- Home

- »

- Advanced Interior Materials

- »

-

Low Pressure Die Casting Machines Market Size Report 2030GVR Report cover

![Low Pressure Die Casting Machines Market Size, Share & Trends Report]()

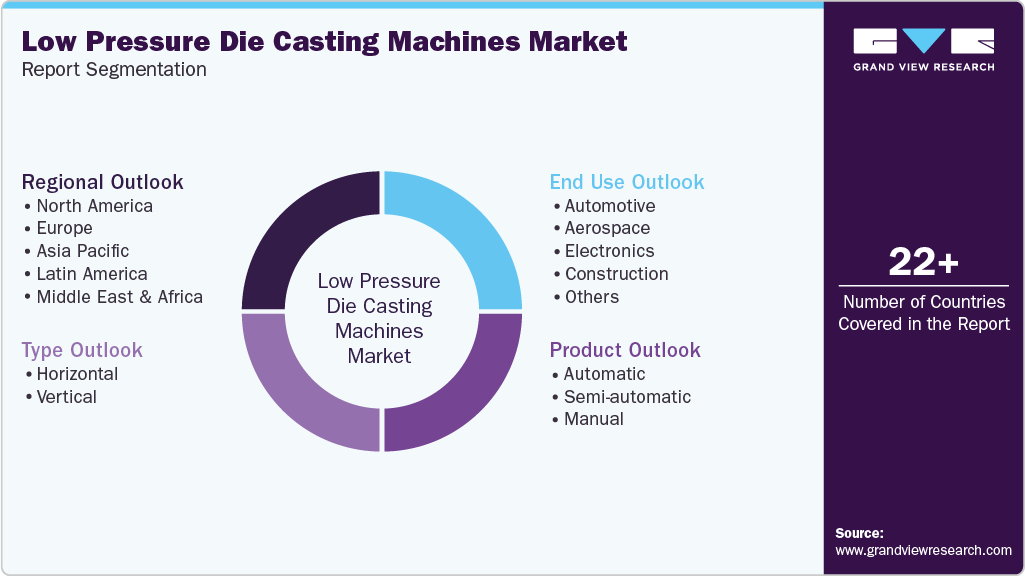

Low Pressure Die Casting Machines Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Automatic, Semi-automatic, Manual), By Type (Horizontal, Vertical), By End Use (Automotive, Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-613-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Low Pressure Die Casting Machines Market Summary

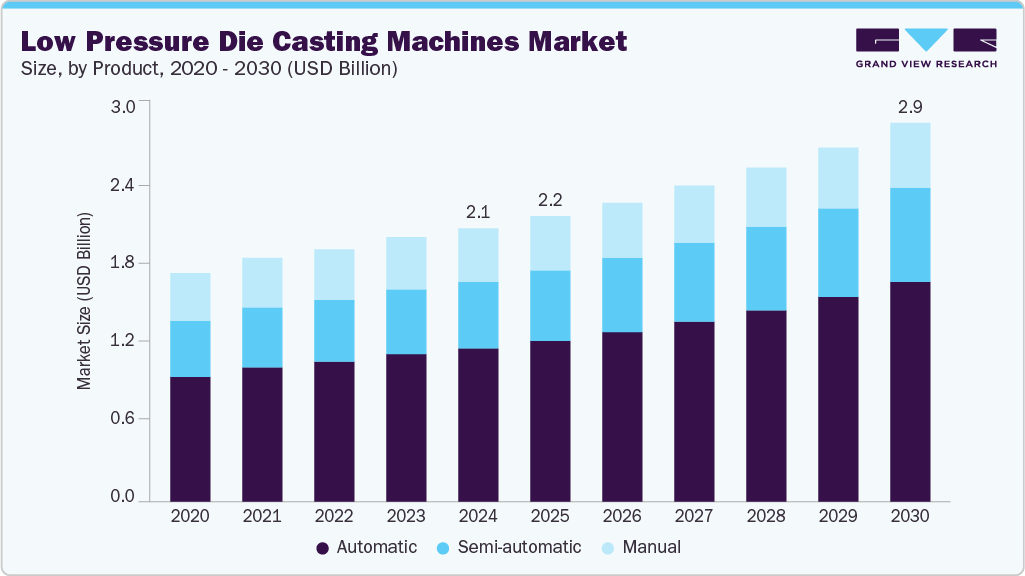

The global low pressure die casting machines market size was estimated at USD 2.15 billion in 2024, and is projected to reach USD 2.98 billion by 2030, growing at a CAGR of 5.8% from 2025 to 2030. The market is growing due to the rising demand for lightweight, high-precision metal components in the automotive and aerospace sectors.

Key Market Trends & Insights

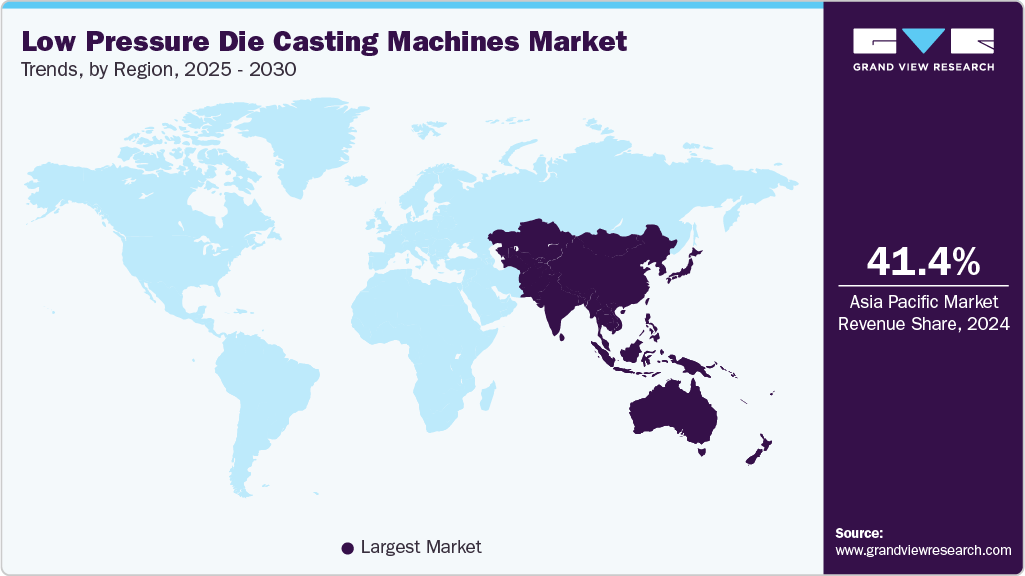

- The Asia Pacific market dominated the market with a revenue share of 41.4% of the revenue share in 2024.

- The low pressure die casting machines market in the U.S. is projected to expand at a CAGR of 6.3% over the forecast period.

- By product, the semi-automatic segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2030 in terms of revenue.

- By type, the vertical segment is expected to grow at a notable CAGR of 5.0% from 2025 to 2030 in terms of revenue.

- By end use, the growth of the electronics segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2030 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2.15 Billion

- 2030 Projected Market Size: USD 2.98 Billion

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2024

As manufacturers aim to improve fuel efficiency and reduce emissions, LPDC machines are increasingly favored for producing aluminum-based parts with superior mechanical properties and minimal porosity.

The global low pressure die casting (LPDC) machines market is undergoing significant transformation due to rapid technological advancements aimed at improving productivity, precision, and sustainability. One of the key innovations is the integration of Industry 4.0 technologies, such as real-time process monitoring, data analytics, and IoT-enabled sensors, which allow manufacturers to continuously optimize the casting process. These smart systems enable precise control over pressure, temperature, and mold filling speed, resulting in higher quality castings with reduced rejection rates.

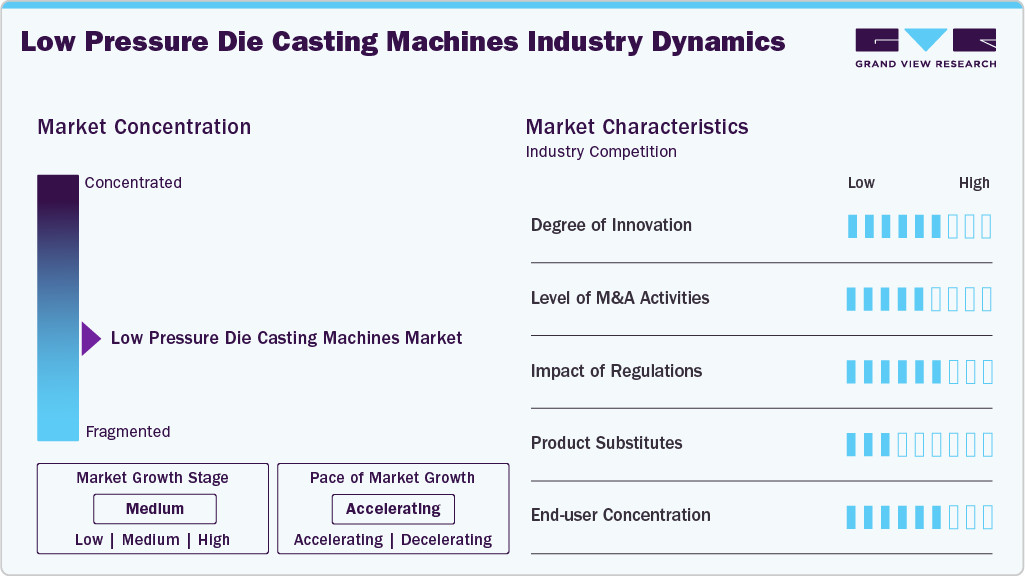

Market Concentration & Characteristics

The global low pressure die casting (LPDC) machine market is moderately concentrated, characterized by a mix of established multinational players and specialized regional manufacturers. Key market participants are focused on developing machines that offer high precision, process consistency, and compatibility with lightweight alloys like aluminum and magnesium, especially to cater to the automotive, aerospace, and electronics industries. Innovation in this market is largely driven by the rising demand for lightweight structural components, increasing automation in casting processes, and the need for energy-efficient, cost-effective production systems.

Market characteristics are shaped by the growing push for vehicle electrification, stringent environmental norms, and the evolving complexity of cast components. As OEMs and Tier 1 suppliers prioritize lightweighting and reduced emissions, LPDC machines are being engineered for higher throughput, flexibility in die changeovers, and improved metallurgical quality. Standards and directives from organizations like the EPA, EU, and ISO are influencing machine design with mandates for sustainable manufacturing practices, energy conservation, and workplace safety. Compliance with these regulatory benchmarks is crucial for vendors to maintain competitiveness, particularly in automotive and aerospace supply chains

Despite the positive outlook, the LPDC machine market faces competitive pressure from high-pressure die casting (HPDC) systems, especially in applications requiring fast cycle times and high production volumes. However, LPDC’s advantages in casting integrity, structural strength, and suitability for complex hollow parts ensure sustained demand in niche but growing applications. To lead the market, manufacturers must continue enhancing automation, integrating digital monitoring technologies, and offering tailored solutions for next-gen casting needs, with a strong focus on sustainability, material efficiency, and reduced operational costs.

Drivers, Opportunities & Restraints

One of the primary drivers of the global LPDC machines market is the growing demand for lightweight and high-strength components, especially in the automotive and aerospace industries. As governments worldwide impose stricter fuel efficiency and emission regulations, manufacturers are turning to aluminum casting technologies like LPDC to replace heavier steel components. Additionally, the rapid adoption of electric vehicles (EVs) is accelerating the demand for complex aluminum parts such as battery housings, suspension systems, and structural body components—many of which are ideally suited for LPDC manufacturing due to its precision and structural integrity.

The diversification of LPDC applications beyond automotive, such as in industrial machinery, consumer appliances, and renewable energy components, is opening new revenue streams for manufacturers. For example, wind turbine hubs, motor housings, and structural casings for energy storage systems are increasingly being manufactured using LPDC technology.

Despite the advantages, the adoption of LPDC machines is restricted by their relatively high capital and operational costs compared to traditional gravity die casting or sand casting methods. Small and medium-sized enterprises (SMEs), particularly in cost-sensitive markets, often face challenges in securing the necessary upfront investment for modern LPDC systems and automation infrastructure.

Product Insights

The automatic segment accounted for the largest revenue share of 56.1% of the overall market in 2024 due to its efficiency, consistency, and ability to reduce labor costs while handling high-volume production. Their integration with digital controls and automation systems makes them ideal for industries focused on scalability and precision. Additionally, they support Industry 4.0 adoption by enabling real-time monitoring and predictive maintenance, which enhances production uptime.

Semi-automatic machines appeal to manufacturers seeking a balance between automation and cost-effectiveness. They offer improved output and reduced human error compared to manual systems while remaining affordable for mid-scale operations. These machines also provide flexibility in process control, making them suitable for a variety of part sizes and production runs.

Type Insights

The horizontal segment led the market and accounted for a revenue share of 62.3% of the overall market in 2024. Horizontal LPDC machines are preferred for producing large, flat components with uniform wall thickness, making them suitable for automotive body parts and machinery casings. Their configuration supports easy handling and higher mold accessibility. This design also allows for efficient use of space in high-throughput manufacturing environments.

Vertical LPDC machines are ideal for casting components that require precise filling and reduced turbulence, such as turbine blades and engine components. Their gravity-assisted flow enhances metal distribution, improving part quality. They are particularly effective in minimizing defects like shrinkage and air entrapment in complex geometries.

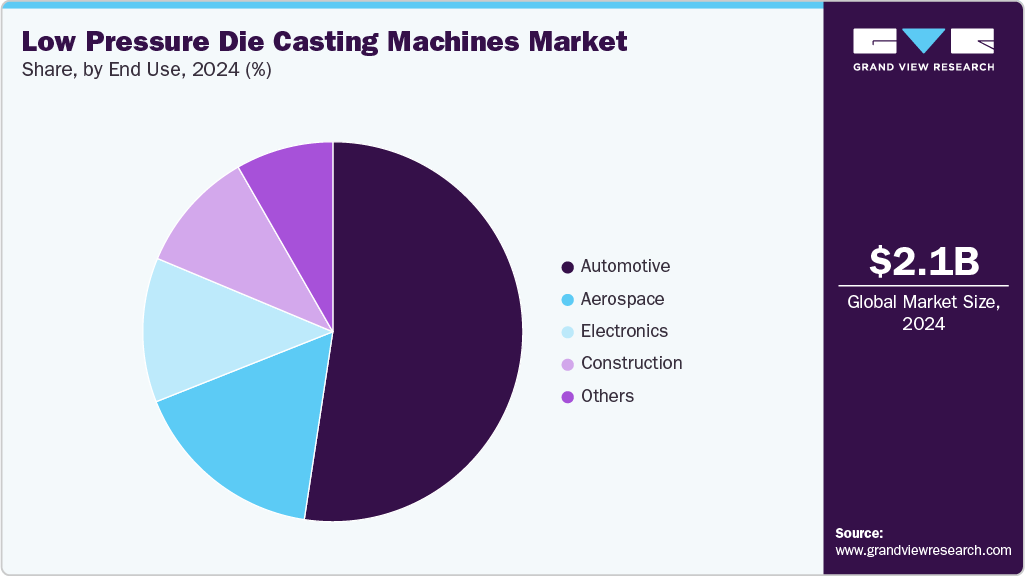

End Use Insights

The automotive segment dominated the market with the largest revenue share of 52.6% of the overall market in 2024 due to the rising need for lightweight, durable aluminum parts for engines, wheels, and structural components, especially amid the electric vehicle boom. LPDC technology supports the production of high-performance components that help reduce overall vehicle weight and improve fuel efficiency or battery range.

The electronics industry uses LPDC to manufacture heat sinks, casings, and connectors that require precise geometry and high thermal conductivity, supporting the trend toward compact and efficient devices. The method’s ability to consistently produce thin-walled, thermally conductive parts supports innovations in power electronics and consumer gadgets.

Regional Insights

The Asia Pacific market dominated the market with a revenue share of 41.4% of the revenue share in 2024 due to expanding industrialization, low manufacturing costs, and robust demand from automotive giants in China, India, Japan, and South Korea. Investments in infrastructure and growing aerospace manufacturing also support the LPDC machine market.

China Low Pressure Die Casting Machines Market Trends

The low pressure die casting machines market in China is projected to grow at a significant CAGR over the forecast period due to its massive automotive manufacturing sector, expansive electronics industry, and government-driven push for industrial automation. Strong domestic demand, export-oriented production, and large-scale infrastructure development further accelerate the use of LPDC in metal component fabrication.

The low pressure die casting machines market in India is expected to grow rapidly over the forecast period fueled by expanding domestic automotive production, a rising focus on lightweight components, and supportive government initiatives like “Make in India.” Increasing FDI in manufacturing and the development of industrial clusters also promote demand for cost-effective and scalable casting solutions.

North America Low Pressure Die Casting Machines Market Trends

The growth of North America low pressure die casting machines market is driven by increased production of electric vehicles, strong demand for precision aluminum components, and the presence of technologically advanced foundries. Government incentives supporting cleaner mobility and energy efficiency further push the adoption of LPDC machines. Additionally, the region’s focus on reshoring manufacturing to reduce supply chain dependencies is accelerating investment in advanced casting technologies.

The low pressure die casting machines market in the U.S. is projected to expand at a CAGR of 6.3% over the forecast period, driven by high demand for lightweight automotive components, a strong presence of aerospace manufacturers, and ongoing investments in electric vehicle production. Technological leadership and early adoption of automation and smart manufacturing systems also support the integration of advanced LPDC machines across industries.

Europe Low Pressure Die Casting Machines Market Trends

Europe low pressure die casting machinesmarket is growing due to stringent emission regulations, a mature automotive manufacturing base, and heightened focus on lightweight metal parts to meet sustainability targets. Continuous R&D in casting technologies across Germany, Italy, and France supports innovation in this field. The presence of premium automotive brands also drives the need for high-quality casting equipment to meet exacting design and performance standards.

The low pressure die casting machines market in Germany, which is Europe’s industrial and automotive hub, is projected to grow at a significant CAGR over the forecast period, driven by LPDC demand for precision engineering, sustainability, and high-quality manufacturing. The presence of major auto OEMs and machinery manufacturers encourages continuous upgrades to efficient and reliable casting technologies like LPDC.

The low pressure die casting machines market in the UK is expected to expand at a considerable CAGR over the forecast period. In the UK, LPDC machine adoption is supported by a focus on lightweight automotive and aerospace components, alongside a steady push for manufacturing modernization post-Brexit. The country’s emphasis on innovation and clean energy transitions also aligns with the efficiency and material savings offered by LPDC technology.

Latin America Low Pressure Die Casting Machines Market Trends

The Latin America low pressure die casting machines market growth is modest but rising, supported by gradual industrial modernization, a growing automotive assembly market in countries like Brazil and Argentina, and increased interest in cost-effective, quality casting technologies for export-oriented manufacturing. Local governments’ efforts to attract foreign direct investment in manufacturing are further creating opportunities for casting technology suppliers.

The low pressure die casting machines market in Brazil is expected to grow at a considerable CAGR over the forecast period. Brazil shows growing interest in LPDC machines, largely driven by the recovery of its automotive sector and increasing infrastructure development. The government’s industrial stimulus programs and regional demand for durable goods are encouraging local manufacturers to adopt more advanced and efficient casting processes.

Middle East & Africa Low Pressure Die Casting Machines Market Trends

The Middle East and Africa low pressure die casting machines market’s growth is supported by expanding construction and transportation industries, increasing investment in local manufacturing, and rising demand for durable, high-performance metal components in the energy and utility sectors. The region’s push for economic diversification beyond oil, particularly in the Gulf states, is encouraging the development of local industrial capabilities, including metal casting.

The low pressure die casting market in Saudi Arabia is expected to grow at a significant CAGR over the forecast period backed by diversification efforts under Vision 2030, which promote the development of domestic manufacturing across the automotive, construction, and defense sectors. Investments in local industrial parks and a focus on self-sufficiency in high-performance metal parts are supporting the expansion of LPDC technology.

Key Low Pressure Die Casting Machine Company Insights

Some players operating in the market include Toshiba Machine Co., Ltd., and Kurtz Ersa, among others.

-

Toshiba Machine Co., Ltd is a Japanese manufacturer specializing in advanced machine tools and industrial machinery such as precision injection molding machines, die casting machines, and machine tools. The company has developed a global presence since its inception, with manufacturing and sales subsidiaries worldwide.

-

Kurtz Ersa is a globally active technology group based in Spessart, Germany. The company specializes in producing foaming and casting machines as well as systems and tools for electronics production. The company operates worldwide with subsidiaries and production facilities across Europe, North America, and Asia, providing customized solutions for various industries.

Key Low Pressure Die Casting Machines Companies:

The following are the leading companies in the low pressure die casting machines market. These companies collectively hold the largest market share and dictate industry trends.

- CPC Machines

- LPM Group

- Hashida Giken Inc.

- ISUZU MFG

- SINTOKOGIO, LTD.

- Colosio Srl

- WELTOP MACHINERY

- Buhler AG

- Toshiba Machine Co., Ltd.

- Idra Group

- UBE Industries, Ltd.

- Dynacast International

- Zhejiang Wanfeng Technology Development Co., Ltd.

Recent Developments

-

In March 2025, Sandhar Technologies Limited, through its wholly-owned subsidiary Sandhar Ascast Private Limited, completed the strategic acquisition of Sundaram-Clayton Limited’s high pressure and low pressure aluminium die casting business at the Hosur plant.

-

In February 2024, ADC Aerospace, a producer of turnkey die-cast parts for defense, aerospace, automotive, specialty industrial, and medical markets have acquired Cast-Rite Corporation, a provider of advanced zinc and aluminum alloy die casting and fabrication solutions.

Low Pressure Die Casting Machines Market Report Scope

Report Attribute

Details

Market size in 2025

USD 2.25 billion

Revenue forecast in 2030

USD 2.98 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

CPC Machines; LPM Group; Hashida Giken Inc.; ISUZU MFG; SINTOKOGIO, LTD.; Colosio Srl; WELTOP MACHINERY; Buhler AG; Toshiba Machine Co., Ltd.; Idra Group; UBE Industries, Ltd.; Dynacast International; Zhejiang Wanfeng Technology Development Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low Pressure Die Casting Machines Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global low pressure die casting machines market report based on product, type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Horizontal

-

Vertical

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Electronics

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The low pressure die casting machines market is primarily driven by the increasing demand for lightweight, high-strength components in the automotive and aerospace industries, aiming to enhance fuel efficiency and reduce emissions. Additionally, advancements in automation and casting technologies are improving production efficiency and precision, further propelling market growth.

b. The global low pressure die casting machines market size was estimated at USD 2,150.0 million in 2024 and is expected to reach USD 2,248.9 million in 2025.

b. The low pressure die casting machines market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 2,983.2 million by 2030.

b. Asia Pacific dominated the market in 2024 accounting for a global revenue share of 41.7% driven by rapid industrialization and the expansion of automotive and electronics manufacturing in countries like China, India, and Japan.

b. Some of the key players operating in the low pressure die casting machines market are CPC Machines, LPM Group, Hashida Giken Inc., ISUZU MFG, SINTOKOGIO, LTD., Colosio Srl, WELTOP MACHINERY, Buhler AG, Toshiba Machine Co., Ltd., Idra Group, UBE Industries, Ltd., Dynacast International, and Zhejiang Wanfeng Technology Development Co., Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.