- Home

- »

- Advanced Interior Materials

- »

-

U.S. & Mexico Stainless Steel Market Share Report, 2019-2025GVR Report cover

![U.S. & Mexico Stainless Steel Market Size, Share & Trends Report]()

U.S. & Mexico Stainless Steel Market Size, Share & Trends Analysis Report By Grade (Duplex Series, 300 Series), By Product (Flat, Long), By Application (Consumer Goods, Heavy Industries), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-860-2

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2018

- Forecast Period: 2019 - 2025

- Industry: Advanced Materials

Report Overview

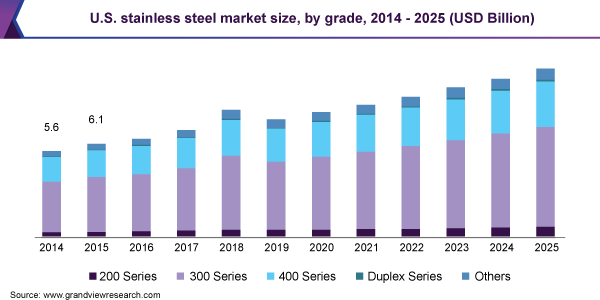

The U.S. & Mexico stainless steel market size was valued at USD 10.70 billion in 2018 and is expected to register a compounded annual growth rate (CAGR) of 4.5% from 2019 to 2025. Increasing demand from the consumer goods sector is estimated to be the primary factor driving market growth. The consumer durables industry is anticipated to attract significant demand for stainless steel. It is one of the dynamic and fastest-growing industries across the U.S. & Mexico. Demand for kitchenware, cutlery, and home appliances is projected to contribute to the growth of the market.

For instance, as per the data released by the U.S. census bureau in 2018, improving housing market coupled with steady growth in wages and robust private consumption resulted in positive sales trend for the consumer durables industry in the U.S. This market is projected to be driven by rising product demand from cookware, kitchen equipment, processing equipment, and decorative applications.

Many home appliances companies have increased the use of stainless steel to manufacture their products over the past years. For instance, Groupe SEB, manufacturer of small appliances, uses a significant amount of stainless steel (about 15,000 tons annually), out of which, around 40% are ferritic grades used for induction cookware, frying pans, and cookware lids. In May 2018, the U.S. government slapped anti-dumping tariffs against the imports of stainless steel flanges from China.

The Department of Commerce in its preliminary investigation found that Chinese exports were 257.1% below the domestic prices. Thereby, directly affecting the sales volume of the domestic producers of the country. Amidst trade tension and protectionist policy of the U.S. government, the imports of stainless steel products observed a decline of nearly 16% from 2017 to 2018 while the domestic production observed growth of nearly 2.0%.

Grade Insights

300 series led the grade segment in 2018 and accounted for a share of more than 58%. Properties of 300 series (austenitic), such as corrosion-resistant, high-temperature resistance, and easy maintenance, make them suitable for consumer goods, automotive, and aerospace applications.

400 series (ferritic) have higher carbon content and thus, have lower rust and corrosion resistance as compared to other series. Properties of 400 series, such as high strength and wear resistance, make them suitable in manufacturing agricultural equipment, motor shafts, knife blades, surgical instruments, and gas turbine exhaust silencers.

Duplex series is predicted to observe the fastest growth from 2019 to 2025. They possess higher toughness than ferritic grades while simultaneously having twice the strength (in few cases) of austenitic stainless steel. Their lightweight and high strength make them suitable for use in the construction of water tanks, brewing tanks, and swimming pools.

Product Insights

Flat products segment led the global market in 2018 and accounted for a share of more than 69%. The dominance of flat products is mainly attributed to their widespread usage in building & construction, automotive & transportation, and heavy industries including oil & gas and chemical industries.

Long products are predicted to register a steady CAGR of 3.7%, in terms of revenue, from 2019 to 2025. Rising spending in the construction sector coupled with the increasing use of long products in several heavy industries is the major factor driving the growth of this segment.

Application Insights

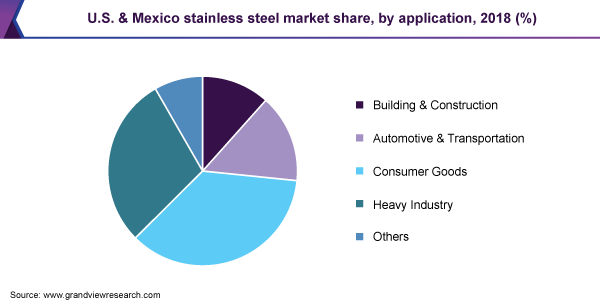

Consumer goods led the market in 2018 and accounted for 36.0% of the revenue share. Stainless steel fulfills the primary requirements of the material used for consumer goods manufacturing, such as aesthetically pleasing look, strong corrosion-resistance, and good mechanical properties over wide range of temperatures. It is an excellent material for commercial, industrial, and residential HVAC applications and is mainly used to manufacture heat exchangers, gas heaters, air handling units and several other cooling, ventilation, and heating components.

In the automotive & transportation industry, an average passenger car consumes about 15 to 22 kg of stainless steel. Currently, it is mainly used for exhaust systems in vehicles while the future growth is likely to be driven by its use as a structural component in automobiles. The product is widely used in the building & construction industry owing to its aesthetic appearance and corrosion resistance properties. Moreover, it can be easily fabricated and provides strength and support to a building structure owing to its high durability.

Regional Insights

The U.S. led the market in 2018 and accounted for 78% of the overall share. High product demand from large-scale consumer goods, automotive, and construction applications in the country is the major factor promoting market growth.

Southwest U.S. is estimated to record the fastest growth in the U.S. from 2019 to 2025. States including Texas and New Mexico is likely to witness steady demand from heavy industries. Texas State is expected to observe nearly USD 1 billion refinery work investments over the coming years. For instance, in 2019, Meridian Energy Group Inc. announced plans to set up a refinery in Winkler County, Texas.

Mexico is projected to have promising growth from 2019 to 2025 due to rising automobile production in the country. The automotive production in Mexico increased by nearly 13% in 2017 and 0.9% in 2018, as per the stats released by the International Organization of Motor Vehicle Manufacturers (OICA). Thereby, aiding to strong growth in stainless steel demand in the country.

Key Companies & Market Share Insights

The U.S. & Mexico stainless steel market is characterized by mostly regional companies with a few of them catering to the international market as well. The industry players compete on the basis of price and quality of the product offered. Companies are devising strategies to enhance their capacity through merger & acquisition. For instance, in 2018, Outokumpu acquired Fagersta wire rod mill in Sweden. The acquisition was made to enhance technological capabilities to produce stainless steel wire rods. Some of the prominent players in the U.S. & Mexico stainless steel market include:

-

ATI

-

POSCO

-

Plymouth Tube Company

-

Aperam

-

Electralloy

-

AK Steel Corporation

-

Outokumpu

-

Universal Stainless, Inc.

-

Continental Steel & Tube Company

U.S. & Mexico Stainless Steel Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 10.5 billion

Volume size in 2020

3,338.1 Kilotons

Revenue forecast in 2025

USD 14.5 billion

Volume forecast in 2025

4,094.8 Kilotons

Growth Rate

CAGR of 4.5% from 2019 to 2025 (revenue-based)

Base year for estimation

2018

Historical data

2014 - 2018

Forecast period

2019 - 2025

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2019 to 2025

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, product, application, region

Country scope

U.S.; Mexico

Key companies profiled

ATI; POSCO; AK Steel Corp.; Continental Steel & Tube Company; Plymouth Tube Company; Universal Stainless, Inc.; Aperam; Electralloy; Outokumpu

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. & Mexico stainless steel market report on the basis of grade, product, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

200 series

-

300 series

-

400 series

-

Duplex series

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Flat

-

Long

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Building & construction

-

Automotive & transportation

-

Consumer goods

-

Heavy industries

- Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

The U.S.

-

Midwest

-

Southeast

-

West

-

Southwest

-

Northeast

-

-

Mexico

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."