- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Meat Extract Market Size And Share, Industry Report, 2033GVR Report cover

![Meat Extract Market Size, Share & Trends Report]()

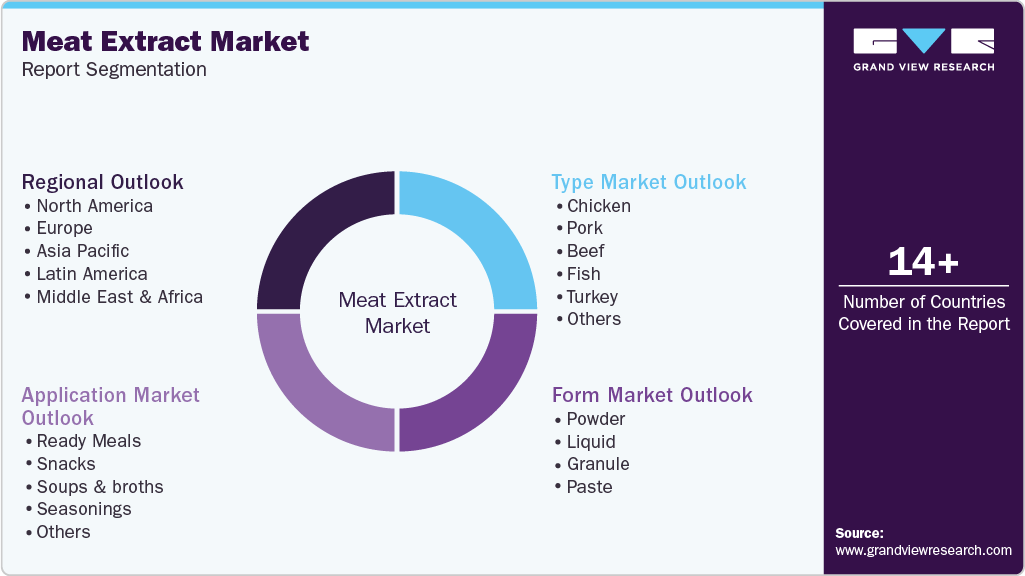

Meat Extract Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Chicken, Pork, Beef, Fish, Turkey), By Form (Powder, Paste, Liquid, Granules), By Application (Ready Meals, Snacks, Soups & Broths), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-605-9

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Meat Extract Market Summary

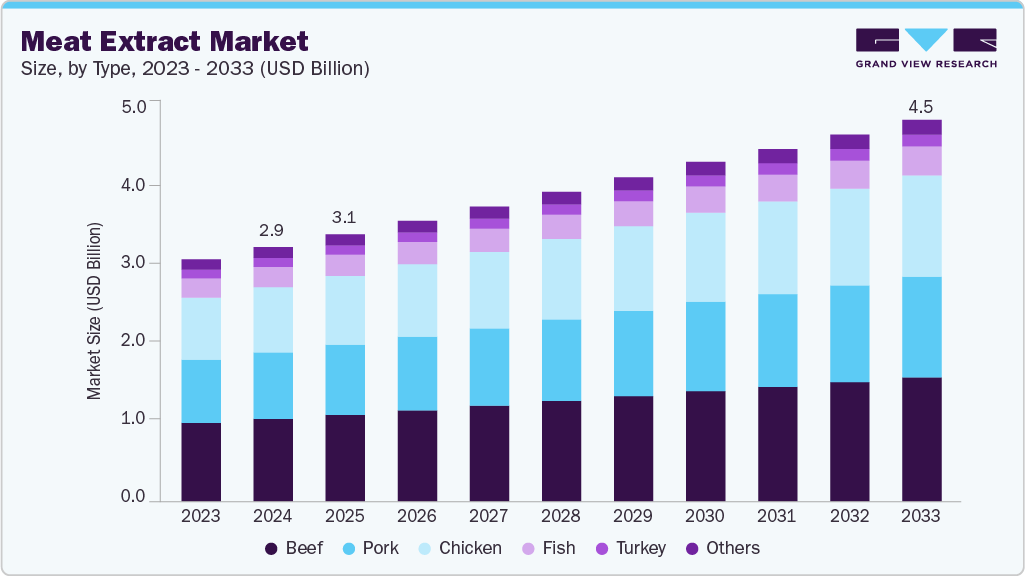

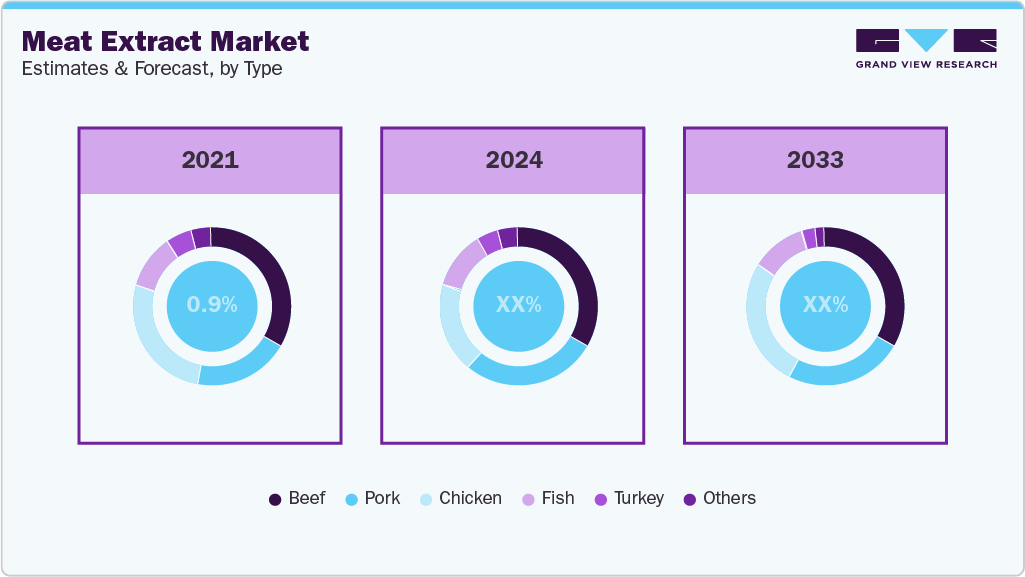

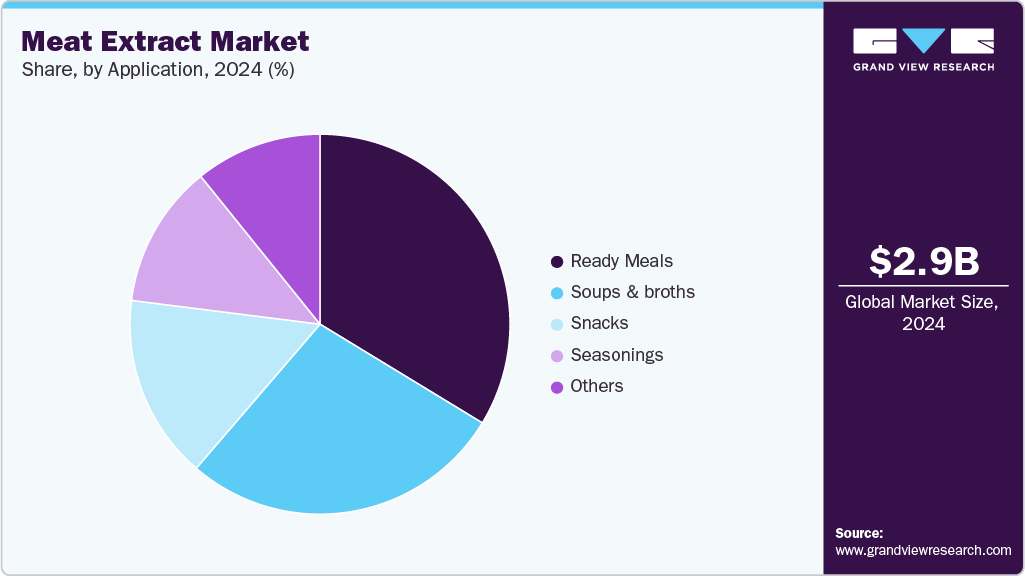

The global meat extract market size was estimated at USD 2,980.6 million in 2024 and is projected to reach USD 4,476.5 million in 2033, growing at a CAGR of 4.6% from 2025 to 2033. The market is anticipated to be driven by changing global diet trends, market developments, and R&D initiatives taken by major companies in the food sector, leading to economic growth in the industry.

Key Market Trends & Insights

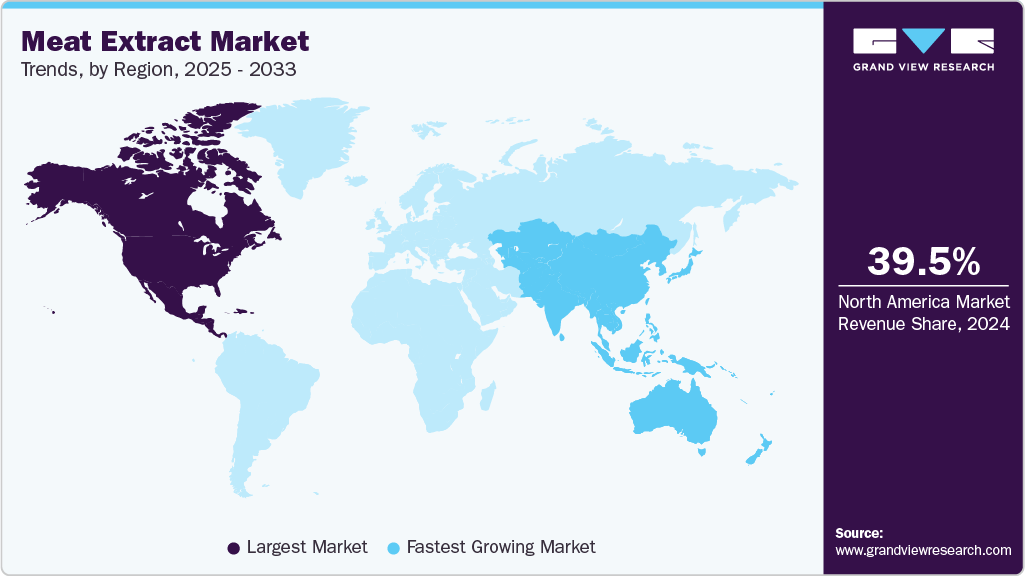

- The North America meat extract market accounted for a revenue share of 39.5% in 2024.

- The meat extract market in the U.S. held the largest market share of 66.9% in 2024.

- Based on type, the beef extract segment in the global meat extract market accounted for a share of 32.4% in 2024.

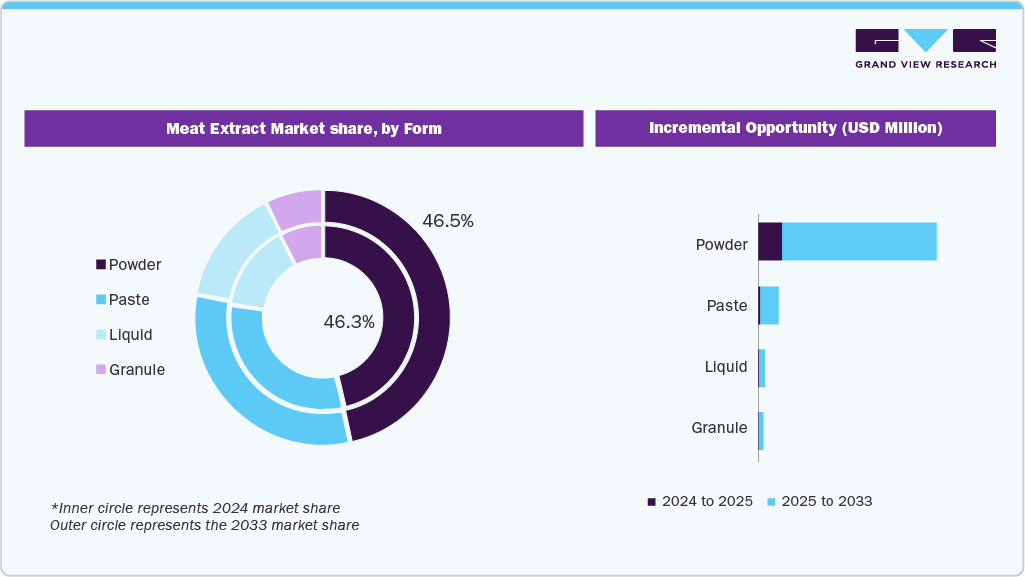

- By form, the powder segment accounted for the largest share of 46.3% of the revenue in 2024.

- By application, the ready meals accounted for the largest share of 33.7%of the revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,980.6 Million

- 2033 Projected Market Size: USD 4,476.5 Million

- CAGR (2025-2033): 4.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

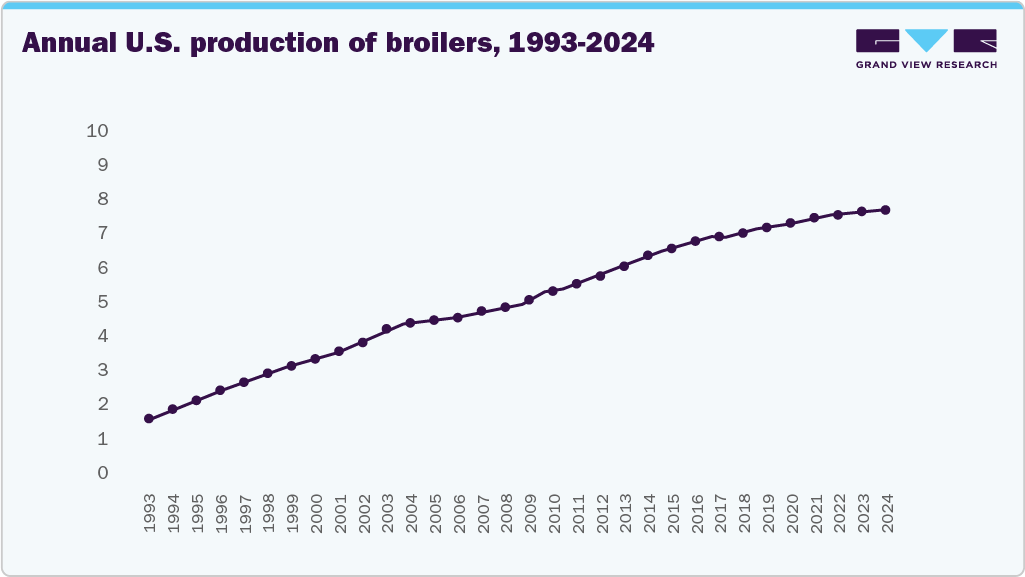

Increasing consumption of a protein-rich diet and rising health consciousness are anticipated to drive the product demand over the next few years. In addition, the growing popularity of beef due to its various certifications, such as halal and kosher, will contribute to the market growth. According to the U.S. Department of Agriculture (USDA), U.S. poultry sales reached USD 70.2 billion, driven mainly by broilers (USD 45.4 billion, +5.8%) in 2024. Supported by efficient production, genetics, and feed resources, broiler output grew 17.3% since 2015.

In addition, global per capita meat consumption is expected to rise at a decent rate by 2025. Processed meat manufacturers are coming up with new products and also adding new flavors to the existing range of products. Innovative launches, such as meat straws by Benny’s Original in different varieties like beef and pork straws, are expected to propel market growth.

As per the data published by the Food and Agriculture Organization (FAO), the total meat production in the world is expected to reach nearly 366 million tons by 2029. Of the total additional output, 76% will be predominantly contributed by the developing countries. Improved genetics, low feed costs, as well as growing demand for meat are anticipated to result in high production values. Subsequently, the market is expected to benefit from the rise in the production of meat over the forecast years.

The growing purchasing power of consumers will also support market growth. There is an increased shift from conventional meat to packaged meat products due to fast-tracked life in both developing as well as developed countries, resulting in an increased demand for meat extract. Moreover, with the growing consumer awareness regarding the consumption of high-nutrition food, the demand for protein is increasing all over the world, thereby augmenting the market growth.

According to the Food and Agriculture Organization of the United Nations (2024), the average daily per capita protein intake has increased from 98.21 g to 121.64 g from 1961 to 2022 in the U.S and 87.38 g to 109.67 g in North America in the same time period. The increasing number of consumers in the Asia Pacific region is opting for animal and animal products as a feasible source of protein. This is expected to propel the product demand over the forecast period.

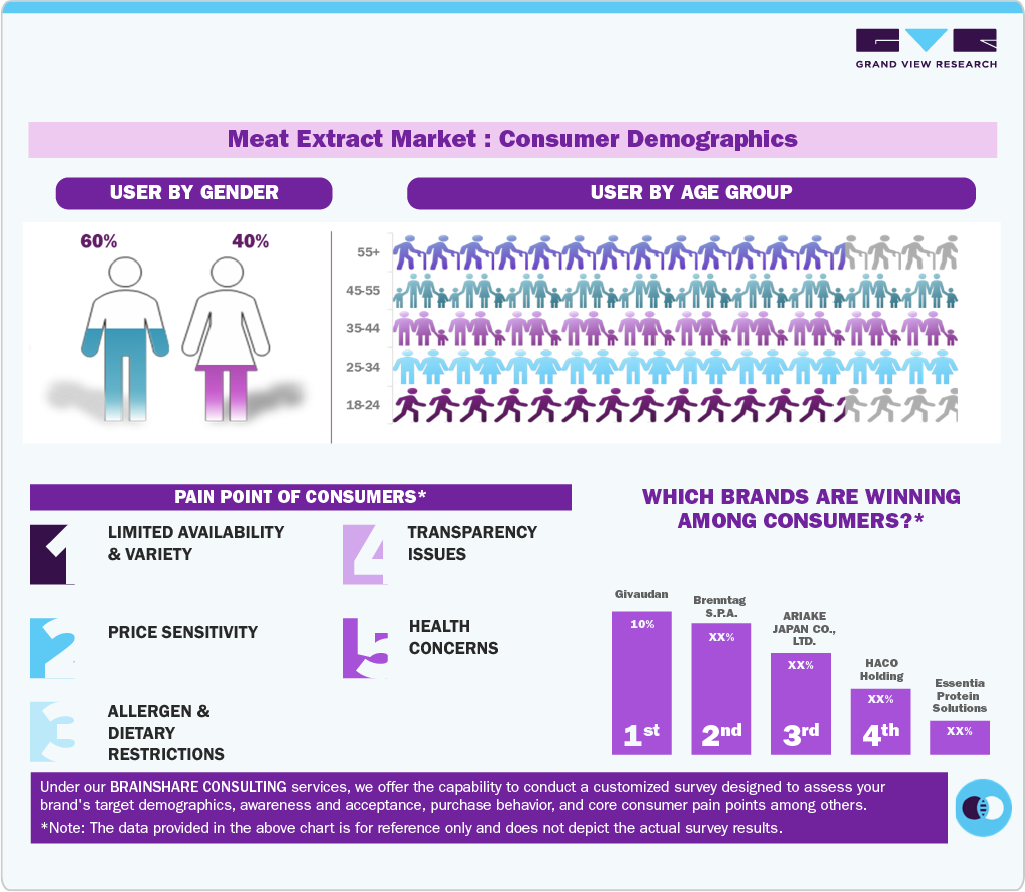

Consumer Insights for the Meat Extract Market

Consumer preferences for meat extract are shaped by rising demand for convenient, protein-rich food solutions that enhance flavor without extensive cooking. Busy lifestyles have fueled interest in ready-to-use meat-based seasonings, soups, and sauces. Health-conscious consumers increasingly look for products with natural ingredients, reduced sodium, and clean-label claims, prompting brands to highlight quality sourcing and minimal processing. Meat extract appeal to home cooks and the foodservice sector, with higher adoption in urban households and premium restaurants. Regional taste preferences also influence product selection, with beef, chicken, and fish extract dominating different markets. In addition, the shift toward packaged, shelf-stable products supports consistent demand.

Growing culinary experimentation has expanded meat extract consumption beyond traditional cooking, with consumers using these products in marinades, spreads, and fusion recipes. Social media-driven food trends and influencer marketing have increased awareness, encouraging trial among younger demographics. Premiumization is evident, as consumers are willing to pay more for organic, grass-fed, or sustainably sourced meat extract. In emerging economies, affordability and small-pack formats are driving first-time purchases. Meanwhile, buyers prioritize product origin, traceability, and ethical sourcing in developed markets. E-commerce has boosted accessibility, allowing niche brands to reach global customers. Overall, consumer demand reflects a balance between convenience, authenticity of flavor, and nutritional value.

Type Insights

The beef extract segment led the market and accounted for a share of 32.4% in 2024, propelled by its widespread recognition and application in imparting a deep, savory umami flavor. Consumer demand for authentic, rich meat profiles in a variety of dishes, from gravies and stocks to seasoned snacks and ready-to-eat meals, directly fuels the growth of beef extract. Its ability to provide a robust meaty foundation without the need for extensive cooking or processing makes it an indispensable ingredient for food manufacturers aiming for consistent taste and quality. Furthermore, the perceived health benefits associated with beef, such as its protein and iron content, contribute to its attractiveness as a functional ingredient, especially in formulations targeting specific nutritional profiles.

The pork extract segment is anticipated to observe a significant growth rate over the forecast period. A key trend driving this segment is the escalating popularity of savory convenience foods, particularly instant noodles, ready-to-eat meals, and bouillon cubes, where pork extract provide a robust and authentic flavor base. Furthermore, the burgeoning global interest in Asian cuisines, which heavily feature pork as a staple, directly translates into increased demand for these extract to achieve traditional and rich flavor profiles in seasonings, soups, and sauces. Moreover, manufacturers are also increasingly seeking natural flavor enhancers to meet clean label trends, and pork extract, derived directly from meat, offer a compelling solution for adding depth, umami, and a savory backbone without artificial additives, thus aligning with consumer desires for wholesome and transparent ingredients. Additionally, the distinct umami and savory notes of pork extract are highly prized for their ability to significantly enhance the taste and mouthfeel of a wide array of food products, from snacks and gravies to processed meats and pet food.

Form Insights

The powder segment accounted for the largest share of 46.3% of the revenue in 2024. Meat extract powder is a potent and rich form of meat stock, which is obtained from chicken, beef, pork, and fish, and is used to make broth for soups and liquid-based foods. The product is insoluble in alcohol while being highly soluble in water and has a distinctly characterized aroma that gives food products the aroma of meaty flavor. The powdered products are rich in nutrients, such as organic acids, vitamins, minerals, nucleotides, polypeptides, amino acids, creatinine, and creatine. The segment is expected to show high growth prospects over the forecast period due to its increased use in food products as a flavor & nutrient enhancer.

The meat extract pastes market is projected to grow significantly at the fastest CAGR of 4.8% from 2025 to 2033. Meat extract pastes are derived from mutton, fish, chicken, beef, and pork and are widely used in the manufacturing of baked & puffed goods, instant noodles, gravies, bouillons & bouillon cubes, canned meat items, pot pies, casseroles, stews, sauces, and soups. The meat extract-based paste adds aroma and enhances the flavors of food products. Rising consumer preference for healthy foods that are prepared using natural additives or flavorings will support segment growth. Companies, such as Nikken Foods Co. Ltd., Carnad A/S, and BRF, focus on R&D activities on varied formulations of meat extract that adhere to the aforementioned concerns of consumers.

Application Insights

The ready meals accounted for the largest share of 33.7%of the revenue in 2024. The increasing awareness about health and nutrition is influencing the market for ready meals with meat extract. Consumers are becoming more conscious of their dietary choices and are looking for options that offer both convenience and nutritional value. Moreover, meat extract used in ready meals can provide a rich source of protein, essential amino acids, and other nutrients, making them an attractive choice for health-conscious individuals.

The soup and broths segment is projected to grow at the fastest CAGR of 5.1% from 2025 to 2033. Consumers increasingly seek convenience without compromising on taste, leading to a surge in demand for ready-to-eat and instant soup products, as well as easy-to-use broth bases for home cooking. Meat extract, derived from beef, chicken, pork, or other meats, serve as concentrated flavor powerhouses, providing the deep umami notes and mouthfeel traditionally associated with long-simmered stocks. This trend is further fueled by a growing appreciation for global cuisines, many of which are founded on robust meat-based broths, driving manufacturers to incorporate high-quality extract to ensure product authenticity and consistency across batches.

Regional Insights

The North America meat extract market accounted for a revenue share of 39.5% in 2024, primarily due to the rising consumption of animal-rich protein sources. In addition, the U.S. was one of the leading producers of beef and is expected to maintain its position over the forecast years. Growing consumption of red meat-based products in Mexico is expected to drive the regional market. Product traceability is a major trend that exhibits the demand for meat extract in North America. A rise in the demand for and consumption of canned foods, increasing population, and new technological improvements are some major factors anticipated to contribute to the regional market growth over the forecast period.

U.S. Meat Extract Market Trends

The meat extract market in the U.S. held the largest market share of 66.9% in 2024. The U.S. has a well-established meat-centric culinary culture, with meat playing a central role in many traditional American dishes. Meat extract serve as a convenient way to infuse these beloved flavors into various recipes, catering to the American preference for rich and savory tastes. In addition, low substitution prospects are likely to result in stable product sales over the forecast period. The industry is anticipated to witness significant growth in demand for concentrate-based meat extract and stock/broth due to various factors, such as decreasing average household size and increasing number of working individuals.

Europe Meat Extract Market Trends

The meat extract market in Europe is projected to grow at a CAGR of 4.2% from 2025 to 2033. Manufacturers across the region, especially those producing soups, sauces, bouillons, and chilled ready meals, are increasingly substituting artificial flavor enhancers like MSG with natural, highly concentrated meat extract (predominantly beef and chicken) to meet consumer demands for simpler, recognizable ingredient lists. Furthermore, the aging population and rising prevalence of convenience culture in Western Europe fuel the demand for premium, high-quality prepared foods, requiring flavor solutions that maintain authentic savory profiles throughout industrial processing and reheating. Thus, the trend leans toward customized, high-specification extract that offer standardized, robust flavor profiles necessary for large-scale, consistent food production across the continent.

Germany Meat Extract Market Trends

The meat extract market in Germany is projected to grow at a CAGR of 4.1% from 2025 to 2033. According to an article published on Beef 2 Live, Germany has a wide range of meat options that are commonly enjoyed by its residents. The most favored varieties include pork, beef, and poultry. Among these, pork holds the title for being the most popular, with individuals consuming an average of 61 kg (134 lb.) of meat per year. When it comes to poultry, chicken takes the lead, followed by duck, goose, and turkey. Additionally, game meats such as boar, rabbit, and venison are readily available throughout the year.

Asia Pacific Meat Extract Market Trends

Asia Pacific meat extract market is growing at the fastest CAGR of 5.3% from the forecast period 2025 to 2033, owing to the rising consumption of processed and conventional chicken products in emerging countries, such as Japan, China, and India. Demand is concentrated in high-volume industrial applications, particularly the formulation of instant noodles, savory snacks, and concentrated seasoning blends common across China, India, and Southeast Asia. The key drivers are centered on convenience and cost-effectiveness; as consumers increasingly rely on ready-to-cook and ready-to-eat meals, extract provide the necessary concentrated flavor base for mass-market products. Culturally, there is a deep preference for rich, umami-laden savory profiles, making poultry and pork extract extremely popular. The market trend here focuses on scalability, efficiency, and the development of extract tailored to the diverse traditional savory bases utilized in the region’s expansive culinary landscape.

China Meat Extract Market Trends

The meat extract market in China is projected to grow at a CAGR of 6.0% from 2025 to 2033. The ongoing rapid urbanization and concurrent shift toward convenience foods underpin this demand. Meat extract, particularly concentrated chicken and pork varieties, are essential ingredients for manufacturers seeking to provide standardized, appealing savory flavor bases across massive markets, including instant noodles, ready-to-eat meals, instant soups, and mass-market seasonings. The need for consistent, robust umami flavor profiles in processed condiments and sauces means that Chinese food manufacturers maintain a continuously high volume demand for standardized, cost-effective meat extract ingredients to guarantee product uniformity across supply chains.

Latin America Meat Extract Market Trends

The meat extract market in Latin America is expected to grow at a CAGR of 5.1% from 2025 to 2033, supported by rising demand for natural flavor enhancers and protein-rich food products. Urbanization and a growing middle class have accelerated the consumption of processed and convenience foods, where meat extract play a key role in adding authentic taste and nutrition. Traditional culinary practices continue to favor beef extract, while chicken-based options are becoming increasingly popular. The expansion of quick-service restaurants, ready-to-eat meals, and food processing industries across the region has further boosted demand for versatile meat extract used in soups, sauces, seasonings, and savory packaged foods.

Brazil Meat Extract Market Trends

The Brazil meat extract market held the highest share of 49.6% of the Latin America revenue in 2024. The growth is driven by its strong position as a global leader in meat production, especially beef, poultry, and pork. Abundant raw material availability and well-developed processing facilities support a consistent supply and competitive pricing. Demand is also reinforced by Brazil’s vibrant food industry, where processed and ready-to-cook meals continue to gain popularity among busy consumers. Beef extract dominate due to the country’s culinary traditions, but chicken extracts are expanding rapidly as consumers seek healthier, lighter alternatives. Innovation in savory snacks, soups, and seasonings further fuels the adoption of meat extract in Brazil’s food processing sector.

Middle East & Africa Meat Extract Market Trends

The Middle East and Africa meat extract market is expected to grow at a CAGR of 3.8% from 2025 to 2033. The market is driven by rising urban populations, growing disposable incomes, and a strong preference for savory, protein-based meals. Poultry-based extracts are particularly popular due to cultural preferences and perceptions of being a healthier protein source. Moreover, traditional regional cuisines, which rely heavily on broths, stews, and spiced dishes, align naturally with meat extract for flavor enrichment. Increasing investments in the foodservice industry, along with the expansion of hotels, restaurants, and catering services, further stimulate demand. Convenient, easy-to-use flavor solutions are increasingly adopted across retail and professional cooking channels.

UAE Meat Extract Market Trends

The UAE meat extract market is growing because of the benefits from the country’s role as a dynamic foodservice and trade hub, where diverse culinary influences and demand for high-quality ingredients are prominent. A multicultural population and a fast-growing hospitality industry drive the use of meat extract in soups, sauces, and convenience foods. The UAE’s strong import infrastructure and trade agreements ensure a steady supply of meat-based ingredients, supporting food processors and restaurants. Rising consumer interest in authentic, flavorful, and convenient food options has further encouraged the use of meat extract across retail shelves, quick-service outlets, and premium dining establishments in the country.

Key Meat Extract Company Insights

Leading companies in the meat extract sector possess strong flavor-science expertise, expanded distribution networks, and integrated supply chains, from slaughtering to extraction, to secure market dominance. Major players such as Givaudan, Essentia Protein Solutions, and JBS S.A. benefit from innovation and efficiency. At the same time, specialist firms like International Dehydrated Foods and Nikken Foods address regional tastes and emerging segments. A surge of M&A activity, joint ventures, and investment in advanced extraction technologies, clean-label formats, and sustainability initiatives underscores company strategies focused on differentiation, traceability, and meeting evolving consumer expectations.

Key Meat Extract Companies:

The following are the leading companies in the meat extract market. These companies collectively hold the largest market share and dictate industry trends.

- Givaudan

- Nikken Foods. Co. ltd.

- Essentia Protein Solutions

- IDF

- HACO Holding AG

- Brenntag S.p.A.

- PT Foodex Inti Ingredients

- Titan Biotech Ltd.

- Carnad A/S

- Multitech Foods Manufacturing Co., Ltd.

- PT Jinyoung

- ARIAKE JAPAN Co., Ltd.

- Maverick Biosciences

- Vina Aroma Co., Ltd

- Meioh Bussan Co., Ltd

Recent Developments

-

In May 2024, PT Ajinomoto Indonesia launched KALDOPLUS, a liquid chicken-meat-extract seasoning designed for the hotel, restaurant, and catering sector. The product offered a more practical and economical alternative to homemade chicken broth by delivering comparable taste and aroma with significantly reduced preparation time, supported by Ajinomoto’s amino acid technology.

-

In November 2023, Givaudan announced a collaboration with neuroscience company Thimus, using the TBox platform to develop Food Emotions powered by Thimus. This program integrates explicit and implicit data to explore how humans experience food, providing unique consumer insights. Thimus' technology, including a portable headset recording brain signals, enables a deeper understanding of consumer preferences and behaviors, revolutionizing how Givaudan co-creates with customers to shape the future of food.

Meat Extract Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,131.8 million

Revenue Forecast in 2033

USD 4,476.5 million

Growth rate

CAGR of 4.6% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain, China; India; Japan; Australia & New Zealand; Brazil; Argentina, South Africa, UAE

Key companies profiled

Givaudan; Nikken Foods. Co. ltd.; Essentia Protein Solutions; IDF; HACO Holding AG; Brenntag S.p.A.; PT Foodex Inti Ingredients; Titan Biotech Ltd.; Carnad A/S; Multitech Foods Manufacturing Co., Ltd.; PT Jinyoung; ARIAKE JAPAN Co., Ltd.; Maverick Biosciences; Vina Aroma Co., Ltd; Meioh Bussan Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meat Extract Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global meat extract market on the basis of type, form, application, and region:

-

Type Market Outlook (Revenue, USD Million, Volume, Kilotons, 2021 - 2033)

-

Chicken

-

Pork

-

Beef

-

Fish

-

Turkey

-

Others

-

-

Form Market Outlook (Revenue, USD Million, Volume, Kilotons, 2021 - 2033)

-

Powder

-

Liquid

-

Granule

-

Paste

-

-

Application Market Outlook (Revenue, USD Million, Volume, Kilotons, 2021 - 2033)

-

Ready Meals

-

Snacks

-

Soups & broths

-

Seasonings

-

Others

-

-

Regional Market Outlook (Revenue, USD Million, Volume, Kilotons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global meat extracts market size was estimated at USD 2,980.6 million in 2024 and is expected to reach USD 3,131.8 million in 2025.

b. The meat extracts market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2033 to reach USD 4,476 million by 2033.

b. The North America dominated the market with a revenue share of 39.5% in 2024. North America is expected to show steady growth over the forecast period owing to the rising consumption of animal-rich protein sources. Growing consumption of red meat-based products in Mexico is expected to drive the regional market.

b. Some of the key market players in the meat extracts market Givaudan, Nikken Foods, Essentia Protein Solutions, IDF, Haco Holding AG, CHIMAB S.p.A., Foodex Inti Ingredients, PT, Titan Biotech Ltd., Carnad A/S, JBS S.A.,Henan Yong Da Foods, Diana Group, Maverick Biosciences, Idf (International Dehydrated Foods, Inc.), Activ International .

b. The market is anticipated to be driven by changing global diet trends, market developments, and R&D initiatives taken by major companies in the food sector leading to economic growth in the industry. Increasing consumption of a protein-rich diet and rising health consciousness is anticipated to drive the product demand over the next few years.

b. China is expected to be the largest regional market over the forecast period in Asia Pacific with 38.58% market share owing to the rising consumption of processed and conventional chicken products in emerging countries, such as Japan, China, and India.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.