- Home

- »

- Medical Devices

- »

-

U.S. Magnetic Resonance Angiography Market Report, 2030GVR Report cover

![U.S. Magnetic Resonance Angiography Market Size, Share & Trends Report]()

U.S. Magnetic Resonance Angiography Market (2023 - 2030) Size, Share & Trends Analysis Report By Technique (Contrast Enhanced MRA, Non-contrast Enhanced MRA), By Indication, By End-use, And Segment Forecasts

- Report ID: GVR-4-68038-769-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

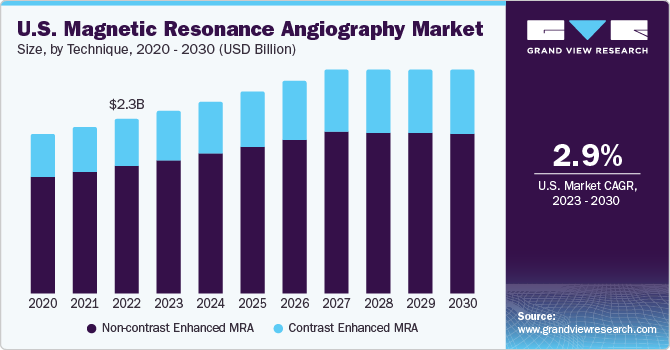

The U.S. magnetic resonance angiography market size was valued at USD 2.28 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.9% from 2023 to 2030. The market growth can be attributed to improving insurance coverage, supportive government regulations, and an increased adoption of magnetic resonance angiography (MRA) techniques. The growing geriatric population and artificial intelligence-based imaging solutions are expected to further fuel market growth in the coming years. An increase in FDA approvals will likely propel the demand for MRI systems. Before marketing MRI systems in the U.S., manufacturers must submit a premarket notification or 510(k), the approval of which is required before introducing their device into interstate commerce.

MRA is a diagnostic procedure for identifying diseases/disorders such as tumors and lesions, which impact mainly the blood vessels and soft tissues. Demand for diagnostic imaging techniques is anticipated to grow steadily over the coming years, especially in soft tissue imaging. In addition, with the increasing geriatric population and the incidence of chronic diseases in the United States, the demand for MRA procedures is expected to rise significantly in the near future.

As per the Administration for Community Living, in the U.S., the population of people aged 65 years and above increased from 37.2 million in 2006 to 49.2 million in 2016, showing a 33% rise. Moreover, the same source states that the population of people aged 85 years and above in the country was estimated at 6.4 million in 2016 and is expected to reach 14.6 million by 2040. The rapidly growing elderly population leads to a higher incidence of chronic diseases, which is likely to drive the market for magnetic resonance angiography in the U.S.

The demand for magnetic resonance imaging (MRI) is predicted to expand in the United States due to rising rates of chronic illnesses such as cancer, cardiovascular diseases, and musculoskeletal problems, as well as technological improvements. Furthermore, there will eventually be an extensive deployment of imaging modalities due to the growing burden of chronic diseases.

For instance, as per an American Cancer Society study from 2021, over 1,898,000 cancer cases (consisting of over 970,200 males and 927,900 females) were expected to be identified in the United States in 2021, with more than 608,000 deaths attributed to the disease. The high prevalence of cancer in the country highlights the need for diagnostic imaging, since early identification can avert the disease's potentially fatal consequences. As a result, it is anticipated that the need for MRI scans is likely to rise nationwide.

The amount of radiological imaging data has grown significantly in the past decade, more than the availability of trained readers. AI can assist in detecting and segmenting normal and abnormal images. Automatic detection is expected to speed up reporting and improve patient experience. As image acquisition and reporting are expected to improve significantly due to the adoption of AI-based applications, the U.S. market for magnetic resonance angiography is expected to expand in the coming years.

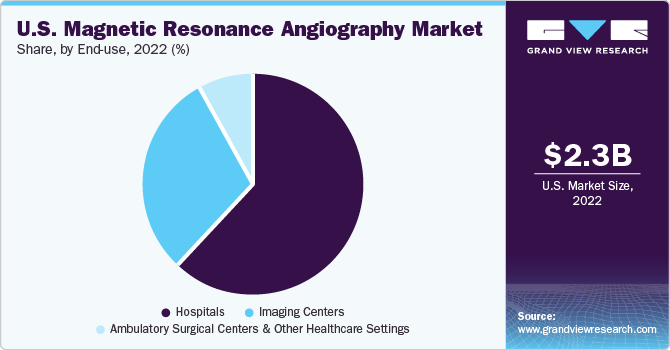

End-use Insights

The hospital segment dominated the market with a revenue share of around 62.2% in 2022, owing to a significant number of scans performed in hospital-owned emergency departments and imaging departments. Because of the increased demand for price transparency and affordable services, hospitals have started offering imaging services in outpatient facilities to offer various diagnostic services at affordable costs.

On the other hand, the imaging centers segment is anticipated to expand at the fastest CAGR of 3.5% over the forecast period from 2023 to 2030 in the U.S. magnetic resonance angiography market. The steadily increasing demand for imaging centers can be attributed to the easy accessibility to these centers and growing volume of outpatient procedures.

Technique Insights

In 2022, the non-contrast enhanced magnetic resonance angiography segment dominated the market with a revenue share of 73.2%, owing to the increased demand for diagnostic procedures without using contrast dyes. Non-contrast enhanced MRAs are recommended for patients who are either pregnant or suffering from kidney disorders. In addition, certain elderly patients are advised to undergo non-contrast-enhanced MRA, which is a safer alternative as no contrast agent is injected into the body.

On the other hand, the contrast-enhanced MRA segment is poised to expand at the fastest CAGR of 3.6% over the forecast period. A contrast agent known as Gadolinium-based Contrast Agent (GBCA) is added during contrast-based MRAs, offering a more detailed image of blood vessels than the tissues or organs surrounding them. Contrast MRAs can also help in identifying tumors. Cancer diagnosis can be made easier by introducing Gadolinium in the system as it assists in spotting tumors.

Indication Insights

The other indications segment dominated the market and held a 75.3% share of the overall revenue in 2022. On the other hand, the abdominal magnetic resonance angiography segment is likely to expand at the fastest CAGR of 3.3% over the forecast period. According to the NCBI, around 8% of Emergency Department (ED) visits are due to acute abdominal pain. The use of MRAs in EDs is limited due to their high cost and low availability. In the U.S., more than 5% of the population over 50 years of age, or 10 million adults, suffer from peripheral vascular disease, which is likely to drive the demand for MRAs in the coming years.

Key Companies & Market Share Insights

Companies such as Siemens & Philips have launched AI-based applications to increase their productivity and streamline workflow. Philips offers SmartExam, an AI-based application that can assist in automatic planning to standardize the MRI exam process. In December 2019, Siemens Healthcare GmbH launched two AI-based MRI software assistants at the Radiological Society of North America (RSNA) conference to help improve the quality of care and increase efficiency.

In June 2022, United Imaging installed new technology for patients at the Memorial MRI & Diagnostic Center in Katy, Texas. In another development, in March 2022, Vizient, Inc. granted a contract to United Imaging, a pioneer in the supply of cutting-edge medical imaging and radiation therapy equipment, for its complete line of DR (X-ray) and MR (magnetic resonance) systems. The agreement boosted the range of modalities that United Imaging offers through Vizient; the company was earlier awarded a contract in 2021 for its advanced CT (computed tomography) equipment suite.

Key U.S. Magnetic Resonance Angiography Companies:

- GE Healthcare (General Electric Company)

- Neusoft Corporation

- Koninklijke Philips N.V.

- Siemens

- ESAOTE SpA

- Hitachi, Ltd.

- Canon, Inc.

- ASG Superconductors SpA

- Shenzhen Anke Hi-tech Co., Ltd.

- Time Medical Holding

- Shimadzu Corporation

- AllTech Medical Systems

U.S. Magnetic Resonance Angiography Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.40 billion

Revenue forecast in 2030

USD 2.93 billion

Growth Rate

CAGR of 2.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, indication, end-use

Country scope

U.S.

Key companies profiled

GE Healthcare (General Electric Company); Neusoft Corporation; Koninklijke Philips N.V.; Siemens; ESAOTE SpA; Hitachi, Ltd.; Canon, Inc.; ASG Superconductors SpA; Shenzhen Anke Hi-tech Co., Ltd.; Time Medical Holding; Shimadzu Corporation; AllTech Medical Systems

Customization scope

Free report customization (equivalent to up to analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Magnetic Resonance Angiography Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. magnetic resonance angiography market report based on technique, indication, and end-use:

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Contrast Enhanced MRA

-

Non-contrast Enhanced MRA

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Abdomen

-

Lower Extremities

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

Ambulatory Surgical Centers & Other Healthcare Settings

-

Frequently Asked Questions About This Report

b. The U.S. magnetic resonance angiography market was estimated at USD 2.28 billion in 2022 and is expected to reach USD 2.40 billion in 2023.

b. The U.S. magnetic resonance angiography market is expected to grow at a compound annual growth rate of 2.9% from 2023 to 2030 to reach USD 2.93 billion by 2030.

b. The Non-contrast Enhanced MRA segment dominated the market with a share of around 73.16% in 2022. This is attributable to the high-quality images of the blood vessels without the usage of contrast dyes.

b. Some key players operating in the U.S. magnetic resonance angiography market are GE Healthcare; Philips Healthcare; Siemens Healthcare, Hitachi, etc.

b. Key factors driving the U.S. MRA market growth include rising awareness about CVDs and associated risk factors, constant improvements in the imaging technologies, and negligible exposure to radiations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.