- Home

- »

- Advanced Interior Materials

- »

-

Heat Exchanger Market Size & Share, Industry Report, 2033GVR Report cover

![Heat Exchanger Market Size, Share & Trends Report]()

Heat Exchanger Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Plate & Frame, Shell & Tube, Air-cooled), By Material, By End-use (Chemical & Petrochemical, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-718-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Heat Exchanger Market Summary

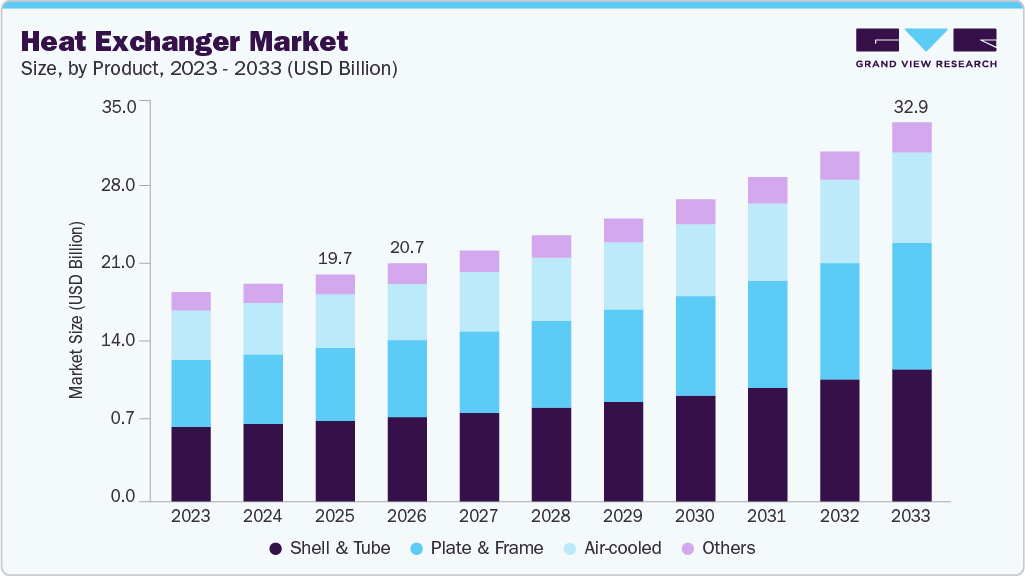

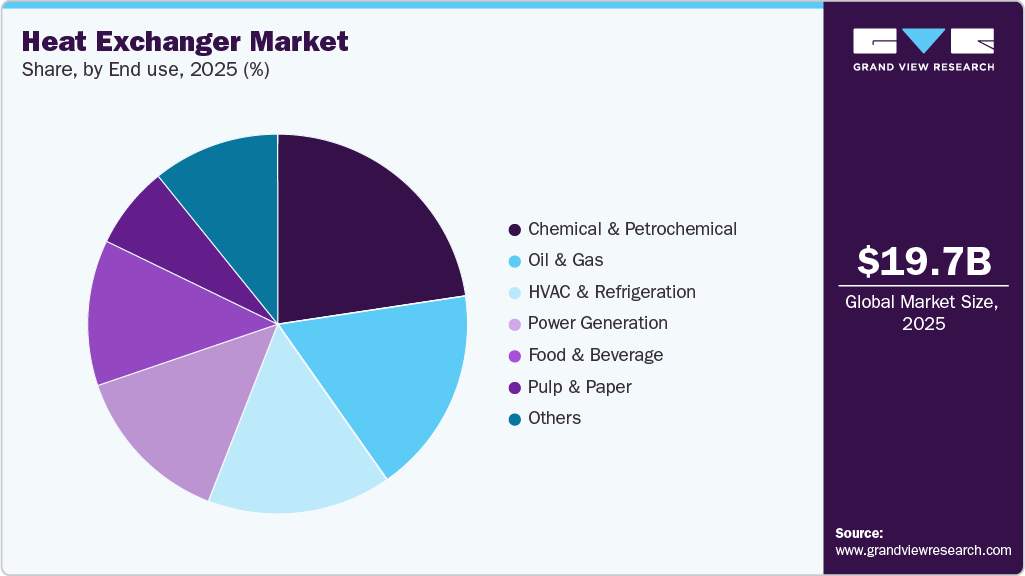

The global heat exchanger market size was estimated at USD 19,724.0 million in 2025 and is projected to reach USD 32,961.4 million by 2033, growing at a CAGR of 6.9% from 2026 to 2033. Rising focus on efficient thermal management in various industries, including oil & gas, power generation, chemical & petrochemical, food & beverage, and HVAC & refrigeration, is expected to drive the demand for heat exchangers over the forecast period.

Key Market Trends & Insights

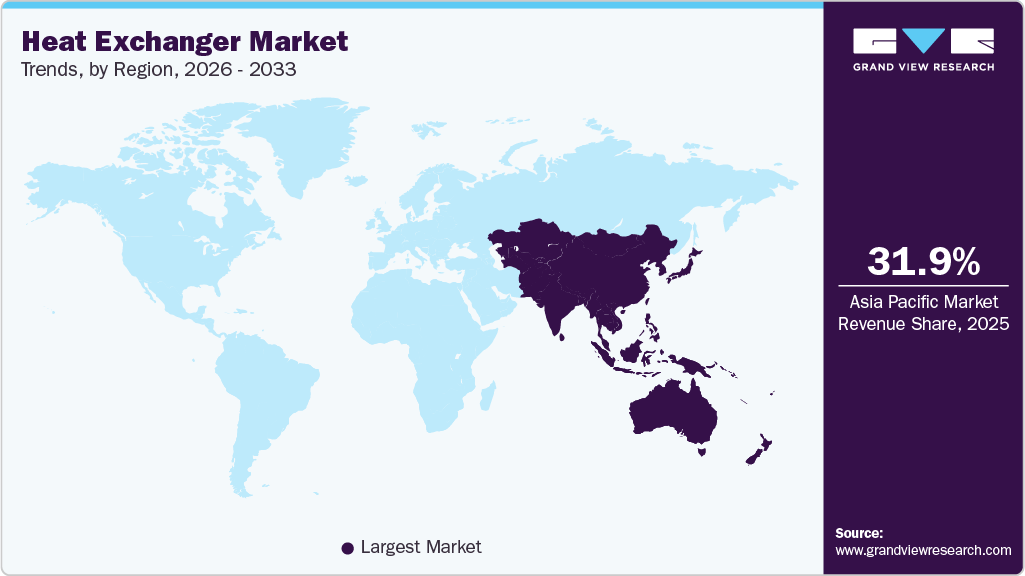

- Asia Pacific dominated the heat exchanger market with the largest revenue share of 31.9% in 2025.

- The heat exchanger market in India is expected to grow at a substantial CAGR of 9.2% from 2026 to 2033.

- By product, the plate & frame segment is expected to grow at a considerable CAGR of 7.4% from 2026 to 2033 in terms of revenue.

- By material, the alloys segment is expected to grow at a considerable CAGR of 7.5% from 2026 to 2033 in terms of revenue.

- By end use, the HVAC & refrigeration segment is expected to grow at a considerable CAGR of 7.8% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 19,724.0 Million

- 2033 Projected Market Size: USD 32,961.4 Million

- CAGR (2026-2033): 6.9%

- Asia Pacific: Largest market in 2025

Continuous technological advancements in heat exchanger design and materials are enhancing performance and expanding applications. Innovations such as micro-channel heat exchangers, improved corrosion-resistant materials, and compact designs contribute to higher efficiency and durability. These advancements are particularly beneficial in industries like aerospace, automotive, and renewable energy, where efficient thermal management is critical. Additionally, rapid industrialization in emerging economies is driving the demand for heat exchangers to support various industrial processes. The combination of technological progress and industrial growth is propelling the heat exchanger market forward.

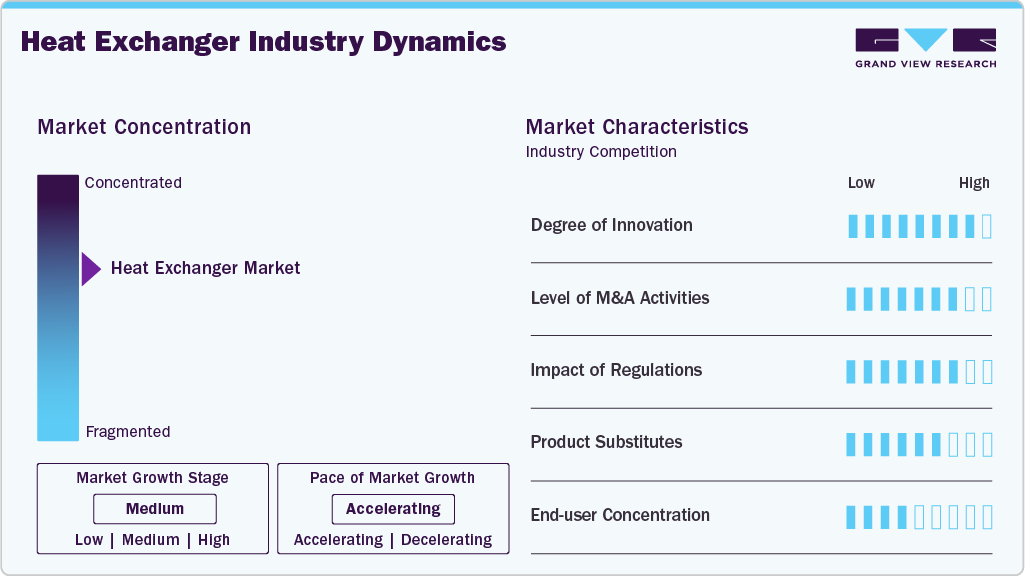

Market Concentration & Characteristics

The global heat exchanger industry is moderately concentrated, with a few major players holding significant market shares due to their advanced technology and global presence. These key companies lead innovation and dominate high-value segments. However, the market also includes many fragmented, smaller players catering to regional and specialized needs. This mix creates a competitive environment with both established leaders and emerging companies.

The heat exchanger industry is marked by continuous innovation focused on improving efficiency, durability, and compactness. Advances in materials such as corrosion-resistant alloys and enhanced heat transfer surfaces drive performance gains. Emerging technologies like additive manufacturing and smart monitoring systems are reshaping product design. Innovation also targets reducing environmental impact by improving energy recovery and lowering emissions. This constant evolution helps companies meet diverse industry demands and regulatory standards.

The market experiences considerably M&A activity as companies seek to expand capabilities and geographic reach. Strategic acquisitions allow firms to integrate complementary technologies and diversify product portfolios. M&A also helps in entering emerging markets and strengthening supply chains. Collaboration between industry leaders and niche specialists is common to accelerate innovation.

Environmental and safety regulations significantly influence the heat exchanger industry by pushing for energy-efficient and eco-friendly solutions. Compliance with international standards such as ASME and ISO ensures product reliability and market acceptance. Regulations targeting emissions reduction promote the adoption of advanced heat recovery systems. Governments’ increasing focus on sustainability accelerates the development of greener technologies. These regulatory pressures encourage manufacturers to innovate while ensuring operational safety.

Drivers, Opportunities & Restraints

Growing demand for energy-efficient systems across industries is a key driver of the heat exchanger market. Increasing industrialization and urbanization boost the need for HVAC, power generation, and chemical processing equipment. Stringent environmental regulations encourage the adoption of advanced heat recovery technologies. Rising focus on reducing carbon footprints drives investment in sustainable solutions. These factors collectively fuel steady market growth worldwide.

Emerging economies present significant growth opportunities due to expanding industrial sectors and infrastructure development. Advancements in materials and smart technologies enable more efficient and compact heat exchangers. The shift toward renewable materials create demand for specialized heat exchangers in solar and geothermal applications. Collaborations between manufacturers and research institutions foster innovation. Growing aftermarket services and maintenance also offer lucrative potential.

High initial capital investment and maintenance costs can limit market adoption, especially among small and medium enterprises. Complex manufacturing processes and stringent quality requirements pose challenges for new entrants. Fluctuating raw material prices affect production costs and profitability. Market growth may be hindered by a lack of awareness or adoption barriers in developing regions.

Product Insights

The shell & tube segment held a significant position in the market, accounting for a share of 35.5% in 2025. Owing to their robust construction and ability to operate under high-pressure and high-temperature conditions, these heat exchangers are widely adopted in industries such as power generation, oil & gas, and chemical processing. Their versatility across diverse applications and relative ease of maintenance continue to support strong demand. In addition, long service life and proven reliability further reinforce their preference in large-scale industrial operations.

Plate & frame heat exchangers represent the fastest-growing segment, driven by their compact design and high thermal efficiency. They are widely favored in industries that require strict hygienic standards, including food & beverage and pharmaceuticals. Their ease of customization, scalability, and lower installation costs further support increasing adoption. Collectively, these benefits position plate & frame heat exchangers for rapid and sustained market expansion.

Material Insights

The metals segment led in terms of revenue, accounting for a share of 62.2% in 2025. Metals dominate the material segment in the heat exchanger market owing to their excellent thermal conductivity and cost-effectiveness. Materials like carbon steel and stainless steel are widely used due to their durability and resistance to corrosion. Metals offer high strength and can withstand extreme temperatures and pressures in various industrial applications. Their recyclability and availability also support large-scale manufacturing. These factors make metals the preferred choice across many sectors.

Alloys are the fastest-growing segment due to their superior corrosion resistance and enhanced mechanical properties. Specialized alloys like nickel-based and titanium alloys are increasingly used in harsh environments such as chemical processing and the marine industries. Their ability to perform under extreme conditions extends the lifespan of heat exchangers and reduces maintenance costs. Ongoing material innovations further drive their adoption.

End Use Insights

The chemical & petrochemical segment led the market in 2025, with a 22.6% share, owing to its extensive need for heat transfer in processes like distillation, condensation, and cooling. High-temperature and high-pressure operations require reliable and durable heat exchangers. Strict safety and efficiency standards drive demand for advanced designs. The scale of these industries also contributes to large-volume consumption.

The HVAC & refrigeration segment is the fastest-growing in the global heat exchanger market due to rising demand for energy-efficient climate control systems. Urbanization and the increasing construction of commercial and residential buildings fuel this growth. Strict environmental regulations are pushing for low-emission cooling technologies. Additionally, advancements in refrigerants and compact heat exchanger designs support rapid adoption.

Regional Insights

North America held a significant share of the global heat exchanger market in 2025, driven by advanced industrial infrastructure and high demand in power generation and chemical processing sectors. Ongoing investments in energy-efficient technologies and stringent environmental regulations support market growth. The presence of key industry players and innovation hubs enhances product development. Raising focus on reducing carbon emissions fuels the adoption of modern heat exchangers.

U.S. Heat Exchanger Market Trends

The U.S. dominated the North American heat exchanger market, accounting for 73.8 % share, owing to its large industrial base and advanced manufacturing capabilities. Strong demand from sectors like power generation, chemical processing, and HVAC drives growth. Strict environmental regulations push companies to adopt energy-efficient technologies. Continuous innovation and high investment in R&D enhance product offerings.

Canada is experiencing significant growth due to expanding oil & gas exploration and renewable energy projects. Government incentives and policies supporting energy efficiency accelerate the adoption of modern heat exchangers. Infrastructure development and industrial modernization also boost demand. Increased focus on sustainability and emissions reduction drives technological upgrades, highlighting Canada’s evolving market potential.

Europe Heat Exchanger Market Trends

The heat exchanger market in Europe is growing due to stringent environmental regulations and a strong regional focus on sustainability and energy efficiency. The presence of well-established chemical, automotive, and HVAC industries continues to generate robust demand for high-performance heat exchangers. Ongoing investments in renewable energy, district heating, and energy-efficient infrastructure further support market growth. In addition, close collaboration between governments and industry players promotes circular economy practices and low-carbon technologies.

Germany remains a key market for heat exchangers, supported by its strong commitment to energy efficiency and sustainable industrial practices. A well-developed research and development ecosystem enables continuous innovation and the deployment of advanced heat exchange solutions. Stringent regulatory requirements further accelerate the adoption of high-efficiency systems across industries.

The UK heat exchanger market is experiencing strong growth, driven by rising investments in renewable energy and the modernization of infrastructure. Government policies aimed at reducing carbon emissions are promoting the adoption of energy-efficient heat exchange systems. Growth in the HVAC and power generation sectors further supports market demand, while collaborations between industry and academia encourage technological innovation.

Asia Pacific Heat Exchanger Market Trends

Asia Pacific dominated the heat exchanger market with a share of 31.9% in 2025, owing to the rising consumption of chemicals in various end-use industries, coupled with growing demand for heat exchangers that offer greater durability, enhanced efficiency, and less fouling. Expanding manufacturing bases and rising energy consumption drive demand for efficient heat exchangers. Government initiatives promoting energy conservation and pollution control further boost the market. Increasing investments in infrastructure and growing adoption of renewable energy technologies support growth. The region’s cost-competitive manufacturing also attracts global players.

China heat exchanger market held a significant share in the Asia Pacific market,driven by its vast industrial base and leading manufacturing capabilities. Rapid urbanization and expansion in sectors like power generation, chemical, and HVAC drive high demand. Strong government support for energy-efficient technologies accelerates market growth. Large-scale infrastructure projects and renewable energy adoption further boost the sector. China’s cost-effective production and technological advancements maintain its market leadership.

The heat exchanger market in the India is expected to grow at a CAGR of 9.2% from 2026 to 2033, owing to increasing industrialization and infrastructure development across multiple sectors. Government initiatives promoting energy conservation and sustainable industrial practices encourage heat exchanger adoption. Rising demand from power plants, chemical industries, and HVAC systems fuels growth. The growing focus on reducing carbon emissions supports investments in advanced technologies. These factors position India as a key growth hub in the region.

Middle East & Africa Heat Exchanger Market Trends

The Middle East and African market is driven by strong demand from oil & gas, petrochemical, and power generation sectors. Investments in infrastructure projects and energy-efficient technologies propel market expansion. Growing awareness of environmental regulations encourages the adoption of advanced heat exchangers. Challenges such as political instability and economic variability exist, but are balanced by ongoing industrial growth. The region’s strategic energy position continues to influence market dynamics.

The UAE holds a significant position in the Middle East & Africa heat exchanger market, fueled by rapid industrialization and major infrastructure projects. Growing demand for energy-efficient HVAC systems in commercial and residential developments supports market expansion. The country’s strong oil, gas, and petrochemical sectors require advanced thermal management solutions. Additionally, government sustainability initiatives and the push for renewable energy are accelerating the adoption of innovative heat exchanger technologies.

Latin America Heat Exchanger Market Trends

The heat exchanger market in Latin America is expanding, driven by growth in the oil & gas and chemical sectors, particularly in Brazil and Mexico. Increasing industrial activity and infrastructure development are boosting demand for efficient thermal management solutions. Supportive government policies promoting sustainability further encourage market adoption. While economic fluctuations may affect investment levels, ongoing modernization efforts provide significant long-term growth potential.

Brazil heat exchanger market is growing due to its expanding oil & gas and chemical industries, which require efficient thermal management solutions. Infrastructure development and modernization efforts across various sectors boost demand. Government policies promoting sustainability and energy efficiency encourage the adoption of advanced heat exchanger technologies. Rising industrialization and investments in renewable energy projects further support market growth. These factors collectively drive Brazil prominence in the Latin America heat exchanger market.

Key Heat Exchanger Companies Insights

Key players operating in the heat exchanger market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Alfa Laval, Danfoss, and Kelvion Holding GmbH.

-

Alfa Laval is a Swedish company specializing in heat transfer, separation, and fluid handling technologies. Founded in 1883, it provides solutions for industries like energy, food, water, and marine. The company is known for its heat exchangers, separators, pumps, and valves. It targets the sustainability segment considerably through energy-efficient and environmentally friendly technologies. With a global presence, Alfa Laval has a strong market presence with a prominent brand.

-

Kelvion Holding GmbH, established in 1920 and headquartered in Bochum, Germany, is a global market player in heat exchanger manufacturing. Operating under the Kelvion brand since 2015, the company offers a diverse portfolio including plate, shell-and-tube, and finned-tube heat exchangers, as well as cooling towers and transformer cooling systems. Kelvion serves various industries such as energy, oil and gas, chemicals, marine, HVAC, refrigeration, and food and beverage sectors. With a presence in over 67 countries, the company provides comprehensive services from product development to installation and after-sales support.

Key Heat Exchanger Companies:

The following are the leading companies in the heat exchanger market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Laval

- Danfoss

- Kelvion Holding GmbH

- Güntner Group GmbH

- Xylem Inc

- API Heat Transfer

- Mersen

- Hisaka Works, Ltd.

- Baker Hughes Company

- Johnson Controls International

- HRS Heat Exchangers

- ITT INC.

- Thermax Limited

- Metalforms Heat Transfer

- Southern Heat Exchanger Corporation

Recent Developments

-

In March 2025, Alfa Laval's collaboration with SSAB and Outokumpu led to the installation of heat exchangers at Laakso Joint Hospital in Helsinki with a 60% lower carbon footprint. This achievement is part of Alfa Laval's Concept Zero initiative, aiming to produce heat exchangers with no fossil carbon emissions by 2033. The project underscores the importance of cross-industry partnerships in catering to the sustainability market.

-

In May 2025, Danfoss launched a new CO₂/water brazed heat exchanger titled H48T-CH built on its Micro Plate technology, aimed at transcritical CO₂ refrigeration systems, especially for the recovery of heat in hypermarkets and supermarkets. The compact unit delivers high thermal performance with low pressure loss and can serve multiple roles such as condenser, sub-cooler, and gas cooler. Its lightweight, frame-free design makes installation easier and allows for more compact CO₂ system layouts while offering strong reliability and resistance to pressure and thermal shock fatigue.

Heat Exchanger Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 20,681.0 million

Revenue forecast in 2033

USD 32,961.4 million

Growth rate

CAGR of 6.9% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Alfa Laval; Danfoss; Kelvion Holding GmbH; Güntner Group GmbH; Xylem Inc; API Heat Transfer; Mersen; Hisaka Works, Ltd.; Baker Hughes Company; Johnson Controls International; HRS Heat Exchangers; ITT Inc.; Thermax Limited; Metalforms Heat Transfer; Southern Heat Exchanger Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat Exchanger Market Report Segmentation

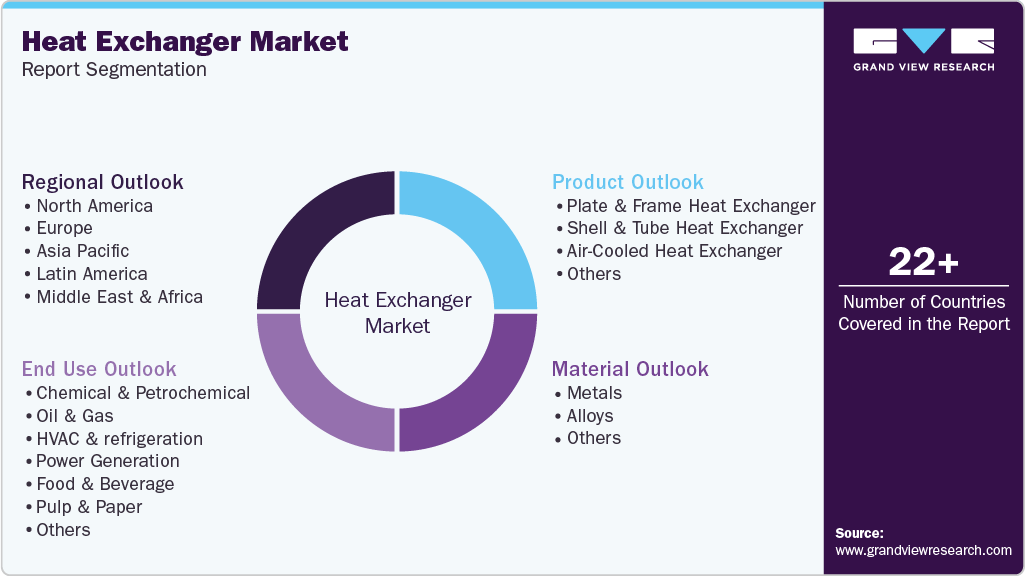

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global heat exchanger market report based on product, material, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Plate & Frame Heat Exchanger

-

Brazed Plate & Frame Heat Exchanger

-

Gasketed Plate & Frame Heat Exchanger

-

Welded Plate & Frame Heat Exchanger

-

Others

-

-

Shell & Tube Heat Exchanger

-

Air-Cooled Heat Exchanger

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Metals

-

Alloys

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemical & Petrochemical

-

Oil & Gas

-

HVAC & refrigeration

-

Power Generation

-

Food & Beverage

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global heat exchanger market size was estimated at USD 19,724.0 million in 2025 and is expected to be USD 20,681.0 million in 2026.

b. The global heat exchanger market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.9% from 2026 to 2033 to reach USD 32,961.4 million by 2033.

b. The Asia Pacific market held a significant share of the market and accounted for a share of 31.9% in 2025 supported by rapid industrialization, expanding urban infrastructure, and increasing focus on energy efficiency. Demand from HVAC, power generation, chemicals, and renewable energy projects continues to drive adoption across the region.

b. Some of the key players operating in the global heat exchanger market include Alfa Laval, Danfoss, Kelvion Holding GmbH, Güntner Group GmbH, Xylem Inc, API Heat Transfer, Mersen, Hisaka Works, Ltd., Baker Hughes Company, Johnson Controls International, HRS Heat Exchangers, ITT Inc., Thermax Limited, Metalforms Heat Transfer, and Southern Heat Exchanger Corporation.

b. The global heat exchanger market is being driven by increasing demand for energy-efficient systems across industrial sectors, aimed at reducing operational costs and emissions. Technological advancements in materials and compact designs are making heat exchangers more versatile and cost-effective.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.