- Home

- »

- Beauty & Personal Care

- »

-

Shea Butter Market Size And Share, Industry Report, 2030GVR Report cover

![Shea Butter Market Size, Share & Trend Report]()

Shea Butter Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Raw/Unrefined, Refined), By Application (Cosmetics & Personal Care, Food, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-490-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shea Butter Market Summary

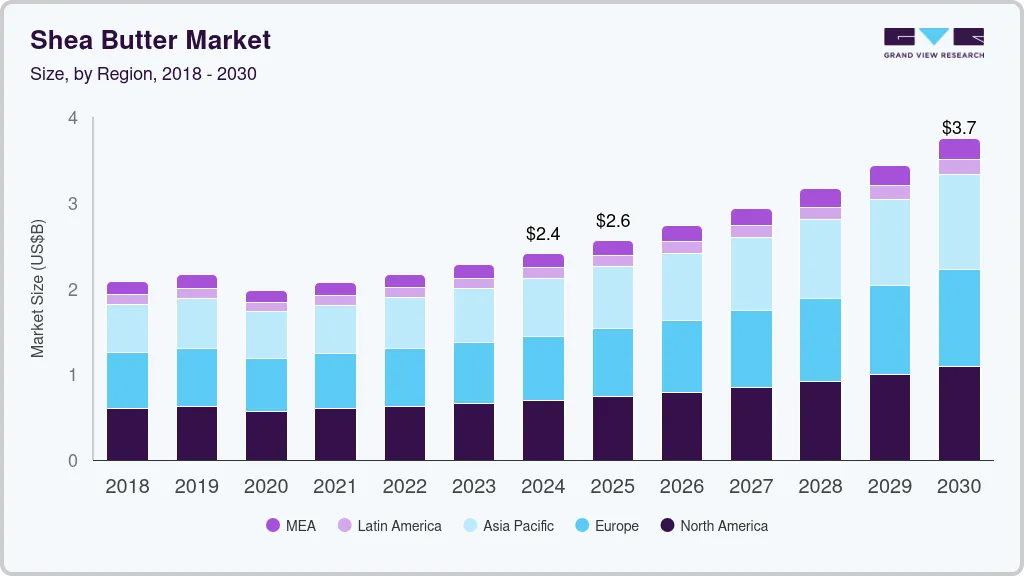

The global shea butter market size was estimated at USD 2,412.4 million in 2024 and is projected to reach USD 3,748.0 million by 2030, growing at a CAGR of 7.9% from 2025 to 2030. This growth is largely driven by rising demand for natural and organic skincare products, with shea butter recognized for its moisturizing, anti-inflammatory, and antioxidant properties.

Key Market Trends & Insights

- The Europe shea butter market accounted for a share of over 30% of the global market revenue in 2024.

- The U.S. shea butter market is expected to grow at a CAGR of 8.2% from 2025 to 2030.

- Based on product, the raw/unrefined shea butter sales accounted for a share of 62.64% in 2024.

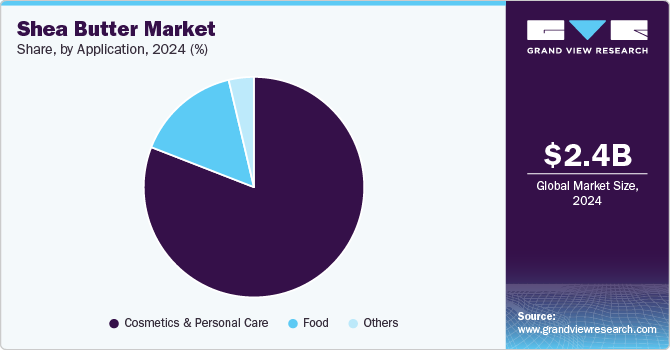

- In 2024, over 80% of global shea butter sales were attributed to its application in cosmetics and personal care products.

Market Size & Forecast

- 2024 Market Size: USD 2,412.4 Million

- 2030 Projected Market Size: USD 3,748.0 Million

- CAGR (2025-2030): 7.9%

- Europe: Largest market in 2024

The beauty and personal care sector, in particular, is a key consumer, spurred by consumer preferences for eco-friendly, sustainable ingredients. In addition, the market is benefiting from increased production capabilities in regions like West Africa, where shea butter is sourced, and ongoing initiatives to improve sustainability in the supply chain.

The growth of the market is closely linked to regulatory frameworks and international partnerships aimed at boosting product quality, safety, and sustainability. In the U.S., shea butter products are governed by strict FDA and USDA regulations, ensuring consumer safety, preventing adulteration, and guaranteeing truthful labeling. These regulations play a significant role in maintaining market confidence, particularly in preventing the adulteration of shea butter, which is a major concern in the U.S. market. The American Shea Butter Institute categorizes imported shea butter into different classes, emphasizing the importance of using high-quality, pure shea butter for its efficacy.

Moreover, strategic collaborations between U.S. entities and African organizations are fostering both economic empowerment and sustainable practices in shea butter production. Notably, the "Shea Gets Greener!" initiative, a partnership with The Savannah Fruits Company, Sundial Brands, and USAID, is set to empower 21,000 women in Ghana, Cote d'Ivoire, and Mali. This collaboration, with an investment of USD 9.3 million, not only enhances production efficiency but also promotes eco-friendly methods. Such initiatives help expand the market by ensuring a steady supply of quality, sustainably produced shea butter, meeting the growing global demand for ethical and natural beauty ingredients.

The approval of shea butter as a novel food ingredient in China in 2017 marked a significant development for the market, expanding its usage beyond cosmetics to food products such as chocolates, ice cream, and bakery items. This shift not only introduces new culinary experiences but also drives market growth as Chinese consumers become more open to incorporating diverse ingredients. However, safety regulations prevent its inclusion in baby food. This broader acceptance of shea butter in food applications is expected to contribute to the market's growth in China as it taps into a new consumer base interested in international and unique food ingredients.

There has been a notable shift towards shea butter, driven by increased demand in the personal care and cosmetics sector in India. Shea butter's moisturizing and nourishing properties make it a popular choice for skincare and haircare products, enhancing its appeal among Indian manufacturers. The country's acceptance of shea butter as a food ingredient by the Food Safety and Standards Authority of India (FSSAI) in 2021 has further boosted imports, particularly from West African countries like Ghana. This regulatory approval has opened up new avenues for the use of shea butter in food products, such as chocolates, contributing to the growth of the market.

Product Insights

Raw/unrefined shea butter sales accounted for a share of 62.64% in 2024. The demand for unrefined shea butter in skincare products is increasing, driven by consumers' growing preference for natural and organic ingredients. Companies like Isivuno Naturals and FirstSeed Organics in South Africa are catering to this demand by offering unrefined shea butter for skincare formulations. The rise of the self-care movement, along with greater consumer awareness about ingredient purity, has led to the popularity of products made with unrefined shea butter. Just Shea Butter, a South African company founded by Wandisa Nkosi, has tapped into this market by sourcing organic-certified shea butter from Ghana, focusing on providing pure, unadulterated products. Their successful marketing efforts via social media have contributed to the growth of the market for unrefined shea butter.

Refined shea butter sales are projected to grow at a CAGR of 7.6% from 2025 to 2030. Companies such as All Organic Treasures GmbH, a Germany-based provider, offer organic shea butter, with its refined version being a nearly odorless and tasteless white solid fat rich in oleic and stearic acid. The refined shea butter is certified as both organic and kosher, making it suitable for food applications, and has a shelf life of at least 18 months. The company collaborates with the Shea Savannah Fruit Company (SFC) to ensure compliance with food-grade certifications, including DE-ÖKO-007 and Kosher. This growing demand for refined shea butter, particularly in food products, reflects the increasing interest in high-quality, certified ingredients that meet both health and regulatory standards in markets like Europe, where ethical sourcing and natural ingredients are highly valued.

Application Insights

In 2024, over 80% of global shea butter sales were attributed to its application in cosmetics and personal care products. This is attributed to its use in cosmetics and personal care products, driven by its growing popularity for its natural, moisturizing, and skin-nourishing properties. Shea butter is rich in essential fatty acids like oleic acid and stearic acid, which are known to hydrate and protect the skin. This makes it a key ingredient in formulations for lotions, creams, lip balms, and hair care products. Brands like L'Occitane, The Body Shop, and Dr Organic have capitalized on the increasing demand for organic, natural beauty products by incorporating shea butter into their ranges. In addition, consumer preference for sustainable and ethically sourced ingredients has further fueled demand, with companies sourcing shea butter from West Africa and ensuring fair trade practices. This shift toward clean beauty and sustainable ingredients has reinforced shea butter’s dominant role in the global cosmetics market.

Shea butter sales in the food industry are projected to grow at a CAGR of 8.5% from 2025 to 2030, driven by its increasing acceptance as a versatile, natural fat used in a variety of food products. Its benefits in enhancing texture, improving shelf life, and contributing to healthier fats have led to its incorporation in products like chocolates, bakery goods, ice creams, and frying oils. For instance, the approval of shea butter as a novel food ingredient in China in 2017 opened up new avenues for its use in food, aligning with rising consumer demand for diverse and healthier food ingredients. Furthermore, shea butter is gaining traction in the vegan food market due to its plant-based origins, which align with the growing trend for plant-based and ethical food alternatives.

Regional Insights

The North America shea butter market accounted for a share of 28.93% of the global market revenue in 2024. Major American brands like The Body Shop and L'Occitane, which focus on natural ingredients, are expanding their product lines with shea butter-based offerings. Furthermore, the approval of shea butter as a food ingredient in regions like the U.S. has spurred growth in its use in edible products such as chocolates and baked goods.

U.S. Shea Butter Market Trends:

The U.S. shea butter market is expected to grow at a CAGR of 8.2% from 2025 to 2030. The U.S. market is shaped by a combination of regulatory oversight and growing demand for natural ingredients in skincare, cosmetics, and food. Shea butter is widely recognized for its versatility, used for skin conditions like eczema, sunburn relief, and wrinkle reduction. However, the market faces challenges, particularly regarding adulteration, as some producers modify shea butter to enhance its fragrance or texture, undermining its therapeutic properties. The American Shea Butter Institute highlights the issue of product delays, with some shea butter reaching consumers after two to three years, causing a loss of potency. To combat this, the Institute advises consumers to check for certifications such as the American Shea Butter Institute's seal.

Europe Shea Butter Market Trends

The Europe shea butter market accounted for a share of over 30% of the global market revenue in 2024. The shea butter market in Europe is experiencing significant growth, driven by the rising demand for eco-friendly, ethically sourced ingredients, particularly in the cosmetics and food industries. European consumers are increasingly prioritizing sustainability and natural products, with the majority of shea butter consumption being directed towards the food industry, while the cosmetics sector holds a smaller but growing share, according to the Global Shea Alliance. This trend is reinforced by stringent regulatory frameworks such as the Cosmetic Regulation (EC 1223/2009) and REACH, ensuring the safety and quality of imported shea butter.

Asia Pacific Shea Butter Market Trends

The Asia Pacific shea butter market is expected to grow at a CAGR of 8.7% from 2025 to 2030. The growth of the market in the Asia Pacific region is being significantly influenced by efforts from various associations, notably the Global Shea Alliance (GSA). As of December 2022, the GSA, a key non-profit organization representing over 600 members globally, launched initiatives to expand shea butter's presence in the Asia Pacific cosmetics and health sectors. With strong roots in Europe and the U.S., the GSA is now focusing on connecting cosmetic brands in Japan, South Korea, and China with rural shea butter producers, primarily women cooperatives. This initiative is expected to empower local producers, promote the use of shea butter in cosmetics, and drive market growth in the region.

Key Shea Butter Company Insights

The shea butter industry is fragmented, with the presence of many developed global players and many developing key market entrants. These players are engaging in major acquisition and promotional activities to increase their customer base and brand loyalty. Prominent companies include The Savannah Fruits Company (SFC), Bunge Loders Croklaan, and Olam International, which are key suppliers of raw shea butter, mainly sourced from Africa. These companies have a strong focus on sustainable sourcing and empowerment of women in West Africa, which aligns with the growing consumer demand for ethically sourced ingredients.

Key Shea Butter Companies:

The following are the leading companies in the shea butter market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Olvea Group

- Sophim S.A.

- Cargill, Inc.

- Suru Chemicals

- Ghana Nuts Company Ltd.

- Croda International Plc

- Agrobotanicals, LLC

- Clariant AG

- AAK AB

Recent Developments

-

In June 2021, the Fuji Oil Group established the Responsible Shea Kernels Sourcing Policy, aiming to exercise sustainable development in the shea butter supply chain. Its approach involves planting 6,000 shea tree saplings annually with an objective to empower women in the shea kernel industry, enhance the production capacity of cooperatives, generate local employment opportunities, and offer training on operational skills and product quality.

-

The Ghana Shea Landscape Emission Reductions Project (GLSERP), launched in early 2024 with an investment of USD 54.5 million, aims to enhance sustainability in Shea farming. This initiative focuses on preventing deforestation, supporting local communities, and boosting the Shea butter value chain.

-

In September 2021, Shea Radiance launched six new body care products in 520 Whole Foods Stores in Virginia, U.S.

Shea Butter Market Report Scope

Report Attribute

Details

Market size in 2025

USD 2,562.1 million

Revenue forecast in 2030

USD 3,748.0 million

Growth rate (Revenue)

CAGR of 7.9% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Malaysia, Australia, Brazil, South Africa

Key companies profiled

BASF SE, Olvea Group, Sophim S.A., Cargill, Inc., Suru Chemicals, Ghana Nuts Company Ltd., Croda International Plc, Agrobotanicals, LLC, Clariant AG, AAK AB

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shea Butter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shea butter market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Raw/Unrefined

-

Refined

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cosmetics & Personal Care

-

Food

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shea butter market size was estimated at USD 2,412.4 million in 2024 and is expected to reach USD 2,562.1 million in 2025.

b. The global shea butter market is expected to grow at a compound annual growth rate of 7.9% from 2025 to 2030 to reach USD 3,748.0 million by 2030.

b. Europe dominated the shea butter market with a share of more than 30% in 2024.

b. Prominent companies include The Savannah Fruits Company (SFC), Bunge Loders Croklaan, and Olam International, which are key suppliers of raw shea butter, mainly sourced from Africa.

b. Market growth is largely driven by rising demand for natural and organic skincare products, with shea butter recognized for its moisturizing, anti-inflammatory, and antioxidant properties. The beauty and personal care sector, in particular, is a key consumer, spurred by consumer preferences for eco-friendly, sustainable ingredients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.