- Home

- »

- Homecare & Decor

- »

-

U.S. MICE Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. MICE Market Size, Share & Trends Report]()

U.S. MICE Market (2025 - 2030) Size, Share & Trends Analysis Report By Event (Meetings, Incentives, Conferences, Exhibitions), By Booking Mode (Direct Booking, Online Travel Agents & Agencies (OTAs), Destination Management Companies (DMCs)), And Segment Forecasts

- Report ID: GVR-4-68040-540-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. MICE Market Size & Trends

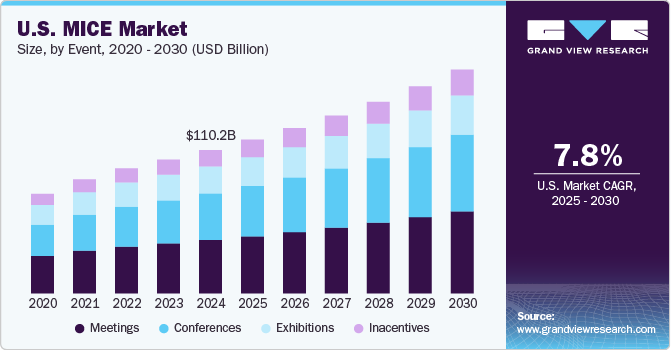

The U.S. MICE market size was valued at USD 110.24 billion in 2024 and is expected to grow at a CAGR of 7.8% from 2025 to 2030. The market growth is attributed to increasing globalization, and the need for networking and collaboration fuels the demand for corporate events. The rise of hybrid event formats, integrating in-person and virtual experiences, also expands audience reach and engagement. Technological advancements in event management, coupled with the availability of state-of-the-art venues, are enhancing the overall experience for attendees.

The demand for MICE travel is witnessing significant growth across the United States, driven by the increasing recognition of its role in facilitating corporate growth, enhancing professional networking, and promoting knowledge exchange. As organizations prioritize face-to-face interactions to foster collaboration and strengthen client relationships, MICE travel has become an essential component of corporate strategy. With the resurgence of in-person events following the pandemic, businesses are leveraging conferences, trade shows, and corporate retreats to re-engage stakeholders, launch new products, and reinforce brand presence.

Furthermore, the expanding global footprint of multinational corporations has amplified the need for cross-border meetings and events, resulting in heightened demand for large-scale conference facilities and destination management services. Technological advancements in event management platforms, hybrid event solutions, and real-time analytics have further enhanced the efficiency and appeal of MICE travel, encouraging companies to allocate higher budgets to host and participate in such events. Additionally, incentive travel programs have gained prominence as a strategic tool for employee recognition, motivation, and retention, contributing to the overall expansion of the MICE segment.

The U.S., with its well-established infrastructure, world-class convention centers, and extensive hospitality networks, remains a preferred destination for both domestic and international MICE events. Cities like Las Vegas, Orlando, and Chicago are recognized for their state-of-the-art exhibition facilities and comprehensive event management support, making them prominent hubs for large-scale trade shows and conventions. For instance, Las Vegas hosts major annual events like CES (Consumer Electronics Show), attracting thousands of attendees from around the world, while Orlando’s Orange County Convention Center remains a leading choice for medical and tech conferences.

Moreover, the rise of regional business hubs such as Austin and Nashville has also contributed to the growth of mid-sized corporate meetings and incentive programs. These cities offer modern venues, cultural experiences, and entertainment options, creating a balanced environment for both business and leisure, often referred to as “bleisure” travel. Companies are increasingly incorporating leisure components into business events, providing attendees with opportunities for relaxation and team bonding.

The robust growth of the hospitality and tourism sectors is playing a vital role in supporting MICE activities. Government initiatives and investments aimed at promoting business tourism and infrastructure development are further strengthening the market's expansion potential. Tax incentives, supportive policies, and funding for convention centers, exhibition halls, and hospitality infrastructure enhance the country’s attractiveness as a premier MICE destination. Collaborations between the public and private sectors further stimulate growth and competitiveness in the market.

The growing trend of experiential marketing encourages businesses to invest in unique, memorable events to engage their audience. The expansion of healthcare, technology, and finance industries has led to a rise in specialized conferences and exhibitions. Furthermore, the rising preference for sustainable and eco-friendly event practices pushes innovation and attracts environmentally conscious businesses. In addition, the growing influence of social media and digital platforms in promoting and amplifying events is playing a significant role in driving U.S. MICE industry growth.

Event Insights

Meetings accounted for a revenue share of 37.3% of the overall U.S. MICE industry in 2024, driven by the growing need for companies to hold strategic discussions, foster collaboration, and share knowledge among teams or stakeholders. The rise of remote work and dispersed teams has increased the demand for in-person meetings to strengthen connections and build trust. Corporate emphasis on employee engagement and professional development has led to a surge in team-building activities and training sessions. Moreover, technological advancements have made meetings more dynamic and interactive, enhancing productivity and participant satisfaction.

Demand for conference services in the overall U.S. MICE industry is set to grow at a CAGR of 8.8% from 2025 to 2030. Increasing interest in industry-specific conferences and knowledge-sharing events is driving this surge. Conferences provide a platform for networking, showcasing innovations, and exchanging ideas, making them indispensable for businesses and professionals alike. The rapid expansion of sectors such as technology, healthcare, and renewable energy has further boosted the demand for niche conferences. Additionally, the integration of digital technologies to enhance hybrid or virtual conference experiences is expanding accessibility and appeal, encouraging consistent growth in this segment of the MICE industry.

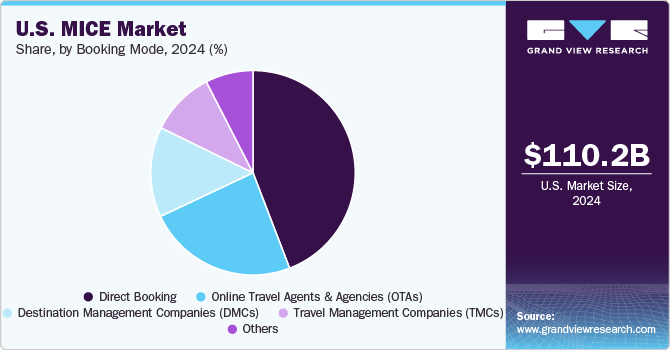

Booking Mode Insights

Booking of MICE service through direct booking accounted for a revenue share of 44.2% in 2024, driven by its simplicity, cost-effectiveness, and increased control over event planning. Businesses and individuals often prefer direct bookings to establish clear communication with service providers and negotiate customized packages tailored to their specific needs. Additionally, advancements in user-friendly online booking platforms have made the direct booking process seamless and efficient. The preference for bypassing intermediaries has further contributed to the significant share of direct bookings in the U.S. MICE industry.

Booking of MICE services through online travel agents (OTAs) in the overall U.S. MICE industry is expected to grow at a CAGR of 9.0% from 2025 to 2030. This growth is driven by the increasing popularity of OTAs due to their convenience, competitive pricing, and wide range of options. OTAs offer streamlined booking processes and access to multiple service providers in one platform, making them highly appealing for businesses and individuals planning MICE events. Additionally, the integration of advanced technologies such as AI and machine learning has improved the personalization and efficiency of OTA services, further contributing to their growing demand. As businesses continue to seek cost-effective and efficient solutions, OTAs are set to play an increasingly significant role in the U.S. MICE industry.

Key U.S. MICE Company Insights

The U.S. MICE industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Global Air-American Express Travel Services (Global Business Travel Group, Inc.), CWT Meetings & Events, BCD Meetings & Events, Maritz, Conference Care, and others.

-

CWT Meetings & Events is a global leader in the MICE (Meetings, Incentives, Conferences, and Exhibitions) market. The company offers end-to-end services, including incentive travel, venue sourcing, strategic meetings management, and more. Their expertise spans various sectors, such as life sciences, automotive, and high tech, providing innovative and sustainable event solutions.

-

BCD Meetings & Events is another prominent player in the MICE industry. It focuses on delivering creative and impactful solutions for meetings and events, emphasizing cost control and personalization. Their services include event planning, logistics, and strategic meetings management. BCD M&E is known for its comprehensive industry insights and trend reports, helping clients stay ahead in the evolving MICE landscape.

Key U.S. MICE Companies:

- Global Air-American Express Travel Services (Global Business Travel Group, Inc.)

- CWT Meetings & Events

- BCD Meetings & Events

- Maritz

- Conference Care

- ATPI Ltd.

- FCM Meetings & Events

- Global Cynergies, LLC

- Capita plc

- AVIAREPS AG

Recent Developments

-

In March 2024, American Express Global Business Travel (Amex GBT) agreed to acquire CWT for approximately USD 570 million on a cash-free, debt-free basis. The transaction, set to close in the second half of 2024 pending regulatory approvals, is funded through stock issuance and cash. This strategic move is expected to enhance investment capacity, generate USD 155 million in annual synergies within three years, and provide CWT customers with improved value and options. Earnings are projected to benefit post-closure.

U.S. MICE Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 118.26 billion

Revenue forecast in 2030

USD 172.05 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Event, booking mode

Country scope

U.S.

Key companies profiled

Global Air-American Express Travel Services (Global Business Travel Group, Inc.); CWT Meetings & Events; BCD Meetings & Events; Maritz; Conference Care; ATPI Ltd.; FCM Meetings & Events; Global Cynergies, LLC; Capita plc; and AVIAREPS AG

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. MICE Market Report Segmentation

This report forecasts revenue growth and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. MICE market report based on event, and booking mode:

-

Event Outlook (Revenue, USD Billion, 2018 - 2030)

-

Meetings

-

Incentives

-

Conferences

-

Exhibitions

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Online Travel Agents and Agencies (OTAs)

-

Destination Management Companies (DMCs)

-

Travel Management Companies (TMCs)

-

Others (Marketplace Bookings, etc.)

-

Frequently Asked Questions About This Report

b. The U.S. MICE market was estimated at USD 110.24 billion in 2024 and is expected to reach USD 118.26 billion in 2025.

b. The U.S. MICE market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 172.05 billion by 2030.

b. The U.S. MICE market accounted for a share of about 5.28% of the overall U.S. MICE market. This is due to technological advancements in event management, coupled with the availability of state-of-the-art venues, are enhancing the overall experience for attendees.

b. Key players in the U.S. MICE market are Global Air-American Express Travel Services (Global Business Travel Group, Inc.); CWT Meetings & Events; BCD Meetings & Events; Maritz; Conference Care; ATPI Ltd.; FCM Meetings & Events; Global Cynergies, LLC; Capita plc; and AVIAREPS AG.

b. Key factors that are driving the U.S. MICE market growth include increasing globalization, and the need for networking and collaboration fuels the demand for corporate events.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.