- Home

- »

- Beauty & Personal Care

- »

-

U.S. Luxury Hair Care Market Size, Industry Report, 2030GVR Report cover

![U.S. Luxury Hair Care Market Size, Share & Trends Report]()

U.S. Luxury Hair Care Market Size, Share & Trends Analysis Report By Product (Shampoos, Conditioners), By Price Range (USD 30 to USD 65, USD 65 to USD 100), By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-234-7

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Luxury Hair Care Market Size & Trends

The U.S. luxury hair care market size was estimated at USD 4.95 billion in 2023 and is expected to grow at CAGR of 8.1% from 2024 to 2030. Increasing inclusion of effective hair care in personal hygiene routine, growing awareness about the efficient products available in the industry, rising disposable income level of certain groups of customers, preferences shifting from chemical to natural hair care, upsurge in demand for hair care products made for men are the key factors which are driving the growth patterns of this industry.

The U.S. market accounted for a share of 23.6% of the global luxury hair care market in 2023. The market for hair care products in luxury range is aggressively influenced by global as well as regional trends. The diverse nature of the population develops widespread range of interests, liking and preferences, which market needs to cater to through variety of products. The recent trend is driven by awareness regarding sustainability and use of natural ingredients in products while eliminating use of chemical elements.

Increasing accessibility to data that can provide important insights regarding consumer behaviour has helped this industry like never before. Primary data collected from specialty stores, hair salons, spa centres, retail outlets, e-retail platforms has turned itself into detailed description about consumer’s preferences, factors that impact purchase decisions, driving factors underlying their choice of products, perspective about brands, ingredients that they prefer and most importantly expectations that they have from a products. For example, a group of customers prefers “value for money” over “brand positioning”, where other group of customers looks for “premium price range” as it is considered as mark of luxury range in such products.

In recent past, the industry is primarily driven by use of natural ingredients and customised products which are developed for addressing particular problem, such as hair fall, strength, dandruff or more. The inclusion of natural elements while absolutely excluding the use of chemicals has helped many brands to position themselves in different category. This assists them in establishing their brands in particular price range as well. Some of the key brands in luxury hair care in U.S. include MOROCCANOIL, Revlon, Garnier, Redken, Pureology and more. These brands are professional products’ brands which offer diligently designed solutions to various hair care issues.

Market Concentration & Characterization

The U.S. luxury hair care industry is growing at accelerating pace and growth stage is identified as high. The industry is characterized by presence of global market leaders such as L’Oréal, which has been dominated the market for decades. However, with growing technological developments coupled with innovation in the field, the industry has the existence of new entrants and other companies, which are operating at little less, or similar scale while addressing the consumer needs.

Degree of innovation is high in the industry. Innovation in this industry is primarily driven by the trends and preferences emerged from consumer behaviour. The innovation in this industry is reflected through variety of alternatives provided by companies through vast product portfolios, increasingly advanced packaging strategies and more. Companies in the industry are also investing in research and development in order to reach next level of innovation in terms of naturally sourced ingredients and their inclusion in product development while not hampering the price range segmentations.

The level of M&A (mergers & acquisitions) is moderate in the industry. Usually, the bigger brands and their multinational parent organisations tend to acquire regional brands or their units in order to enhance their presence as well as product portfolio. In February 2023, the renowned consumer goods company, Unilever announced that they have completed acquisition of K18. Through this acquisition, Unilever expanded its presence in high growth premium spaces.

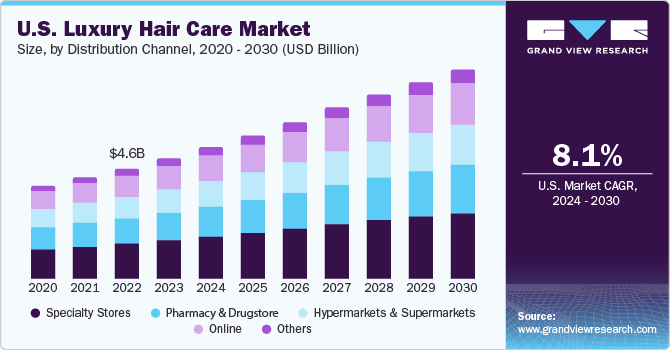

Distribution Channel Insights

The sales for luxury hair care market through specialty stores accounted for a revenue share of 31.6% in 2023. The industry is fueled by presence of specialty stores in urbanized areas of the country. When lands of developed country and growing disposable income of consumers meet the specialty stores opened by single or multiple brands in urban areas and busy streets of cities like Los Angeles or New York, the businesses enjoy sales at unprecedented volumes. Same has been the case about luxury hair care industry in the United States. For instance, in June 2023, French brand working in cosmetics, skin care, hair care, and fragrance industry opened standalone spa in New York City, Gansevoort and Hudson Street, one of the prime locations in famous Meatpacking District from NYC.

The online sales of luxury hair care products in the U.S. are expected to grow at a CAGR of 8.9% from 2024 to 2030. Increasing work hours, growing time spent in travels, and the unparalleled convenience factor offered by the online mode of distribution has resulted in the developing lucrative opportunities for the online sales of the luxury hair care products in the United States.

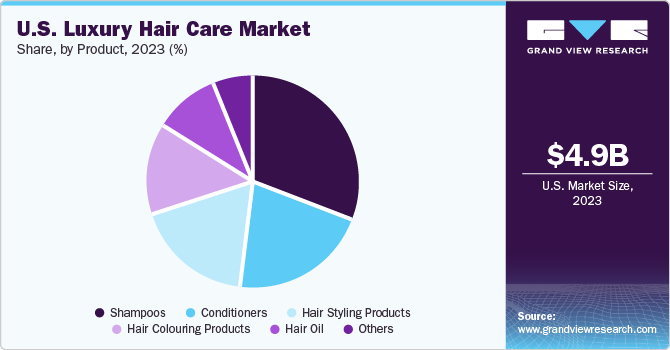

Product Insights

Shampoos accounted for a share of 30.7% in 2023. Shampoo is one among the heavily promoted products in the United States. The product is primarily distributed through supermarkets and hypermarkets across the states. However, it generates lucrative sales through other means of distribution as well. The shampoo products range is generally developed on the basis of variety of hair care issues such as hair fall, daily shine and care, dandruff, hair-breakage, split ends and more. In addition, industry provides variety of products for variety of users including babies, women and men. Shampoos developed with inclusion of natural ingredients such as plant oils, aloe, organic honey, olive, essentials oils, almond oil, and shea butter are generating extraordinary demand through group of consumers in this market.

The hair coloring products market in the U.S. is projected to grow at a CAGR of 9.3% from 2024 to 2030. Growing awareness in the country regarding harmful effects caused by use of chemically developed hair colours, industry has been experiencing unceasing demand for hair colouring products made from natural ingredients such as henna, acacia concinna or popularly known as shikakai, eclipta prostrata, beetroot, hibiscus, lemon, olive oil and others.

Price Range Insights

Luxury hair care products ranging from USD 30 to USD 65 accounted for a share of 39.9% in 2023. The products offered by companies in this price range are often preferred by the customers for two main factors associated with them, the fragrances and unique ingredients used in the formulation of the product. For instance, BAIN OLÉO-RELAX is a moisturizing shampoo characterised with presence of ingredients such as Coconut Oil, Extracted oil from the Shorea robusta seed, Rosa Canina fruit oil. The Kérastase Paris brand offers it for $42 in 250 ml packaging.

The demand for products ranging from USD 65 to USD 100 is expected to grow at a CAGR of 8.9% from 2024 to 2030. Products in the price range are slightly differentiated from the previous range and usually these products tend to provide solution for specific hair care related problem. For instance, Oribe's Gold Lust Transformative Masque is available for $70 in 150 ml packaging. It is marketed as one of the effective modern remedies to rebuild damaged hair through use of white tea and jasmine extracts.

Key U.S. Luxury Hair Care Company Insights

The market is characterised by presence of global brands who consider the United States as one of the biggest markets in the world. In addition, the companies operating within domestic market have also been generating great amount of attention from consumers in the U.S. This market is poised with lucrative opportunities which are expected to assist the industry to grow at rapid pace.

Key U.S. Luxury Hair Care Companies:

- L’Oréal Groupe

- Living proof

- Aveda (Estée Lauder Companies)

- Briogeo Hair

- Rucker Roots

- MOROCCANOIL

- K18HAIR

- Shiseido Company, Limited

- Advent International (Olaplex)

Recent Developments

-

In March 2024, Rucker Roots, one of the key players in the natural and effective hair care solutions in the United States, has debuted in selected Walmart stores across the country.

-

In February 2024, L'Oréal Paris launched Hyaluron + Pure, featuring a Shampoo, Conditioner, and Oil Erasing Scalp Serum through exclusivity deal with Walmart. The launch is said to be driven by the success experienced through similar Walmart exclusive launch of L'Oréal Paris Elvive Hyaluron + Plump collection.

U.S. Luxury Hair Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.40 billion

Revenue Forecast in 2030

USD 8.60 billion

Growth Rate

CAGR of 8.1% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, Distribution Channel, Price Range

Key companies profiled

L’Oréal Groupe, Living proof, Aveda (Estée Lauder Companies), Briogeo Hair, Rucker Roots, MOROCCANOIL, K18HAIR, Procter & Gamble (Ouai), Shiseido Company, Limited, Advent International (Olaplex)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Luxury Hair Care Market Report Segmentation

This report forecasts growth at country level and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. luxury hair care market report based on product, distribution channel and price range:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Shampoos

-

Conditioners

-

Hair Colouring Products

-

Hair Styling Products

-

Hair Oil

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drugstore

-

Specialty Stores

-

Online

-

Others

-

-

Price Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

USD 30 to USD 65

-

USD 65 to USD 100

-

USD 100 to USD 150

-

USD 150 to USD 200

-

Above USD 200

-

Frequently Asked Questions About This Report

b. The U.S. luxury hair care market size was estimated at USD 4.95 billion in 2023 and is expected to reach USD 5.40 billion in 2024.

b. The U.S. luxury hair care market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 8.60 billion by 2030.

b. Shampoos dominated the U.S. luxury hair care market with a share of 30.7% in 2023. This is attributable to the growing consumer adoption of specialized shampoos for different hair & scalp issues, including dandruff, breakage, split ends, etc.

b. Some key players operating in the U.S. luxury hair care market include L’Oréal Groupe, Living proof, Aveda (Estée Lauder Companies), Briogeo Hair, Rucker Roots, MOROCCANOIL, K18HAIR, Procter & Gamble (Ouai), Shiseido Company, Limited, and Advent International (Olaplex).

b. Key factors that are driving the market growth include the increasing disposable incomes of consumers and the growing adoption of hair care products by men.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."