- Home

- »

- Homecare & Decor

- »

-

U.S. Meat Slicer Market Size, Trends, Industry Report, 2030GVR Report cover

![U.S. Meat Slicer Market Size, Share & Trends Report]()

U.S. Meat Slicer Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Manual Slicer, Semi-automatic Slicer, Fully Automatic Slicer), By Blade Size, By End-use (Household, Food Service), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-592-1

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Meat Slicer Market Size & Trends

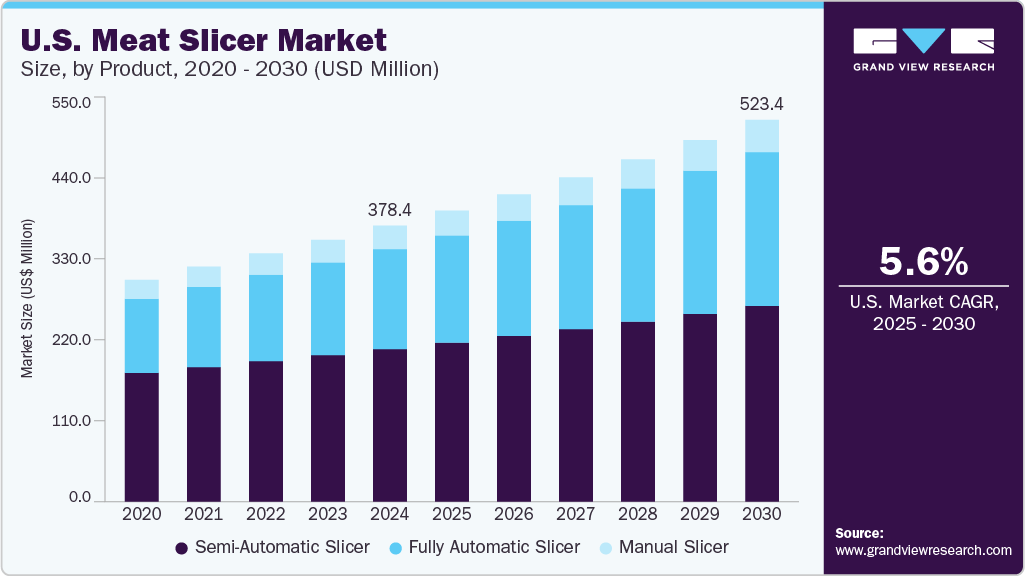

The U.S. meat slicer market size was estimated at USD 378.4 million in 2024, and it is projected to grow at a CAGR of 5.6% from 2025 to 2030. The target market is evolving rapidly, influenced by shifting consumer preferences and operational demands in commercial kitchens and at-home food preparation. As more consumers in the U.S. embrace gourmet cooking and charcuterie trends, high-precision meat slicers are becoming a primary appliance in premium home kitchens. In commercial space, delis, food processing & packaging, and retail companies seek slicers that offer speed, consistency, and minimal waste to meet high-volume needs.

For instance, in July 2023, Subway, an American fast-food chain, announced a significant operational shift to install meat slicers across 20,000 of its locations. With this development, the company aimed to reduce the high shipping costs of sliced meat.

Technological innovations are reshaping the meat slicer landscape. Modern slicers now feature smart technologies, such as IoT capabilities, allowing for real-time monitoring and predictive maintenance. Advancements in blade materials, including ceramic and titanium-coated stainless steel, have enhanced durability and slicing precision. Safety enhancements, like automatic shut-off systems and ergonomic designs, improve user experience and reduce workplace injuries. In addition, the integration of eco-friendly practices, such as energy-efficient motors and the use of recyclable materials, reflects the industry's commitment to sustainability, leading to growth in the volume of sales over recent years.

The demand for specialized meat slicers tailored to niche applications is on the rise. Manufacturers are introducing slicers with customizable settings and digital controls to cater to specific meat products, such as artisanal charcuteries. In recent years, the market has witnessed the introduction of several unique slicers with digital interfaces and touchscreen controls, which have gained attention from a significant pool of consumers. For instance, in 2024, Bizerba unveiled its state-of-the-art vertical slicer, the VSP F, at SÜFFA 2024. This fully automated premium slicer features a touch-free depositing system and automatic carriage drive. It incorporates SmarterSlicing technology, which simplifies maintenance tasks such as sharpening and cleaning, thereby extending the machine’s lifespan and performance.

Food safety and traceability have become paramount in the meat processing industry. Companies are integrating advanced technologies into meat slicers to monitor sanitation schedules, product batches, and operator handling. For example, in 2024, Slovacek Sausage implemented SG Systems’ V5 Traceability and GS1-128 Meat Labeling in their production processes. This integration enhances compliance with stringent health regulations by providing granular, real-time tracking and data analysis capabilities. Such systems facilitate quick responses to safety issues, ensuring products meet safety standards consistently.

The rise of small-scale food businesses has led to an increase in demand for compact, multi-functional meat slicers. These units combine slicing with other functions such as weighing, portioning, and vacuum sealing, optimizing space and efficiency. In 2024, manufacturers introduced slicers with sleek, modern designs that complement contemporary kitchen decor, catering to consumers who value both functionality and aesthetics. Features such as automatic shut-off mechanisms and safety guards have become standard, addressing consumer concerns about accidents in the kitchen.

Consumer Surveys & Insights

In 2024, U.S. consumers exhibited evolving preferences in meat consumption and food preparation, influencing the meat slicer industry. A significant trend is the heightened demand for premium meat products. Consumers are increasingly opting for grass-fed and antibiotic-free beef, reflecting a shift towards quality and health-conscious choices. This preference necessitates precise slicing to maintain product integrity, thereby driving the adoption of advanced meat slicers in both commercial and home settings.

Sustainability has also become a pivotal factor in purchasing decisions. According to PwC's 2024 Voice of the Consumer Survey, U.S. consumers are willing to pay nearly 10% more for sustainably produced goods. Key sustainability incentives influencing purchases include waste reduction, eco-friendly packaging, and positive environmental impact. This trend underscores the importance for meat slicer manufacturers to incorporate sustainable practices in their products, such as energy-efficient designs and recyclable materials.

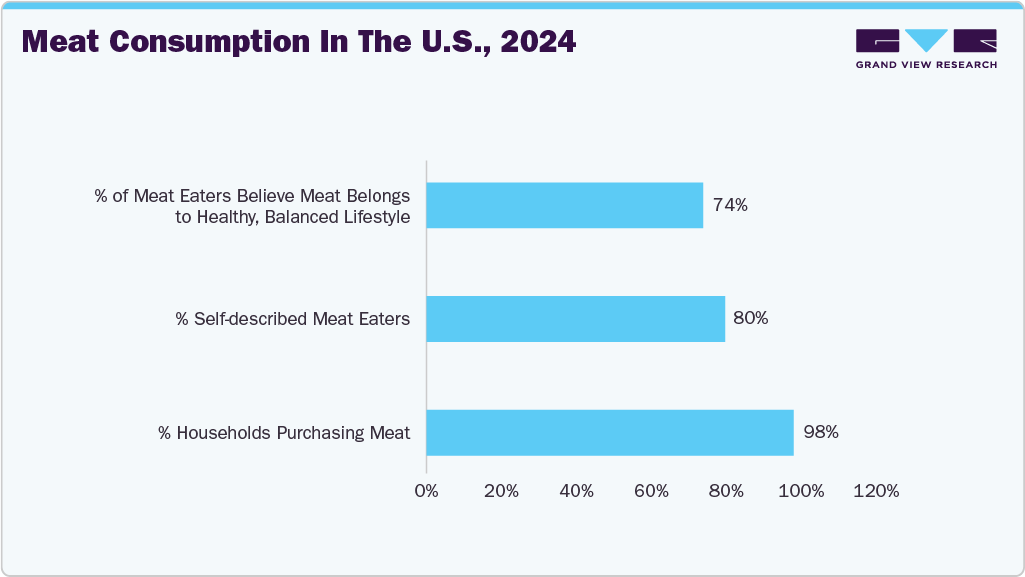

The evolving U.S. meat consumption landscape, highlighted by the Power of Meat 2024 report survey, has significant implications for the meat slicer industry. With 98% of U.S. households purchasing meat and 80% identifying as meat eaters, the demand for tools that support efficient, high-quality meat preparation remains robust. Meat slicers are becoming essential in commercial and home settings as consumers increasingly seek control over portion size, presentation, and freshness.

Notably, Baby Boomers purchase meat 53 times per year, and Millennials, who spend nearly $17 per purchase, represent key customer segments driving the need for durable and precise slicing equipment. As these groups look for value and performance, slicer manufacturers respond with multifunctional, compact, and digital-interface models that enhance convenience and consistency.

Product Insights

The semi-automatic meat slicers held a revenue share of 55.3% of the overall U.S. meat slicer industry in 2024. Their popularity stems from a balanced blend of manual control and automation, offering efficiency without the complexity or cost of fully automatic units. Widely used in delis, butcher shops, and mid-scale food service operations, these slicers are preferred for their reliability, ease of use, and ability to maintain consistent slice thickness with minimal training. Their moderate price point also appeals to small and medium-sized businesses aiming to optimize output while managing operational costs.

The demand for fully automatic slicers is expected to grow at a CAGR of 7.5% from 2025 to 2030. This growth is driven by the rising demand for high-volume meat processing, particularly in industrial food manufacturing and large retail chains. The ability to operate continuously with minimal manual intervention makes them ideal for meeting strict hygiene standards, reducing labor costs, and increasing throughput. Technological advancements such as programmable slicing and integrated weighing systems are enhancing their appeal. As labor shortages persist and automation becomes a competitive advantage, fully automatic slicers are expected to lead innovation and adoption in the evolving U.S. meat processing industry.

End-use Insights

The food service category held a prominent market share of 51.8% in terms of end use in 2024. Restaurants, delis, fast food chains, and cafes rely heavily on meat slicers for consistent, high-volume slicing of meats, cheeses, and cold cuts to maintain quality and speed of service. With the rising trend of made-to-order meals and increased consumer demand for freshness and customization, food service operators increasingly invest in semi-automatic and 10-12-inch blade slicers that strike a balance between performance and footprint. Moreover, the sector's need for operational efficiency, hygiene compliance, and minimal food waste makes meat slicers a critical kitchen asset, thereby sustaining their dominance in the market.

Furthermore, the food processing & packaging sector is expected to witness a CAGR of 8.1% from 2025 to 2030, driven by automation trends and the scaling of centralized production facilities. This sector requires industrial-grade, fully automatic slicers capable of handling continuous, high-volume operations while meeting stringent safety and precision standards. Rising demand for pre-packaged, ready-to-eat meats and the growth of private-label products in retail further fuel investments in large-format, smart slicers with digital controls and integrated weighing or portioning systems. As production scales and labor shortages persist, the need for automated, efficient slicing solutions will drive rapid growth in this segment.

Distribution Channel Insights

In 2024, the B2B segment held a market share of 87.2%, driven by strong demand from commercial establishments such as restaurants, delis, catering services, food processors, and institutional kitchens. These businesses require durable, high-capacity slicers that can handle continuous use while ensuring consistency and speed. Semi-automatic and fully automatic slicers, often with advanced features like programmable slicing and digital interfaces, are widely adopted in this segment. Bulk purchasing, recurring procurement, and the growing focus on operational efficiency make B2B a dominant force, with industry players prioritizing slicer performance, hygiene standards, and ROI.

The demand in the B2C segment is expected to witness a CAGR of 6.8% from 2025 to 2030, as more consumers embrace cooking at home, driven by health consciousness, cost-saving motives, and interest in gourmet food preparation. The rise of premium home appliances, combined with e-commerce accessibility and growing culinary awareness via social media, has made compact, easy-to-use meat slicers increasingly appealing to households. Manufacturers are responding with user-friendly models featuring safety mechanisms, sleek designs, and multifunctionality. As consumer expectations grow for professional-grade performance at home, the B2C market is poised for accelerated growth, especially in urban and health-focused demographics.

Blade Size Insights

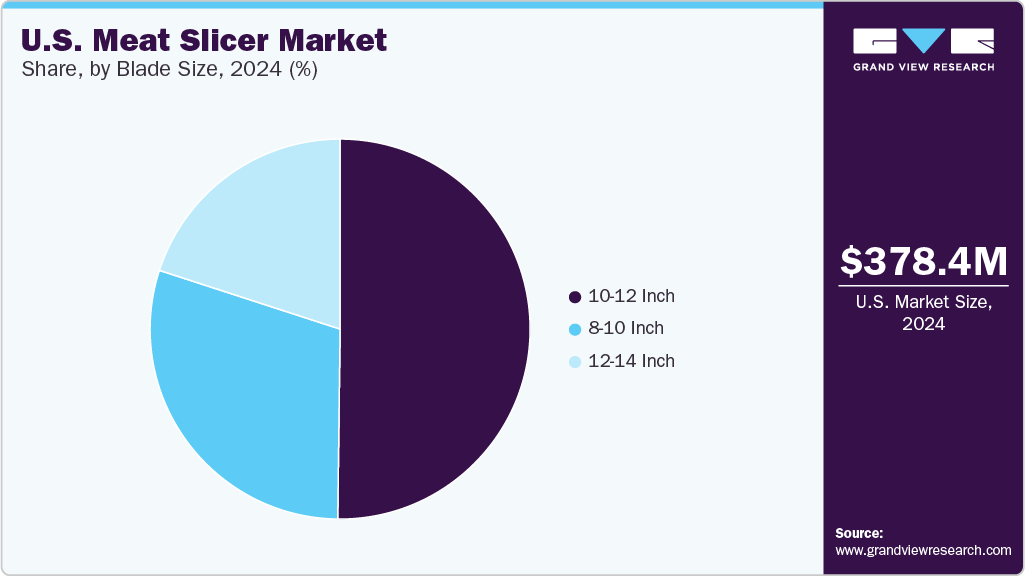

In 2024, the 10-12 inch blade category led the market with a share of 50.2% due to its versatility and optimal balance between capacity and footprint. These slicers are widely favored in both commercial and advanced residential settings, as they can efficiently handle a variety of meat types and thickness preferences without taking up excessive counter space. Their ability to process moderate-to-high volumes of meat makes them ideal for delis, small restaurants, and grocery stores. In addition, this size range offers compatibility with both manual and semi-automatic slicers, further reinforcing its widespread adoption across segments and contributing significantly to market revenue.

The demand for 12-14-inch blade slicers is projected to witness a CAGR of 7.0% from 2025 to 2030, primarily fueled by increased usage in industrial and large-scale food service operations. These slicers are designed for high-throughput environments where bulk slicing of large meat cuts, such as roasts and hams, is routine. The larger blade size reduces the need for frequent repositioning of the product, thereby enhancing speed and consistency. As demand grows for advanced slicing solutions in meat processing plants and chain supermarkets, this segment is expected to benefit from technological upgrades, automation integration, and expanding commercial food production across the U.S.

Country Insights

The Midwest meat slicer market held a market share of 31.9%, largely due to its strong agricultural and meat processing industry. States such as Iowa, Illinois, and Wisconsin are major hubs for livestock farming and meat production, supporting a dense network of food processors, packaging facilities, and commercial kitchens. This industrial backbone drives demand for heavy-duty, fully automatic, and semi-automatic meat slicers in large-scale operations. In addition, the Midwest’s strong presence of retail chains and institutional food service providers reinforces equipment demand across the commercial value chain, solidifying the region's dominant position in the market.

The Southeast meat slicer industry is projected to witness a CAGR of 7.2% from 2025 to 2030, fueled by rapid urbanization, growing population, and expanding food service and hospitality sectors. States such as Florida, Georgia, and North Carolina are experiencing a surge in restaurants, catering services, and quick-service food chains, all of which require efficient slicing solutions to support high-volume operations. Furthermore, the rise in tourism and event-based catering in this region has accelerated the need for reliable and multifunctional meat slicers. With increased investments in commercial food infrastructure and a growing middle-class consumer base, the Southeast is poised for robust, sustained growth in the coming years.

Key U.S. Meat Slicer Company Insights

The U.S. meat slicer industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market areGlobe Food Equipment Co., Hobart, Van Berkel International S.r.l., Vollrath Company, LLC, Univex, MVP Group, and others.

-

Globe Food Equipment Co. is a major player in the U.S. meat slicer industry, recognized for offering a wide range of products that cater to various food service scales. Its lineup includes 9" manual economy slicers for light-duty use and 13" heavy-duty automatic slicers designed for high-volume commercial kitchens. Globe’s slicers are widely utilized in delis, grocery stores, and mid-size restaurants, emphasizing performance, safety, and value. According to industry estimates, Globe holds a significant share in the semi-automatic slicer segment, which represents a significant portion of the total U.S. meat slicer industry.

-

Hobart Corporation, a division of Illinois Tool Works, commands a significant presence with its high-performance slicers such as the HS Series and the Centerline Edge line. These slicers are known for safety innovations like the Interlocking Gauge Plate System and durable Borazon sharpening stones. Hobart equipment is widely used across food service chains and institutional kitchens. The company benefits from the growing demand for digital and automated slicers, which is expected to see a substantial CAGR through 2030 in the U.S. market.

Key U.S. Meat Slicer Companies:

- Globe Food Equipment Co.

- Hobart

- Van Berkel International S.r.l.

- Vollrath Company, LLC

- Univex

- MVP Group

- Weston Brands LLC

- Bizerba

- Grasselli

- KitchenWare Station LLC

Recent Developments

-

In May 2025, GEA Group unveiled its latest automated slicing line at the IFFA trade show. This innovative system integrates advanced technologies, including pre-scanning of meat, cheese, and alternative products, to optimize slicing processes. The new line aims to help customers save raw materials (both product and packaging), increase production capacities, and improve sustainability.

-

In September 2023, Marel introduced its ECO SLICING technology, designed to reduce energy consumption in food processing. This technology allows slicing at higher temperatures, minimizing the need for extensive raw material preparation and significantly lowering energy costs.

-

In December 2024, Bizerba announced that all direct thermal materials used in its label production would be free of Bisphenol A (BPA) and Bisphenol S (BPS) by January 1, 2025. This proactive step ensures compliance with California's Proposition 65 regulations, providing customers with a seamless path to meeting regulatory requirements without the need for additional product labeling.

U.S. Meat Slicer Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 399.2 million

Revenue forecast in 2030

USD 523.5 million

Growth rate

CAGR of 5.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends

Segments covered

Product, blade size, end-use, distribution channel, region

Country scope

U.S.

Key companies profiled

Globe Food Equipment Co.; Hobart; Van Berkel International S.r.l.; Vollrath Company, LLC; Univex; MVP Group; Weston Brands LLC; Bizerba; Grasselli; KitchenWare Station LLC

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Meat Slicer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. meat slicer market report based on product, blade size, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Slicer

-

Semi-automatic Slicer

-

Fully Automatic Slicer

-

-

Blade Size Outlook (Revenue, USD Million, 2018 - 2030)

-

8-10 Inch

-

10-12 Inch

-

12-14 Inch

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Food Service

-

Retail

-

Catering Companies

-

Food Processing & Packaging

-

Institutional

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

Company Websites

-

Third-party-retailers

-

-

B2C

-

Wholesalers/Distributors

-

Departmental Stores

-

Online Retailers

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Mid-west

-

Northeast

-

Southeast

-

Southwest

-

Frequently Asked Questions About This Report

b. The U.S. meat slicer market was estimated at USD 378.4 million in 2024 and is expected to reach USD 399.2 million in 2025.

b. The U.S. meat slicer market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030, reaching USD 523.5 million by 2030.

b. In 2024, the 10–12 inch blade category led the market with a share of 50.2% due to its versatility and optimal balance between capacity and footprint.

b. Some of the key players in the U.S. meat slicer market are Globe Food Equipment Co., Hobart, Van Berkel International S.r.l., Vollrath Company, LLC, Univex, MVP Group, Weston Brands LLC, Bizerba, Grasselli, and KitchenWare Station LLC.

b. The market growth is influenced by shifting consumer preferences and operational demands in commercial kitchens and at-home food preparation. As more consumers in the U.S. embrace gourmet cooking and charcuterie trends, high-precision meat slicers are becoming a primary appliance in premium home kitchens.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.