- Home

- »

- Consumer F&B

- »

-

U.S. Meat Extract Market Size & Share, Industry Report 2033GVR Report cover

![U.S. Meat Extract Market Size, Share & Trends Report]()

U.S. Meat Extract Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Chicken, Pork, Beef, Fish, Turkey), By Form (Powder, Liquid, Granule, Paste), By Application (Ready Meals, Snacks, Soups & Broths, Seasonings), And Segment Forecasts

- Report ID: GVR-4-68040-813-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Meat Extract Market Summary

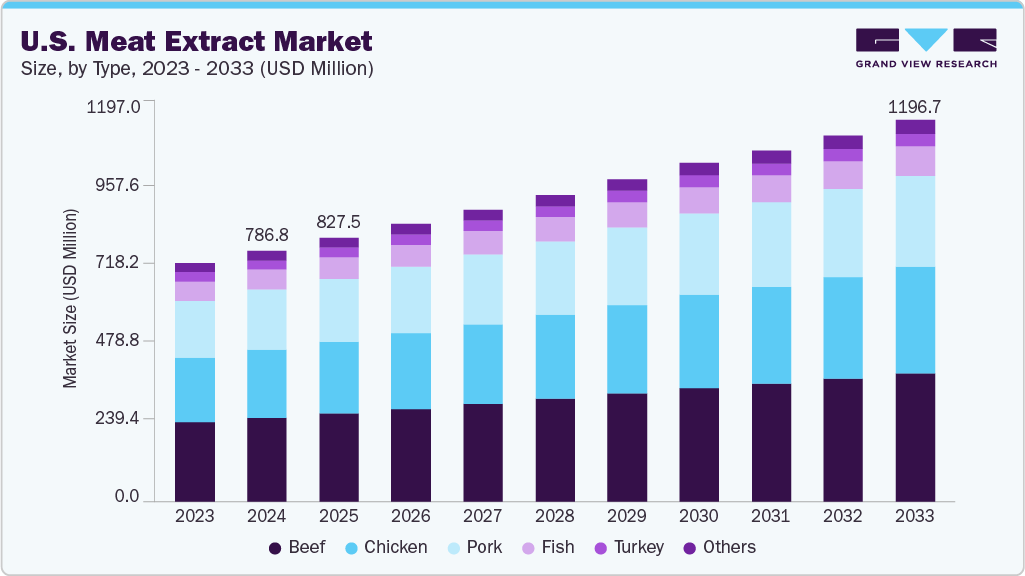

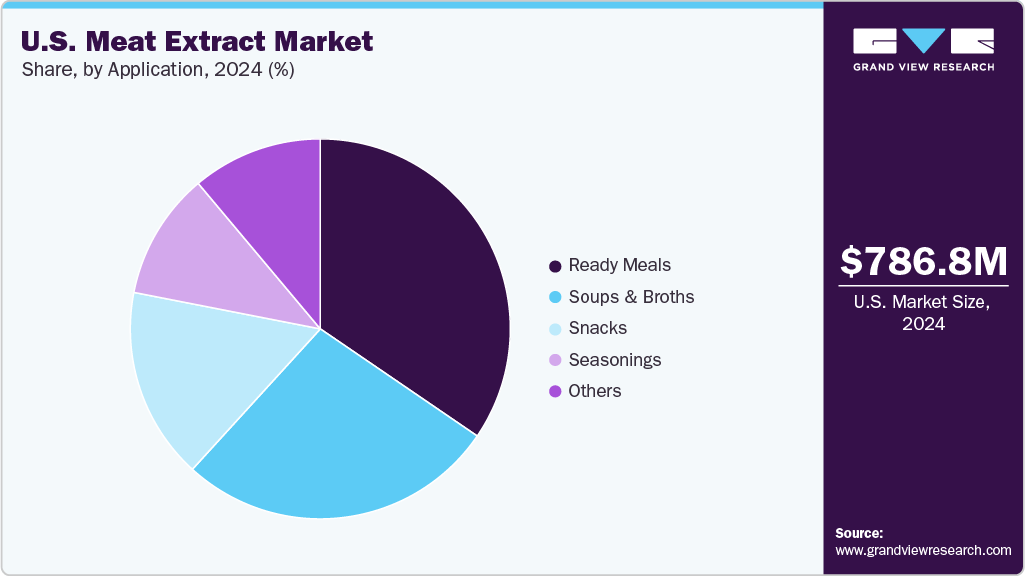

The U.S. meat extract market size was estimated at USD 786.8 million in 2024 and is expected to reach USD 1,196.7 million by 2033, growing at a CAGR of 4.7% from 2025 to 2033. As diets like paleo and keto become more popular, consumers are seeking protein-rich, nutrient-dense ingredients, and meat extracts serve as a convenient and concentrated source of protein.

Key Market Trends & Insights

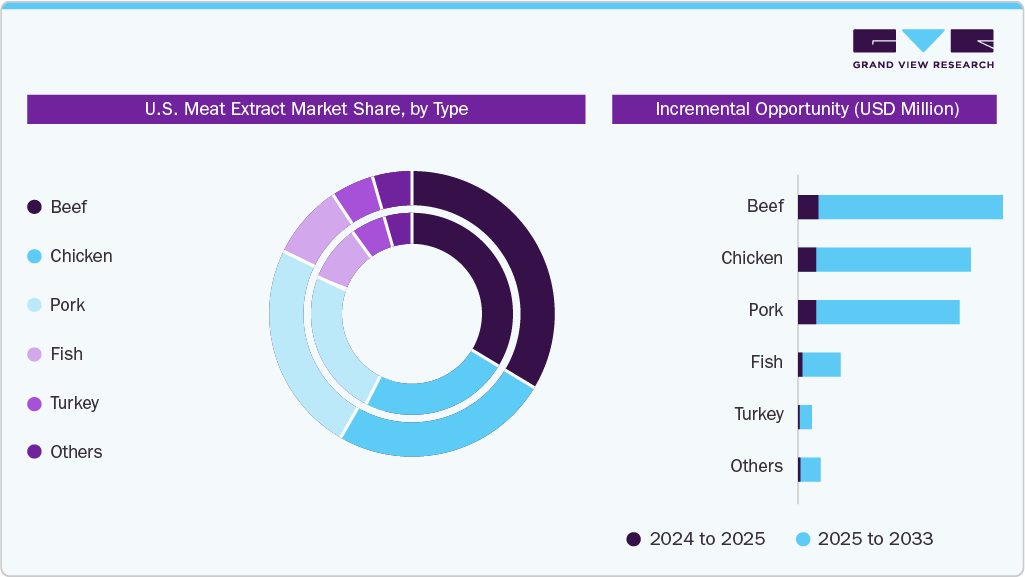

- Based on type, the beef extracts segment accounted for a share of 33.5% in 2024.

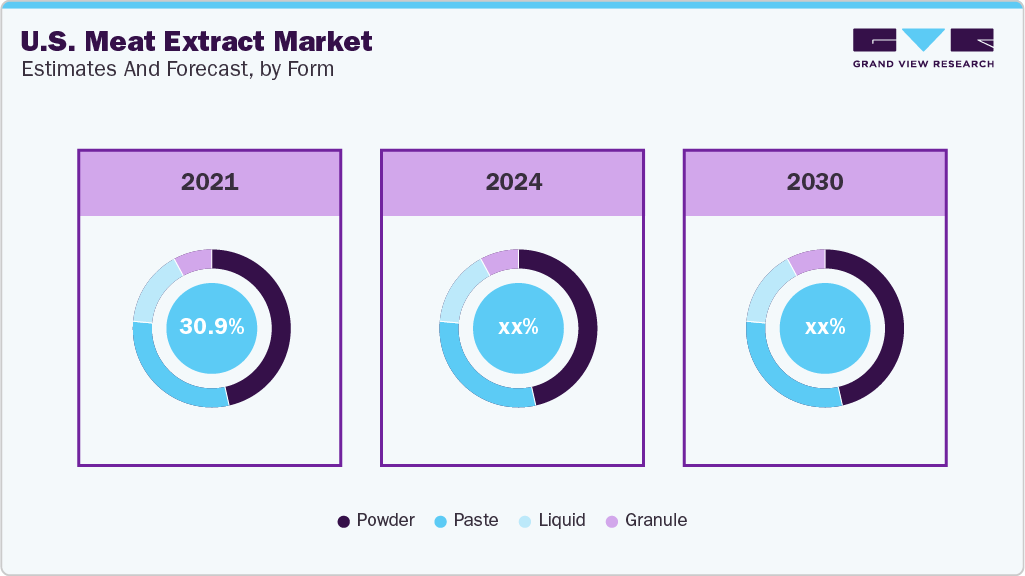

- By form, the powdered meat extract segment dominated the U.S. meat extract market with a revenue share of 45.3% in 2024.

- By application, the ready meals segment dominated the U.S. meat extract market with a revenue share of over 34.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 786.8 Million

- 2033 Projected Market Size: USD 1,196.7 Million

- CAGR (2025-2033): 4.7%

Additionally, consumers are increasingly prioritizing clean-label products-foods that are natural, additive-free, and non-GMO. Meat extracts, which are perceived as a more natural alternative to artificial flavor enhancers, fit well into this trend. The growing demand for clean, wholesome ingredients is pushing more manufacturers to include meat extracts in their products, such as ready-to-eat meals, sauces, and soups, which are popular in today’s fast-paced world. The ongoing health-conscious movement further fuels the preference for these products. Beyond culinary uses, meat extracts are gaining traction in the pharmaceutical and biotech industries, where they are used as components in culture media, boosting the demand across various sectors. The increasing application of meat extracts in different industries, coupled with their versatility, is contributing significantly to the market's growth.The U.S. has witnessed a decline in meat consumption in recent years. Several factors have contributed to this trend. Health concerns remain a dominant reason, as many Americans are reducing their intake of red and processed meats due to their association with health risks such as heart disease, obesity, and cancer. According to the United States Department of Agriculture (USDA), total meat per capita consumption in the U.S. declined slightly in 2023, marking the first decrease since 2014.

Additionally, there is a growing shift toward sustainability and animal welfare, with many consumers choosing food practices that prioritize environmental responsibility. In September 2024, the USDA updated its labeling guidelines to crack down on greenwashing: all voluntary “climate-friendly” or “regeneratively farmed” claims on meat products-including extracts-must now be substantiated by third-party verification. This aims to ensure that sustainability claims in ingredient sourcing and processing are backed by verifiable data.

The USDA’s Meat and Poultry Processing Expansion Program (MPPEP) invested over USD 1 billion in 2023 to incentivize processors including those producing extracts to upgrade equipment for improved water efficiency, reduced emissions, and enhanced waste management.

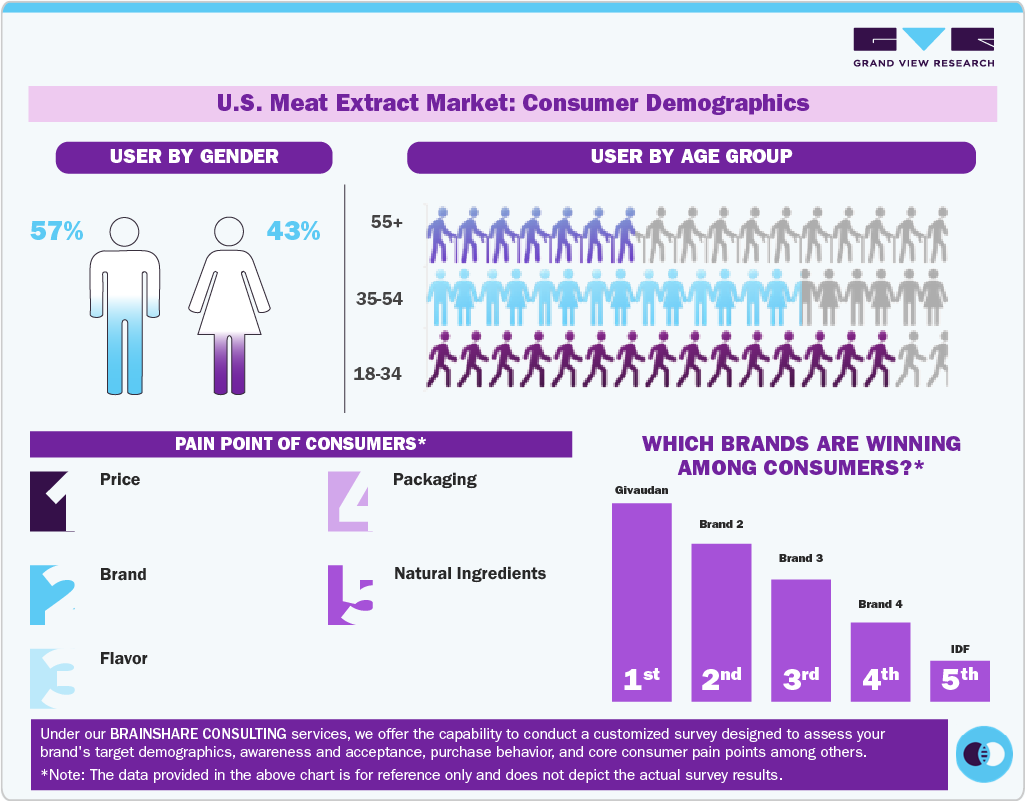

Consumer Insights for U.S. Meat Extract

American consumers are increasingly embracing meat extracts, driven by fundamental shifts in lifestyle, dietary priorities, and convenience expectations. These concentrated flavor enhancers have become essential ingredients in the modern American kitchen, supported by compelling consumer behavior trends.

Protein has expanded beyond traditional meals to become a critical component across all eating occasions. 74% of consumers describe eating meat as an important part of their diet, while 57% of consumers who read nutrition labels specifically check for protein content. This protein-centric mindset creates substantial opportunities for meat extract manufacturers, as these concentrated ingredients provide an efficient way to boost protein content in convenience foods.

Social media is fundamentally changing American food preferences, with most consumers trying new foods influenced by social media platforms. This digital influence drives demand for bold global flavors and creative meal solutions, creating opportunities for specialized meat extract products that cater to trending international cuisines. Household penetration remains extraordinarily high at 98% of American households purchasing meat products, with meat included in approximately 87% of home-cooked meals weekly. This universal adoption provides a massive addressable market for meat extract ingredients across all income levels and demographics.

Additionally, younger generations are leading flavor experimentation, embracing multicultural protein meals and high-protein lifestyle trends popularized on platforms like TikTok and Instagram. This trend supports demand for diverse meat extract varieties, from Korean-inspired beef extracts to Latin American chicken flavor profiles. Moreover, American consumers increasingly appreciate umami-rich flavors. Meat extracts serve as primary sources of natural umami compounds, including glutamates and nucleotides that enhance overall flavor perception.

Type Insights

Beef extract held the largest share of 33.5% in the U.S. meat extract industry in 2024. There is growing demand for natural flavor enhancers across the food industry, particularly in soups, sauces, seasonings, and ready meals. Beef extracts deliver a rich umami taste that is perceived as more authentic and natural than artificial additives, making them attractive for both mass-market and premium food applications. This aligns with the broader clean-label movement, where consumers favor recognizable, minimally processed ingredients. High-protein consumption trends driven by health-conscious consumers, fitness enthusiasts, and aging populations seeking muscle maintenance have made beef extracts appealing as a way to boost protein content while enhancing flavor in various food products.

Chicken extract is anticipated to witness a CAGR of 5.1% from 2025 to 2033. The market for chicken meat extract is witnessing growth due to the rising consumer preference for poultry-based flavors over red meat options. Health-conscious consumers often perceive chicken as a leaner, lower-fat, and more versatile protein, making chicken extracts a popular choice in soups, sauces, snacks, and ready meals. This health-driven shift has encouraged food manufacturers to incorporate chicken-derived flavors more extensively across product categories.

Form Insights

Powdered meat extract held the largest share of 45.3% in 2024. As more consumers shift toward high-protein diets, powdered meat extract serves as an easily digestible and protein-packed ingredient for various applications, from snacks to meal replacements and protein bars. The rise of meal kits, dehydrated soups, and dry rub seasonings in the U.S. has created a strong demand for flavor-rich, easy-to-handle powdered ingredients.

Meat extract pastes are anticipated to witness a CAGR of 5.0% from 2025 to 2033. Paste formats offer superior ease of use for industrial and food service applications as there is a rising preference for quick meal solutions without compromising on nutritional value. The popularity of meat-based spreads, especially for sandwiches and snacks, has surged in line with broader trends towards high-protein diets. Innovations in product offerings, such as low-fat, organic, and gourmet varieties, are further driving consumer interest.

Application Insights

The ready meals accounted for the largest share of 34.5% in 2024. Rapid urbanization, busy work schedules, and a higher proportion of women in the workforce have led consumers to seek quick, easy-to-prepare meal options. Ready-to-eat and heat-and-eat meals fit this need perfectly, and meat extracts play a key role in delivering rich flavors without the long cooking times traditionally needed for meat-based dishes. This makes them a preferred ingredient for manufacturers aiming to meet the lifestyle needs of time-pressed consumers.

The soup and broths segment is projected to grow at the fastest CAGR of 5.2% from 2025 to 2033. Meat extracts provide a concentrated, ready-to-use base that ensures consistent flavor and aroma across production batches, reducing cooking time and operational complexity in large-scale soup and broth manufacturing. Consumers are increasingly preferring clean-label products with authentic taste profiles. Meat extracts offer a natural umami boost without relying heavily on artificial flavorings or MSG, aligning with clean-label and “no additives” trends in soups and broths.

Key U.S. Meat Extract Company Insights

Key players operating in the U.S. meat extract market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Meat Extract Companies:

- Givaudan

- Nikken Foods

- Essentia Protein Solutions

- IDF

- Haco Holding AG

- CHIMAB S.p.A.

- Foodex Inti Ingredients, PT

- Titan Biotech Ltd.

- Carnad A/S

- JBS S.A.

Recent Developments

-

In April 2024, Glanbia announced its acquisition of Flavor Producers, a US-based flavors and extracts business, for an initial consideration of €300 million. Glanbia plans to operate Flavor Producers within its Glanbia Nutritionals and Nutritional Solutions business segment, viewing the acquisition as consistent with its strategy of acquiring complementary businesses to grow its "Better Nutrition" platforms. The deal significantly expands Glanbia's flavor offerings. It provides new capabilities in the attractive and growing natural and organic flavors market, aligning with long-term consumer trends toward clean-label and natural ingredients.

U.S. Meat Extract Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 827.5 million

Revenue Forecast in 2033

USD 1,196.7 million

Growth rate

CAGR of 4.7% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, application

Country scope

U.S.

Key companies profiled

Givaudan; Nikken Foods; Essentia Protein Solutions; IDF; Haco Holding AG; CHIMAB S.p.A.; Foodex Inti Ingredients, PT; Titan Biotech Ltd.; Carnad A/S; JBS S.A.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Meat Extract Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. meat extract market report by type, form, and application:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Chicken

-

Pork

-

Beef

-

Fish

-

Turkey

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Powder

-

Paste

-

Liquid

-

Granules

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Ready Meals

-

Snacks

-

Soups & Broths

-

Seasonings

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. meat extract market size was estimated at USD 786.8 million in 2024 and is expected to reach USD 827.5 million in 2025.

b. The U.S. meat extract is expected to grow at a compounded growth rate of 4.7% from 2025 to 2033 to reach USD 1,196.7 million by 2033.

b. Powdered meat extract held the largest share of 45.3% in 2024. As more consumers shift toward high-protein diets, powdered meat extract serves as an easily digestible and protein-packed ingredient for various applications, from snacks to meal replacements and protein bars.

b. Some key players operating in U.S. meat extracts market include Givaudan; Nikken Foods; Essentia Protein Solutions; IDF; Haco Holding AG; CHIMAB S.p.A.; Foodex Inti Ingredients; and others

b. Key factors that are driving the market growth include increasing per capita consumption of meat and growing application of meat extract in foodservice industry

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.