- Home

- »

- Distribution & Utilities

- »

-

U.S. Microgrid As A Service Market Size, Share Report, 2030GVR Report cover

![U.S. Microgrid As A Service Market Size, Share & Trends Report]()

U.S. Microgrid As A Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Grid Type (Grid Connected, Islanded), By Service Type (Software As A Service, Monitoring & Control, Operation & Maintenance), And Segment Forecasts

- Report ID: GVR-4-68040-611-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Microgrid As A Service Market Trends

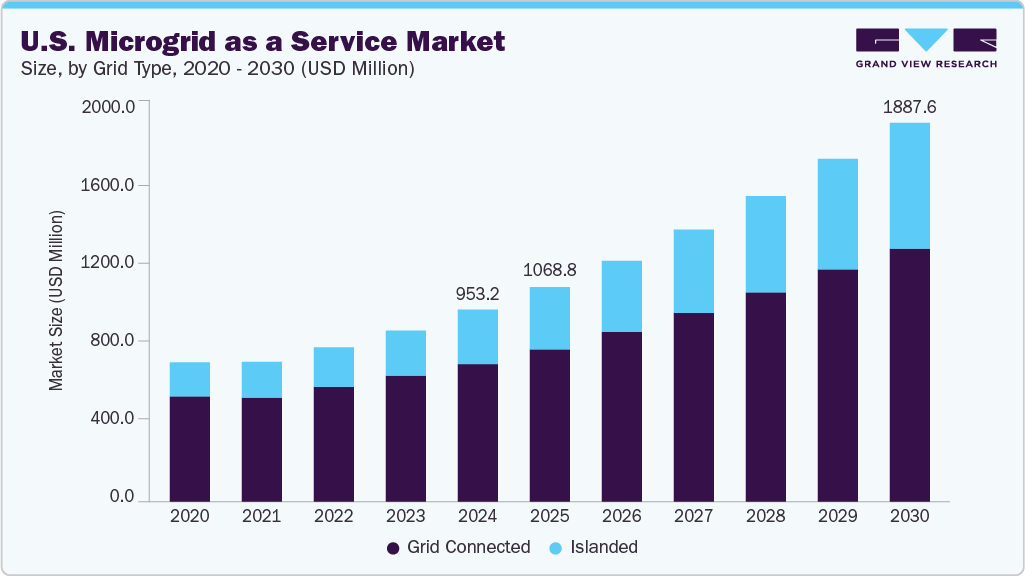

The U.S. microgrid as a service market size was valued at USD 953.2 million in 2024 and is projected to grow at a CAGR of 12.0% from 2025 to 2030. The market growth is being driven by increasing demand for renewable energy integration, the need for resilient power infrastructure, and supportive government policies and incentives. Microgrid as a service is a turnkey solution that includes design, installation, operation, and maintenance of microgrids, providing energy reliability and resilience without the need for upfront capital investment. It is primarily deployed across sectors such as industrial, commercial, military, and educational institutions. This model supports decarbonization goals, enhances grid independence, and improves energy cost predictability.

In January 2023, AlphaStruxure announced an agreement to construct, design, and operate microgrid infrastructure at the John F. Kennedy International Airport. The microgrid infrastructure at New Terminal One (NTO) will provide resilient, sustainable, cost-predictable, and locally generated energy.

In the energy infrastructure sector, microgrid as a service (MaaS) has become essential for delivering reliable, efficient, and resilient power solutions, especially for critical facilities such as hospitals, military bases, universities, and data centers. MaaS enables these institutions to operate independently from the main grid during outages or peak demand, ensuring continuous operation and energy security. Its turnkey model-covering design, installation, financing, and maintenance-eliminates upfront capital requirements, making advanced energy systems more accessible. Rising concerns over climate resilience, aging grid infrastructure, and increasing demand for uninterrupted power drive widespread MaaS adoption in both public and private sectors.

In commercial and industrial settings, MaaS supports decarbonization goals by integrating renewable energy sources such as solar, wind, and battery storage. It allows companies to optimize energy use, reduce greenhouse gas emissions, and meet corporate sustainability targets. MaaS systems also manage energy costs through peak shaving, demand response, and load optimization. The model offers predictable long-term operating expenses, enabling businesses to shift from a capital-intensive model to a service-based energy strategy.

Microgrids are also being adopted in underserved or remote communities, where traditional grid expansion is impractical. MaaS providers offer scalable, localized power systems that support economic development and improve quality of life. Technological advancements in digital energy management platforms, AI-based control systems, and battery efficiency are accelerating MaaS deployment, making it more adaptive and data-driven.

Market Concentration & Characteristics

The market growth is high, and the pace of market growth is accelerating. The U.S. Microgrid as a Service (MaaS) market is characterized by moderate industry concentration, shaped by vertically integrated energy service providers with strong engineering, financing, and long-term operations capabilities.

Innovation is a defining feature of the MaaS landscape, with the convergence of AI-driven energy optimization, advanced battery storage, and digital twin modeling enabling providers to deliver more resilient and cost-efficient systems. Developments in islanding capabilities, hybrid generation integration, and remote monitoring contribute to operational agility and minimal service disruption. These advancements meet rising demand for decarbonized, reliable energy across mission-critical sectors such as defense, healthcare, and transportation, reinforcing the strategic value of MaaS models in modernizing outdated grid infrastructure.

The threat of service substitution remains low. While diesel generators, standalone battery storage, and traditional backup systems offer interim reliability, they fail to deliver the full suite of benefits MaaS provides-namely, lifecycle cost savings, real-time optimization, emissions reductions, and full-service energy management. As organizations increasingly prioritize ESG performance, energy autonomy, and grid independence, MaaS solutions gain competitive traction, reinforcing their market foothold across critical infrastructure and commercial campuses.

End-user concentration is moderate, with a diversified customer base ranging from municipal governments and transit agencies to universities, data centers, and military facilities. Public-sector entities lead in contract volume and project scale, but commercial adoption is accelerating due to rising energy costs and sustainability mandates. This broadening customer mix spreads demand risk, enables use-case flexibility, and reinforces the economic and operational case for MaaS as a long-term energy strategy, supporting sustained market growth.

Grid Type Insights

The grid connected segment accounted for a dominating market share of 72.0% in 2024. Its ability to offer enhanced grid reliability, economic optimization, and seamless integration with utility infrastructure drives this dominance. Grid-connected microgrids support real-time energy balancing, demand response, and peak shaving, making them ideal for municipalities, campuses, and large commercial facilities. As utilities and end-users seek to modernize energy systems without compromising cost or regulatory compliance, the grid-connected model enables monetization through ancillary services while maintaining access to backup capabilities.

The Islanded segment is expected to grow at a CAGR of 15.5% during the forecast period, emerging as a critical configuration within the U.S. microgrid as a service market. Its ability to operate independently from the main grid makes it essential for mission-critical facilities such as military bases, hospitals, and remote infrastructure. Islanded microgrids ensure energy security, continuity of operations, and resilience during grid outages or extreme weather events. As climate-related disruptions intensify and energy independence becomes a strategic priority, the segment’s autonomy and reliability position it as a key solution.

Service Type Insights

The monitoring & control service segment accounted for a leading share of 35.1% in 2024, underscoring its critical role in optimizing microgrid performance and reliability. These services enable real-time oversight, automated decision-making, and dynamic load balancing, ensuring efficient energy use and rapid response to grid fluctuations or outages. Monitoring & control systems are particularly valued in sectors requiring uninterrupted power and operational transparency, such as healthcare, defense, and public infrastructure. As energy systems grow more complex and decentralized, this segment benefits from increasing demand for intelligence-driven operations, cybersecurity, and seamless integration with distributed energy resources, solidifying its central position within MaaS offerings.

The Software as a Service (SaaS) segment is projected to witness the fastest CAGR of 15.3% over the forecast period, driven by the increasing need for intelligent energy management and predictive analytics. These platforms enable real-time monitoring, forecasting, and remote control of distributed energy resources, offering enhanced operational efficiency and cost optimization. SaaS solutions are particularly valuable in managing complex microgrid systems across campuses, industrial sites, and municipalities, where energy usage must align with dynamic load profiles and regulatory targets.

Key U.S. Microgrid As A Service Company Insights

Several key players are shaping the U.S. Microgrid as a Service (MaaS) market, offering integrated solutions that combine hardware, software, and energy management services to enhance grid resilience and sustainability.

-

General Electric Company provides comprehensive microgrid solutions, including control systems and battery energy storage, tailored for commercial and industrial clients. Their offerings aim to reduce energy costs and ensure uninterrupted power supply during outages, supporting critical infrastructure like hospitals and military facilities.

-

ABB offers smart power solutions for microgrids, focusing on energy innovation and the transition to new energy management methods. Their technologies support commercial and industrial sites in managing distributed energy resources effectively.

Key U.S. Microgrid As A Service Companies:

- ABB

- Aggreko

- AlphaStruxure

- Ameresco

- Anbaric Development Partners, LLC.

- Eaton

- General Electric Company

- Pareto Energy

- PowerSecure, Inc.

- Siemens

- Spirae, LLC

Recent Developments

-

In March 2025, Ameresco, in partnership with Hannah Solar Government Services, completed a USD 10.9 million Water Resiliency Microgrid Project at White Sands Missile Range, New Mexico.

-

In February 2024, San Diego Gas & Electric (SDG&E) launched four new microgrids in the communities of Tierra Santa, Clairemont, Boulevard and Paradise. These new projects are expected to strengthen grid reliability and power resiliency simultaneously.

U.S. Microgrid As A Service Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1,887.6 million

Growth Rate

CAGR of 12.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grid type, service type

Key companies profiled

ABB; Aggreko; AlphaStruxure; Ameresco; Anbaric Development Partners, LLC.; Eaton; General Electric Company; Pareto Energy; PowerSecure, Inc.; Schneider Electric; Siemens; Spirae, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Microgrid As A Service Market Report Segmentation

This report forecasts revenue growth at U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. microgrid as a service industry report based on grid type and service type.

-

Grid Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Islanded

-

Grid Connected

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Software as a Service

-

Monitoring & Control Service

-

Operation & Maintain Service

-

Frequently Asked Questions About This Report

b. The U.S. radiofrequency electrosurgery generators market size was estimated at USD 346.62 million in 2024.

b. The U.S. radiofrequency electrosurgery generators market is expected to grow at a compound annual growth rate of 2.63% from 2025 to 2030 to reach USD 407.45 million by 2030.

b. The monopolar segment dominated the market, accounting for 59.66% of the revenue in 2024 due to its versatility and widespread clinical adoption.

b. Some key players operating in the U.S. radiofrequency electrosurgery generators market include ETHICON (Johnson & Johnson), Abbott, Olympus America, Sutter Medical Technologies USA, elliquence, Medtronic, Boston Scientific Corporation or its affiliates., Aspen Surgical Products, Inc, Erbe USA, Incorporated, and Intuitive Surgical.

b. Key factors driving the market growth include the rising number of surgical procedures, the rise of minimally invasive techniques, and advancements in electrosurgical technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.