- Home

- »

- Consumer F&B

- »

-

U.S. Meal Kit Delivery Services Market Size, Report, 2030GVR Report cover

![U.S. Meal Kit Delivery Services Market Size, Share & Trends Report]()

U.S. Meal Kit Delivery Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Heat & Eat, Cook & Eat), By Service (Single, Multiple), By Platform (Online, Offline), By Meal Type (Vegan, Vegetarian), And Segment Forecasts

- Report ID: GVR-4-68040-323-6

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. meal kit delivery services market size was estimated at USD 10.4 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030. The hectic work schedules and busy lifestyles of consumers across the country leave them with less time for cooking at home. This is driving the preference and demand for ready-to-eat meal kits instead of takeout and other unhealthy food options.

The U.S. meal kit delivery market accounted for a share of 86.4% of the global meal kit delivery market in 2023. The number of meal kit delivery service providers has been rising as an increasing number of people are becoming aware of the adverse health effects of junk food.

A large number of consumers purchase meal kits in the country to save time and effort. Meal kits have become an inexpensive and healthier alternative to pre-cooked food items in retail stores or restaurants. Furthermore, key players, such as Sun Basket and Blue Apron, witnessed a strong product demand during the COVID-19 outbreak.

Offering Insights

The cook-and-eat segment held a market share of 61.6% in 2023. The growing popularity of gourmet-style cooking and trying new recipes at home is projected to drive the segment’s growth. As per a survey by Peapod in 2018, 43% of the participants planned to cook at home more often in 2019. This trend has even gained prominence among millennials in the country, with 59% of the millennials surveyed revealing that they were keen on cooking at home more frequently. These trends are expected to bode well for the segment’s growth.

The heat-and-eat segment is expected to grow at a CAGR of 11.3% over the forecast period. Heat & eat is gaining popularity among the working population due to their hectic lifestyles and busy schedules with no or less time for cooking. Companies operating in this segment are trying to enhance convenience for their consumers. Some companies focus on plant-based meals, keto diets, paleo diets, and other types of diets to address the various consumer concerns. These factors are projected to drive the segment’s growth over the forecast period.

Service Insights

The single delivery segment accounted for a revenue share of 58.8% in 2023. The largest consumer group for meal kit delivery services is millennials and Generation Z. This group mainly comprises students and professionals who lead busy lives and prioritize maintaining a healthier lifestyle.

The multiple-delivery service segment is expected to grow at a CAGR of 11.2% from 2024 to 2030. These meals are made of fresh ingredients and balanced in terms of nutrition. Thus, regular consumption of these kit meals is not harmful to health. Meal kits also reduce the time required for cooking, providing the satisfaction of cooking and families having homemade food.

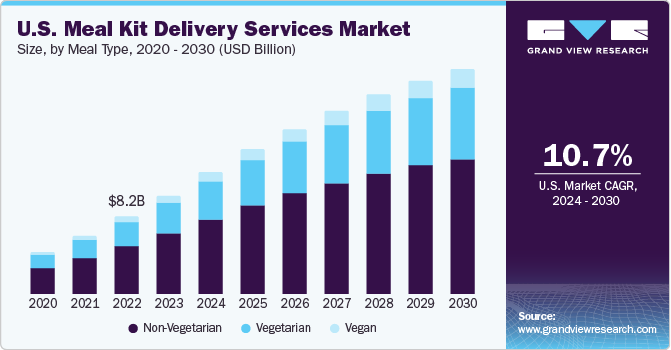

Meal Type Insights

Non-vegetarian meal kit delivery services accounted for a revenue share of 61.6% in 2023. The segment’s growth is attributed to the popularity of non-vegetarian meal kits in the U.S. and the nutritional value associated with this meal type. Non-vegetarian foods are rich in amino acids that are beneficial for the body and help build immunity.

The vegan meal kits segment is expected to grow at a CAGR of 12.9% over the forecast period. Growing acceptance of veganism among consumers, especially millennials, is boosting the market for vegan foods. The vegan population is growing significantly in the U.S. owing to the rising prevalence of lactose intolerance and various food allergies.

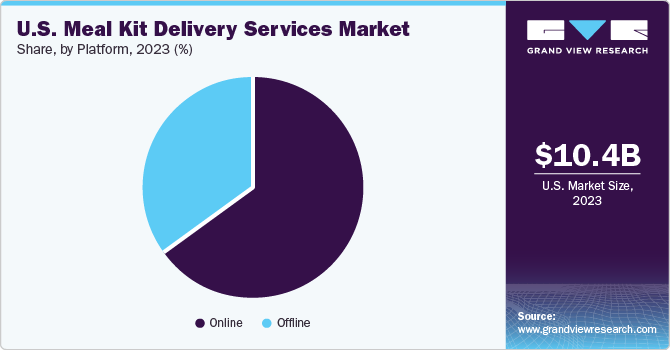

Platform Insights

The online platform segment accounted for a revenue share of 64.7% in 2023. Increasing demand for meal kit delivery services resulted in a rise in local small businesses providing these convenient services. These delivery services often feature popular local cuisines. The availability of service providers online helps customers find a suitable provider for themselves after comparing the menu, features, benefits, and pricing of multiple companies.

The offline segment is expected to grow at a CAGR of 11.0% over the forecast period. In this segment, meat kits are available at Tesco, Walmart, Kroger, and other retailers. Both large- and small-scale organizations offer their meal kits via offline channels due to the large consumer base of these stores.

Key U.S. Meal Kit Delivery Services Company Insights

Companies face intense competition, mainly from the top players, as they have vast distribution networks, strong brand recognition, and a large consumer base. Companies have been implementing various expansion strategies, such as mergers & acquisitions and new product launches, to stay ahead in the game.

Key U.S Meal Kit Delivery Services Companies:

- Blue Apron, LLC

- Sun Basket

- Freshly Inc.

- Relish Labs LLC (Home Chef)

- Purple Carrot

- Gobble

- Fresh n' Lean

- Hungryroot

- HelloFresh

- Marley Spoon Inc.

Recent Developments

-

In June 2022, Blue Apron introduced seasonal meal kits that were available throughout the year. This move was aimed at bringing special occasions to life. The new category was launched with a Summer Lobster Box

U.S. Meal Kit Delivery Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 23.7 billion

Growth rate

CAGR of 10.7% from 2024 to 2030

Historical period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, service, platform, and meal type

Key companies profiled

Blue Apron, LLC; Sun Basket; Freshly Inc.; Relish Labs LLC (Home Chef); Purple Carrot; Gobble; Fresh n' Lean; Hungryroot; HelloFresh; Marley Spoon Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Meal Kit Delivery Services Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. meal kit delivery services market report based on offering, service, platform, and meal type:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat & Eat

-

Cook & Eat

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Single

-

Multiple

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Meal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vegan

-

Vegetarian

-

Non-Vegetarian

-

Frequently Asked Questions About This Report

b. The U.S. meal kit delivery services market size was estimated at USD 10.40 billion in 2023 and is expected to reach USD 12.87 billion in 2024.

b. The U.S. meal kit delivery services market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 23.71 billion by 2030.

b. The single service kits captured the largest share of more than 59% in 2023 in the meal kit delivery services market.

b. Key players operating in the market includes Blue Apron, LLC; Freshly Inc.; HelloFresh; Sun Basket; Relish Labs LLC (Home Chef); Gobble; Marley Spoon Inc.; Purple Carrot; Fresh n' Lean; Hungryroot

b. Increasing preference for home-cooked and chef-cooked food among millennials is a major factor contributing to the growth of the market. The delivery service has been gaining high popularity and adoption among Generation Y and Z. The increasing preference for the product is driven by the benefits of homemade meals, as they are more economical in comparison to take-outs and home delivery services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.