD 572.7 million

Growth Rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end use

Key companies profiled

CPC Group, Dynacast, The Schaefer Group, ItalpresseGauss, LPM Group, Bent River Machine, Kurtz Ersa, Inc., Shibaura Machine, Buhler, Idra S.r.l.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Low-pressure Die Casting Machine Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. low-pressure die casting machine industry report based on product, type, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Horizontal

-

Vertical

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Electronics

-

Construction

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.