- Home

- »

- Pharmaceuticals

- »

-

U.S. Medical Foods for Orphan Disease Market Report, 2030GVR Report cover

![U.S. Medical Foods For Orphan Disease Market Size, Share & Trends Report]()

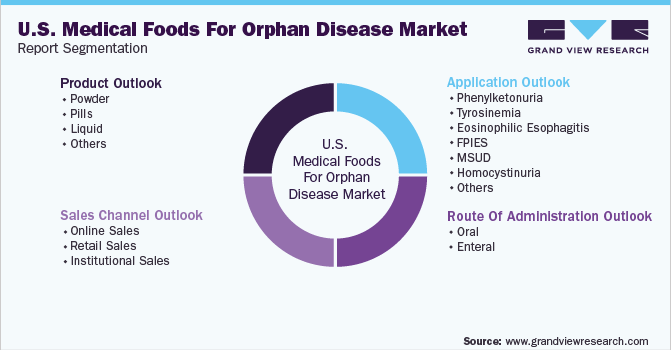

U.S. Medical Foods For Orphan Disease Market Size, Share & Trends Analysis Report By Route Of Administration, By Product, By Application, By Sales Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-038-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

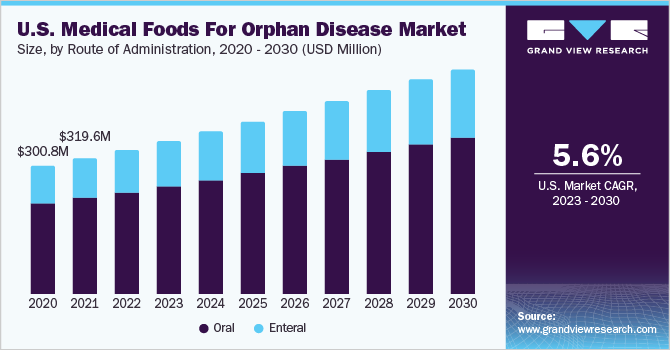

The U.S. medical foods for orphan disease market size was valued at USD 339.4 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% over the forecast period from 2023 to 2030. The market is driven by various factors such as increasing awareness about orphan diseases and the growing prevalence of such rare conditions. Additionally, growing government programs for early screening and growing efforts by major players to develop products that target these niche segments portend a potential future for development. The COVID-19 pandemic increased the burden on healthcare services and treatment sensitivity for critically ill patients. The growing incidence of COVID-19 in various states, coupled with the rapidly increasing geriatric population that are susceptible to various health conditions, is a major factor contributing to the growth. In addition, weakened immunity and poor health due to comorbidities can increase the severity of COVID-19 in the population. This is expected to boost the adoption of medical food formulas and processes, dealing with rare conditions.

The treatment of many rare diseases requires specific medical foods to prevent severe disabilities and facilitate normal growth in children and adults. For instance, some of the orphan diseases such as food protein-induced enterocolitis syndrome, maple syrup urine disease, and short bowel syndrome require special nutritional needs for their treatment. For instance, infants and children with FPIES are frequently provided hypoallergenic formulas that exclude potential allergens like soy, grains, and dairy. These factors are critical drivers of market growth.

The market is expected to experience growth during the forecast period due to increasing government initiatives aimed at raising awareness of rare diseases, providing early screening of newborn babies, and offering financial assistance to patients. In addition, an increase in research activities in various fields, such as nutrigenomics, proteomics, and metabolomics, establish links between food and genes, which can further surge the need for medical foods in personalized treatment regimens. These medical foods are used to improve in-born metabolic errors in which a specific enzyme defect can interfere with the normal metabolism of carbohydrates, proteins, and fats.

Nestle, Danone, and Mead Johnson & Company are some of the key players due to their strong product portfolios and financial performances. The players adopt strategies such as product launches, partnerships, mergers, and acquisitions, and also remain prominent drivers of growth. In January 2020, Nestle and Allergan made a joint decision to acquire Zenpep, a U.S. company that offers medication for patients with digestive problems, in order to expand their medical food business segment. Additionally, the market’s growth is expected to be boosted by the increased production of oral medical food products in the form of pre-thickened products, powders, and pills. For instance, in October 2022, Relief launched PKU Golike in the U.S., a medical food product designed for the dietary management of phenylketonuria (PKU).

Route Of Administration Insights

The oral route segment accounted for the highest revenue share in terms of route of administration in 2022 and its revenue share was 70.8%. Key factors responsible for the largest market share include the high commercial viability of the orally administered products and higher preference for orally administered foods for special medical purposes owing to the ease of consumption provided by them. In addition, the increase in the manufacturing of various products such as pills, powders, and pre-thickened products is boosting growth.

The enteral segment is expected to expand at the fastest CAGR over the forecast period. The key players are launching products that can be administered through the enteral route, thereby propelling growth. Thus, there is a significant potential for enteral products.

Product Insights

The powder segment accounted for 35.3% of the revenue share in 2022. The segment dominated the market owing to a high preference for powdered formulations due to ease of consumption. The medical food market in the U.S., specifically in the orphan disease powder segment, serves individuals with uncommon and hereditary conditions like phenylketonuria (PKU), maple syrup urine disease (MSUD), and homocystinuria. These medical foods are formulated with specific amino acids, vitamins, and minerals to meet the unique nutritional needs of patients with these conditions.

The liquid segment is also expected to grow at a lucrative rate over the forecast period. Growing preference for these products owing to ease of administration and convenience in consumption is a key factor expected to fuel the growth. Companies catering to this segment are placing a greater emphasis on patient safety and product quality to ensure that medical foods for orphan diseases meet the highest standards. Some of the companies offering food in this segment include Cambrooke Therapeutics, Nutricia North America, and Danone North America, among others.

Application Insights

The other segment accounted for 36.5% of the revenue share in 2022. The segment dominated the market owing to various initiatives pertaining to the development of treatment alternatives for rare diseases, an increase in awareness about rare diseases, and funding provided for the development of orphan products.

The FPIES segment is also expected to grow at a lucrative rate over the forecast period. The awareness about this condition is growing in the U.S. There are several educational and other initiatives, such as conferences, videos, webinars, & events, including Food Allergy Awareness Day and Rare Disease Day, being undertaken by organizations such as International FPIES Organization that are contributing to the growth of this market.

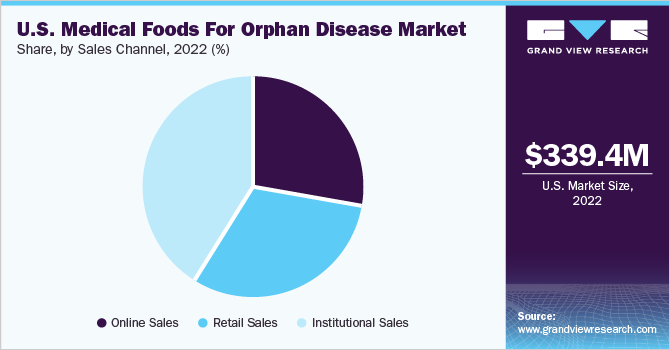

Sales Channel Insights

Institutional sales held the majority share of 41.1% in 2022. The international sales of medical foods for orphan diseases is driven by growing awareness of these conditions and the need for specialized nutrition support. Medical foods are consumed under physician supervision and consumption of enteral & oral foods is high in healthcare institutions such as hospitals, clinics, and care centers. The companies are expanding their reach into international markets to meet the growing demand for medical foods for orphan diseases and to provide specialized nutrition support to patients around the world.

The online sales segment is expected to grow lucratively over the forecast period. The trend of e-commerce and online sales of these foods for orphan diseases is growing, as more patients seek convenient and accessible options for purchasing these specialized nutrition products. The online sales of medical foods for orphan diseases are expected to increase in the coming years owing to the growing demand for these products and the convenience of online purchasing options.

Key Companies & Market Share Insights

The key players in the market are adopting strategies such as partnerships, collaboration, mergers, and acquisitions, to increase their market position. Several market players are attempting to put demand-friendly strategic plans into action. The development of new products and high R&D investments to develop disease-specific formulas are some of the strategies being implemented by market players. Key players are also collaborating with policymakers to address the issue of nutritional imbalance in patients suffering from orphan diseases in the country.

In August 2020, Nestle Health Science announced the acquisition of IM HealthScience, a nutrition science company. IM HealthScience owns brands such as FDgard, IBgard, REMfresh, and Fiber Choice. This acquisition was aimed at helping the company expand and create a robust product portfolio in the nutrition business. Some of the prominent players in the U.S. medical foods for orphan disease market include:

-

Danone

-

Abbott

-

Nestlé

-

Mead Johnson & Company

-

Relief Therapeutics

U.S. Medical Foods For Orphan Disease Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 360.1 million

Revenue forecast in 2030

USD 527.5 million

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historic data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Route of administration, product, application, sales channel

Country scope

U.S.

Key Companies Profiled

Danone; Abbott; Nestlé; Mead Johnson & Company; Relief Therapeutics

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Foods For Orphan Disease Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical foods for orphan disease market report based on the route of administration, product, application, and sales channel:

-

Route Of Administration Outlook (USD Million, 2018 - 2030)

-

Oral

-

Enteral

-

-

Product Outlook (USD Million, 2018 - 2030)

-

Powder

-

Pills

-

Liquid

-

Others

-

-

Application Outlook (USD Million, 2018 - 2030)

-

Phenylketonuria

-

Tyrosinemia

-

Eosinophilic Esophagitis

-

FPIES

-

MSUD

-

Homocystinuria

-

Others

-

-

Sales Channel Outlook (USD Million, 2018 - 2030)

-

Online Sales

-

Retail Sales

-

Institutional Sales

-

Frequently Asked Questions About This Report

b. The U.S. medical foods for orphan disease market was estimated at USD 339.4 million in 2022 and is expected to reach USD 360.1 million in 2023.

b. The U.S. medical foods for orphan disease market is expected to grow at a Compound Annual Growth Rate of 5.6% over the forecast period from 2023 to 2030 to reach USD 527.5 million by 2030.

b. The others segment accounted for 36.5% of revenue share in 2022. The segment dominated the market owing to various initiatives pertaining to the development of treatment alternatives for rare diseases, increase in awareness about rare diseases, and funding provided for the development of orphan products.

b. Some of the key market players operating in the market are Danone, Abbott, Nestlé, Mead Johnsons and Relief Therapeutics among others.

b. The market is driven by various factors such as increasing awareness about orphan diseases and the growing prevalence of such rare conditions. Additionally, growing government programs for early screening and growing efforts by major players to develop products that target these niche segments portend a potential future for development.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."