- Home

- »

- Beauty & Personal Care

- »

-

Luxury Hair Care Market Size, Share, Industry Report, 2030GVR Report cover

![Luxury Hair Care Market Size, Share & Trends Report]()

Luxury Hair Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Shampoos, Conditioners, Hair Coloring Products, Hair Styling Products, Hair Oil), By Price Range, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-942-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury Hair Care Market Summary

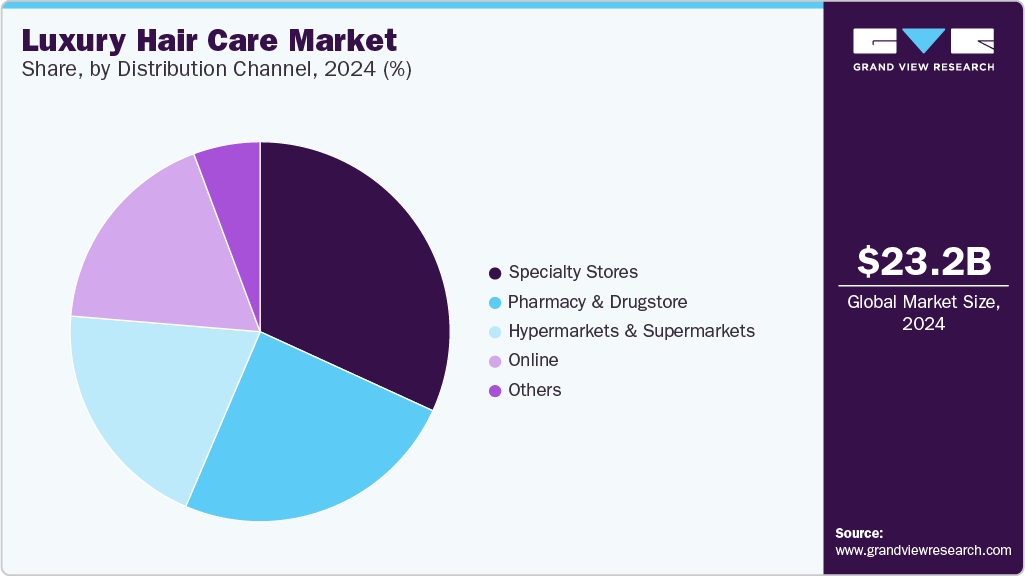

The global luxury hair care market size was estimated at USD 23.2 billion in 2024 and is projected to reach USD 40.24 billion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The market growth is attributed to a rising preference for effective and customized hair care products that cater to specific hair concerns.

Key Market Trends & Insights

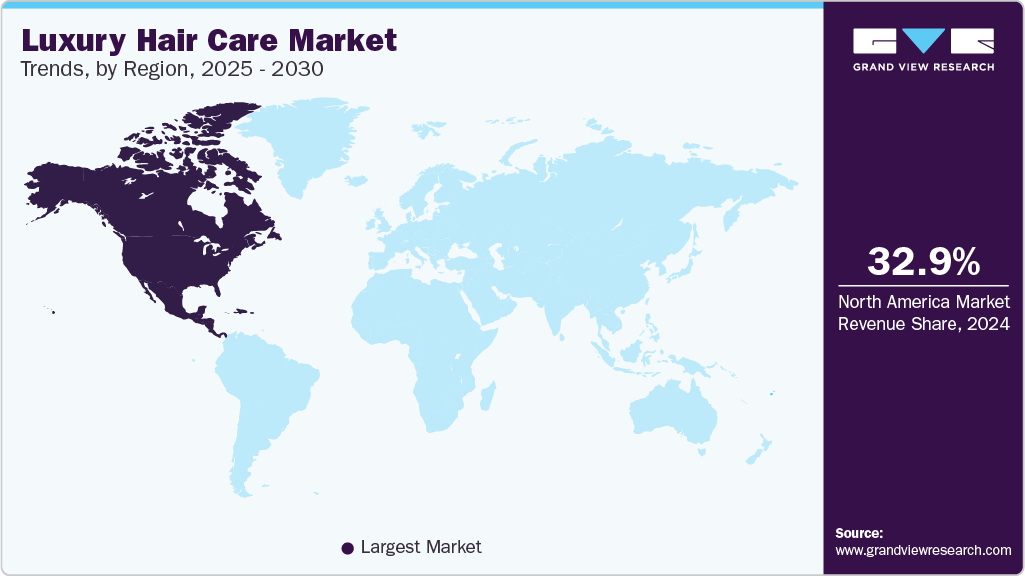

- North America global luxury hair care market dominated the global industry in 2024 with a share of about 32.95%.

- The luxury hair care market in Asia Pacific is expected to witness a CAGR of 10.9% from 2025 to 2030.

- In terms of product, the luxury shampoo segment led the market and accounted for a share of 30.78% in 2024.

- In terms of price range, luxury hair care products priced between USD 30 and USD 65 segment accounted for the largest market share of 40.15% in 2024..

- In terms of distribution channel, the sales through specialty stores segment held a share of 31.83% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 23.2 Billion

- 2030 Projected Market Size: USD 40.24 Billion

- CAGR (2025 - 2030): 9.4%

- North America: Largest market in 2024

Furthermore, the increasing popularity and availability of videos, tutorials, and pictures of trendy hairstyles and complex hair care routines are driving the growth of the industry. Luxury brands are expanding their presence in developing regions as these markets showcase significant potential for growth. It presents significant opportunities for new entrants.The surge in luxury hair care products is linked to the rising popularity of specialized treatments such as scalp care and hair loss solutions. These offerings, often priced higher due to their targeted formulations, contribute to the overall growth of the premium segment, reflecting consumers' willingness to invest in advanced and effective hair care solutions. This is leading to an increase in the demand for luxury brands like Gisou, which incorporates its exclusive Mirsalehi honey into a line of products, while Virtue Labs focuses on keratin-based treatments crafted to enhance the health of various hair types.

The companies can target the rising popularity of specialized treatments such as scalp care and hair loss solutions, which are often positioned at a higher price point. Consumers' increased focus on hair and scalp health encourages innovation in the hair care industry, creating opportunities for brands to differentiate themselves.

Consumer Insights

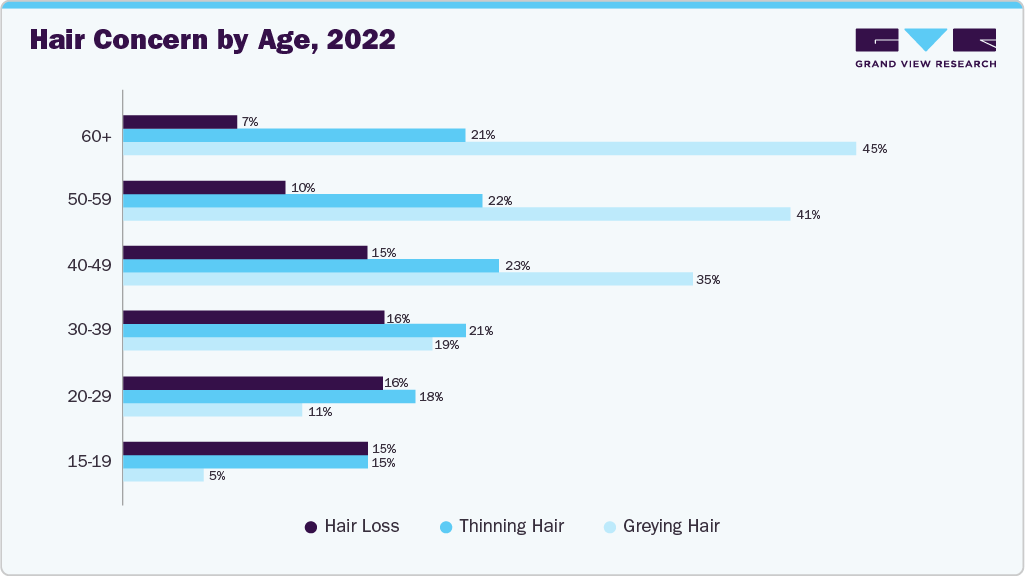

Hair concerns, such as greying hair, thinning hair, and hair loss, are progressively increasing with age. Even younger age groups (15-29) report noticeable concerns, especially with thinning hair and early signs of hair loss. This reflects a broader shift in consumer awareness toward early signs of aging. Alongside this, external stressors such as post-pandemic anxiety, political instability, and the fast-paced nature of modern life are accelerating premature aging in younger demographics like Gen Z and millennials. These younger consumers are becoming more conscious of their appearance and are seeking effective, preventative hair care solutions earlier in life.

This heightened awareness is contributing to the expansion of the luxury hair care market. Consumers are increasingly willing to invest in high-end, multifunctional products that promise not only aesthetic improvements but also long-term health benefits. The 31% growth in product SKUs globally targeting hair loss (2021 - 2022) and the rise of nutraceutical brands like Nutrafol and Arey point to a significant pivot toward premium, naturally formulated solutions. As consumers prioritize quality over price-despite inflationary pressures-luxury hair care brands are in a strong position to cater to this demand with scientifically backed, anti-aging, and stress-relieving formulations. The convergence of wellness, beauty, and functionality is driving a new era in hair care, where premium, holistic products are no longer a niche but a growing expectation across all age groups.

Trump Tariff Impact

The Trump administration’s tariff structure, aimed at rebalancing trade deficits and protecting domestic industries, has had ripple effects across global markets, including the luxury hair care sector. One significant move was the imposition of tariffs on European Union imports, which prompted the European Union (EU) to respond with retaliatory tariffs of 25% on a range of U.S. goods, including beauty and personal care items such as perfumes, shampoos, skincare products, and makeup. These measures have introduced added cost burdens for luxury beauty brands operating across U.S.-EU borders, complicating supply chains and threatening price competitiveness in already premium-priced product categories.

For the luxury hair care industry, these tariffs have significantly impacted both production costs and consumer pricing strategies. Brands that rely on transatlantic exports and imports are forced to absorb additional tariff costs or pass them on to consumers-potentially reducing demand or eroding brand loyalty. This is particularly challenging in a market where the perception of quality and exclusivity is key. Increased tariffs make U.S. luxury hair care products less attractive in the EU and vice versa, which may shift purchasing preferences toward domestic alternatives or non-tariff-affected markets, disrupting established brand-consumer relationships.

The impact is especially pronounced for British luxury brands, which are heavily export-oriented. According to Walpole, the British luxury trade association, 70% of British luxury goods are exported, and the U.S. accounts for 22% of these exports. This makes the American market critically important for the UK luxury hair care industry. Tariffs on British beauty exports to the U.S. put considerable pressure on these brands, threatening sales volumes, shrinking profit margins, and potentially discouraging investment in U.S. market expansion. For niche and artisanal luxury hair care producers, the added costs can be particularly prohibitive.

In the long term, if trade tensions persist, luxury hair care brands may be forced to reconsider their global strategies-restructuring supply chains, establishing local manufacturing bases, or even shifting market focus away from the U.S. or EU altogether. While tariffs are a tool of economic policy, their unintended consequence is often a distortion of consumer choice and the suppression of cross-border brand growth in sectors like luxury beauty, which rely heavily on international prestige and seamless market access.

Product Insights

The luxury shampoo led the market and accounted for a share of 30.78% in 2024. Shampoos are an essential part of the personal care routine. The rising demand for shampoos is attributed to the increasing prevalence of hair-related problems such as oily scalp, dandruff, dry hair, and hair fall. Environmental challenges such as rising pollution can be harmful to hair and scalp health, further bolstering segment growth. In addition, consumers are becoming more conscious about personal hygiene and grooming, which, in turn, is creating a significant demand for luxury hair care products, including shampoos.

Luxury hair coloring products are estimated to grow at a CAGR of 10.8% from 2025 to 2030. Increased awareness of the harmful effects of chemicals in hair colors has pushed the demand for natural and organic hair colors. A rising number of consumers prefer plant-based hair dyes instead of coloring chemicals. Manufacturers are, therefore, developing products to substitute harmful components with plant-based ingredients.

Price Range Insights

Luxury hair care products priced between USD 30 and USD 65 accounted for the largest market share of 40.15% in 2024. Luxury hair care products offered in this range are preferred for their fragrance and unique formulations and ingredients. Christophe Robin, a Paris-based A-list colorist brand, offers a regenerating hair mask that helps rejuvenate dry, damaged, and chemically treated hair. Priced at USD 51, the product contains prickly pear oil, a rare and revered active ingredient. The formula works to improve the appearance of split ends and makes hair stronger. It contains other ingredients like glycerin, flower/leaf extract, citric acid, and hydroxycitronellal.

Hair care products priced between USD 65 and USD 100 are anticipated to register a CAGR of 10.4% from 2025 to 2030, reflecting rising consumer demand for ultra-premium formulations and high-performance ingredients. Luxury hair care brands may strategically target a specific demographic that is willing to invest more in their care and grooming. This could include consumers who prioritize quality and view hair care as an integral part of their lifestyle. Bumble and Bumble, based in the U.S., offers hair spray that is infused with its Hair Preserve Blend formulation. The restorative spray acts like a liquid bandage. It contains other ingredients such as algae extract, Centella Asiatica (hydrocotyl) extract, caffeine, Rosmarinus officinalis (rosemary) leaf extract, and more. The product is free from parabens, phthalates, mineral oil, and formaldehyde.

Distribution Channel Insights

The sales through specialty stores held a share of 31.83% in 2024. Specialty stores offer a special range of product choices and help consumers make quick purchase decisions owing to in-person assistance. These stores emphasize visual merchandising and create intricate product displays, attracting more customers. In-store interactions with customers are valuable as they help form long-term brand loyalty. Some of the popular specialty stores are Space NK, based in London. It is widely spread across the UK, Ireland, and the U.S. The store offers various hair care brands such as Briogeo, Oribe, Ouai, Virtue, Olaplex, The Ordinary, Bamford, Diptyque, and many other brands.

The online channel is expected to grow at a CAGR of about 10.5% from 2025 to 2030. E-commerce has grown in popularity over the past few years due to its convenience, and many consumers purchase premium hair care products online. This trend is particularly prominent in developing countries such as India, Brazil, and several African countries. Considering the high popularity of online retail platforms for various hair care products, several players have been offering their products directly to customers online. For instance, in June 2023, Kérastase introduced its premium haircare products on Amazon with a starting price of USD 19. The products include Kérastase Discipline Oléo-Relax Advanced Hair Oil, Kérastase Resistance Force Architecte Shampoo, and Kérastase Blond Absolu Ultra-Violet Purple Shampoo.

Regional Insights

North America global luxury hair care market dominated the global industry in 2024 with a share of about 32.95%. Rising consumer interest in high-end haircare products and increasing spending on hair styling products are some of the key factors fueling product demand in the region. North America is one of the vital markets for luxury hair care, driven primarily by the U.S. Most countries in North America have shown strong economic growth over the years and as a result, consumers in these countries have a higher spending power, which enables them to opt for high-end hair care and other beauty products.

U.S. Luxury Hair Care Market Trends

The luxury hair care market in the U.S. is driven by rising consumer awareness of ingredient quality, personalized beauty regimens, and the increasing convergence of wellness and premium grooming. Affluent and aspirational consumers are gravitating toward high-end hair care solutions that offer not only functional benefits-such as damage repair, hydration, and scalp health-but also align with broader lifestyle values like clean beauty, sustainability, and self-care. Brands such as Oribe, Olaplex, and Alterna Haircare have capitalized on this shift by offering salon-grade formulations enriched with potent ingredients like biotin, bond-building actives, plant-based proteins, and botanical extracts sourced from sustainable origins. For instance, Olaplex’s patented Bis-Aminopropyl Diglycol Dimaleate technology has become synonymous with professional-grade hair repair, making it a best-seller both online and in prestige retail outlets like Sephora and Ulta. Similarly, Oribe’s Gold Lust collection, infused with white tea, baobab, and bio-restorative complex, appeals to consumers seeking both performance and a luxury sensorial experience.

Asia Pacific Luxury Hair Care Market Trends

The luxury hair care market in Asia Pacific is expected to witness a CAGR of 10.9% from 2025 to 2030. As economies in Asia thrive, a corresponding surge in disposable income has empowered consumers to allocate more resources to personal care, especially hair care products. This economic upswing has opened the doors for the entry of luxury international brands into the region. For instance, Nuggela Sule, a leading hair care brand in its home market (Spain-based player), has successfully penetrated the Asian markets, particularly China and Singapore, securing the top spot for its shampoo on Amazon. As the brand establishes its presence in these markets, it sets its sights on untapped opportunities in emerging economies like Indonesia, Vietnam, and Taiwan.

Key Luxury Hair Care Companies Insights

Key players operating in the luxury hair care market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Luxury Hair Care Companies:

The following are the leading companies in the luxury hair care market. These companies collectively hold the largest market share and dictate industry trends.

- L’Oréal Groupe

- EstéeLauder Companies, Inc.

- SEVEN, LLC

- Alcora Corporation

- Kao Corporation

- KOSÉ Corporation

- Jose Eber

- PHILIP KINGSLEY PRODUCTS LTD.

- RAHUA

- KEVIN.MURPHY

Recent Developments

-

In April 2025, Cécred-the luxury hair care brand founded by renowned artist Beyoncé Knowles-Carter-was launched nationwide at Ulta Beauty, marking the retailer’s largest exclusive hair care debut to date. The brand became available both online and across more than 1,400 Ulta Beauty retail locations throughout the U.S., signifying a major milestone in its expansion strategy, just one year following its initial market entry. Cécred’s Foundation Collection, featuring flagship products such as the Hydrating Shampoo and Conditioner, the Fermented Rice & Rose Protein Ritual, and the widely acclaimed Restoring Hair & Edge Drops, was formally integrated into Ulta Beauty’s premium product portfolio.

-

In February 2024, Kao Corporation launched Melt, a premium hair care line positioned around the concept of "relaxing beauty." The collection featured a carbonated shampoo inspired by professional head spa treatments, meticulously developed to stimulate multiple senses and deliver an elevated, luxurious self-care experience.

-

In November 2023, Kérastase, a L’Oréal brand, introduced the Blond Absolu 2% Pure Hyaluronic Acid Serum, a pioneering product designed to address the hydration needs of blonde hair. This serum features the highest concentration of hyaluronic acid ever incorporated into a Kérastase haircare product, combining both macro and micro hyaluronic acid to deeply hydrate and repair bleached and damaged hair while moisturizing the scalp. Notably, it represents Kérastase's inaugural scalp-specific product tailored explicitly for blondes, aiming to enhance hair health from the root.

Luxury Hair Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.64 billion

Revenue forecast in 2030

USD 40.24 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

L’Oréal Groupe; EstéeLauder Companies, Inc.; SEVEN, LLC; Alcora Corporation; Kao Corporation; KOSÉ Corporation; Jose Eber; PHILIP KINGSLEY PRODUCTS LTD.; RAHUA; KEVIN.MURPHY

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Hair Care Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury hair care market report on the basis of product, price range, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Shampoos

-

Conditioners

-

Hair Coloring Products

-

Hair Styling Products

-

Hair Oil

-

Others

-

-

Price Range (Revenue, USD Billion, 2018 - 2030)

-

USD 30 to USD 65

-

USD 65 to USD 100

-

USD 100 to USD 150

-

USD 150 to USD 200

-

Above USD 200

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drugstore

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global luxury hair care market was estimated at USD 23.16 billion in 2024 and is expected to reach USD 25.64 billion in 2025.

b. The global luxury hair care is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 40.24 billion by 2030.

b. The North America dominated the market with a share of around 32.95% in 2023. This can be attributed to the Increasing consumer fascination for unique and high-end haircare products and a surge in online spending on beauty products.

b. Some of the key players operating in the luxury hair care market include L’Oréal Groupe, EstéeLauder Companies, Inc., SEVEN, LLC, Alcora Corporation, Kao Corporation, KOSÉ Corporation, Jose Eber, PHILIP KINGSLEY PRODUCTS LTD., RAHUA, KEVIN.MURPHY.

b. Key factors that are driving the luxury hair care market growth are Unique and innovative branding and promotional efforts the introduction of bespoke products and a rising preference for effective and customized hair care products that cater to specific hair concerns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.