- Home

- »

- Medical Devices

- »

-

U.S. Medical Device Testing Services Market Report, 2033GVR Report cover

![U.S. Medical Device Testing Services Market Size, Share & Trends Report]()

U.S. Medical Device Testing Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Biocompatibility Tests, Chemistry Test, Microbiology & Sterility Testing, Package Validation), By Phase (Preclinical, Clinical), And Segment Forecasts

- Report ID: GVR-4-68040-727-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Medical Device Testing Services Market Summary

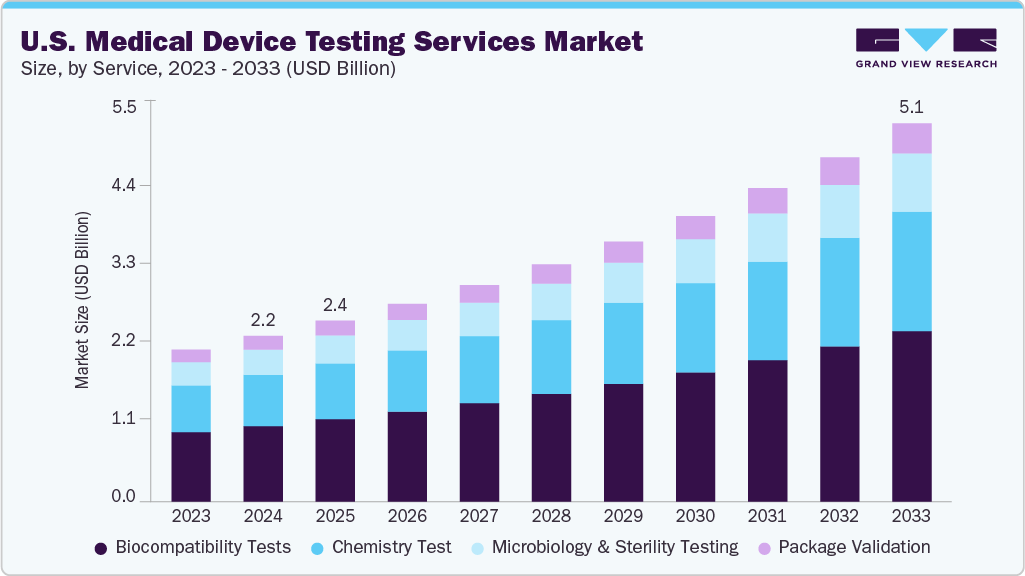

The U.S. medical device testing services market size was estimated at USD 2.23 billion in 2024 and is projected to reach USD 5.09 billion, growing at a CAGR of 9.66% from 2025 to 2033. The market is driven by a strong regulatory framework, rapid technological innovations, and the increasing complexity of devices entering the market.

Key Market Trends & Insights

- Based on service, the biocompatibility tests segment held the largest market share of 45.62% in 2024

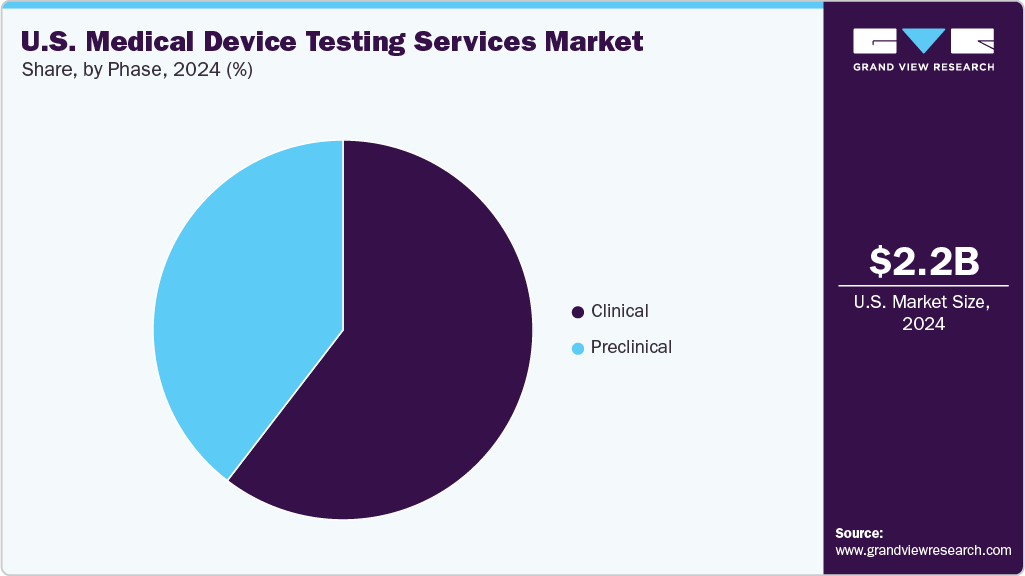

- By phase, the clinical segment held the largest market share of 60.56% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.23 Billion

- 2033 Projected Market Size: USD 5.09 Billion

- CAGR (2025-2033): 9.66%

Other factors contributing to market growth are an aging population, a rise in chronic diseases, and a robust innovation pipeline. Manufacturers are increasingly outsourcing testing functions to reduce compliance costs, navigate regulatory complexities, and accelerate product launches. Besides, the stringent safety and performance standards set by the U.S. Food and Drug Administration (FDA) and international compliance requirements such as ISO and IEC standards fuel demand for specialized third-party testing services. These services are essential for ensuring regulatory compliance, mitigating risks, and accelerating the time-to-market for manufacturers, particularly in high-growth sectors like minimally invasive surgical tools, implantable devices, diagnostic imaging systems, and wearable technologies.

In addition, the rising complexity in device design due to advanced materials, miniaturization, and the integration of artificial intelligence (AI), Internet of Things (IoT), and wireless technologies has expanded testing requirements to encompass cybersecurity validation, software performance testing, usability engineering, and interoperability assessments. Besides, the surge in clinical trials for both novel and next-generation devices has increased the demand for capabilities in electrical safety, electromagnetic compatibility (EMC), mechanical durability, microbiological safety, and biocompatibility evaluation. Also, the current testing processes cover multiple stages, including feasibility studies, performance verification, and post-market surveillance, ensuring product efficacy and patient safety.

Moreover, service providers are expanding their laboratories with strategic initiatives such as mergers and acquisitions and partnerships to broaden their geographic reach, especially near major U.S. medical device manufacturing hubs. In addition, technological advancements such as automation, simulation-based validation, real-time data analytics, and high-throughput testing platforms are being adopted to enhance precision, efficiency, and scalability. These innovations and advanced imaging, AI-driven defect detection, and digital twin modeling enable more predictive and cost-effective testing solutions.

Thus, as the medtech sector continues to evolve rapidly, the U.S. medical device testing services industry is expected to drive the innovation, compliance, and patient safety further strengthened & supported by regulatory rigor, expanding device complexity, and the integration of advanced technologies into both products and testing methodologies. Such aforementioned factors are expected to drive the market over the estimated timeframe.

Opportunity Analysis

The medical device testing services market in the U.S. is fueled by the rapid development of innovative medical technologies and the increasing complexity of device designs. Key advancements such as miniaturization, smart sensors, wireless connectivity, and AI integration drive the demand for specialized testing services, particularly in cybersecurity, software validation, and interoperability. In addition, the rising demand for implantables, wearables, and minimally invasive surgical devices is expanding the need for thorough biocompatibility, performance, and sterilization testing. Stringent regulatory requirements from the FDA and the necessity of adhering to global standards underscore the importance of partnering with expert third-party testing providers.

Moreover, outsourcing trends amplify the market potential as manufacturers aim to reduce time-to-market, lower compliance costs, and leverage advanced testing technologies. There are also promising opportunities in automation, simulation-based validation, rapid microbiological methods, and geographic expansion near manufacturing hubs to offer quicker, localized services. Thus, these factors are expected to provide robust and sustained growth over the estimated time period.

Impact of U.S. Tariffs on the U.S. Medical Device Testing Services Market

The U.S. tariffs on imported medical devices, components, and laboratory equipment have significantly disrupted the medical device testing services industry. The higher costs of raw materials, testing instruments, and reagents have increased the operational expenses for testing laboratories, squeezing profit margins and altering pricing structures. In addition, the supply chain delays from these tariffs have hindered the procurement of essential testing equipment and materials, leading to longer testing timelines and bottlenecks in device validation processes. Besides, most manufacturers are struggling to meet regulatory submission deadlines, which has resulted in greater reliance on third-party testing providers to navigate compliance issues. Smaller laboratories are particularly vulnerable, facing increased challenges due to their limited sourcing flexibility and lower negotiating power, which increases the repercussions of cost increases and logistical hurdles.

However, the medical device testing services market in the U.S. is expected to witness robust growth over the estimated time period. The growth is fueled by device innovation, stringent FDA and ISO regulatory mandates, and a trend toward outsourcing testing services to specialized firms. Moreover, developments such as automation, rapid microbiological methods, digital twin simulations, and AI-driven defect detection further support the laboratories in mitigating the impact of tariff-induced delays and cost challenges. Furthermore, ongoing investments in regional laboratory expansion and strategic partnerships enhance market capacity, ensuring that the demand for timely, compliant, high-quality testing continues to drive long-term growth.

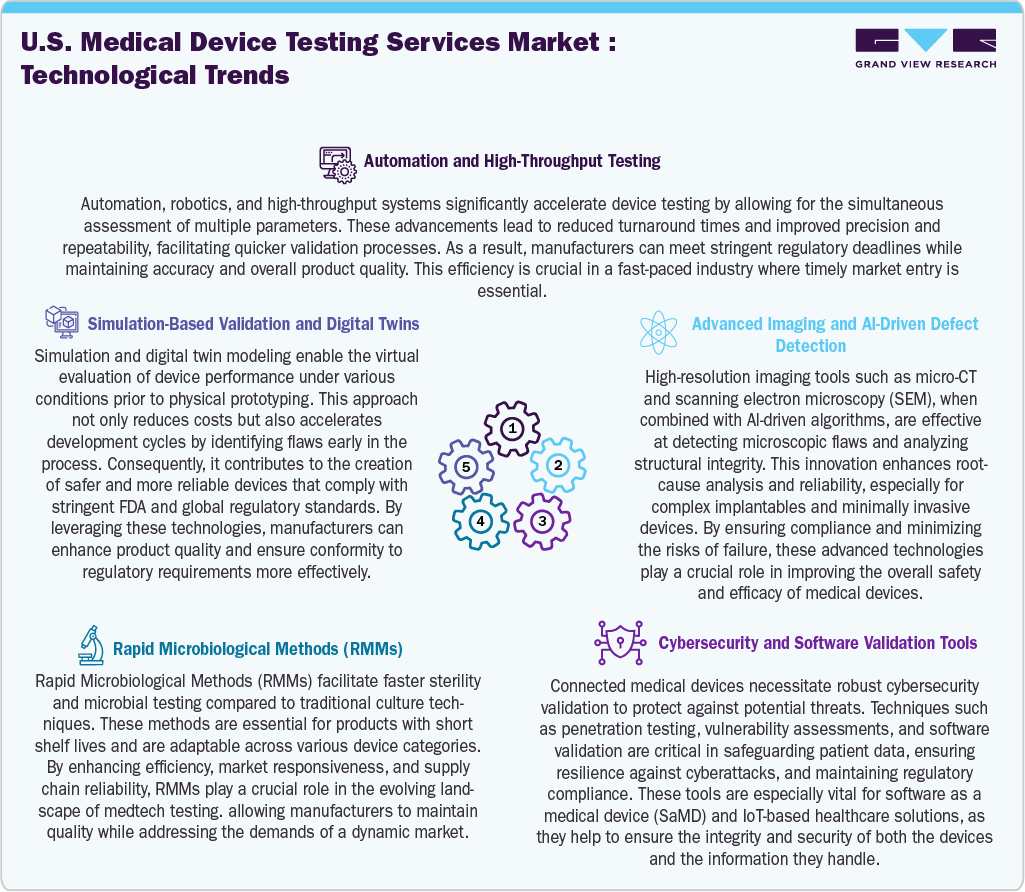

Technological Advancements

The medical device testing services market in the U.S. is driven by technological advancements that improve efficiency, precision, and compliance. Automation and high-throughput testing facilitate the simultaneous evaluation of multiple parameters, further reducing turnaround times while maintaining consistency and accuracy. In addition, simulation-based validation and digital twins enable virtual modeling of device performance under various conditions, minimizing development costs and identifying potential flaws early in the process. Besides, advanced imaging technologies such as micro-CT scanning and scanning electron microscopy, paired with AI-driven defect detection, offer detailed structural analyses that allow for the early identification of microscopic defects in complex devices.

Furthermore, rapid microbiological methods (RMMs) are revolutionizing sterility and contamination testing by providing faster results than traditional culture-based methods, thereby enhancing supply chain responsiveness for time-sensitive products. As connected medical devices become more prevalent, cybersecurity and software validation tools have become essential, providing robust protection against vulnerabilities, securing patient data, and ensuring compliance with regulations. Thus, these innovations enhance testing capabilities, facilitate quicker market entry, and ensure the safety and reliability of next-generation medical technologies.

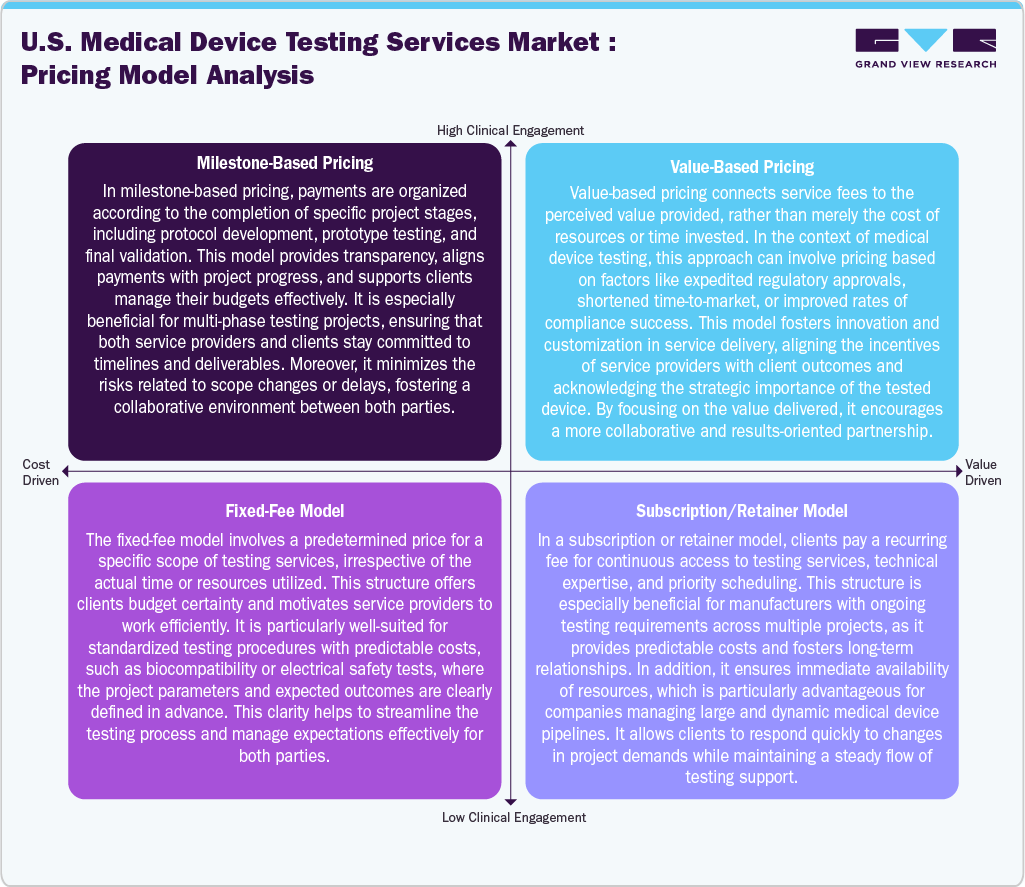

Pricing Model Analysis

The medical device testing services market in the U.S. utilizes various pricing models to cater to diverse client requirements and project intricacies. Milestone-based pricing links payments with the completion of specific project stages, such as protocol development, prototype evaluation, and final validation. This approach aligns costs with project progress, supporting the mitigation of financial risk for clients. In addition, the fixed-fee models offer predetermined pricing for a defined scope of work, providing budget certainty and incentives for efficiency, particularly for standardized tests like biocompatibility or electrical safety.

Value-based pricing focuses on linking fees to the results achieved, such as accelerated regulatory approvals or shortened time-to-market. This model aligns the incentives of service providers with client outcomes, encouraging more customized solutions. Furthermore, subscription or retainer models allow for ongoing access to testing services, technical expertise, and priority scheduling, making them ideal for manufacturers that require continuous testing across various projects. Thus, these pricing models provide flexibility, cost predictability, and strategic alignment, enabling clients to choose methods that best fit their project complexity, timelines, and desired results.

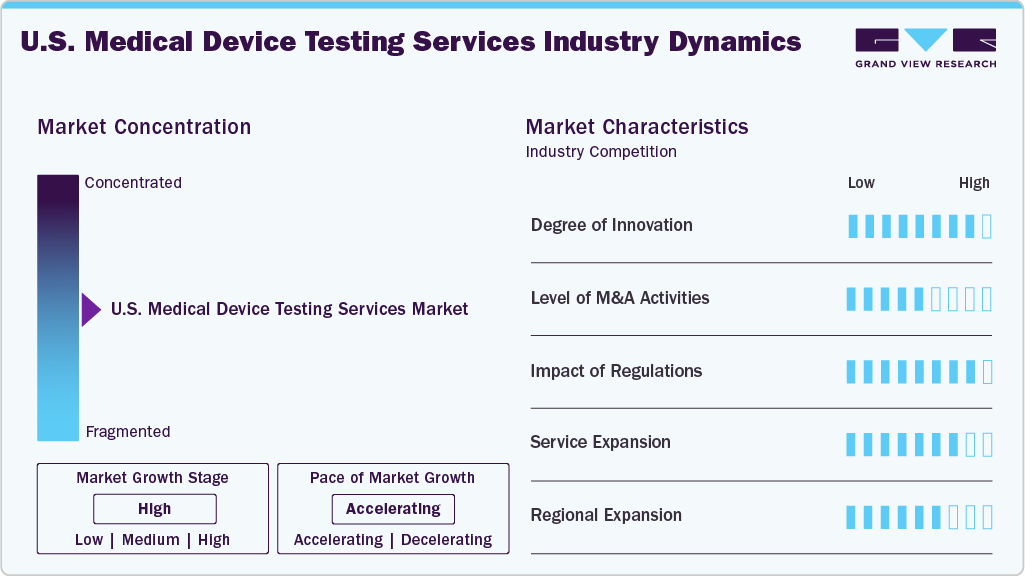

Market Concentration & Characteristics

The market growth stage is moderate, and pace of growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

The U.S. medical device testing services industry is highly innovative, driven by advancements in AI, IoT-enabled devices, miniaturization, and smart sensors. Besides, the continuous development of rapid, automated, and simulation-based testing solutions enhances accuracy, efficiency, and regulatory compliance across complex device categories.

Stringent FDA regulations and international standards such as ISO 13485 significantly influence the market. Compliance requirements drive demand for specialized third-party testing, ensure patient safety, and necessitate continuous testing methodologies and documentation updates.

Mergers and acquisitions in the U.S. medical device testing sector are active, as companies seek to expand service portfolios, acquire specialized expertise, and strengthen market presence. Strategic deals enhance capabilities, increase geographic reach, and support integration of advanced testing technologies.

Providers are broadening their offerings to include software validation, cybersecurity, rapid microbiological methods, and AI-driven detection. In addition, expanding service lines meets evolving device complexity and client needs while supporting faster product approvals and reduced time to market.

Medical device testing companies are expanding their laboratory networks near key manufacturing hubs across the U.S. and across the globe. In addition, country expansion improves accessibility, accelerates turnaround times, and strengthens partnerships with device manufacturers and regulatory bodies.

Service Insights

In 2024, the biocompatibility tests segment held the largest market share, accounting for a revenue share of 45.62%. The U.S. biocompatibility testing market is expanding due to increasing regulatory requirements and the growing complexity of implantable and wearable devices. Tests assess cytotoxicity, sensitization, irritation, and systemic toxicity to ensure patient safety. Besides, rising demand for advanced biomaterials, minimally invasive devices, and novel polymers is fueling the market growth. In addition, third-party providers offering standardized, rapid, and ISO-compliant testing solutions have gained increased attention, further supporting faster regulatory approvals and enabling manufacturers to mitigate safety risks while meeting stringent FDA and international biocompatibility standards. Such factors are expected to drive the market during the estimated timeframe.

The chemistry test segment is expected to grow significantly during the forecast period. Chemistry testing in the U.S. medical device sector evaluates materials, leachables, extractables, and chemical stability, ensuring device safety and compliance. The growth of complex polymers, coatings, and combination products drives demand for precise analytical methods. Regulatory enforcement by the FDA and global standards such as USP <232>/<233> strengthen the need for chemistry testing. Outsourcing specialized laboratories with advanced instrumentation, automation, and high-throughput capabilities ensures reliable results, accelerates product development, and reduces time-to-market for innovative medical devices.

Phase Insights

The clinical segment accounted for the largest revenue share in 2024. The market is growing due to rising number of trials for novel implantables, diagnostic devices, and digital health solutions. The clinical testing services support evaluation of safety, performance, and effectiveness in human subjects. Besides, range of services offered such as feasibility studies, pivotal trials, and post-market surveillance is expected to drive the market. Increasing regulatory requirements, demand for real-world evidence, and complex device designs support outsourcing to specialized testing providers. In addition, advanced data analytics, monitoring technologies, and electronic reporting enhance trial efficiency, ensuring compliance, accelerating approvals, and reducing overall development timelines for medical devices in the U.S. Such factors are expected to support the market.

The preclinical segment is expected to grow at a significant CAGR during the forecast period. The segment is driven by the increasing need for preclinical testing in the U.S. as it evaluates device safety, efficacy, and performance prior to human trials. This involves in vitro studies, animal testing, and functional assessments, which are conducted under simulated physiological conditions. Besides, rising innovation in implantable, minimally invasive tools and combination products has increased the need for third-party preclinical services, further supporting market growth. In addition, regulatory guidance mandates robust data generation, creating new opportunities for providers specializing in biocompatibility, mechanical performance, and toxicology. Moreover, efficient preclinical testing accelerates regulatory submission, mitigates clinical risks, and supports the faster commercialization of next-generation medical technologies. Such aforementioned factors are expected to drive the market over the estimated time period.

Key U.S. Medical Device Testing Services Company Insights

The key players operating across the market are adopting inorganic strategic initiatives such as partnerships, mergers, acquisitions, service launches, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in March 2025, Nelson Labs company mentioned that it performs product-sterility testing through rapid microbiological methods at three laboratory sites located in three U.S. and Europe. This method enables sterility assurance for a wide variety of medical devices and pharmaceuticals. Unlike traditional rapid sterility testing, which often focuses on biological or short-shelf-life items, this solution is designed for diverse applications.

Key U.S. Medical Device Testing Services Companies:

- SGS SA

- Laboratory Corporation of America Holdings

- Nelson Laboratories, LLC

- TÜV SÜD

- Charles River Laboratories

- Element Minnetonka

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group Plc

- North America Science Associates Inc. (NAMSA)

Recent Developments

-

In March 2025, FLEX LTD. mentioned a new product introduction center near Massachusetts to support healthcare customers with end-to-end product development. It includes an 8,000 sq. ft. NPI lab & a 2,000 sq. ft. testing lab facility covering various medical applications.

-

In January 2025, NAMSA mentioned the agreement to acquire WuXi AppTec’s medical device testing division in the U.S. WuXi AppTec is a global provider of comprehensive research, development, and manufacturing solutions that support the pharmaceutical & life sciences sectors in advancing innovations & bringing new treatments to market.

U.S. Medical Device Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.43 billion

Revenue forecast in 2033

USD 5.09 billion

Growth rate

CAGR of 9.66% from 2025 to 2033

Actual Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, phase

Country scope

U.S.

Key companies profiled

SGS SA; Laboratory Corporation of America Holdings; Nelson Laboratories, LLC; TÜV SÜD; Charles River Laboratories; Element Minnetonka; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group Plc; North America Science Associates Inc. (NAMSA) among others.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Device Testing Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. medical device testing services market report based onservice and phase:

-

ServiceOutlook (Revenue, USD Million, 2021 - 2033)

-

Biocompatibility Tests

-

Cardiovascular Device's Biocompatibility Tests

-

Orthopedic Device's Biocompatibility Tests

-

Dental Implant Devices' Biocompatibility Tests

-

Dermal Filler's Biocompatibility Tests

-

General Surgery Implantation Devices Biocompatibility Tests

-

Neurosurgical Implantation Devices Biocompatibility Tests

-

Ophthalmic Implantation Device's Biocompatibility Tests

-

Others

-

-

Chemistry Test

-

Chemical characterization (E&L)

-

Analytical method development and validation

-

Toxicological Risk Assessment and consulting

-

-

Microbiology & Sterility Test

-

Bioburden Determination

-

Pyrogen & Endotoxin Testing

-

Sterility Test & Validation

-

Antimicrobial Testing

-

Others

-

-

Package Validation

-

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Preclinical

-

Large animal research

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Test

-

-

Small animal research

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Test

-

-

-

Clinical

-

Frequently Asked Questions About This Report

b. The U.S. medical device testing services market size was estimated at USD 2.23 billion in 2024 and is expected to reach USD 2.43 billion in 2025.

b. The U.S. medical device testing services market is expected to grow at a compound annual growth rate (CAGR) of 9.66% from 2025 to 2033 to reach USD 5.09 billion by 2033.

b. The biocompatibility tests dominated the U.S. medical device testing services market in 2024 with a market share of 45.62%. The segment growth is driven by increasing regulatory requirements and the growing complexity of implantable and wearable devices. Besides, the tests assess cytotoxicity, sensitization, irritation, and systemic toxicity to ensure patient safety. Besides, the rising demand for advanced biomaterials, minimally invasive devices, and novel polymers is fueling the market growth.

b. Some of the key market players include SGS SA, Laboratory Corporation of America Holdings, Nelson Laboratories, LLC, TÜV SÜD, Charles River Laboratories, Element Minnetonka, Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc, and North America Science Associates Inc. (NAMSA) among others.

b. The market is driven by a strong regulatory framework, rapid technological innovations, and the increasing complexity of devices entering the market. Other factors contributing to market growth are an aging population, a rise in chronic diseases, and a robust innovation pipeline. Manufacturers are increasingly outsourcing testing functions to reduce compliance costs, navigate regulatory complexities, and accelerate product launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.